- Failure of Canada’s unemployment rate for June 2021 (MoM) to beat estimates at 7.7% slowed down the progress of the Canadian dollar.

- UK’s growth in wages is expected to hover around 2.5% in the second half of 2021.

- Canada saw the number of hours worked in June 2021 decrease 4% below their pre-pandemic levels, as the population of employees working from home also fell to 4.7 million (-400,000).

The GBPCAD pair closed at a high of 1.39% in the week leading to July 9, 2021, and was up 0.15% as of 1:45 am GMT on July 12, 2021.

The composite PMI data for June 2021 (MoM) boosted the British pound after beating consensus estimates at 62.2 from 61.7. Services PMI also lifted the pound at 62.4, beating estimates by 1.13% but was down 0.79% from the previous month of June 2021.

Low employment levels

Failure of Canada’s unemployment rate for June 2021 (MoM) to beat estimates at 7.7% slowed down the progress of the Canadian dollar. It stood at 7.8% from a previous record of 8.2% and was down 0.4 points.

Data from the labor force survey (LFS) showed that there was a decrease of 61,000 or -3.7% in the total number of Canadians unemployed as of June 2021. The number of hours worked in the month also decreased by 4% below their pre-pandemic heights as the number of employees working from home also fell to 4.7 million (-400,000).

Government data from Statistics Canada also indicated that full-time employment positions fell by 33,000 as 264,000 new part-time posts were created. However, the previous two months of May and April 2021 had seen a total loss of 132,000 in the part-time employment record.

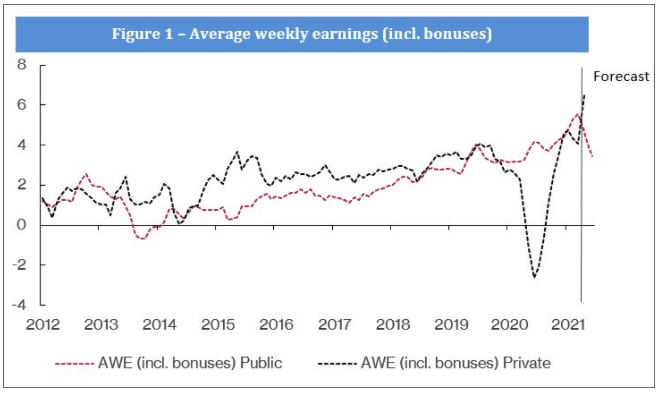

Higher monthly UK wage growth

The National Institute of Economic and Social Research (NIESR) predicted a short-term increase in UK average wages. However, the growth in wages was slated to hover around 2.5% in the second half of 2021.

UK average weekly earnings (AWE)

The growth in average weekly earnings (AWE) in the UK is expected to hit 8.1% in Q2 2021 from 4.2% in Q1 2021. This growth is attributed to compositional effects, without which the increase in earnings will remain 2.5%. Industrial production rose 0.8%, falling short of an earlier projection of 1.5%.

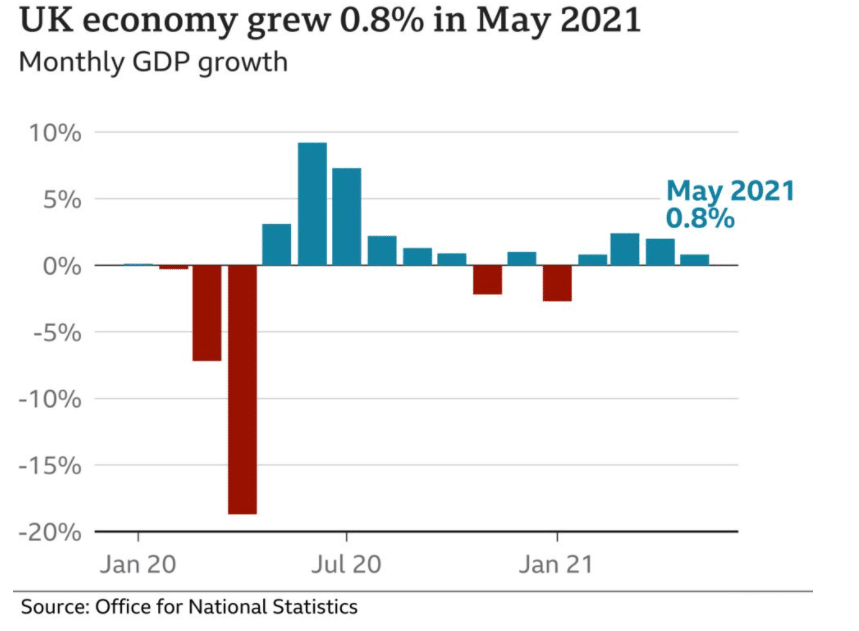

The monthly GDP for May 2021 was at 3.6%, indicating positive economic growth. May 2021 saw the GDP rise 0.8% due to the ease of coronavirus restrictions. Restaurants were allowed to serve customers indoors, with food services rising 37.1% in the month.

GDP Growth in the UK Economy

Construction output for May 2021 (MoM) was down 0.8% from a previous record of 1.0%, failing to beat estimates at 1.0%.

However, the output level was up 0.3% (YoY) or £43 million above the pre-pandemic output in February 2020. Repair and maintenance also increased by £365 million (+7.5% YoY), as new work decreased by £320 million in May 2021.

Technical analysis

The GBPCAD pair formed an ascending broadening wedge with the price rising from 1.7057 to 1.7302. This move tested the second support (marked 2) at 1.7179. The first support was seen at 1.6880.

There is a rising volume indicating the increase in buyers. The 14-day RSI shows high buying activity at 68.21, approaching the 70.0 overbought area.

The pair may be headed towards 1.7589 resistance. At 1.7305, the pair is also staying above the 9-day EMA, which is at 1.7208.