We Like:

- Trade when you want as the broker offers no inactivity

- Tickmill is a top-tier regulated broker, holds a license from the FCA

- Leverages ECN technology for ultra-fast execution of orders

- Low trading fees

- Benefit from a $30 welcome bonus

- Segregation of clients’ funds in top-tier banks

- Offers razor-sharp spreads starting from 0.0 pips

- Provides copy-trading services through myfxbook

- Trade with cutting-edge tools like Authochartist

- Experience no slippages and requotes when placing trades

- Boost your trading knowledge using the well-furnished educational resources

- Allows hedging and trading instruments

- Never lose more than you invested as the broker offers a negative balance mechanism

We Don’t Like:

- Traders may face overnight slippages

- Overnight swap fees

- High fees on the market spread for the classic account traders as it starts from 1.6 pips

- Fewer tradable instruments compared to other brokers

- Not accepted in the United States

The Verdict:

Tickmill Group Limited is a unified entity of brokers under the trademark Tickmill Ltd scattered across the globe, but the head office is headquartered in London, England. The other offices operate in Seychelles, Malaysia, Cyprus, among other regions. Collectively, the brokerage giant claims to provide forex and CFDs trading services bolstered by ECN technology that sheds light on ultra-fast executions and no requotes.

Tickmill Ltd notes that its orders execute in about 0.20 seconds across the 80+ tradable instruments. It also cites to offer meager spreads starting from as low as 0.0 pips, but some clients registered with the commission-free account face spreads fluctuating from 1.6 pips. Traders can also maximize their leverage up to 1:500 and mitigate the resulting risks through the negative balance protection mechanism offered by the broker. Nonetheless, trading with Tickmill means you are dealing with a reputable company as it holds top-tier regulation licenses.

Company details

Co-founder of Tickmill Group Limited Nikolai Nikolajenko and his friend established the company in 2014, focusing on providing forex and CFDs trading services backed by innovative technology to retail and corporate traders. As of late 2015, Tickmill had added forex and CFDs to its products’ portfolio giving all sorts of traders a chance to speculate on the price movement of a wide range of assets.

Currently, the forex and CFDs liquidity provider runs a spectrum of offices in different sections of the globe, serves over 300K clients. It offers over 80 tradable instruments with ultra-fast executions fueled by ECN technology and tight spreads starting from 0.0 pips. In addition, it assures that clients have direct access to multilingual expert support when exploring its asset classes.

Tickmill assets include:

- Forex

- Stock indices

- Oil

- Bonds

- Cryptocurrencies

Forex assets trade by buying and selling the underlying forex pair. In contrast, the other classes trade as CFDs giving customers the ability to go long and short without owning the underlying instrument. This also paves the way for clients to benefit even when the financial markets go down. Tickmill provides cutting-edge trading platforms integrated with powerful trading tools to traders when speculating its array of products. The tools give the limelight to an effective trading environment that shaves down latency for instant executions and one-click trading.

The integrated trading tools include:

- Autochartist

- Myfxbook copy trading

- Economic calendar

- FX calculators

- VPS

As the tools help traders double their earnings, they must also deposit a required amount to trade. Tickmill offers several account types coupled with an Islamic account to a wide range of clients, depending on their trading objectives. The accounts come with different trading conditions. For example, the minimum deposit differs through the accounts as it is capped at $100 for the classic account but stretches through the low spread accounts to hover at $50,000 for VIPs.

However, Tickmill also provides neutral conditions to all the traders. It cites to provide negative balance protection across all accounts, waives all fees on deposits capped at $100 and one-time deposits of $5,000, and allows all clients to trade with freedom by obliterating inactivity fees. In addition, traders have diverse payment options to fund and withdraw money from their Tickmill accounts.

They include:

- Bank wire transfers

- E-wallets like Skrill and Neteller

- Credit/ Debit cards like Visa

Moreover, trading with Tickmill Group limited guarantees you maximum security of your assets as the broker assures offering transparency activities and confirms falling under a reputable regulation. It holds licenses from credible regulatory bodies such as the FCA, ASIC, and many others.

Regulations

- It is regulated by the Financial Conduct Authority (FCA), license № 717270.

