We Like:

- Raw market spreads starting from 0.0 pips

- 24/7 multilingual customer support

- Powerful trading tools

- Deep liquidity

- Trade CFDs on FX and other products

- Offers social trading services

- Regulated by two-tier agencies making it relatively safe

- Suitable for both retail and institutional traders

- No inactivity fees

- Holds clients’ funds in segregated bank accounts

- No deposit or withdrawal fees

- Offers about 15 payment options

- Accepts deposits in ten different base currencies

We Don’t Like:

- No negative balance protection

- Charges commissions on trades depending on the account type

- Not regulated by a top-tier body

- Charge transaction fees for some payment options

- Not available to US residents

The Verdict:

IC Markets is an online CFDs provider based in Sydney, Australia, and runs offices in Cyprus and Bahamas. The broker claims to provide CFDs on FX and other markets with raw spreads starting from 0.0 pips fueled by deep liquidity, fast executions, and leverage of up to 1:500. It confirms that about 180,000 traders composed of both retail and institutional clients speculate on its products worldwide.

The CFDs provider made its debut in the financial trading world in 2007, assuring to renovate the trading industry with cutting edge technology bolstering deep liquidity, lightening-executions, and raw spreads starting from 0.0 pips. Currently, IC Markets offers the best asset prices via superior liquidity, low latency connectivity, and powerful trading platforms.

Company details

Online CFDs trading company IC Markets launched in 2007 in Australia and received regulation from the Australian Securities and Investment Commission (ASIC). The broker aimed to tap into deep liquidity trading, offering raw spreads fluctuating from 0.0 pips and ultra-fast executions on many markets.

IC Markets now serves about 185,000 traders speculating CFDs on FX and a spectrum of other markets backed by 24/7 multilingual expert support. The markets trade with low latency, razor-sharp raw spreads, and fast executions. IC Markets claims that orders execution speeds clock an average of under 40 milliseconds.

IC Markets’ assets include:

- FX

- Indices

- Commodities

- Crypto

- Futures

- Bonds

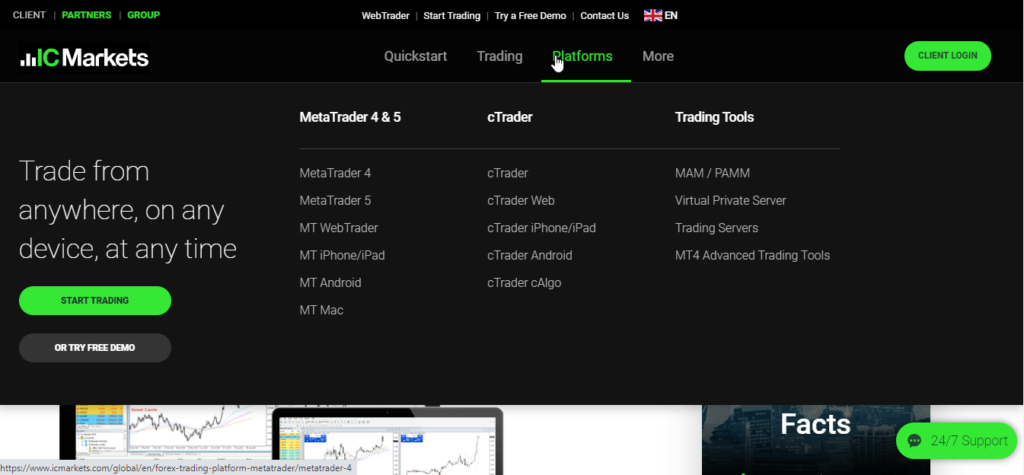

Collectively, these assets yield more than 1,700 tradable instruments that clients trade using the broker’s trading platforms. IC Markets provides the popular MetaTrader platforms coupled with the copy trading platform cTrader that comes in handy to signal providers and followers. All the trading platforms suit to operate on different operating systems and the web. They also integrate with state-of-the-art trading tools shedding light on profitable CFDs trading.

