We Like:

- Negative balance protection

- Offers over 20,000 trading instruments providing a wide coverage in the financial market

- Min. deposit of $50 with a leverage of up to 1:500

- Raw spreads from 0.0 pips

- Simplified account opening process

- MT4 &MT5 trading platforms

- ECN trading platform with deep liquidity

We Don’t Like:

- Charges very high inactivity fees ($60 quarterly after three months of inactivity)

- Few educational resources

- Use of scalping and high-frequency strategies is not allowed

- A deposit of $5000 is required to access the raw spreads.

The Verdict:

Hong Kong-based MultiBank Group is a multi-regulated financial service provider established in 2005. Currently, the company provides access to over 20,000 financial instruments across asset classes such as FX, metals, commodities, indices, and cryptos with tight pricing on major currency pairs and commodities such as gold and silver.

The broker operates as a pure No-Dealing Desk (NDD), providing access to the most liquid market with instant sub-second executions. The broker also boasts of being the number one financial derivative broker providing a min. deposit of $50, raw spreads of 0.0 pips, and maximum leverage of 1:500 depending on the account.

The broker is among the most regulated brokers with over ten regulators across five continents. The regulators include top-tier regulator ASIC and others such as BaFIN, FMA, DFSA, and FSC. Multibank is hence a secure and trustworthy brokerage firm.

Company details

Hong Kong-headquartered financial brokerage company MultiBank Group was established in 2005 in California, USA, as a CFD and FX broker. Since its debut, the company has strived to transform the brokerage space offering attractive services, trading platforms, and products.

MultiBank is recognized as one of the largest financial derivatives firms globally, holding a paid-up capital of over US $322 million. The company provides access to 20,000+ CFD instruments across major asset classes with meager spreads starting from 0.0 pips and multi-lingual expert customer care 24/7.

The broker prides itself as the pioneer of the financial exchange industry, maintaining over 20 offices globally. It operates as a No-Dealing Desk providing direct market access and fast executions with negative balance protection to its wide client base. Multibank reports over 320,000 clients in 90 countries globally.

The broker’s assets include:

- FX

- Indices

- Metals

- Commodities

- Cryptos

These asset classes can be speculated on the company’s power platforms MT4 and MT5. The platforms are highly customizable and multi-lingual and are fitted with 24/7 customer support. These platforms are also integrated with the most powerful tools responsible for boosting clients’ experience on the company’s website. Clients can access these platforms from Monday 00:00 GMT through Friday 23:59 GMT.

Trading conditions, however, vary depending on the type of account or the platform the client chooses. Min. spreads start from 0.0 pips on FX with a leverage of up to 1:500 — min. deposit is $50 depending on the account type chosen.

Integrated trading tools include:

- Virtual Private Server (VPS)

- Expert advisors

- MAM and PAMM accounts

- Fix API

- Economic calendar

Regulations

The broker is regulated across five continents, making the FX and CFDs provider. The regulatory agencies include:

- Australian Securities and Investments Commission, AFSL (416279).

- The British Virgin Islands Financial Service Commission.

- Germany’s Federal Financial Supervisory Authority, HRB (73406).

- Spain’s National Securities Market, (120).

- Financial Market Authority, (491129z).

- Also authorized and regulated by the Dubai Financial Services Authority.

- And the Cayman Islands Monetary Authority, (1811316).

Trading platforms

The broker provides two major trading platforms, MT4 & MT5, where clients can access the asset classes provided. The platforms can be accessed through the Web, Windows, and Mac.

Other alternative platforms offered include the WebTrader and Mobile App. In addition, traders can choose a copy trading platform either as signal providers or investors.

