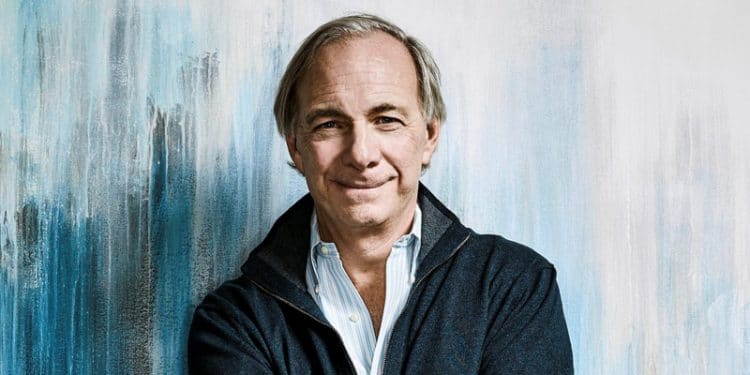

Who is Ray Dalio?

Born on August 8th, 1949, Ray Dalio is an American billionaire philanthropist and hedge fund manager. Since 1985 he’s been serving as the co-chief investment officer of BridgeWater Associates. He is also the founder of Bridgewater which, within ten years of its creation, secured a $5 million investment from the World Bank’s retirement fund in 1985.

The son of a jazz musician, Dalio grew up in New York City’s Jackson Heights. Dalio’s first foray into the trading world came at the age of 12 when he bought Northeast Airlines shares for $300 and eventually tripled his investment following the airline’s merger with another company. His educational degrees include an MBA from Harvard Business School in 1973 and a bachelor’s degree in finance from Long Island University.

After Harvard Business School, he began trading commodities futures, which was a rare choice for at that time. He was attracted to them because they possessed low margins. An inflationary surge soon sent commodity prices sky-high, making commodities trading, the new trendy thing to do. The demand for Dalio rose quickly and a brokerage firm soon snapped him up as Director of Commodities.

After a “not so successful” initial years in Wall Street, Dalio moved to a larger, more successful brokerage after the previous one fell victim to the bad stock market environment at the time. However, he was soon dismissed for insubordination. Perhaps his biggest success came when he started Bridgewater Associates from an office in his apartment in Manhattan. The firm would go on to become one of the biggest hedge funds in the world. He is also the author of the book “ How the Economic Machine Works: A Template for Understanding What is Happening Now”, which focuses on using various criteria to assess the potential of different economies.

Ray Dalio correctly made a prediction about the upcoming global financial crisis. Bloomberg markets included him in their list of the 50 most influential people in both 2011 and 2012. In 2017, he authored “Principles: Life and Work” which became a New York Times #1 bestseller, as well as Amazon’s #1 business book for the year. A second book entitled “Principles Economics & Investing is in the works.

As of February 2020, Ray Dalio’s net worth is $18.7 billion. He reportedly earned an astounding $1.1 billion in 2014, which included a share of his firm’s performance and management fees, stock and option awards, and cash compensation.

Ray Dalio Trading Principles

While we can’t definitely lock in on the trading principles he uses consistently, we do have a fair idea about his methodology and trading philosophy from the information he has provided over the years. Here are five essential investment rules that any investor can apply.

- Diversification: Dalio’s interpretation of diversification is quite unique and specific and is based on the principle of reality. Investors can achieve this by diversifying across currencies, asset classes, geographical, markets, etc. However, traders must grasp the fact that a majority of what they choose are going to provide lackluster returns and even have a chance of losing money. Many investors can become delusional when evaluating the worth of a particular investment or about their investment choosing ability. Focusing on reality makes the diversification rule a critical factor in achieving long-term investment success. Dalio specifically says that the Risk factor can decrease by 80% if one possesses 15 uncorrelated investments.

- Understanding the risk of inflation: The next rule for investors is to balance one’s portfolio. This should be based on inflation risk because of its significant impact on financial markets. Traders should know how to conduct portfolio optimization, regardless of shifts in inflation. This is the only way one can achieve consistent returns over time.

A trader should not attempt to predict inflation and deflation pressures. They should instead design a balanced portfolio by examining data in the current economic environment. - Investors should not possess any Biases: Bias is one of the prime reasons why investors hold on to their positions and get wiped out. When approaching the market, investors either possess a bearish or bullish bias. As a result of these biases, investors hold positions for too long. They should focus on diversification to avoid this bias.

- Selling the winners and Buying the losers: One of the things Dalio teaches investors is to take profits on stocks that are fully priced. In other words, traders should cease to hold stocks after it generates substantial gains. Instead, they should sell them to reinvest the profits. They should reinvest only in shares of good companies that have lagged the market or sector. Dalio calls this “rotating the portfolio”. Thus, instead of holding on to large winners even after their winning streak ends, investors should reinvest in good companies whose prices have not gone higher yet. Higher the price of an investment, the less likely that its price will continue to increase.

- Learning About What Moves Interest Rates: Rather than trying to predict interest rates, investors should first be aware of their structure and understand the factors that cause rates to move.