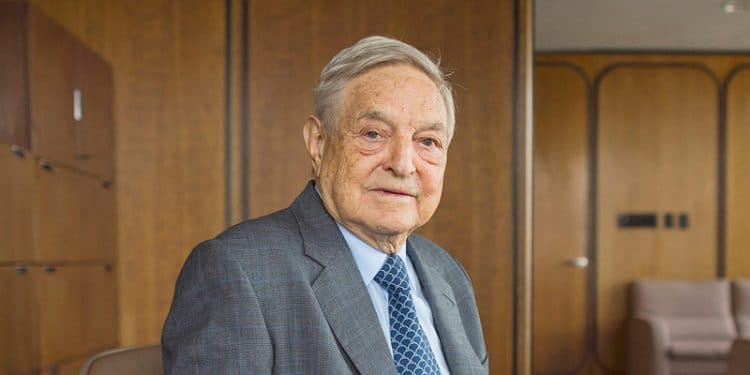

If you are new to trading, then you must know about the greatest traders and investors in the world so you can learn from them. George Soros is a worldwide name who knows how to speculate right.

Who is George Soros?

George Soros is a Hungarian-American billionaire investor and philanthropist. Born in Budapest, he immigrated to the UK in 1947. He started his business career by doing various jobs at merchant banks in the UK and the US. Soros started his first hedge fund “Double Eagle” in 1969. In 1970, his second hedge fund “Soros Fund Management” came into life. He renamed Double Eagle to “Quantum Fund”.

This fund had $12 million of assets when it was founded, and the assets went to $25 billion in 2011. Soros supports progressive and liberal political causes and donates through his foundation, the “Open Society Foundations”. In May 2020, his net worth was $8.3 billion as he had already donated over $32 billion to the Open Society Foundations. He donates for various philanthropic causes, such as civil initiatives to reduce poverty, increase transparency, scholarships, and universities around the world.

George Soros Top Trade

The world knows and remembers Soros as the man that broke the Bank of England. Being a well-known currency speculator, Soros does not limit his activities to a particular geographic area. Instead, he opted to seek opportunities in the entire world. In September of 1992, Soros borrowed $10 billions of dollars’ worth of British pounds. After that, he converted those into German marks. When the pound crashed, he repaid the lenders according to the new value of the pound which was lower than before. By doing this, he gained $1 billion which was the excess due to the difference between the pound’s value and the mark’s value during the trading of a single day. After unwinding his position, he made roughly $2 billion in total.

A similar move that Soros made involved Asian currencies during the Asian Financial crisis of 1997. Many believe that his participation in a speculative frenzy majorly contributed to the collapse of Thailand’s currency, the Baht.

When the bets were placed by the speculators, it also forced the currency issuers to try and maintain the ratios by buying their currencies in the open markets. After that, the governments ran out of money and they had to abandon this effort. As a result, currency values plummeted.

Governments feared that Soros would take an interest in their currencies because when he did, other speculators also followed him and the situation could be described to a pack of wolves preying on a herd of elk. These speculators were able to borrow and leverage massive amounts of money. So, it was impossible for smaller governments to survive this assault.

George Soros Trading Principles

Soros has some unique theories that he follows while investing his money, and they are:

- The reflexivity theory: Soros relies on reflexivity in his investment strategy. It is a method that values assets by depending on market feedback. This way, it gauges how the rest of the market values assets. Soros predicts market bubbles and other market opportunities by using reflexivity.

- The scientific method: Soros determines his market moves relying on the scientific method and creates a strategy that tracks what is likely to transpire in the financial markets according to the current market data. He tests his theory with a small investment first. If the theory proves positive, he broadens his investment.

- Blend of political acumen and investment acumen: This is the strategy that helped Soros earn the famous title of “The Man Who Broke the Bank of England”. Soros placed a bet against the U.K. government’s decision of hiking interest rates on September 16, 1992. That set off a trigger effect, devalued the British pound, and set stocks higher after the devaluation. This move earned him $1 billion. The British currency slid amid economic and political turmoil that involved the policy of higher interest rates.

- Consolidate and reflect: Soros uses a few advisors to make major investment decisions. He confers with his team of analysts and makes sure that they review his strategy. He believes that it is best to take time to read and reflect a strategy before applying it. If the analysts can point out a weakness, then he does not go for it.

- Physical cues: This is something very unique about Soros. He listens to his body while making investment decisions. There is no logic behind this but he would abandon an investment if he experiences a headache or a backache.

He has also shared his thoughts about his trading principles that can help novice traders:

- A trader needs to understand that he/she is not always right so he can cut losses short.

- Traders should be flexible in their trades so they can change their minds and reverse positions when they need it.

- The key to profitability is all about big wins and small losses; not the winning percentage.

- Market trends are not the result of fundamental reasons but the extremes of investors’ emotions.

- A losing trade is not a problem. The real problem is failing to cut the loss by adding a losing position.

- Systematic and profitable trading is based on math and probabilities. It is not exciting or fun but it is boring.

- If a trend extends from its average, it has higher odds of a snapback and reversion.

- Profitable trades are not the obvious ones. They are not expected and counter-intuitive.

- A trader should trade with the trend until the end when it bends.

Coming from great investors, these tips can be really helpful for novice traders.