What Is It?

The Big Ben breakout strategy is a day trading technique that aims to take advantage of the trading range that comes before the London Opening session. It involves taking a short position and a long position, just below and above the London trading range respectively. The strategy has been existing for decades. However, to properly implement this strategy, you need proper understanding regarding the reality behind the price.

In this strategy, the traders capture the first directional intraday move that often occurs within the first few hours after the London/Frankfurt market opens, which is approximately at 1 a.m. ET.

How Does this Strategy work?

At 8:00 AM GMT when the London market opens, some early volatility can be experienced. It’s the same case with almost all the major financial centers around the world and specifically for the New York and London times as the latter trading sessions experience the most forex volume. Major banks and financial institutions start their day at this point and this is where most of the trading volume activity is generated as they try to accommodate their corporate clients.

Thus, it becomes inevitable that you will get more volatility when trading at London or New York open. This becomes your prime opportunity to make money trades, as more volatility signifies more trading opportunities. The trading activity during this time is largely compressed. If a trader misses his/her entries and a trend later emerges from the opening range breakout, the market will not provide opportunities for the trader to get back into the trend.

The GBP/USD currency rate is considered ideal for this strategy as it is traded outside of the London trading hours. As a result, a huge increase in trading is experienced in the United Kingdom which provides a real market opening, which is the aim of this strategy. For instance, the currency pair is virtually non-existent during Asian trading hours. But after London open, the same pair accounts for almost one-quarter of all forex trading in the market. The currency pairs which have more 24-hour trading normally have less of a distinct open or close as all of them pass through different money centers.

Perfect Time to Trade Big Ben Strategy?

It is unanimously agreed by many that the ideal time to trade the strategy is one hour before and after the London open. This gives you two hours of searching for trading opportunities. To explain it more clearly, you will only need to sit in front of the chart from 7 to 8 AM GMT and from 8 to 9 GM. In the majority of the instances, the volatility starts picking up thirty minutes before the London open.

How to Trade Big Ben Breakouts?

You can trade the Big Ben Breakout strategy by fading the pre-open move as fading the London Open gives us a high probability trading setup. However, you need to adhere to some strict trading directives for the opening range breakout. Firstly, never trade every single trading day. Rather wait for the market to confirm all the rules. The steps involved in trading this strategy are as follows.

Defining the London Trading Range

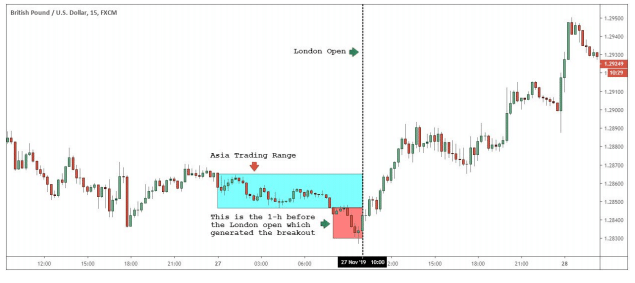

In this case, we are going to define the trading range by using the method that takes only the body of the candles into consideration, ignoring the wicks. The trading range is outlined in the chart for GBP/USD below.

The Asia trading range has a tendency to attract buy and sell stops both below and above the trading range. The bulk of selling and buying stops make it an easy target for generating smart money.

Breakout Generated by the One hour Open Before the Trading Range

The momentum really starts to increase from one hour earlier than the London open. As the most traded volume is generated during the London session, the forex market can take off in any direction. We can note the one-sided move in the GBP/USD chart below.

Notice that there aren’t any interruptions in the momentum activity, which is necessary for this trading setup to function.

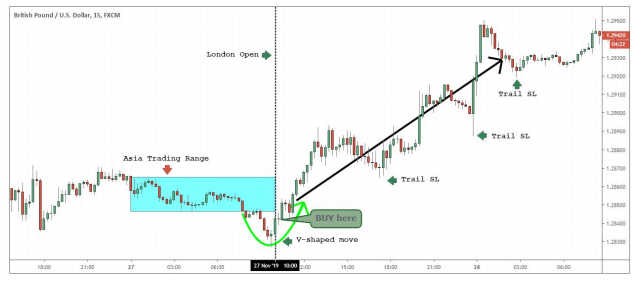

Price needs to fade

The price should fade the preopen move immediately after the opening of the London Session. In case, the move starts fading, you can be convinced that it was a false breakout. Always lookout for the price to pull back into the range at the same speed it went up.

In other words, the bullish momentum that produced the false breakout has to be equal to the bearish momentum used to fade the pre-open move. Enter your first trade after the first five minutes after the price reversal has been confirmed. You should see a V-shaped price formation once this setup is completed.

Ride the trend or Take profit

The next step involves measuring the size of the Asia trading range and projecting it from the top or bottom of your range to receive your profit target. However, this type of setup has a chance of increasing your trading day in the days to come.

In the example setup above, you can employ other trading tactics to profit from this trend. For instance, you can use a trailing stop as a better take profit strategy. Always be open to other trading methods for trade management.

Using Time Stops instead of Price Stops

You will need to employ some unconventional trading tactics to fade the London breakout. Using a time stop in place of a price stop is the right way to go. To implement a time-stop, simply exit the trade if the price doesn’t completely reverse the pre-opening breakout within the first hour after the London open.

Final Thoughts

By using this strategy, the chances of your success in the forex market go up many-fold, provided you have a complete grasp of the technical concepts behind the London open. Always try to take the setups which align with all the rules explained above. Using a time stop loss and using volatility are the best ways to achieve success in this setup.

Can I please have the indicator ?