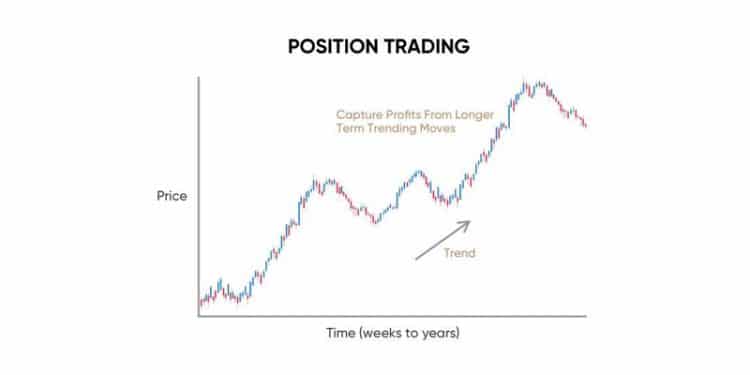

Positional trading is a popular trading strategy in which traders, as well as forex robots engaged in automated trading, try to benefit from the move in the primary trend. The strategy differs from scalping as well as swing trading, whereby people seek to profit from short term fluctuations that occur in the market.

Positional traders, as well as Forex EAs, deploying this strategy ignore short term price movements in favor of profiting from the long term trends. Therefore the trading strategy possesses all the attributes of investing.

The strategy assumes the momentum style of trading, conversely eliminating the importance of entry. The primary goal here is to identify a long term trend, open a trade-in that direction, and stay with the trend until it reverses. As a money-making hack in positional trading, trades are left open and run for weeks, months, or even years.

The Best Positional Trading Strategy

Positional traders carry out in-depth fundamental and technical analysis to identify ideal entry and exit points in the market. Fundamental analysis allows traders to ascertain some of the developments or policies likely to influence investment patterns in the long run.

Technical analysis, on the other, entails the use of some of the best forex indicators to study price action patterns. As one of the best forex trading secrets, positional trading relies heavily on on-trend and oscillator indicators.

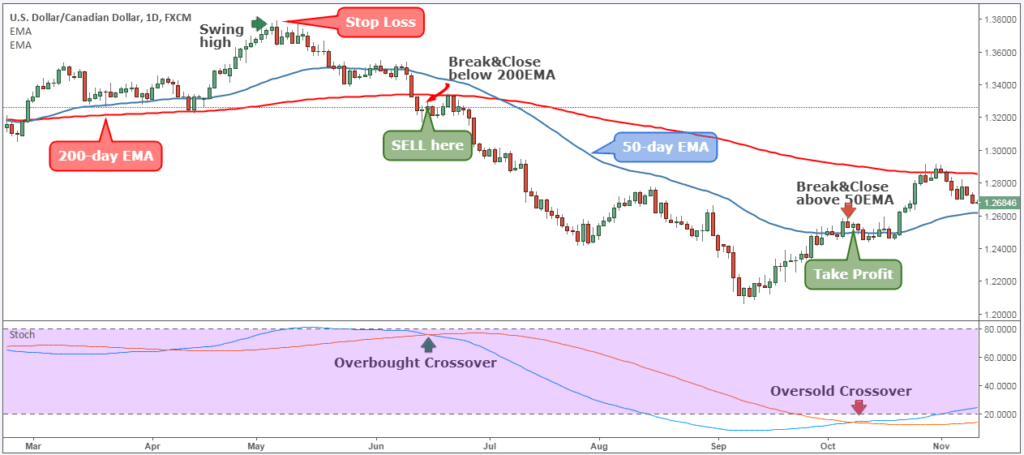

In this case, we are going to use a 50-day EMA and 200-day EMA as well as Stochastic indicator and Relative Strength Index. 50-day and 200-day EMA are the most powerful and best forex indicators for automated FX trading. The two indicators are used to time the market trend whenever a crossover occurs.

Conversely, whenever the short term moving average, 50-day EMA, crosses the long term 200-day EMA from below, on the daily chart, the same implies commencement of an uptrend. Traders, as well as Algorithmic FX trading systems, use this opportunity to eye buy opportunities as part of a positional trading strategy. The crossover, in this case, is often referred to as the golden cross.

Inversely, whenever the short moving average 50-day EMA crosses the long term moving average 200-day from above and starts going lower, the same implies a downtrend. Likewise, traders, as well as automated forex trading systems, use this opportunity to eye sell opportunities. The crossover, in this case, is referred to as death crossover.

Stochastic RSI Crossover

The fact that moving averages are lagging indicators calls for the use of other indicators that respond fast to price changes. The Stochastic RSI indicator would be the best fit for addressing the flaws of moving averages crossovers

Whenever a stochastic RSI produces a crossover above the 20 levels, traders, as well as forex robots, should be mindful of a potential bullish trend. Likewise, whenever the Stochastic RSI crosses below the 80 levels the same implies commencement of a potential downtrend.

When to Buy and Sell

Once the crossovers occur, that would not be enough to open buy and sell opportunities. Conversely, traders should only open buy positions when price rises and crosses over the 200-day EMA. Whenever price is above the long term moving average, it often tends to move in the uptrend until a trend reversal occurs.

Similarly, an opportunity to sell would occur when the price falls and closes below the 200-day EMA. The closing, in this case, signals a powerful bearish signal.

Taking Profits

When it comes to taking profits using this positional trading strategy, two conditions must be satisfied. First, the stochastic RSI indicator must rise above the 80 level signaling overbought market conditions. Given that price might remain in overbought conditions much longer than expected. It is also important two consider another factor before closing a trade.

A second confirmation that one needs to exit a buy position in a positional trade occurs when the 50-day EMA crosses the 200-day EMA from above and starts to move lower. If this was to happen, then it signals trend reversal from bullish to bearish. Likewise, traders can use this opportunity to close a position and lock in profits.

Similarly, in case of a sell position in bearish position, a trader or automated trading system would look to close a position whenever the 50-day EMA rises and crosses above the 200-day EMA signaling the end of a bearish trend.

Setting Stop Loss

Setting a stop loss is an important forex trading secret when it comes to protecting an underlying capital. In positional trading, stop-loss orders should be placed below the most recent swing low in case of an uptrend. Likewise, it can be placed above the most swing high in case of a downtrend.

The stop-loss strategy, in this case, gives the long term trend enough room to breathe. Likewise, it uses chart patterns and price points in the chart to signal a change in the price structure.

Conclusion

Positional trading is an effective trading strategy for people looking to make significant profits while not taking into consideration constant market fluctuation. The trading strategy requires a lot of patience and discipline.