The crypto market is marked by high levels of volatility. For long-term traders, this volatility is the noise that they pay no attention to most of the time. However, shorter-term traders often look to profit from these frequent spikes and troughs. Scalping is one of the most popular strategies in this regard. The strategy is not native to the digital assets market but has been in use for years in markets such as forex and stocks.

About scalping in crypto

This is a technique in which traders aim to make several small profits off of price movements within a day. The idea is that by accumulating these small profits, one can have a substantial amount over time. The strategy is well suited to crypto because of the volatile nature of its markets. What’s more, traders can utilize leverage in order to multiply their profits and tight stop-losses to reduce their risk exposure.

Typically, scalpers need to react quickly to execute scalp trades. Positions are held open for only a few minutes at a time, sometimes even seconds. Though all trading techniques require discipline, scalpers have an essential need to adhere to their trading strategies seeing as they enter numerous trades and aim at small profits from each. A single large loss could very well negate all their accumulated profits.

This strategy is popular because it exposes traders to lower risk. Additionally, since the time spent per trade is short, it reduces the risk of suffering large price moves caused by fundamental events. What’s more, since smaller moves happen more often than larger ones, scalpers will always have numerous trading opportunities to profit from.

How it works

Oftentimes, scalpers will rely on technical analysis to place their trades. This is because they need to perform analysis in real-time, which leaves little to no time for fundamental analysis. The best timeframe for this strategy is the 5-minute chart, as it is well suited for analysis. Usually, positions will be opened every 5 to 10 minutes.

If you wish to start scalping crypto, you can do it manually or automatically. For the former, you would have to actively monitor the charts and enter trades yourself. This requires steady focus and impeccable timing. For the automatic option, you would need to utilize a trading bot to enter and exit positions on your behalf. Such bots will autonomously open and close positions, as well as execute appropriate risk management measures.

Sometimes, scalpers will enter trades without performing much analysis. In such a situation, the scalper is trading on instinct. Usually, this approach is reserved for seasoned experts, and it is called intuitive scalping.

Types of scalping strategies

Range trading

Instead of displaying a clear upward or downward trend, crypto prices will oscillate steadily in a range with no discernible trend. In such instances, prices tend to adhere to a valid support and resistance level. Once these are identified, scalpers can take advantage by buying at support and selling at resistance.

Arbitrage trading

Sometimes, a cryptocurrency will bear different prices on different exchanges. Scalpers who notice this can therefore buy the asset on the cheaper exchange, then sell it on the exchange where it’s priced higher. This is called arbitrage trading. Both of these trades are executed almost instantaneously, and they have the advantage of bringing about price uniformity across exchanges.

How to create a scalping bot without coding

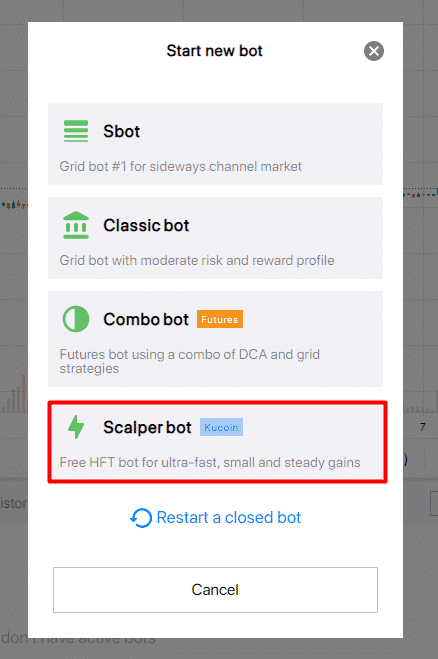

On Bitsgap, you can create a bot to place scalp trades for you automatically. To do that, go to the Bots page on the Bitsgap website, and click on start new bot. This will open a widget containing several bot types, from which you’ll choose the scalper bot option.

Once that is done, you will be prompted to choose a crypto trading pair. Choose the coin you intend to trade. You will then need to enter the amount of fiat you wish to invest. Alternatively, you can use the slider to specify the percentage of your account balance you wish to invest with.

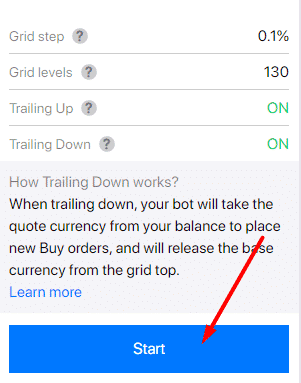

Notably, you won’t need to specify more settings as they will be automatically preset according to the current market conditions. However, you should still press the start button to confirm that all the settings are in order before launching your bot. This should appear as below.

Once all the settings are confirmed, press the confirm button. The launching process will begin, and the platform will inform you of any errors, if any. In the absence of those, you will have successfully created a scalping trading bot.

Conclusion

Scalping is a popular trading approach that aims to take advantage of small price movements. The volatility of the crypto market makes it suitable for scalping. Most of the time, scalpers will rely on real-time technical analysis to place their trades. However, seasoned traders can open these positions on intuition alone. The good news is that you can utilize a trading bot to place these trades for you automatically. On platforms such as Bitsgap, you can even create your own bot with no coding required. It is important to apply appropriate risk management techniques, as any large losses can negate all your accumulated profits.