We Like:

- Over 25 years in the trading space

- Offers competitive spreads

- $0 minimum deposit

- No deposit or withdrawal fees

- Provides powerful trading tools

- Regulated by top-tier agencies

- Trade CFDs on many instruments

- Well-established broker with 10+ offices around the globe

- An array of payment options

- Available in the USA

We Don’t Like:

- Charges overnight fees

- Charges a ten euros inactivity fee after 12 months of an account’s dormancy

- Some bank withdrawals charge a transaction fee

- No guaranteed stop-loss orders for US or UK clients

- No negative balance protection to USA traders

- Core account traders incur a trading commission

The Verdict:

Oanda is a financial corporation with about 25 years in the brokerage industry since its launch. It offers CFDs exclusively on a wide range of markets with competitive spreads averaging at 1.1 pips and a leverage of up to 200:1. The CFDs liquidity provider operates around 12 offices in ten different countries, but the corporation’s head office is headquartered in New York, United States. Oanda also cites falling under reputable regulation led by top-tier agencies such as the FCA and the USA’s NFA.

Its range of products trade as CFDs allows clients to maximize profit by going long and short and diversifying their portfolio by trading many asset classes without owning the underlying instrument. Oanda claims to have won clients’ hearts in the retail and corporate trading space from 200+ nations worldwide.

Company details

Online CFDs brokerage company Oanda Corporation launched in 1996 as a tech startup just when the internet was being rolled out into the world, believing that the incoming technology would open up the markers for currency data and trading. The startup went through transformations to a complete CFDs provider and expanded to other regions in its early years.

Currently, the Oanda conglomerate consists of about 12 offices located in ten different countries under varying jurisdictions. They collectively provide CFDs on multiple asset classes with meager competitive spreads from one pip to retail and institutional traders. Oanda claims that these clients emerge from 200+ countries and trade the broker’s products with leverage of 200:1.

Oanda offers CFDs on the following asset classes:

- FX pairs

- Indices

- Commodities

- Metals

- BTC

These assets yield about 100 tradable instruments encompassing FX pairs, major global indices, soft and hard commodities, and a spectrum of precious metals. Clients speculate on the prices of the instruments giving them the hedge even when the markets go down by going long and short. CFDs also allow them to diversify their portfolio by trading a wide range of products without owning the underlying instrument.

Oanda also notes providing powerful trading tools accessible through its trading platforms that give clients the upper hand against the CFDs marketplace volatility by obliterating major risks. The tools offer real-time market insights, help come up with scripts and trading strategies, and other features.

Oanda offers the following trading tools:

- Autochartist

- FX indicators

- Scripts and strategies

- VPS

- Economic calendar

With such tools, exploring a broker’s range of markets becomes a fun experience. However, the tools only prove wherewithal through a live trading account as clients double their initial investment while utilizing the tools accordingly. Oanda offers three live account types that clients open to trade its instruments leveraging on the above tools.

But, ahead of tapping into the broker’s liquidity markets, they must fund their chosen account type with any amount as the broker has capped its minimum deposit at $0 but advocates traders to have around $200 for effective trading. It also confirms to not ask for verification documents for clients making gross deposits below USR $9,000.

Oanda provides several account funding options to cater to its huge clientele across the world. It also assures to mitigate all fees on deposits and withdrawals, but traders might incur some transaction fees added by the funding platform or bank.

Its payment options include:

- Bank transfers

- Wire transfers

- Visa

- MasterCard

- Neteller

- Skrill

Wrapping up, Oanda provides two leading trading platforms available on several interfaces, making it easy for traders to access the markets anywhere. These platforms include the MetaTrader 4 and 5 and come in versions such as android, IOS, web, and desktop.

Regulations

Oanda proves to operate under several jurisdictions imposing stringent rules that gear the US-based broker to conduct transparent brokerage services to its traders. The regulation framework consists of reputable top-tier and two-tier agencies like the FCA, NFA, among others.

- Oanda Global Markets Ltd is registered in the British Virgin Islands (BVI) and holds license No. SIBA/L/20/1130 from the BVI Financial Services Commission (FSC).

- Oanda Australia Pty Ltd is registered and regulated by the Australian Securities and Investment Commission. License No. ABN 26 152 088 349, AFSL No. 412981.

