Success in the forex market is dependent on traders or forex robots’ ability to identify a trend and ideal entry and exit points. Currency pairs don’t trend all the time. Instead, there are periods of consolidation where price remains subdued in a given range. Likewise, traders need to identify various stages when engaging in trend trading.

Currency pair’s price action activity tends to shift from trending to directionless as the number of users increases from time to time. These periods of directionless price action often makes it impossible for traders to make profits through trend trading. Instead, scalping, swing trading or hedging often emerge as ideal trading strategies for such situations.

Below are the four stages that any trend trading trader should be aware of.

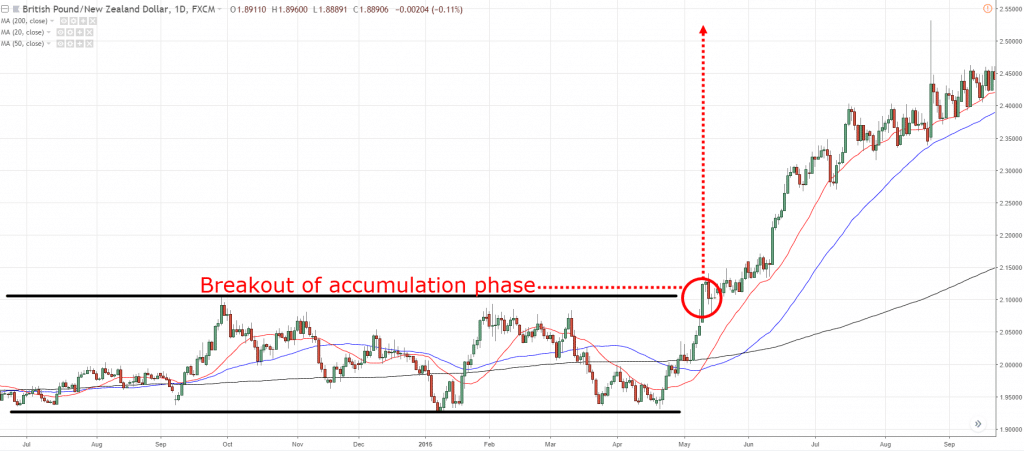

Stage 1: Accumulation Phase

The accumulation phase is synonymous with the consolidation phase, whereby price tends to move in a range after falling for over six months or more. The consolidation phase can last for weeks or months, whereby price remains contained in a range with bulls and bears at equilibrium.

During this stage of trend trading, the 200-Day Moving Average often used to identify underlying long term trends tends to flatten out. Traders, as well as forex expert advisors, should focus on trading the range rather than trying to force trend trading.

Conversely, it would be wise to enter a short position at the top end of the range, which acts as a resistance level. Similarly, a trader can enter a long position on price, bouncing off the support level at the lower end of the channel.

As one of the most important money-making hacks during this phase, traders or automated FX trading systems should avoid trading in the middle of the range as it acts as a poor trade location.

Stage 2: Advancing Phase

Advancing phase precedes the accumulation phase whereby price breaks out of the range either upwards or downwards. In case of an uptrend, the price will form higher highs and higher lows. Likewise, traders and FOREX Expert advisors can use this opportunity to enter long positions on pullbacks to the moving average. In a strong uptrend, there will be more up days than down days, and the price will be above a longer-term moving average, such as 200- SMA.