- Authorized and regulated by the Seychelles Financial Authority (FSA), license № SD008.

- It is also licensed by the Cyprus Securities and Exchange Commission (CySEC), № 278/15.

- The broker is authorized and regulated by the Financial Services Authority of Labuan, license № MB/18/0028.

- The liquidity provider’s branch in Africa is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa, license № FSP 49464.

As noted in this review, Tickmill operates as a unified entity of brokers based in different sections of the world. Each Tickmill branch falls under a jurisdiction depending on the region. For starters, the UK-based subsidiary is authorized and regulated by the FCA, while the FSCA of South Africa surveys Tickmill Africa. Other reputable agencies that watch Tickmill financial activities include the CySEC and the FSA of Seychelles and Labuan.

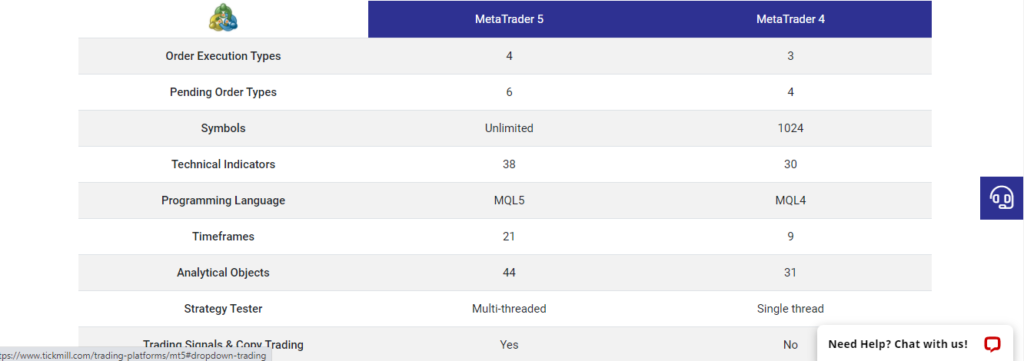

Trading platforms

Tickmill provides state-of-the-art trading platforms to clients to tap into the financial markets and speculates with fast executions and fewer requotes. The platforms come integrated with powerful trading tools to help achieve these goals. Some of the tools include built-in economic calendars, analytical objects, trading signals, among others. Clients choose the MetaTrader 4 or 5 depending on their trading objectives, and the platforms operate across a wide range of operating systems and interfaces, allowing them to trade from anywhere.

MetaTrader 4

- Order execution types — 3

- Pending order types — 4

- Symbols — 1024

- Technical indicators — 30

- Programming language — MQL4

- Time frames — 9

- Analytical objects — 31

- Strategy tester — single-threaded

- Trading signals & copy trading — no

- Reports — tables only

- Built-in Economic calendar — no

MetaTrader 5

- Order execution types — 4

- Pending order types — 6

- Symbols — unlimited

- Technical indicators — 38

- Programming language — MQL5

- Time frames — 21

- Analytical objects — 44

- Strategy tester — multi-threaded

- Trading signals & copy trading — yes

- Reports — charts & tables

- Built-in Economic calendar — yes

Range of markets

Tickmill boasts as the number one forex and CFDs provider in the financial markets leveraging ECN technology to offer lightning-fast executions with no requotes. The broker ascertains that most of the orders placed execute in 0.20 seconds in a no-dealing desk environment with low spreads starting from 0.0 pips.

Tickmill also confirms that its range of markets holds more than 80 tradable instruments for clients to speculate guided by real-time multilingual support with a leverage of up to 1:500. Some of the asset classes include forex pairs, stocks, metals, and many more.