MetaTrader 4

- Tradable products — FX, metals, indices, commodities, cryptos

- Stop-out level — 50%

- Execution type — market order

- One-click trading

- Market depth of current quotes

- VPS hosting

- Notifications to track important market events

- Full EA functionality

- 50+ technical analysis indicators and analytical tools

- Powerful algorithmic trading with a built-in MLQL4 development environment

- Max. number of lots per click: 30 for FX; ten for metals; five for stocks, indices, commodities, and crypto

- Advanced fundamental analysis, including financial news and economic calendar

- Social trading

MetaTrader 5

- Tradable products — FX, metals, indices, commodities, cryptos

- Stop-out level — 50%

- Execution type — market order

- One-click trading

- Market depth of current quotes

- VPS hosting

- Notifications to track important market events

- Full EA functionality

- 80+ technical analysis indicators and analytical tools

- Powerful algorithmic trading with a built-in MLQL5 development environment

- Maximum number of lots per click: 30 for FX; ten for metals; five for stocks, indices, commodities, and cryptos

- Advanced fundamental analysis, including financial news and economic calendar

- Social trading

Range of markets

Multibank Group of brokers allow traders access to a wide range of markets yielding about 20,000 tradable instruments. As the brokerage company confirms, customers speculate the products as FX and CFDs with ultra-fast executions geared by ECN technology.

As a result, customers experience zero slippages, tight spreads starting from 0.0 pips, and extremely low latency. Moreover, the broker couples these trading features with a leverage of up to 1:500.

Forex

About 55 currency pairs encompass major FX crosses, and exotics trade on the broker with razor-sharp spreads starting from 0.0 pips and zero commissions. Also, the array of fx pairs exchange against seven base currencies includes significant currencies such as the USD, EUR, GBP, and many more. Its market participants also have access to leverage of up to 1:500.

Stocks

Stocks sometimes referred to as shares, are units of a company traded in OTC or CFDs. Multibank Group limited provides 1000 shares traded as CFDs with a leverage of up to 1:20 or a margin level of 5%. As a result, traders do not own the underlying stock but speculate on their prices by swapping long or short.

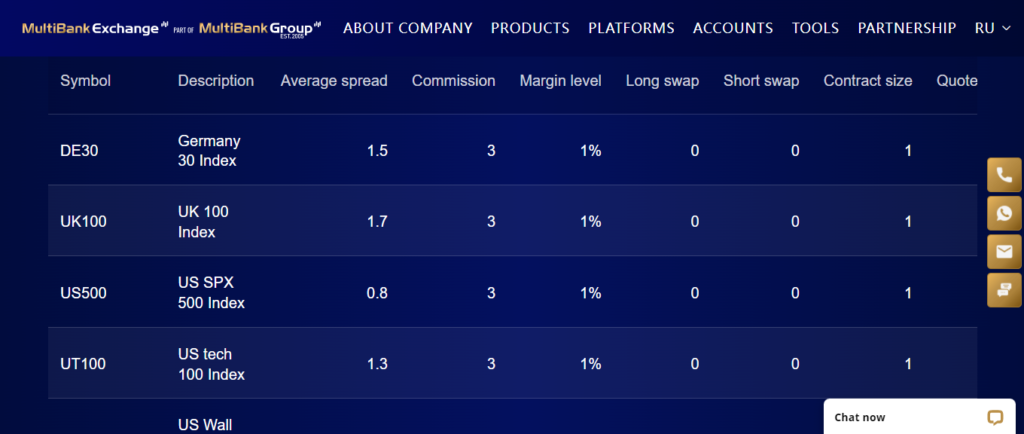

Indices

The index marketplace at the broker supports global index markets such as the UK 100, US Wall Street 30, and many more that trade with a leverage of up to 1:100 as CFDs. Traders can swap long and short with commissions capped at three, but the average spread fluctuates depending on the index product. However, the margin level is neutralized at 1% for all the index assets.