- The European branch in the UK holds license No. 542574 from the Financial Conduct Authority (FCA).

- In the USA, the Oanda corporation is registered with the US Commodity Futures Trading Commission (CFTC) and also holds license No. 0325821 from the National Futures Association (NFA).

Trading platforms

Even with the long experience, Oanda is yet to roll out its proprietary trading platform. The broker only offers the world’s popular trading platform — the MT4 and MT5, instead of other brokers that blend these platforms with their trading platform. However, Oanda cites to have furnished its platforms with powerful trading tools and tailored them to offer clients a good trading environment.

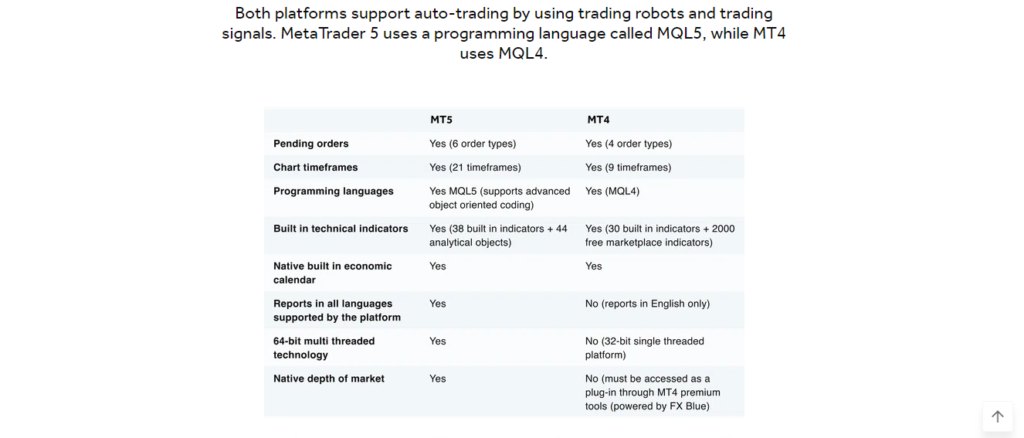

MT5

- Pending orders — yes (six order types)

- Chart timeframes — yes (21 time frames)

- Programming languages — yes, MQL5

- Built-in technical indicators — yes (38 + 44 analytical objects)

- Native built-in economic calendar — yes

- Multilingual — yes

- 64-bit multi-threaded technology — yes

- Native depth of market — yes

MT4

- Pending orders — yes (four order types)

- Chart time frames — yes (nine time frames)

- Programming languages — yes, MQL4

- Built-in technical indicators — yes (30 + 2000 free marketplace indicators)

- Native built-in economic calendar — yes

- Multilingual — no, reports in English only

- 64-bit multi-threaded technology — no (32-bit single-threaded platform)

- Native depth of market — no

Range of markets

Oanda offers a wide range of products that clients speculate as CFDs with competitive spreads starting from one pip and leverage of up to 200:1 aided by 24/5 customer support. The asset basket holds about 45 FX pairs of major and minor currencies, commodities, indices, and other products. Oanda says to offer around 100 instruments yielding from its range of markets.