Integrated trading tools include:

- VPS

- Servers

- FX calculators

- Economic calendar

- MT4 tools

- EA’s

With access to these tools, traders have the opportunity to double their initial account investment. IC Markets caps the initial monetary size needed at $200 across all account types. The account types offer different features tailored to serve special types of clients depending on their trading objectives. However, despite the varying account type conditions, IC Markets provides multiple payment options accessible to all traders in ten different base currencies and waives all fees on funding and withdrawing funds from the broker.

Regulations

The number one Australian CFDs provider IC Markets falls under a reputable regulation pillared by agencies such as the ASIC, CySEC, and the FSA of Seychelles. The regulation framework marks it as a two-tier regulated broker, meaning it’s relatively safe to trade with. Besides, IC Markets guarantees clients safety of assets citing to holds funds in segregated top-tier bank accounts.

- Registered in Seychelles with the No. 8419879-2 and regulated by the Financial Services Authority of Seychelles with license No. SD018.

- International Capital Markets Pty Ltd is registered in Australia with the Reg. No. 123 289 109 and holds license No. 335692 from the ASIC.

- IC Markets EU Ltd is registered in Cyprus and regulated by the CySEC, license No. 362/18.

- IC Markets Ltd is registered in the Bahamas and regulated by the Securities Commission of the Bahamas, license No. SIA-F214.

Trading platforms

IC Markets provides cutting-edge platforms backed by powerful trading tools making trading easy and effective for clients. The leading trading platforms serving all sorts of traders include the MT4 and its predecessor, the MT5. Among these popular platforms exist the social trading platform cTrader that fuels copy-trading, cushioning newbies and investors following signal providers against the risks of financial trading.

