Dan Zanger is a technical stock trader who was noticed by the media after turning a mere $10,775 to over $18,000000 in just under two years during the internet bubble. Dan J. Zanger holds the world record for the highest percentage increase in a personal portfolio, 29,233 percent annual gain.

As a highly competent stock picker and chartist, he has been featured in several magazines ranging from Fortune, Active Trader, Forbes, and Stocks and Commodities.

Dan Zanger spent his childhood in Los Angeles’ San Fernando Valley. After enrolling in college, Zanger dropped out to pursue snow skiing for a few years in Idaho and Colorado. He also worked numerous odd jobs during this time, such as being a cab driver, a bellhop, and even a prep cook to support himself.

With no professional background under his belt and just a high school degree, Zanger moved back to LA and started working for a landscape company, eventually receiving his California Contractor’s license. As the internet bubble began to form in 1997, internet and technology stocks took center stage. Zanger sold his Porsche to raise capital for his entry into the market. He sold it for a measly $11,000, which he ultimately turned into $18 million over the next year. This success allowed him to leave his contracting job behind and become a full-time trader.

Styles and setup used

Zanger is a pure technical analyst who has spent over 30,000 hours researching every form of chart pattern imaginable and how they behave in various contexts and scenarios. He is a swing trader who focuses on momentum breakout patterns with holding periods ranging from weeks to years. The main reason why so many members have kept around is the opportunity to discover fresh potential momentum breakout stocks.

For nearly two decades, Zanger has employed the same chart pattern setups. The chart patterns Dan Zanger outlines are 11 Most Common Stock Chart Patterns, employing a mix of them in his trades. Cup and handles, flags, pennants, triangles, head and shoulders, and channels are all examples of classic chart patterns. Even in this age of algorithmic trading systems, it’s amazing how successfully these patterns continue to play out and repeat. Classic patterns are simplest to discern after they have been established, not to oversimplify. The key is to spot them early in the formation phase so you can catch more of the motion before they become ‘textbook’ instances.

Dan Zanger’s trading principles

Dan’s trading principles can be summed up into 10 Golden rules he follows, applicable to all traders striving for success.

- Traders have to ensure that the stock possesses a well-formed pattern or base before considering buying it.

- As the stock breaks the boundary of a pattern or base, a trader should buy it. They have to ensure that the volume is above the recent figures before the breakout occurs. The maximum a trader should be willing to pay is up to 5% above the pattern’s boundary.

- Traders should quickly sell their stock if it returns under the breakout point. They can set stops $1 below the breakout point. Traders can increase this to a maximum of $2 for more expensive stocks.

- If the stock moves up between 15% to 20% from its breakout point, Traders should sell 20% to 30% of the position.

- The stronger the stocks are, the longer a trader should hold them. They should sell any stock that acts sluggish or which has ceased moving up.

- Traders should actively try to keep their selections in strong groups of stocks.

- Stocks become vulnerable to sell-offs after the market moves for a substantial period of time, which can happen very quickly. Traders should be aware of resistances and reversal patterns for exiting out of stocks.

- Traders should pay attention to their stock’s volume behavior and how the stock reacts to spikes in volume, which can be found out from charts.

- Dan Zanger mentions many stocks with buy points in his newsletter. However, traders shouldn’t buy a stock right away after the market touches the buy point. Instead, traders should consider the stock’s current price action in relation to volume, as well as general market conditions.

- Don’t trade on margin until you master your psychology, charts, and the markets.

What is Chartpattern.com?

Beginning in 1996, Dan Zanger created a faxed newsletter reaching hundreds of beginner traders. Eventually, this evolved into his own educational website in 1998. There, traders can study and trade patterns in interesting daily stock charts. The website currently provides services to hedge funds, private traders, and industry market makers, serving thousands of traders worldwide. Dan includes the analysis of major indices along with short-term sentiment through NYMO. The newsletter covers story stocks, major trends, as well as personal picks and setups which Dan selects and watches.

Each of Dan’s newsletters, on average, includes around sixteen charts. Dan Zanger also personally interacts with subscribers during each trading day from Monday to Friday via a chat room, answering questions and providing feedback on stocks.

Since 1998, Dan Zanger has run Chartpattern.com, a stock market research and analysis subscription service. On the official website, you can find Zanger’s trading rules, evidence of media presence, past winning trades, an educational section, and even a free 2-week trial. Below, let’s look closer at the services the website provides.