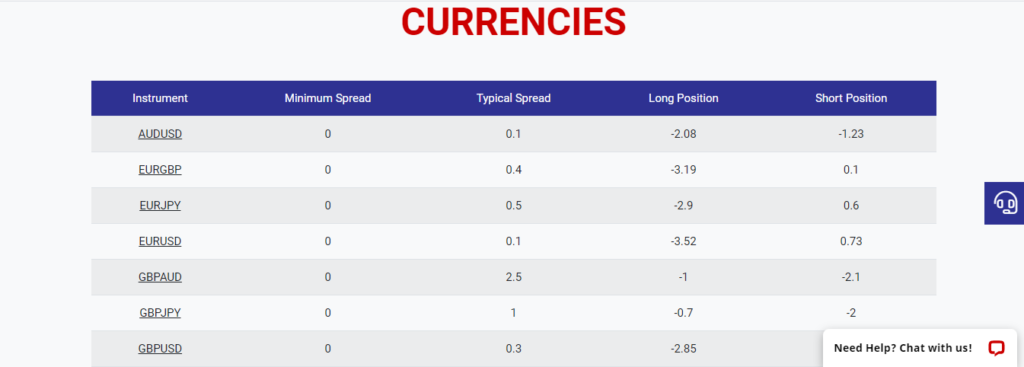

Forex

The foreign exchange market at Tickmill Ltd holds 60 currency pairs encompassing significant majors, minors, and exotics and trades 24/5 backed by multilingual customer support with competitive spreads and leverage of up to 1:500. Some FX crosses include EUR/GBP, EUR/USD, allowing traders to own the underlying currency asset rather than speculate on their prices as CFDs.

Stock indices and oil

Indices are a group of stocks trading on a global exchange platform that traders speculate on as CFDs without owning the underlying asset helping clients diversify their portfolios as they can choose to go long or short. Tickmill allows clients to trade various stock indices coupled with oil 24/5 with ultra-fast executions, competitive spreads, and leverage of up to 1:100. Some of the instruments include UK100, US 30, DE30, and Brent crude oil.

Precious metals

Tickmill also offers an array of precious metals for customers to speculate on the price movement against significant currencies in the commodities marketplace. The precious metals market trades 24/5 fueled by ECN executions and multilingual customer support, with spreads fluctuating from 0.0 pips and leverage going up to 1:500. In addition, the broker allows traders to use any strategy when speculating this market’s assets, such as gold and silver.

Bonds

Bonds or treasuries are financial instruments traded as CFDs by speculating whether their price will plunge or surge in the market. Tickmill opens the door for clients to such products trading 24/5 guided by real-time expert support. Some of the bond instruments offered by the broker include the EUR BUND, EURO BUXL, and a spectrum of German bonds. The spreads start as low as 0.0 pips, and the leverage extends up to 1:100.

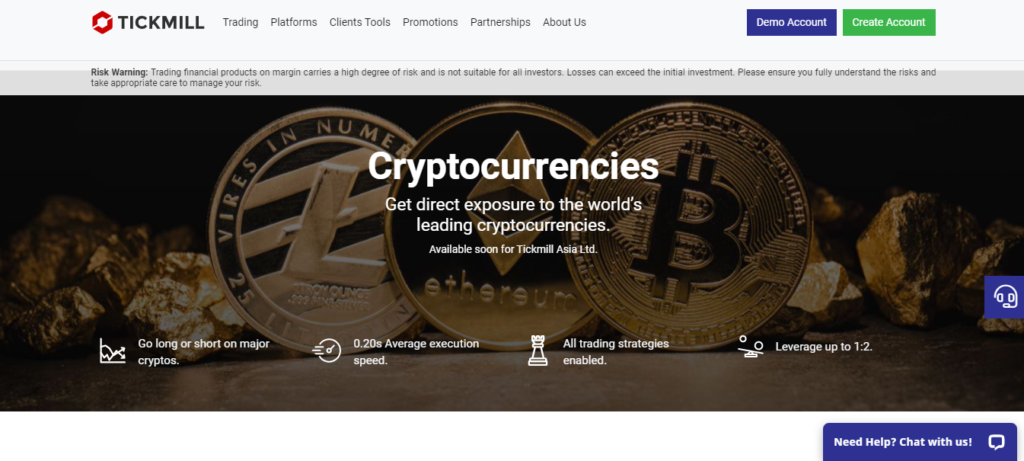

Cryptocurrencies

The crypto market is among the most volatile markets in the financial industry. The digital assets’ prices fluctuate, giving traders a platform to speculate on the price movement 24/7. Tickmill offers a wide range of these assets led by the pioneer cryptocurrency BTC and allows its traders to go long or short, giving them the hedge even when the market drops. Traders can apply all strategies on these products as they trade with competitive spreads, speedy executions, and leverage of 1:2.