MT4

- Market-leading spreads and low commissions — yes

- Available on all platform versions — yes

- Leverage of up to — 1:500

- Min. lot size of 0.01

- Flexible funding and withdrawal options — yes

- No trading restrictions

- Lightening-fast order executions

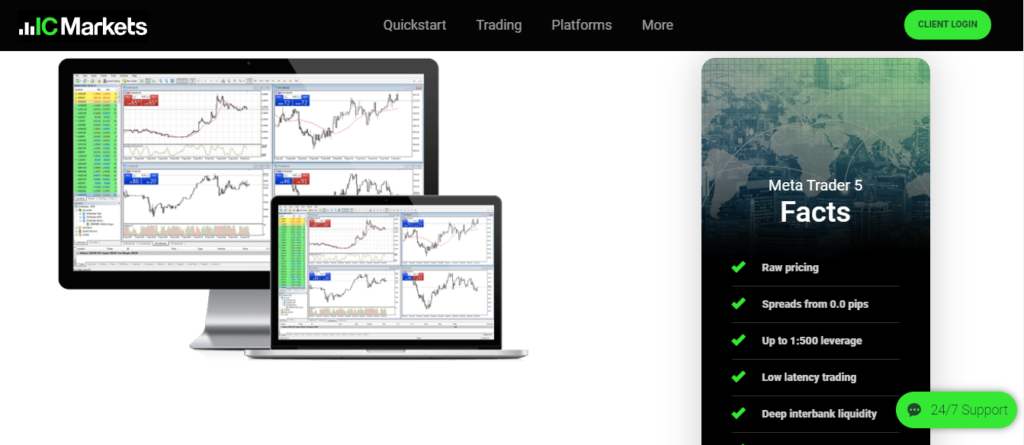

MT5

- Available on all platform versions — yes

- Raw pricing — yes

- Spreads from 0.0 pips

- Leverage up to — 1:500

- Low latency trading — yes

- Deep interbank liquidity — yes

- Multi-asset platform — yes

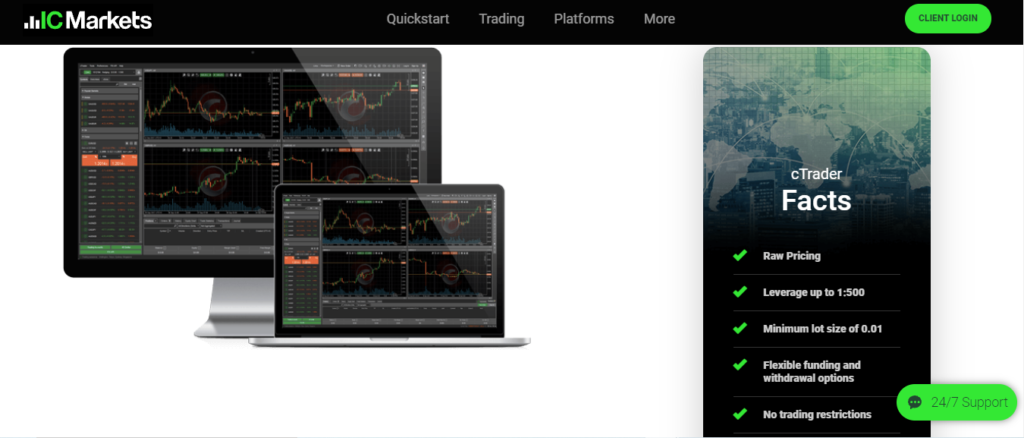

cTrader platform

- Raw pricing — yes

- Leverage up to — 1:500

- Min. lot size of 0.01

- Flexible funding and withdrawal options

- No trading restrictions

- Fast order executions

Range of markets

IC Markets provides a wide range of products for clients to speculate as CFDs with deep liquidity, superior executions, and meager raw spreads. The markets’ bracket encloses 61 pairs trading as CFDs, 23 indices, commodities, 1600+ stocks, among others. All these instruments trade with real-time expert support allowing clients to mitigate issues and problems encountered during trading by contacting the support team.

Forex

IC Markets boasts of being among the few brokers offering forex CFDs in the financial markets. It allows clients to trade 61 currency pairs as CFDs from Monday to Friday with tight spreads from 0.0 pips, deep liquidity, and leverage of up to 1:500. The FX pairs compose of significant pairs, minors, and exotics.

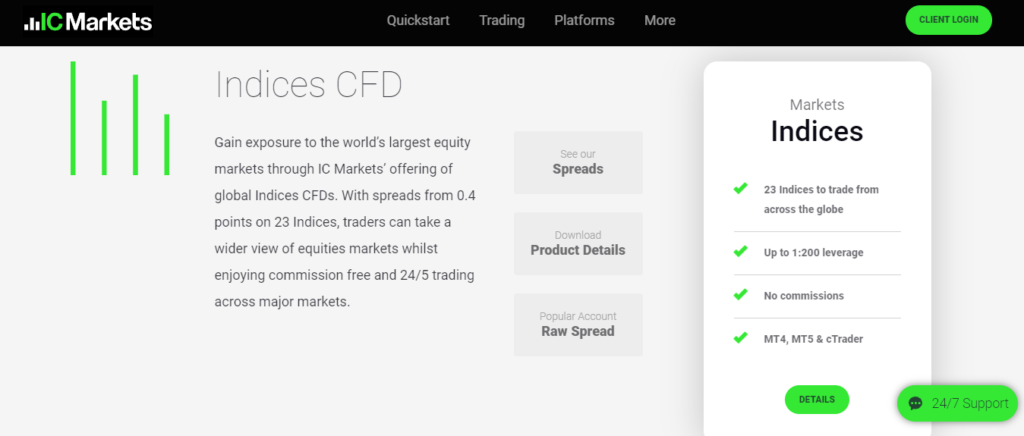

Indices

About 23 global indices trade at IC Markets from Monday to Friday backed by real-time customer support with tight spreads from 0.4 points and leverage of up to 1:200. IC Markets also confirms that these instruments trade with no commissions through its platforms.