Dan Zanger chartpattern newsletter review

Report

You can subscribe to the Zanger Report newsletter for $125 per month or $360 every quarter, and you can pay by check or credit card.

Since 1998, Zanger has issued this trademark thrice-weekly newsletter. Each report contains a macro technical analysis of the US market utilizing benchmark indices such as the S&P 500, as well as up to 16 watch list charts with comments pointing out present and potential chart patterns with potential price objectives or projections. The equities chosen are often medium to high-priced momentum stocks that are held for the long term.

Zanger may occasionally bring out potential short-selling opportunities and under-$15 stocks. The watch lists do not include any “undervalued stocks.” Zanger favors liquid equities having the potential to erupt to the upside over months or years.

Chat room

Dan Zanger’s service has this as one of its most significant features. Subscribers to The Zanger Newsletter have access to the live chat room as well. There are moderators and many experienced traders in the room that keep things professional. Throughout the market day, the number of participants fluctuates between 300 and 450. The goal of this room is for subscribers to share ideas and have real-time access to new trading opportunities.

The chatroom has a large number of intraday traders who publish their trade entries and exits. The moderators keep things professional and will ban any disruptive users, such as penny stock pumpers.

Zanger usually posts market commentary, updates his analysis, and answers inquiries in the late mornings or early afternoons. Members are essentially on their own to either develop new trade ideas and handle their entries and exits or piggyback on some of the room’s more popular deals. Zanger takes the time to address queries from members, but he rarely sends out particular trade alerts. It’s a genuinely organic engagement with the community in this form, and Zanger seems comfortable with it.

Of course, it goes without saying that you should perform your own research before relying on others. However, using the invaluable input from Dan Zanger, traders are likely to be consistently profitable.

Advantages and disadvantages

Advantages

- You will have access to a chat room where traders debate strategy and market developments.

- Daniel Zanger provides you with a unique commentary as well as all of his technical stock trading knowledge.

- Every morning, before the market opens, you will receive a market update.

- Three newsletters are sent out each week, each including information on significant market indices and equities to which you should pay attention.

- If you follow the tactics they recommend, you have a good chance of making money.

Disadvantages

- Dan Zanger does not provide very specific instructions for getting in and out of a trade. He may create a trendline, but you’ll have to make your best judgment as to where to enter, including the stop loss placement.

- He also makes modifications to his positions during the trading day that you won’t know about until the next day’s email update unless you’re in his chat room all day.

- There is no educational component with training videos or materials to read. Dan has a few books he recommends and a list of guidelines, but that’s it. Learning enough to do it on your own would be difficult.

Dan Zanger strategy

Find market leaders by industry and sector

Zanger searches 1,400 stocks every night and picks 50-60 to keep an eye on the next day. Then he concentrates on those with increasing volume and potentially profitable patterns. He makes his move when a pattern breaks out on high volume. First, choose the market that is most likely to rise. You need stocks with a high level of volatility. Then, find the company that is on top of it and stick with the stock.

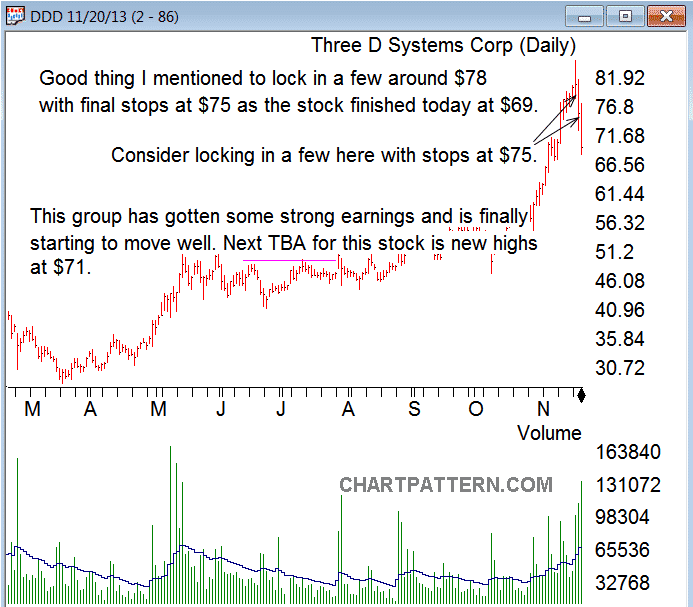

For example, companies that create three-dimensional printers have been strong market leaders in the Application Software space. As you see in the chart above Three-D Systems Corp has been a big winner, posting strong earnings and forming trend continuation patterns.

