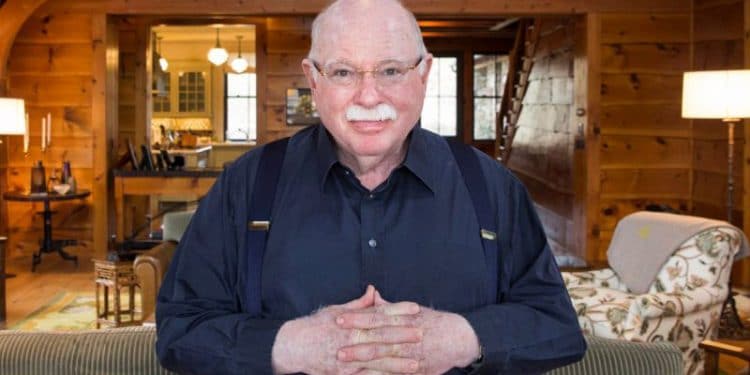

Who is Michael Steinhardt?

Born on December 7th, 1940, Michael H. Steinhardt is a famous American investor, philanthropist and hedge fund manager. He is the founder of Steinhardt Partners, which recorded an average annualized return of 24.5%, between the years 1967 and 1978. After losing one-third of his fund’s value in the bond market crisis of 1994, he came back stronger as the head of WisdomTree Investments, which had $43 billion in AUM (Assets under management).

Steinhardt’s graduated from the University of Pennsylvania and started working for Calvin Bullock. His first foray into fund trading started in the late 1960s when he came possessing an analytical background. He started working at Loeb Rhoades & Co as an analyst, following the conglomerate industry. Using his investment earnings, Steinhardt founded hedge fund Steinhardt, Fine, and Berkowitz in 1967, along with co-investors Jack Nash and William Salomon. The fund, which would later be called Steinhardt Partners, would provide an annualized return of 24.5% to its clients. This nearly tripled the annualized performance of the S& P 500 Index over that same time period. They charged a management fee of 1% and a performance fee of 15% (later 20%).

In 1971, Steinhardt Partners became the only profitable hedge fund. This was massively due to the massive short position which it took during the market crash of 1969, amassing a total return of 361%.

Following decades of success however, the U.S. Securities and Exchange Commission investigated his firm for manipulation of the short term treasury Note market in the 90’s. As part of a settlement made with the SEC and the Department of Justice, Steinhardt personally paid 75% of a $70 million settlement. Regardless, his firm had made $600 million by trading treasury positions.

Steinhardt came out of retirement to work for WisdomTree Investments, becoming chairman. It had a total of $41.2 billion under management as of July 2018. The growth of WisdomTree stagnated in 2007 and 2008, as a result of the stock market and financial sector being overweighed. They recovered their position later in recent months, as its stock price appreciated greatly.

Michael Steinhardt Top Trade

Perhaps the greatest trade of Michael Steinhardt’s career came in the fall of 1981. At a time when interest rates were going through the roof, Steinhardt, then 40, sat on a 4:1 leveraged long bet on 10-year treasuries. For a while, the forecasts look grim and could nearly wipe him out. However, in October of the same year, when the long-term rates fell back after recording a peak of 15%. His $250 million bets, which included $200 of borrowed money, made him a 40% profit.

Steinhardt’s contrarian trading style involves conviction as an important quality. Steinhardt, who has repeatedly demonstrated his resolve of maintaining large positions in his career, stayed with his investment during the six-month climax in interest rates during the above period. Apart from remaining unaffected from the market moving against him, Steinhardt also did not succumb to the psychological pressures when other complaining investors questioned his transition into trading treasuries after dealing with stocks. Because he believed he was right, his conviction helped him to make the famous trade.

Michael Steinhardt Trading Principles

Steinhardt has an invaluable relationship with block traders who began to facilitate large trades and provide liquidity when investors began to pour money into Wall Street. Because Steinhardt controlled big trades and decisions, traders used to come to him. As a result, Steinhardt took full advantage of inefficient prices in the short-term. He bought low and sold high. Steinhardt’s firm was one of the first in the market to predict interest rates by using monetary analysis.

Steinhardt’s variant perception is a contrarian approach. According to him, extreme bullish and bearish readings can be characteristic of extended trends, although sentiments are very bearish at bottoms and very bullish in tops. Thus, the trick is to be a contrarian at the right moment, requiring him/her to filter out true opportunities. The filters that Steinhardt uses combine market timing and a keen sense of fundamentals.

A key ingredient in Steinhardt’s characteristics of favorable risk/return is flexibility, which is demonstrated by the ease at which he goes long or short. He also stresses that there are no fixed patterns or formulas and a trader needs to adapt to these market changes quickly.

Additionally, his investing strategy is summarized by the six golden rules of investing provided by him.

- Investors should make all their mistakes early on in their life.

- They should always make a living doing something they enjoy.

- Every trader should be intellectually competitive.

- They should strive to make good decisions even when they have incomplete information.

- They should always trust their intuition.

- They should not make small investments.

According to Steinhardt, asking the right questions is always the priority in investing. The analytical process as well as the research can be tough. To understand what investors need to look out for, they require an analytical framework to guide them. They should also know the variables that can assist them in solving the question of “pulling the trigger” or not.

Another one of Steinhardt’s tips is to never take losses personally. For an investor or trader, it becomes mentally difficult to entirely detach oneself from investment results, especially if one is going through a rough patch. However, it is important for them to keep the long-term goal in mind when experiencing heavy losses. The will to come back strong is evident from Steinhardt’s own escapades when he clocked more than 20% in 1995 after coming back from a disastrous financial position in 1994.