The Fibonacci trading strategy is one of the most effective ways to ride the major trend. You might have heard the famous proverb in the Forex market “Trend is your friend”. To trade with the major trend, you need to find the endpoint of the retracement. And the best way to find the sweet trading spot is to use the Fibonacci retracement tools. Carefully read this article to learn the perfect way to use the Fibonacci retracement tools like the pro trader.

What is a retracement?

If you notice the price movement in any asset, you will see the market is going up with some minor pullback in the north. And when it goes down, you notice the minor pullback in the south. The minor pullbacks in any asset are known retracement and it gives the traders a perfect opportunity to ride the trend.

In an uptrend, you need to find the endpoint of bearish retracement to execute the long orders. Similarly, you need to find the endpoint of bullish retracement in the bearish trend, to place your short orders. And Fibonacci retracement tools will help you to identify the key retracement phase of the market.

Drawing the retracement level

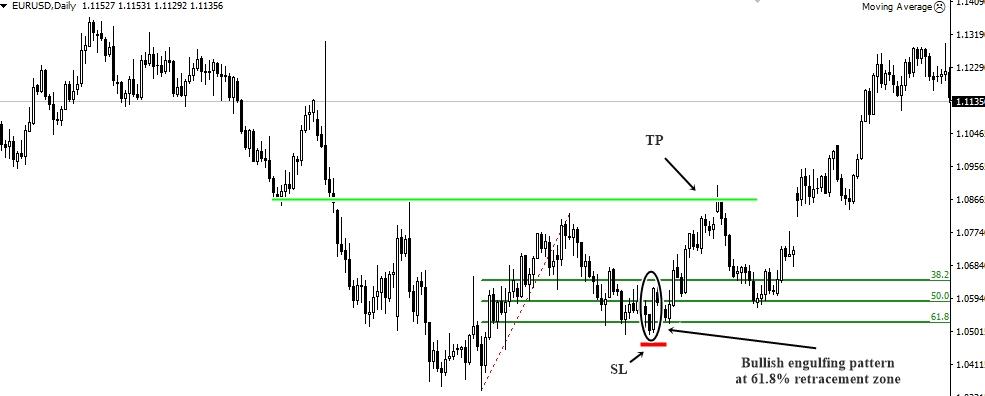

You don’t have to do any complex calculations to draw the retracement levels. To find the bullish retracement level, just use the most recent swing low and high. The first point of the Fibonacci retracement tool should be at the swing low and the endpoint will be at the swing high. Let’s see an example.

Figure: Executing long order at 61.8% retracement zone

Notice how we have drawn the key retracement zone using the recent low and high. Some of you might think about why we have just three Fibonacci retracement levels. Though there are many retracement levels, it’s better to rely on 38.2%, 50% and 61.8% retracement level. These are often known as the sweet spot for the retail traders. If you spot any price action confirmation signals at these levels, you can execute the trade and expect to make a decent profit. Notice how we have executed the long orders at the 61.8% retracement level with the bullish engulfing confirmation signals.

Setting up the stop loss

There are two basic ways you can set the stop loss while using the Fibonacci trading strategy. Those who love to trade in the most conservative way should always set the stop loss using the 61.8% retracement level. But using the 61.8% retracement zone as the key level to set the stops, requires big trading capital.

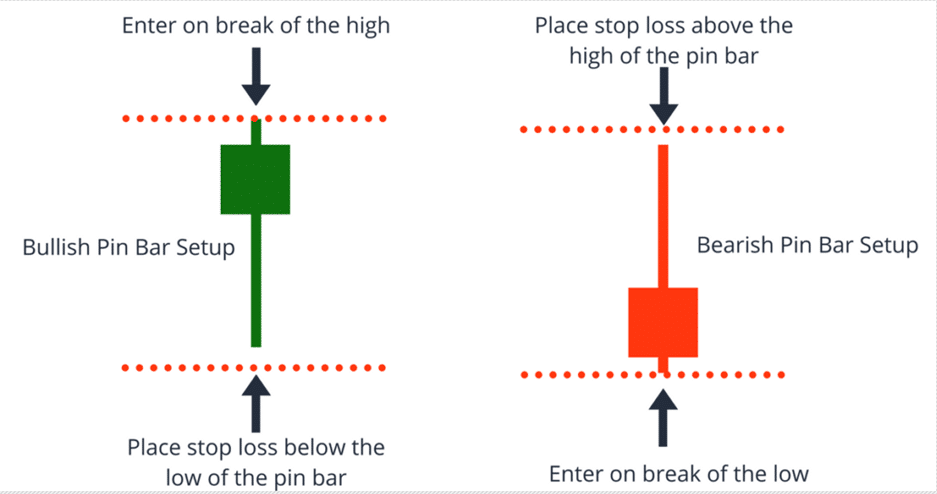

Figure: Placement of the stops using the tail of candlesticks

Unless you are trading with a big investment, trading with a stop loss can be a very difficult task. For this very reason, the elite traders often use the price action confirmation signals to place the stops. Look at the above diagram and you can notice how the stop is placed by using the bullish engulfing pattern.

Reversal in trend

Never think the Fibonacci trading strategy always helps you to make a profit. At times you will lose trades even after following all the rules. If for any reason price breaks below the 61.8% retracement level, you can consider it as a trend reversal sign. So, always be prepared to deal with such consequences or else it will be tough to recover the loss. But the reversal in the Forex market doesn’t occur too frequently. If you can stick to the Fibonacci trading strategy and trade with managed risk, you can expect to make consistent profit by using this strategy.

Using the trailing stops

You must learn to use the trailing stops to make consistent profit from this market. Those who rely on Fibonacci trading strategy often fails to maximize the profit factors. To maximize your profit factor, you must learn to use the trailing stops. Let’s say, you have executed a long order in the GBPUSD pair. If the price moves 50 pips in your favor, move the stop loss to the breakeven point. And keep trailing the stops by using the knowledge of minor support and resistance level. But this might be tough for the amateurs since they don’t have enough skills to deal with the minor levels.

Useful tips

To maximize the profit factors in the Fibonacci trading system, you must learn to analyze the price action signals. Trading the market with the price action signals greatly improve your execution. Once you learn to trade with tight stops, you can increase the lot size without taking too much risk. And never try to execute any trade on the event of high impact news. Focus on the stable market condition as it gives much more accurate data. And if the trade hits the potential stops, never get frustrated. Losing should be considered as a part of this profession. And always trade with 1:3+ risk to reward ratio while using this strategy.