Keep an eye on the market breadth

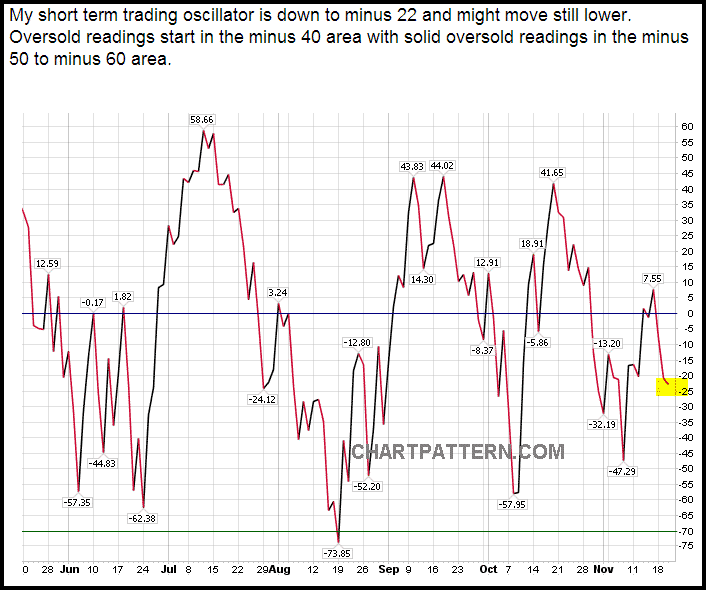

In particular, one should employ a bespoke oscillator that analyzes market breadth advance-decline data which alerts trend strength and probable reversals. When it reaches severe lows or highs, it usually signals that a reversal is on the way, and it’s time to cash in.

In the chart above, whenever the oscillator reaches extreme levels, such as +/- 40, the market is very likely to reverse shortly.

Recognize the sectors that are changing

When transportation and technology stocks lead the market, the market is likely to turn bullish. Be cautious if equities that have been trailing the market take flight and the dogs develop wings or if defensive sectors such as utilities outperform. This usually happens near the end of a rally. The dominant sectors reveal a lot about where we are in the economic cycle.

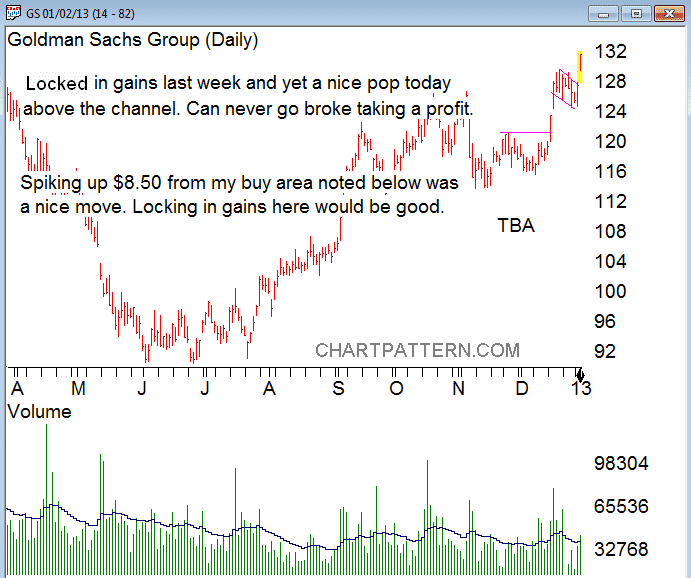

Goldman Sachs’ daily chart above shows how strongly it rallied into early 2013, owing in part to rising interest rates. However, the Fed’s QE measures fared exceptionally well in 2009, rising more than 200 percent.

Recognize the most common reversal chart patterns

Stocks and markets overall rarely shift direction without giving enough warning. Head and shoulders, double and triple tops, parabolic curve, the rounding top, and the bearish and bullish wedges are all-powerful patterns.

Dan also discovered other crucial reversal tools. The Key Reversal bar is the first. Exit if a stock makes a new high on heavy volume and then falls to a two- or three-day low. The Naked Bar is identical to a Key Reversal Bar, except it has a buying frenzy that raises it far higher than prior bars, as the name implies. It can also indicate that a parabolic blow-off is coming to an end.