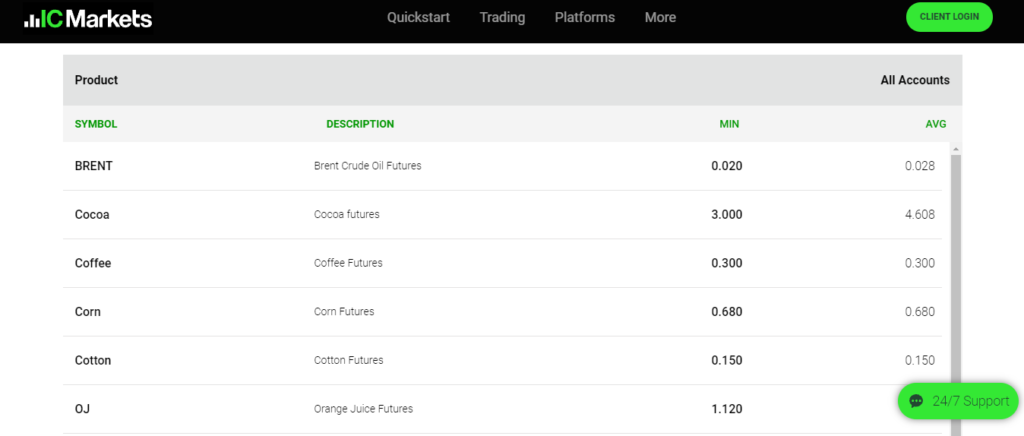

Commodities

Over 22 commodity products encompass energies, precious metals, and soft commodities trade at IC Markets from Monday through Friday, aided by expert customer support with meager spreads starting from 0.0 pips, deep liquidity, and leverage of up to 1:500.

Stocks

1600+ stock instruments trade at IC Markets across global exchanges such as NASDAQ, NYSE, ASX. Clients have the opportunity to earn dividends and speculate these products as CFDs when trading. They access the market via the MT5 and experience ultra-fast executions.

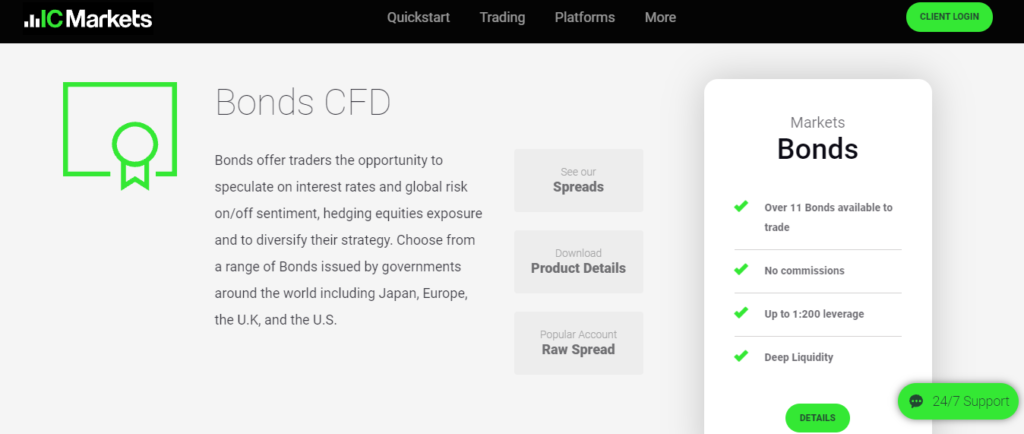

Bonds

Bonds CFDs allow traders to speculate on the interest rates and global risks. IC Markets offers eleven to traders that clients speculate from Monday to Friday with no commissions, deep liquidity, and leverage of up to 1:200.

Cryptocurrencies

Market analysts taunt the crypto market as one of the world’s most volatile financial markets. Price fluctuations are driven by news and demand, giving CFDs traders a 24/7 marketplace to speculate on the digital asset’s prices. IC Markets also opens the crypto market seven days a week, trading with leverage of up to 1:5.

The market supports 13 cryptos consisting of pioneers such as BTC, Ethereum, among others. Moreover, clients can go long or short hence having the hedge even when the market goes down.

Main features

So far, we have come across most of the broker’s main features bolstering its services. In summary, IC Markets supports the following features:

- Tight raw spreads — IC Markets extremely low spreads starting from 0.0 pips

- Lightening-fast executions — The broker confirms to execute orders in under 14 milliseconds.

- Superior technology — IC Markets notes to have partnered with the best trading technology companies and provided cutting-edge trading tools.

- 24/7 customer service also asserts to provide helpful customer support from Sunday to Saturday through email, calls, and live chat.

