The Triple Exponential Moving Average (TRIX) indicator is a two-pronged indicator. It acts as both a momentum oscillator and a trend-following tool. Like the latter, it shows the strength and direction of price momentum. As the former, it is used to point out oversold or overbought levels on a price chart. It is known for highlighting major price trends, as it only takes into account those trends that last longer than its time frame.

How it’s calculated

In essence, this indicator is a triple Smoothed Exponential Moving Average. What this means is that it’s an EMA of an EMA of an EMA. Usually, an EMA prioritizes the most recent data in its calculation, which almost completely eliminates lag. When you smooth an EMA, however, it introduces lag, and every time you smooth it, the more it lags behind the price.

Let’s assume we are calculating a 10-period TRIX. Here’s how to go about it:

Step 1: Calculate a 10-period EMA using closing prices.

Step 2: Obtain a 10-period EMA of the result obtained in step 1.

Step 3: Obtain a 10-period EMA of the result in step 2.

Step 4: Calculate TRIX by obtaining the 1% change of the triple-smoothed EMA obtained in step 3.

The result should be a fairly smooth line that oscillates above and below a zero line. Consequently, this line will be oscillating between positive and negative zones.

How it functions

As aforementioned, TRIX has two functional abilities. In following trends, when TRIX is oscillating in the positive zone, it means that prices are in an uptrend. The bulls have the upper hand whenever the TRIX line is in the positive region. In the same way, when its value is in the negative zone, it denotes that prices are in a downtrend and bears have the upper hand.

TRIX also works as an oscillator to mark potential peaks and troughs. When it strikes extreme positive levels, it denotes overbought conditions, which may signify an impending downturn. When it hits the extremities in the negative zone, it denotes oversold conditions. This could be a sign of an incoming bullish reversal.

How to obtain signals from a chart

Crossing the zero line

As aforementioned, while TRIX is in the positive region, it signifies that momentum is leaning towards the bulls while the negative region means bearish momentum is winning. Therefore, when the indicator crosses the zero line from below, this is a sign of a shift in the market sentiment. At this point, traders can open long positions as prices will most likely be rallying.

Alternatively, a zero-line cross from above indicates a waning bullish momentum and, in its place, a strengthening bearish sentiment. When the indicator crosses below this line from above, traders will be looking to open short trades to take advantage of the resultant downturn.

Crossing a signal line

To fine-tune this indicator’s accuracy, traders often use a signal line in conjunction with the TRIX. This signal line is essentially a Moving Average of the TRIX. For this reason, this signal line tends to lag behind it.

Signals are obtained whenever our indicator crosses this signal line. A cross above this signal line yields buy signals, as prices begin to rise following this cross. Similarly, a cross below the signal line will indicate that prices are embarking on a downturn, which gives sell signals.

These signals are useful in both trending and consolidating market periods. When the market is trending, a crossing of the signal line shows the end of a price retracement and the resumption of the prevailing trend. During consolidation, TRIX hovers around the signal line, showing that support and resistance levels are currently holding.

Divergence from price

When the price is trending upwards but the TRIX line is headed downwards, that is usually a bearish divergence. More often than not, it precedes a downturn in prices. Similarly, when prices are trending downwards, but the TRIX indicator is in an uptrend, it signifies an incoming bullish reversal.

Combination with other indicators

Signals obtained from TRIX can be useful in trading, but if they are confirmed by other indicators, their chances of success improve significantly. For this reason, most traders combine this indicator with other oscillators such as RSI and MACD.