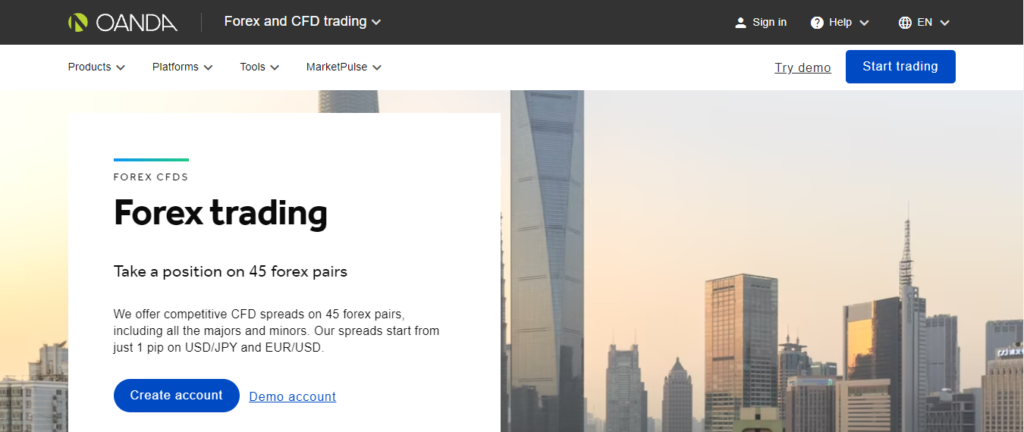

Forex

Oanda prides itself as the best FX trading broker allowing clients to buy and sell these instruments and speculate on their prices without owning the underlying currency pair. Meaning at Oanda, traders do both forex and CFDs trading when exploring the FX market’s instruments.

Trading happens 24hrs from Monday to Friday, backed by expert customer support allowing traders to pass queries and problems met during the process. Approximately 45 FX pairs of both majors and minors trade with a maximum leverage of 200:1. But the minimum spread starts from one pip and depends on the FX pair. About five base currencies trade against other significant pairs on Oanda’s popular forex pairs.

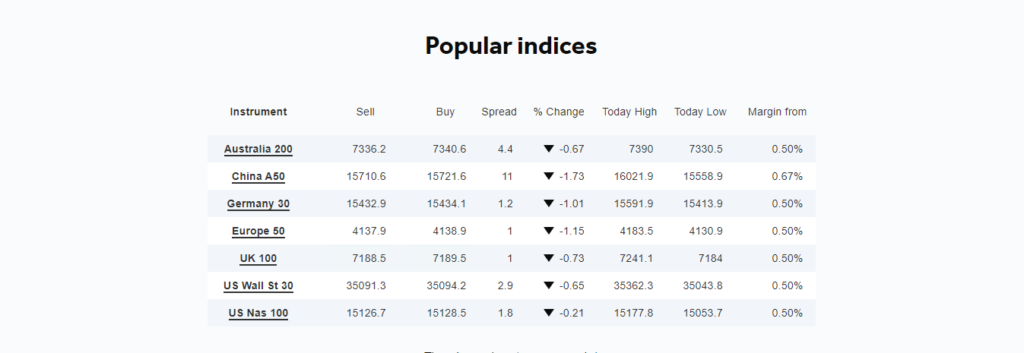

Indices

An index asset is a group of shares from companies on an exchange that clients speculate on its price by going long or short. Meaning they have the hedge even when the price goes down. Oanda offers major global indices consisting of Australia 200, China A50, UK 100, among others. The products trade from Monday to Friday, backed by 24/5 customer support with competitive spreads and leverages.

Metals

Metals are hard commodities that only include precious products such as gold, silver, diamond, palladium, copper, among other valuable metals that clients trade as CFDs. Essentially, you only speculate on the products’ prices by going long or short without owning the instrument itself. Oanda offers three types of metals — gold, silver, and copper.

Traders access these instruments 24/5 trading against the USD as gold trades from 25 cents and silver from 1.3 cents with competitive leverage and real-time customer support.

Commodities

The commodities marketplace at Oanda supports a stream of energy products and copper. The market opens from Monday through Friday, and trades are backed by expert customer support. Some of the instruments offered include Brent Crude Oil, Natural gas, and West Texas Oil. Oanda confirms to provide competitive spreads for these products citing that Brent Crude Oil trades with a minimum spread starting from three pips.

Bitcoin

The world’s popular cryptocurrency also trades at Oanda as CFDs meaning that clients speculate on its price as it rises and drops due to volatility. The spread starts from the US $100 while margin rates fluctuate from 10%.

Main features

Amid unpacking the broker’s information, we have come across several features that give it traction to get more clients to gear it to success. These features include:

- Well-regulated broker — Oanda falls under a solid regulation cushioned by both top-tier and two-tier regulation bodies making the broker safe to trade with.

- Favorable trading conditions — with a minimum spread capped at one pip and max leverage of 200:1, Oanda proves to be suitable for both novice and veteran traders. It also allows a minimum deposit of any amount above $0.

- Quality trading platforms offer renowned trading platforms that most traders have interacted with, making it easy for clients to explore the markers.

- Powerful trading tools — Oanda offers powerful trading tools like EA advisors that integrate with the trading platforms or come as plugins.