Main features

After unpacking Tickmill content, we have come across many features that fuel the broker to achieve its milestones and clientele. Currently, it confirms winning several prestigious awards and hitting a milestone of 385+ M executed trades.

Its main features include:

- Top-tier regulated — the broker holds a top-tier regulation license from the FCA.

- Leverages ECN technology — it provides ultra-fast executions with no requotes fueled by ECN technology.

- Offers meager spreads and large leverage — the forex and CFDs provider offers low spreads starting from 0.0 pips and leverage of up to 1:500.

- Trade a wide range of instruments — the broker traders access more than 80 tradable instruments speculated as forex and CFDs.

- Intuitive trading platforms — the broker offers the world’s popular trading platforms tailored to serve peculiar traders depending on their objectives.

- Cutting-edge trading tools — clients also have access to integrated trading tools that pave the way for profitable trading. Such tools include Autochartist, VPS, forex calculators, economic calendar, and myfxbook for copy trading.

- Multiple payment platforms — traders can fund their accounts from anywhere with any amount starting from $100 using payment options such as E-wallets, bank cards, bank transfers, among others. The broker waives deposit fees for all amounts capped at $100, but withdrawals attract a certain fee.

- Rich educational resources — the broker provides dozen of educational materials to traders such as webinars, Ebooks, video tutorials, articles, and many more.

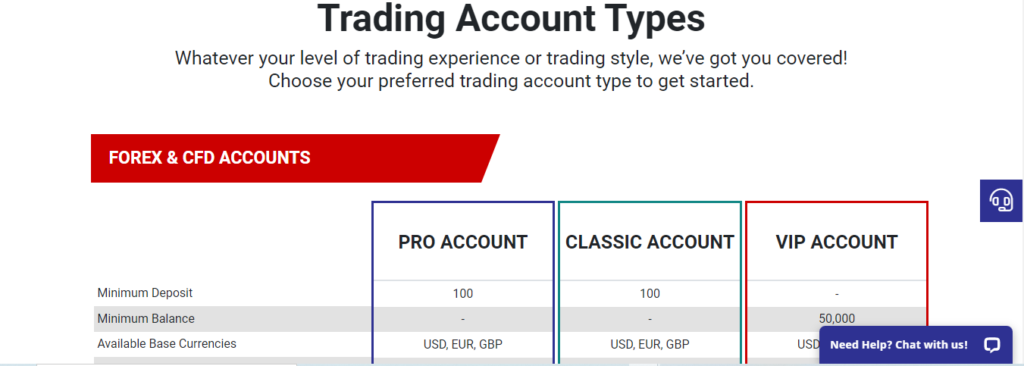

Types of trading accounts

Clients have access to three account types to select depending on their trading goals. The accounts are tailored to serve different sets of traders as some traders would choose to access the markets with zero commissions while others would prefer to trade with zero spreads but pay commissions on the volume of trades.