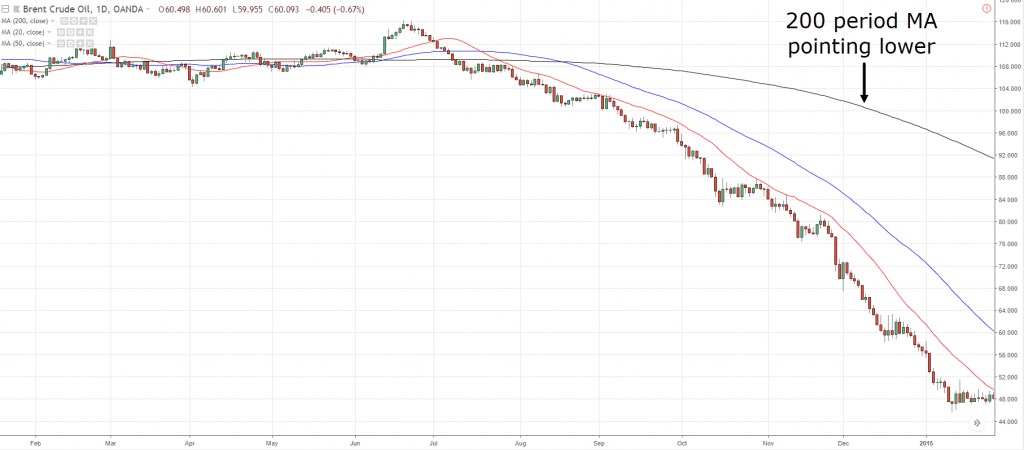

Likewise, in case of a downtrend, the price will form lower lows and will be below a long term moving average, such as 200 days moving average. In contrast to an uptrend, there are usually more down days than up days with a downtrend. Similarly, whenever price bounces back to the moving average, traders or forex trading instruments can enter short positions as the price is often likely to continue edging lower.

The best strategy to use during the advancing phase is to enter long or short positions in the direction of the trend, whenever price pulls back to the moving average.

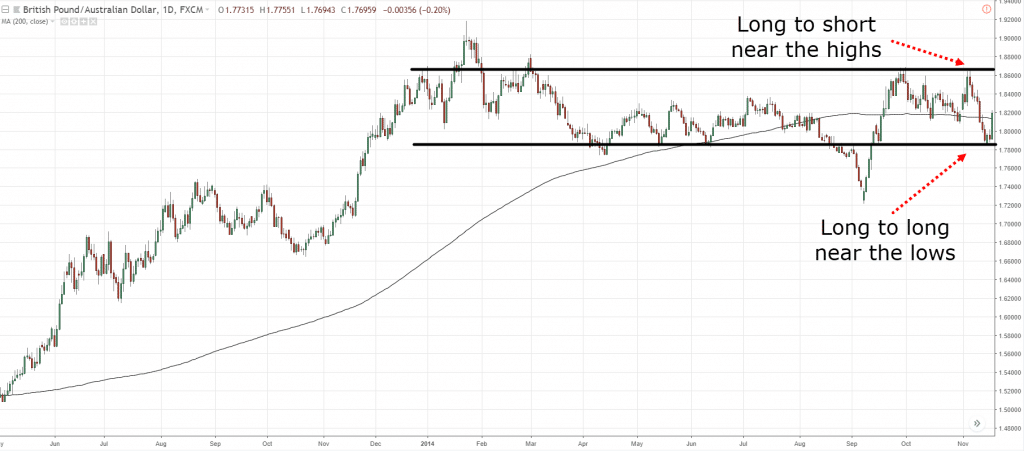

Stage 3: Distribution Phase

The distribution phase occurs after price trends in a given direction for some time, such as six months or more. Just like the accumulation phase, distribution can last for some time as it often looks like a long period of consolidation.

In the distribution phase, price is often consolidated in a range as the long term moving average flattens out.

In the chart above, it is clear that the price was trending upwards before it consolidated and started moving in arrangement. An important forex trading secret is to trade the range during the distribution phase. In this case, a trader or an Algorithm FX trading system can enter long at the lows of the range and short at the highs of the range.

Stage 4: Trend Resumption Or Reversal

Price would often resume its long term trend after the distribution phase or reverse. For instance, if the price was trending upwards before exhaustion kicked in and the price started trading in a range, it is often expected to resume its uptrend and continue powering high after some time. Similarly, if the uptrend has run its course, then the price might reverse and start moving in the opposite direction.

Therefore it is important for traders to be watchful during the distribution phase as the price can break out either in the direction of the underlying uptrend or reverse and start moving in the opposite direction.

A trend trading strategy would be ideal for this phase to profit on either the long term underlying trend or the emergence of a new trend in the opposite direction.

Conclusion

Different stages in trend trading come about as a result of traders’ activity in the market. When the market is trending, then traders, as well as forex robots, should focus on trading in the direction of the trend. Similarly, during the consolidation phase, the focus should be on trading the ranges, entering short at the resistance level, and long at support levels.