- Resourceful education materials — the broker understands the risks of CFDs and FX trading and provides educational materials for traders to improve their trading knowledge, especially newbies.

- Variety of payment platforms — with the imprint of clients from 200+ countries, Oanda provides international payment systems such as E-wallets, bank cards, and wire transfers for clients to fund and withdraw funds from any region.

Types of trading accounts

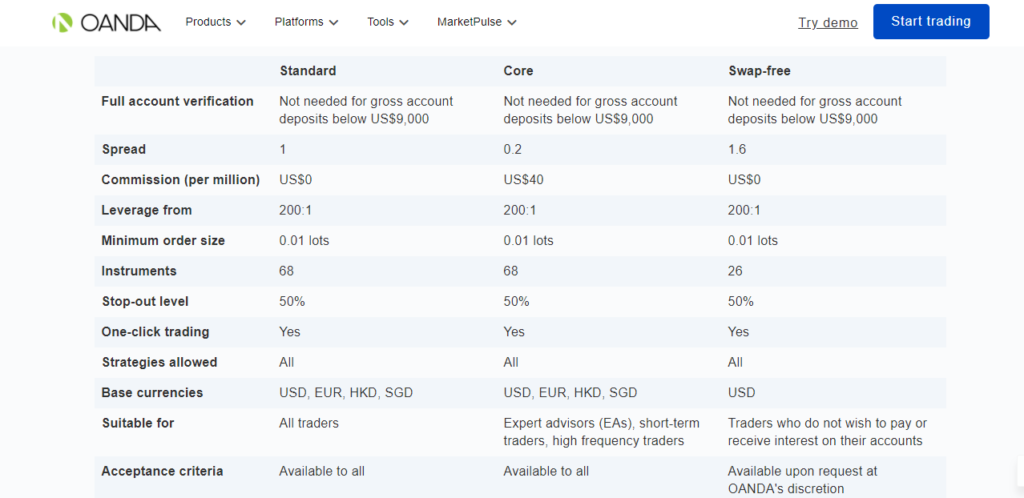

As we mentioned, Oanda provides three live accounts and a demo account. The demo account comes in handy to beginners ahead of understanding how trading works. The real or live accounts include:

- The Standard account

- The Core account

- The Swap-free

The Standard account

- Full account verification — not needed for gross account deposits below the US $9,000

- Spread — 1

- Commission (per million) — $0

- Leverage from — 200:1

- Minimum order size — 0.01 lots

- Instruments — 68

- Stop-out level — 50%

- One-click trading — yes

- Strategies allowed — all

- Base currencies — USD, EUR, HKD, SGD

- Suitable for — all traders

- Acceptance criteria — available to all

The Core account

- Full account verification — not needed for gross account deposits below the US $9,000

- Spread — 0.2

- Commission (per million) — $40

- Leverage from — 200:1

- Minimum order size — 0.01 lots

- Instruments — 68

- Stop-out level — 50%

- One-click trading — yes

- Strategies allowed — all

- Base currencies — USD, EUR, HKD, SGD

- Suitable for — expert advisors, short-term traders, high-frequency traders

- Acceptance criteria — available to all

The Swap-free account

- Full account verification — not needed for gross account deposits below the US $9,000