- Two-tier regulated broker — IC Markets holds two-tier regulation licenses from agencies such as the ASIC.

- Furnished with educational materials — IC Markets assures traders a wide range of educational resources, such as articles, video tutorials, webinars, and others to help boost trading skills.

Types of trading accounts

As introduced in this review, IC Markets offers multiple account types suited for particular clients. These include live accounts and a demo account that best comes in handy for novice traders.

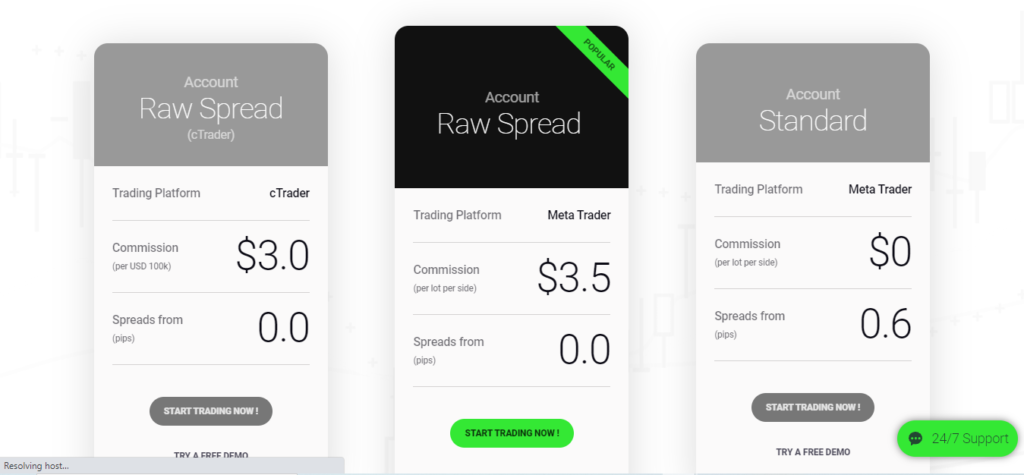

The Raw spread account

- Trading platform — cTrader

- The commission per lot — $3

- Spreads from — 0.0 pips

- Starting deposit — $200

- Leverage — 1:500

- Max. No. of position orders per account — 2000

- Server location — London

- Micro Lot trading — yes

- Currency pairs — 64

- Index CFD trading — yes

- Stop out level — 50%

- One-click trading — yes

- Islamic accounts — yes

- Trading styles allowed — all

- Order distance restriction — none

- Programing language — C#

- Suitable for — day traders and scalpers

The MetaTrader raw spread account

- Trading platform — MetaTrader

- The commission per lot — $3.5

- Spreads from — 0.0 pips

- Starting deposit — $200

- Leverage — 1:500

- Max. No. of position orders per account — 200

- Server location — New York

- Micro Lot trading — yes

- Currency pairs — 64

- Index CFD trading — yes

- Stop out level — 50%

- One-click trading — yes

- Islamic accounts — yes

- Trading styles allowed — all

- Order distance restriction — none

- Programing language — MQL4

- Suitable for — EA’s and Scalpers

The Standard account

- Trading platform — MetaTrader

- The commission per lot — $0.0

- Spreads from — 0.6 pips

- Starting deposit — $200

- Leverage — 1:500

- Max. No. of position orders per account — 200

- Server location — New York

- Micro lot trading — yes

- Currency pairs — 64

- Index CFD trading — yes

- Stop out level — 50%

- One-click trading — yes

- Islamic accounts — yes

- Trading styles allowed — all

- Order distance restriction — none