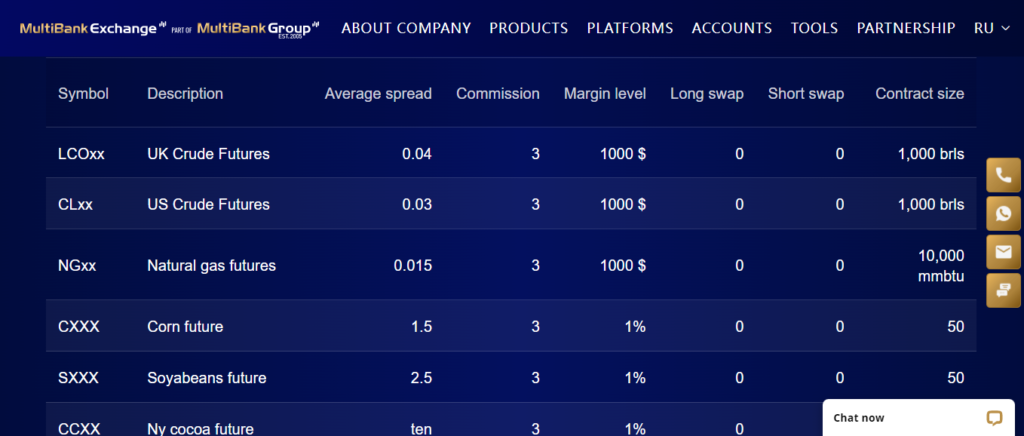

Commodities

Commodities at Multibank trade as CFDs in the futures and spot markets. They include energies and soft commodities like cocoa, corn, coffee, and many more. The spread varies depending on the commodity product, but the commission is capped at three. Futures such as natural gas futures and UK Crude futures, plus an array of others, allow traders to speculate on the price of those assets with defined conditions. At the same time, spot instruments in the commodities bracket help them take advantage of the current market rates.

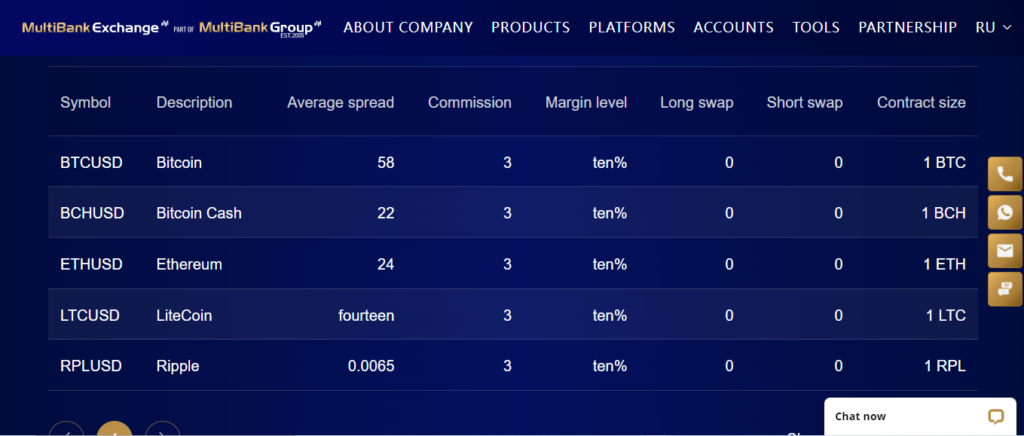

Cryptocurrencies

A spectrum of crypto assets trades at the broker as CFDs with a margin level of 10%. The products include BTC, Ripple, LTC, Ethereum, Bitcoin Cash, and a few others. The average spread depends on the digital asset, but the commission is capped at 3. Also, the crypto instruments trade against USD as the quote currency, and customers can swap long or short.

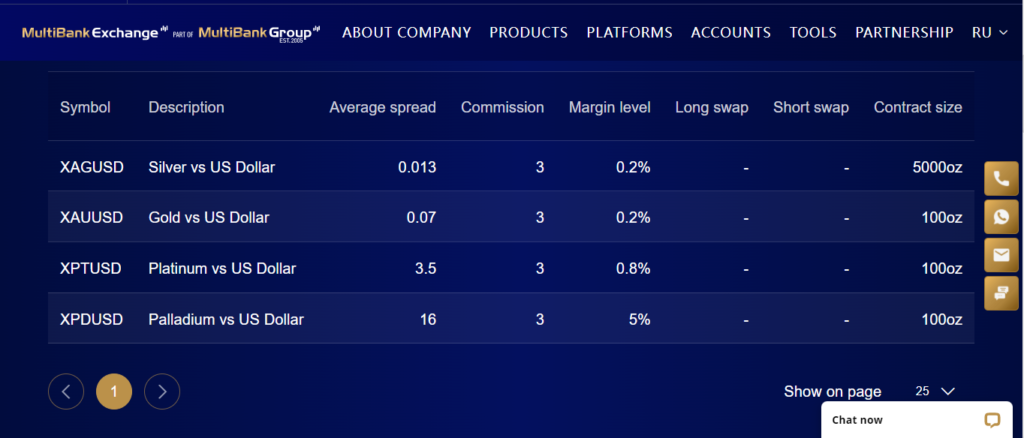

Metals

Trade gold and silver with tight spreads and leverage of up to 1:500 at the broker. The margin level starts from 0.2% on gold and silver but extends up to 5% on products like palladium and 0.8% on platinum. However, the commission is capped at three, and assets trade as CFDs allowing clients to diversify their portfolios.