- Spread — 1.6

- Commission (per million) — $0

- Leverage from — 200:1

- Minimum order size — 0.01 lots

- Instruments — 26

- Stop-out level — 50%

- One-click trading — yes

- Strategies allowed — all

- Base currencies — USD

- Suitable for — traders looking to incur only spread charges

- Acceptance criteria — available upon request at the broker

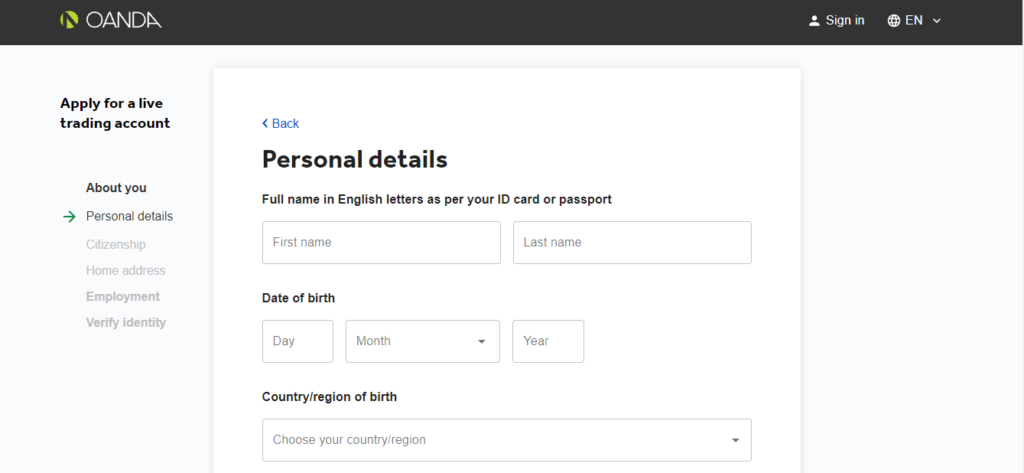

Opening an account at Oanda

The account opening process is relatively fast and involves the following steps.

Step 1: Log into their website and click the create account button.

Step 2: Fill the registration forms.

Step 3: Verify your identity.

Step 4: Receive login details.

Step 5: Fund the account.Step 6: Start trading.

Commissions and spreads

Oanda operates as a market maker as the minimum spread starts from one pip for the standard account and 1.6 pips for the swap-free account, meaning the broker adds commission on the spread. The spreads fluctuate depending on the instruments and begin as high as three pips for some assets.

The core account traders face a $40 commission on a 1 million volume of trades, but their spreads tighten down to as low as 0.2 pips. Oanda also charges overnight fees and a 10 euro inactivity fee after twelve of an account’s dormancy.

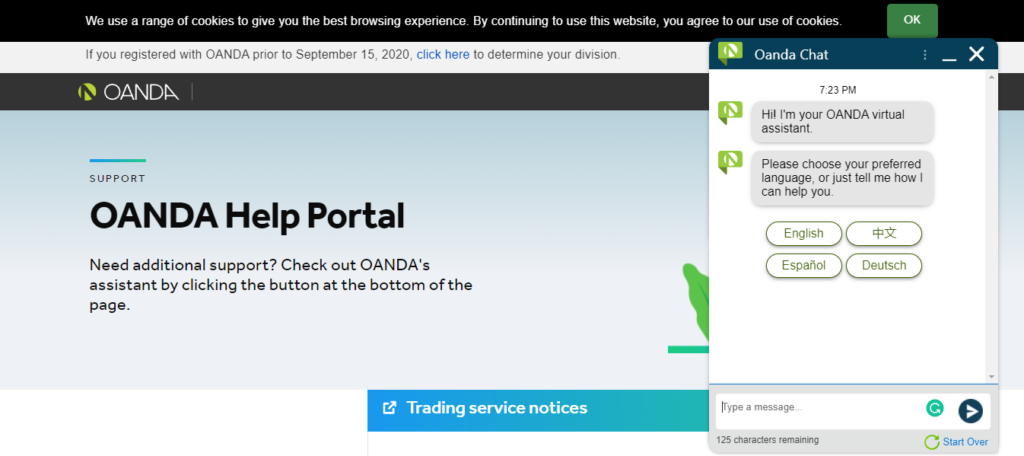

Customer service

Oanda claims to offer 24/5 customer support. Clients access the customer support services through email and via the help button on the broker’s website. After clicking the help button, the site prompts you to select your country and redirects you to a furnished “Help portal” page. There, the client interacts with the support team directly via the live chat button.

Oanda Review

What we liked

- No deposit fees

- Option for a swap-free account

- Easy account opening

- Multiple payment platforms

- 24/5 multilingual customer support

- Easy to open an account

- Well regulated broker

What we disliked

- Less trading instruments compared to other brokers

- No proprietary trading platform

- Does not offer social / copy trading

- Overnight fees and commissions on the core account

The bottom line

Oanda proves to be a legit online FX and CFDs brokerage platform for all sorts of traders as it falls under a reputable regulation, waives most fees charges, and offers a minimum deposit of $0 to traders. However, the broker provides fewer tradable instruments compared with other liquidity providers. Some instruments’ spreads are capped a bit high, which can prompt newbies to incur losses.