The housing market is an important part of the American economy. According to Zillow, the total market value of all homes in the US is valued at more than $36.2 trillion. This makes it significantly bigger than the country’s total Gross Domestic Product (GDP) of over $21 trillion. In this article, we will look at how you can use housing data in forex trading.

Why is housing important?

The goal of most Americans is to own a home. This is what is known as the American dream. As a result, many people do the best that they can to own a home or several properties for investment purposes. Indeed, the aggregate mortgage debt in the US totals more than $10 trillion. Millions of homeowners have a mortgage, especially now that interest rates are at historic lows.

Housing data is important for several reasons. First, housing forms an important part of the US GDP calculation. GDP is calculated using the C + I + G (X – M). In this, C stands for consumption while I stands for investments. G represents government purchases. X and M are exports and imports. Therefore, housing is represented in both C and I.

Second, a home is typically the most expensive item that a person will ever buy. Therefore, when housing numbers are impressive, it means that the economy is doing well. Besides, you need to have money, at least a deposit, to buy a home.

Third, a home represents the biggest share of a person’s net worth since it is an asset. Therefore, with an asset, one can get loans from banks or other non-banking lenders.

Therefore, forex traders, investors, and policymakers tend to pay closer attention to the housing numbers. In most cases, house prices will do well when the economy is doing well. This is primarily because higher prices mean that there is more demand for housing units.

The housing sector is so important that it led to the Global Financial Crisis (GFC) of 2008/9. This crisis happened after mortgage defaults soared, leading to the collapse of several banks like Bear Stearns and Lehman Brothers.

Key housing indicators in the US

As a forex trader, there are several key indicators that can guide you to determine whether the housing market is doing well. These numbers come both from the government, while others come from private entities. Let us look at some of the most popular ones.

Building permits

Like in most countries, home builders need to take a permit from local city councils. Therefore, in the US, the housing department receives the number of new permits issued every month. It then tabulates the data and releases it on a monthly basis. In theory, a higher permit number means that the housing market is strong.

Housing starts

Housing starts refers to residential units whose excavation of the foundation has started. This is one of the most important numbers because it means that the developer has already committed to building the project.

It is more important than permits because permit holders can stay for months before starting to build. This report also contains numbers on the housing units that are yet to be completed.

Pending home sales

The pending home sales data is published every month by a trade agency that represents realtors. This number shows the number of home sales where a contract between the seller and the buyer has been signed. It is a good indicator of the state of the real estate industry. In most cases, it can take time before a deal is closed.

Existing home sales

This number measures the number and value of transactions of existing homes that were sold in a given month. These houses include single-family homes, condos, and co-ops. This number is usually published by the National Association of Realtors.

New home sales

As the name suggests, the new home sales data refers to new homes that were sold in a given month. In a strong economy, the number of new home sales tends to keep rising.

Home price index

This data refers to the overall prices of new and existing homes in the country. The HPI tends to rise when the economy is doing relatively well.

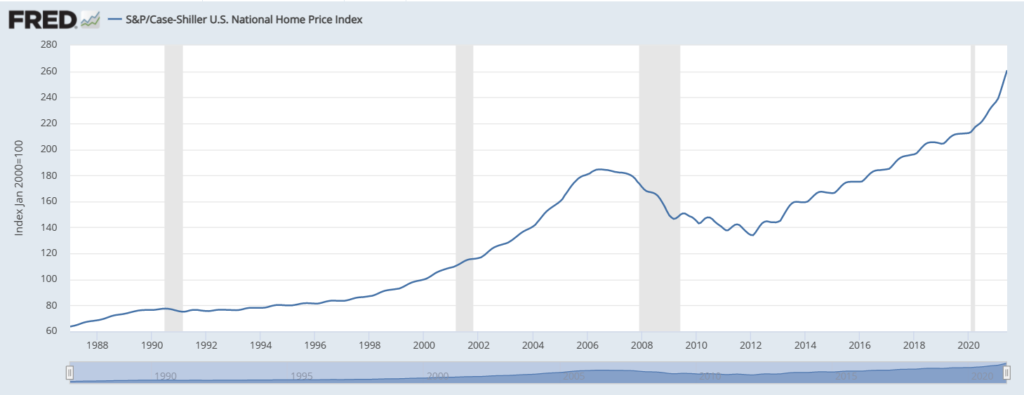

Case-Shiller home price index

The chart above shows that the Case-Shiller National Home Price index has been in a sharp upward trend.

What affects the housing market?

The housing market is driven by several factors. First, the industry does well when interest rates are low. In a period of low rates, people will have easier access to financing. As a result, this tends to lead to more demand for homes. An increase in demand leads to higher prices. As shown above, the HPI jumped since the Global Financial Crisis (GFC) as interest rates have remained relatively low.

Second, the housing industry has a correlation with the state of the overall economy. When the unemployment rate is low, and wages are rising, the demand and prices are likely to rise.

Third, commodity prices have an impact on the housing market since they affect the cost of construction. Some of the most useful commodities that affect home prices are lumber, steel, and aluminium.

Summary

So, how do you use the US housing data in forex trading? While the housing numbers are important gauges of the economy, they typically have minimal impact on the US dollar. In fact, unless there is a major miss or beat, the US dollar rarely moves when the data is released.

Still, this data can help you understand the state of the economy and anticipate actions by the Fed. When housing data, together with other macro numbers are strong, they make a case for a hawkish Federal Reserve. This, in turn, leads to a relatively strong US dollar.