TRIX + RSI

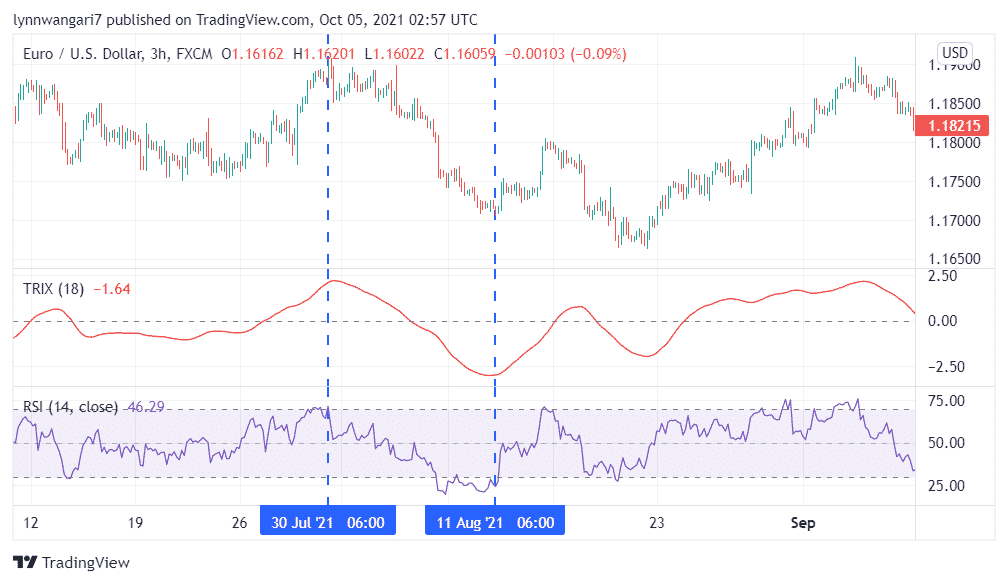

From the example below, we can see the entry signal on 30th July when RSI recorded overbought conditions for the EURUSD pair. Shortly afterward, TRIX was also overbought, and then it started on a downturn. This confirmed the signal to enter a short position.

On 11th August, the RSI was oversold for a while before it embarked on an uptrend. Similarly, the TRIX indicator troughed, confirming that our currency pair was indeed oversold. This confirmed the exit of our short. True to this prediction, prices went bullish shortly afterward, marking the end of our bearish run.

TRIX + MACD

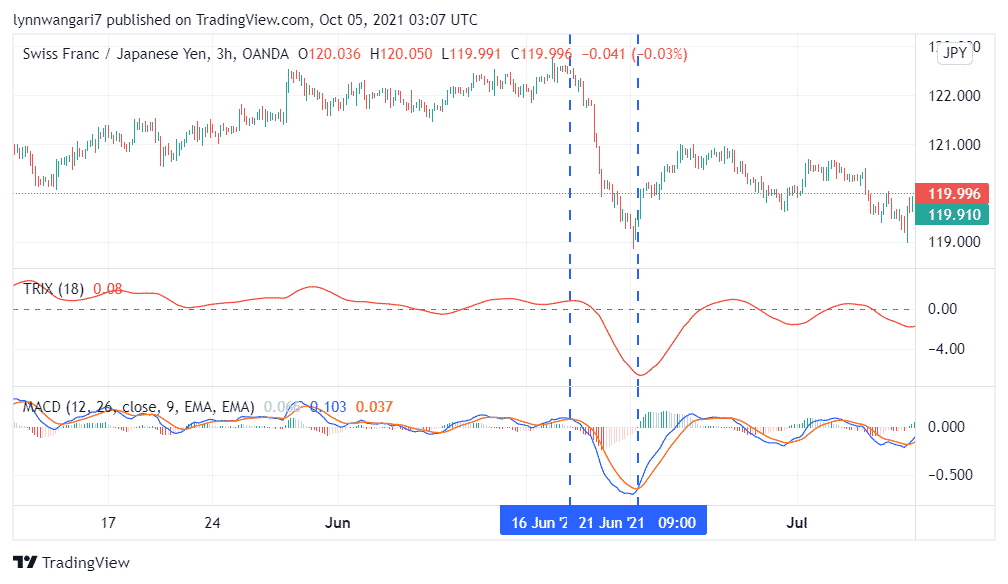

In the example below, we see the MACD cross below its red signal line on 16th June, giving our first bearish flag. Shortly afterward, the TRIX line plummeted and crossed below the zero line. This was a confirmation of the signal to go short.

On 21st July, the TRIX indicator reached a trough, signifying that the CHFJPY pair was oversold. Further, the MACD made a bullish crossover pattern, which confirmed the end of our downtrend. This was the signal to close our positions and take profit.

Conclusion

The TRIX indicator can be used as a trend-following tool and as an oscillator. It gives signals by crossing the zero line, making crossovers with a signal line, or through divergences with the price. For increased signal accuracy, this indicator is often used in collaboration with the RSI or the MACD.