- Programing language — MQL4

- Suitable for — Discretionary Traders

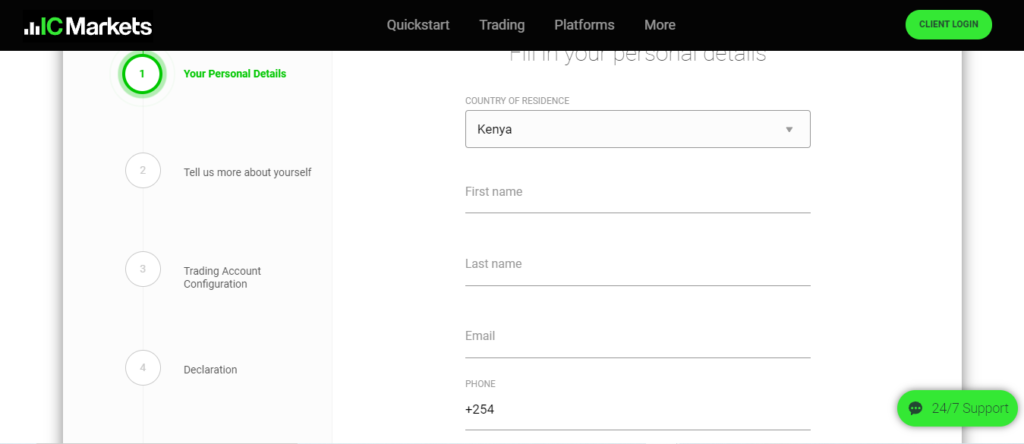

Opening an account at IG Markets

The account opening process is relatively fast and involves the following steps.

Step 1: Log into their website and click the start trading button.

Step 2: Fill in your personal details.

Step 3: Verify account.

Step 4: Agree on terms and conditions.

Step 5: Fund the account.

Step 6: Start trading.

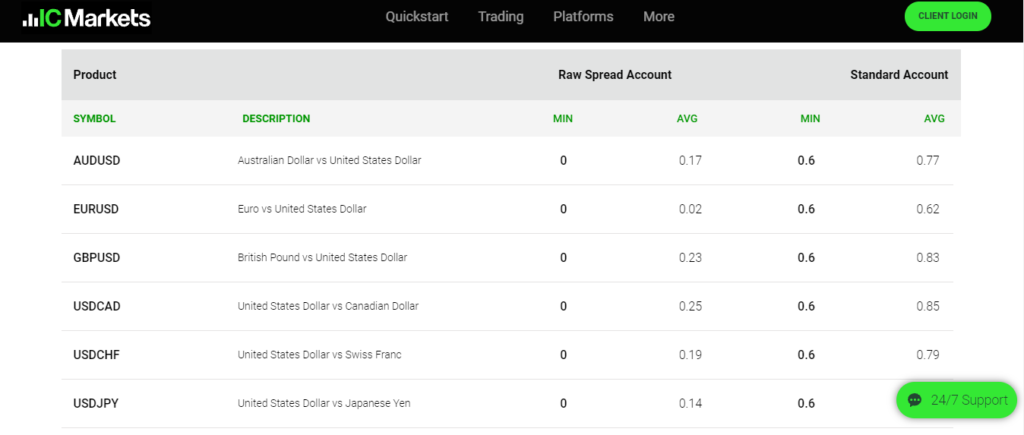

Commissions and spreads

It offers deep liquidity, lightning-fast executions, and raw spreads starting from 0.0 pips. This means the broker operates as a No dealing desk and does not add fees on the market spread. However, some clients incur fees due to the spread via the standard account. The min. spread starts from 0.6 pips. But unlike the raw spread traders, the standard account traders do not face any trading commissions. Raw spread account traders incur commissions averaging $3-$3.5 per lot.

Customer service

The broker boasts of providing award-winning customer support that attends to clients around the clock in multiple languages. Customers contact the support team through calls, emails to the helpdesk, live chats, and access a wide range of educational materials.

IC Markets Review

What we liked

- Tight spreads

- Superior trading technology

- Deep liquidity

- Low latency connection

- Segregation of funds

- Easy account opening

- Well-customized official website

What we disliked

- No negative balance protection

- Not regulated by top-tier agencies

- Not accepted in the USA

The bottom line

The broker prides itself on implementing cutting-edge trading technology, offering interbank liquidity, fast executions, and tight spreads. It claims to serve about 180,000 traders from around the world, speculating on its 17,000+ instruments.

However, the broker falls under a two-tier regulation despite the luring pros, making it relatively safe to trade with. It also charges commissions per lot and fails to offer negative balance protection meaning clients can lose more than they invested.