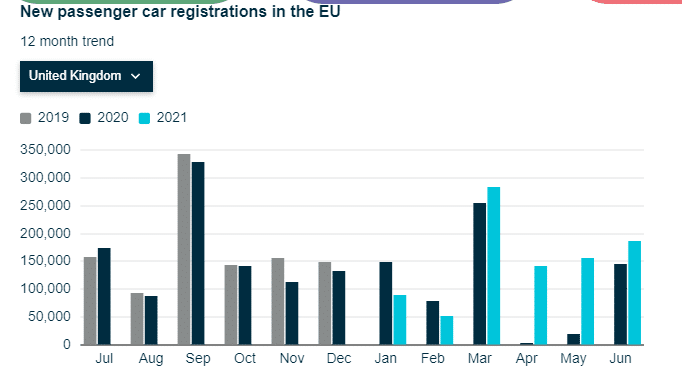

- While UK car registrations rose 28% in June 2021 (YoY), it had declined from the previous reading of 674.1% in May 2021.

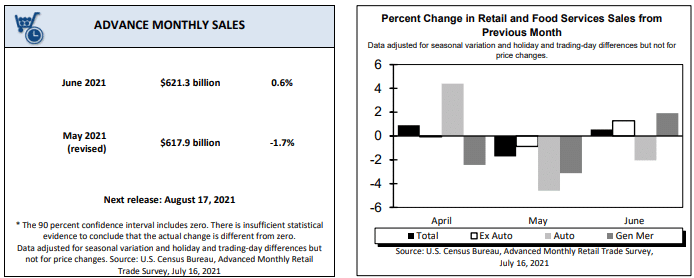

- Core retail sales in the US for June 2021 (MoM) rose 1.3%, beating estimates at 0.4%.

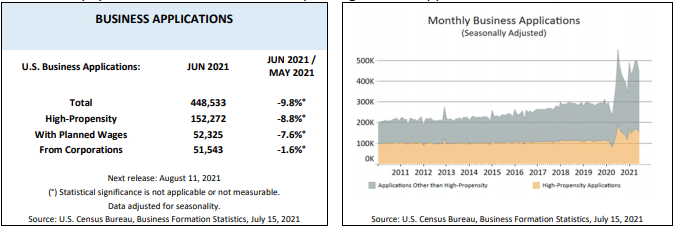

- Application for business formations in the US declined 9.8% in June 2021 to 448,533

The GBPUSD pair fell 0.41% on July 16, 2021, from the previous day’s close. It closed at 1.3772, losing 0.0056 points after it had opened at 1.3828. The British pound was adversely affected by a decrease in car registration in June 2021.

UK car registrations rose 28% in June 2021 (YoY), showing an increase of 186,128 units. However, the record showed a decline from the previous reading of 674.1%. On monthly analysis, car registration in the UK gained 18.8% in June 2021, up from 10.7% in May 2021. The EU saw a 10.4% increase in car registrations in June 2021.

UK’s car registrations

The number of new cars registered in the UK had, however, declined 34.45% from March 2021 highs at 283,964.

US retail sales

Core retail sales in the US for June 2021 (MoM) rose 1.3%, beating estimates at 0.4%, while core retail sales in May 2021 had declined 0.9%. According to the US Commerce Department (BEA), retail sales stood at $621.3 billion, up 0.6% from May’s sales earnings at $617.9 billion.

US retail and food sale (June 2021)

Consumer purchases from retail stores excluding gas and automotive for June 2021 (MoM) also rose 1.1% from a previous decline of 1.0%. May 2021 had also seen retail sales increase 0.3% (MoM) and 15.6% (YoY). It was buoyed by strong sales in clothing at 47.1% (YoY) as the ease of Covid-19 restrictions influenced the US economy in Q2 2021.

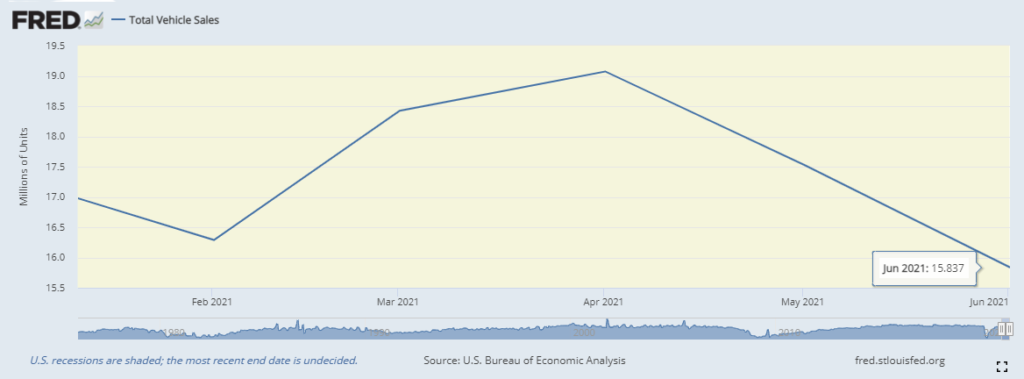

However, the vehicle sales index in the US declined to 15.837 in June 2021 from a high of 19.073 in April 2021.

Total sale of vehicles in the US

Vehicle sales in May 2021 continued to fall to 17.529 due to the scarcity of new cars. Reduced vehicle supply was caused by a global shortage in semiconductors.

Business formation

Application for business formations in the US declined 9.8% in June 2021 to 448,533.

Statistics on US Business formations

The Midwest had the highest decrease at 74,535 in June 2021 (MoM). A US survey conducted among businesses indicated that 1.8 million Americans had turned down new job offers to continue receiving unemployment benefits. The lure of unemployment benefits has decreased the urge to start new businesses with many fearing the rising inflation and wages.

Business formations with planned salaries/ wages declined 7.6% as applications in corporations also dropped 1.6% in June 2021. In the four quarters leading to June 2021, business applications had also dropped 6.9%, indicating the slow pace of recovery post-pandemic.

As of June 19, 2021, approximately 14.1 million Americans (adults) were under the unemployment benefits program. The weekly number had declined 6.74% to 360,000 as of July 10, 2021, from 386,000 the previous week.

UK financial stability

The Bank of England is hoping to maintain the bank rate at 0.1%, with its next meeting scheduled for August 5, 2021. The UK is scheduled to reopen on July 19, 2021.

The UK’s inflation has already surpassed the 2.0% target, posting 2.5%. Investors are hopeful that the BoE will start reducing the quantitative easing program that consists of £875 billion in gilts and £20 billion worth of corporate bonds, adding up to £895 billion.

Technical analysis

The GBPUSD pair formed a rounded top pattern that began on May 4, 2021. We expect a short-term bearish formation that may lead to a downtrend reaching 1.3724 after crossing 1.3731.

Volume is rising, with the 14-day RSI at 37.47, slightly above the oversold region. If the price reverses, it may trade in a range of 1.3755 and 1.4054.