Main features

- Provides deep liquidity — the broker reports offering clients market order executions fueled by ECN technology with no slippages and requotes.

- Tight spreads — it also notes to provide razor-sharp spreads across its asset classes starting from 0.0 pips.

- Multi-regulated broker — it holds licenses from nine financial regulators worldwide, making it a safe brokerage platform to deal with. In addition, it runs offices located across the globe, giving it the imprint of a well-established broker.

- State-of-the-art trading platforms and cutting-edge tools — traders access well-furnished trading platforms available on multiple terminals in real-time. The platforms also integrate with powerful trading tools such as EAs, VPS hosting, Fix API, etc.

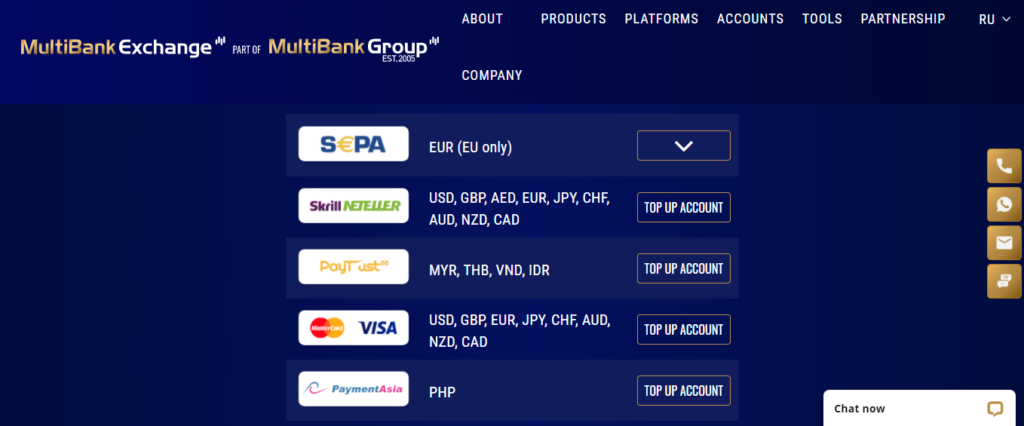

- Multiple payment options — the broker provides several payment options for clients to fund and withdraw money from their accounts.

Types of trading accounts

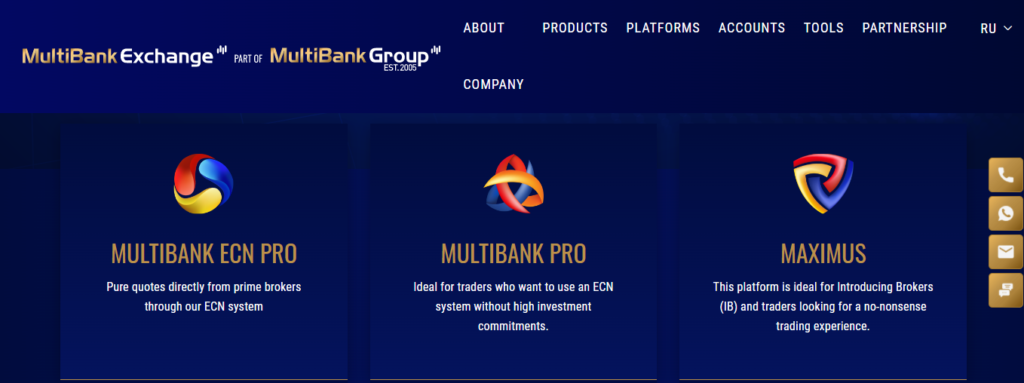

Multibank Group offers several account types with different features tailored to serve specific clients. They include:

- ECN PRO

- PRO

- Maximus

ECN Pro account: for market participants looking to trade pure quotes

- Min. deposit $5,000

- Spread from 0.0 pips

- Leverage up to 1:500

- Social trading

- Technical and customer support 24/7

- Traded on the MT4 & MT5

Pro account: for market participants looking to use ECN without high investment commitments

- Min. deposit $ 1,000

- Spread from 0.8 pips

- Leverage up to 500: 1

- Social trading

- Technical and customer support 24/7

- Available on the MT4 and 5

Maximus account: for market participants looking to trade without ECN commitments

- Min. deposit $ 50

- Spread from 1.5 pips

- Leverage up to 1: 500

- Social trading

- Technical and customer support 24/7

- Available on the MT4 and 5

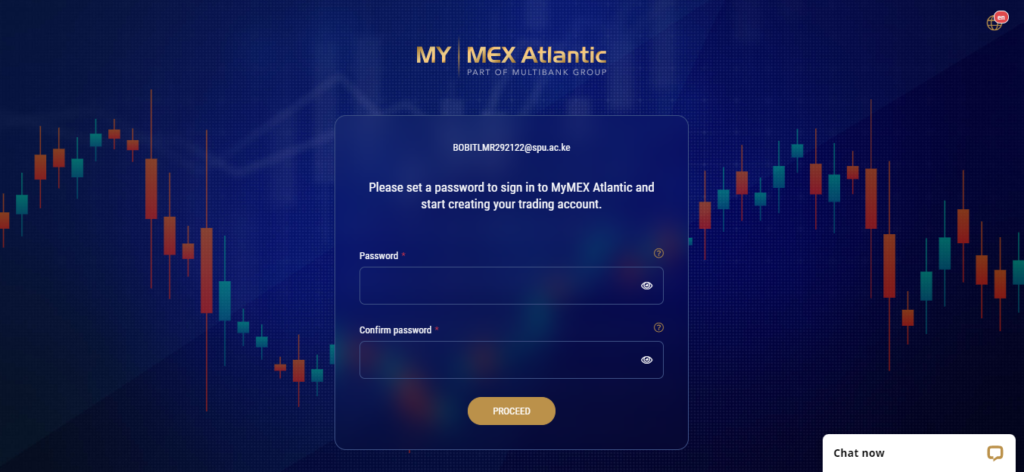

Opening an account at Multibank Group Limited

Step 1. Log into their website and click the open account button.

Step 2. Select the regulatory body applicable to you.

Step 3. Enter your email address in the form that pops up.

Step 4. Create and confirm the password.

Step 5. Verify the email and receive login details.

Step 6. Fund the account and start trading.

Commissions and spreads

Multibank operates as a true NDD broker offering tight spreads starting from 0.0 pips. It also couples the ECN business with a standard account that allows traders to evade ECN investments by trading with spreads starting from 1.5 pips.

However, the ECN account traders face a higher deposit capped $5000, and their account balance should rally from $20,000. Moreover, they might incur other ECN investment fees. In addition, the broker adds commissions on assets like stocks, indices, and metals.

Customer service

The broker prides itself on providing award-winning customer support 24/7 that clients reach out to for any query or inconveniences. It offers an array of channels that traders can use to contact the support team. Such options include a live chat button, email, phone calls, and social media accounts.

MultiBank Broker Review

What we liked

- Crypto deposits are available

- Low spreads starting from 0.0 pips

- Top-notch customer support

- Easy account opening

- Wide range of markets

- Low latency

- No slippage

- Well established and regulated broker

What we disliked

- No educational materials provided

- Trading commissions on CFDs

- High inactivity fees capped at $60

- Does not accept clients from the USA

The bottom line

Multibank Group Ltd boasts being one of the highly-rated FX and CFDs brokerage platforms as it serves clients across five continents with tight spreads and ultra-fast executions with no requotes or slippages. Its asset classes support 20,000 tradable instruments allowing traders to diversify their portfolio while trading CFDs of products like cryptos and shares and also take advantage of current market prices in spot instruments.

Although, the broker might not be the perfect place for a novice market participants to start as the broker fails to provide educational materials. This could make it difficult for newbies to understand the financial markets. In addition, the charges a high inactivity fee capped at $60 per month. As a result, clients have no freedom to trade when they feel like it.