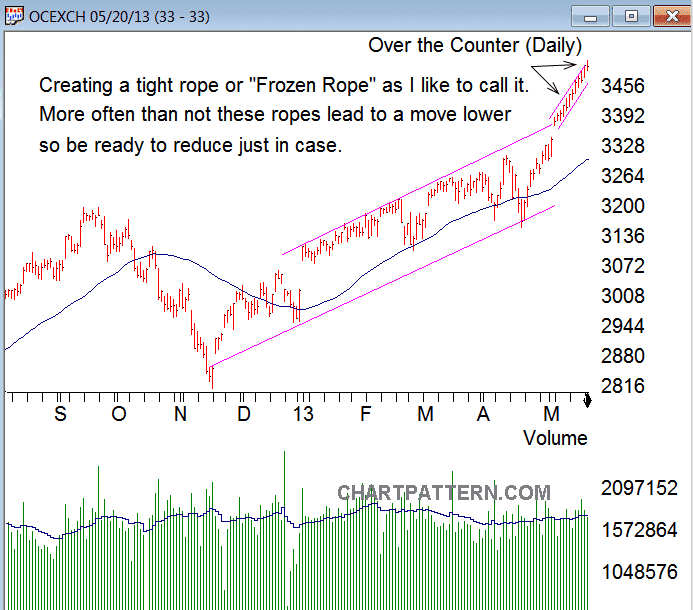

Frozen rope chart pattern

When a stock moves up in an orderly fashion – too orderly – at a 45-degree (or so) angle, it forms a Frozen Rope pattern, as shown in the chart below.

When volatility falls to a multi-month low, “more frequently than not, these ropes lead to a move lower,” according to the narrowing range.

The Federal Reserve should never be overlooked

What the Fed does now is more critical than it has ever been. Therefore, it’s essential to be aware of what the Federal Reserve is doing. In addition, experienced traders soon understand that the Federal Reserve’s actions and methods for supporting the economy impact stocks significantly.

Dan Zanger top trades

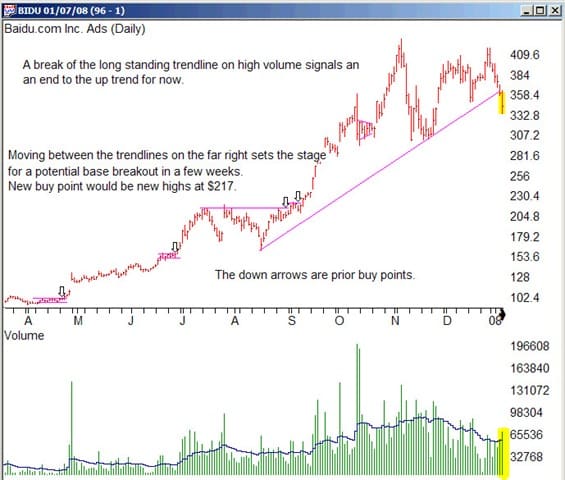

Baidu (BIDU)

Dan Zanger recommended BIDU at just over $100 per share. The chart below shows the technical patterns used for entries.

Before dividing 1 for 10, the stock rose several hundred percent, and today trades at roughly $80 or $800 with pre-split pricing, a return of 500 percent or more.

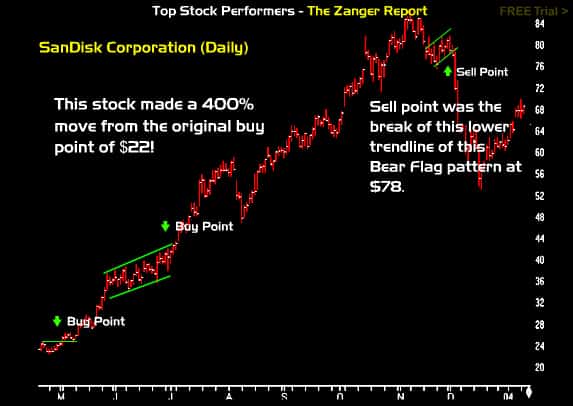

SanDisk (SNDK)

Dan recommended SanDisk when it was at $22.00 per share. The stock rose to over $80 before breaking down and being tagged as a sell, resulting in a 400% return.

As you see in the charts above, there are solid reasons for entries and exits, enabling us to tap into the logic of Zanger’s trading approach.