The Pro account

- Minimum deposit — $100

- Minimum balance — $0

- Available base currencies — USD, EUR, GBP

- Spreads from — 0.0 pips

- Max leverage — 1:500

- Min lots — 0.01

- Commissions — 2 per side per 100,000 traded

- All strategies allowed — yes

- Swap-free Islamic account option — yes

The Classic account

- Minimum deposit — $100

- Minimum balance — $0

- Available base currencies — USD, EUR, GBP

- Spreads from — 1.6 pips

- Max leverage — 1:500

- Min Lots — 0.01

- Commissions — no

- All strategies allowed — yes

- Swap-free Islamic account option — yes

The VIP account

- Minimum deposit — unlimited

- Minimum balance — $50,000

- Available base currencies — USD, EUR, GBP

- Spreads from — 0.0 pips

- Max leverage — 1:500

- Min Lots — 0.01

- Commissions — 1 per side 100,000 traded

- All strategies allowed — yes

- Swap-free Islamic account option — yes

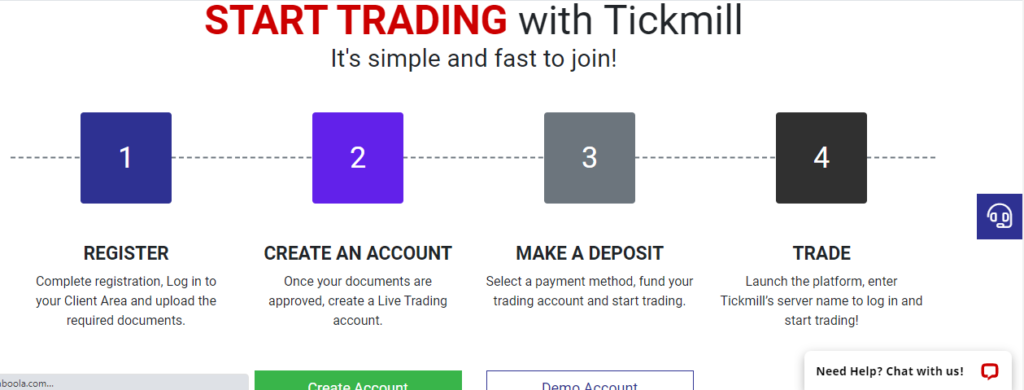

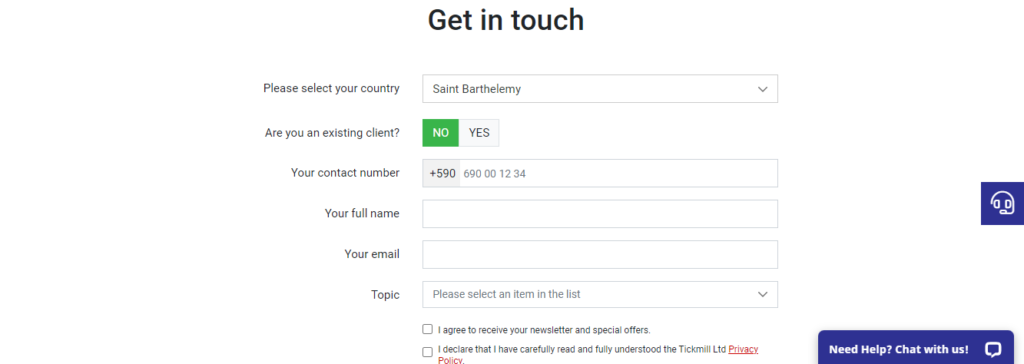

Opening an account at Tickmill Ltd

The account opening process is relatively fast and involves the following steps.

Step 1. Log in to Tickmill’s official website and click the create account button.

Step 2. Fill in your details on the form that pops up.

Step 3. Agree on the terms and submit the form.

Step 4. Verify your account by submitting KYC documents.

Step 5. Log into your account and fund it.

Step 6. Start trading.

Commissions and spreads

As Tickmill’s business model is widely commission-based, it operates as a non-dealing desk broker leveraging ECN technology. Customers experience very low spreads starting from 0.0 pips meaning that they do not incur fees on the market spread. However, they incur commissions on the volume of trades as replicated on the Pro and VIP accounts.

The broker also adds fees on the market spread for the Classic account traders citing that the minimum spread starts from 1.6 pips. Although, these clients do not incur any trading commissions. Generally, Tickmill is a low-fee broker, but other fees may arise during withdrawals and deposits above $100.

Customer service

Tickmill alludes to offering dedicated multilingual customer support that clients can contact in real-time. Clients have access to several buttons linking to the support team on the broker’s official website. For starters, they can choose to file a query through the contact us page or contact the support via the call and live chat button. These are also coupled with a FAQ page that includes answers to all relevant queries likely to be raised by clients. In addition, Tickmill conforms to provide a rich educational platform that helps all levels of traders explore the financial markets.

Tickmill Review

What we liked

- Razor-sharp spreads starting from 0.0 pips

- State-of-the-art trading platforms integrated with cutting-edge trading tools

- Deep liquidity

- Low latency due to ECN technology

- Segregation of funds

- Easy account opening

- Rich educational resources

- Well-regulated broker

What we disliked

- Fees on withdrawals

- Commissions on trades

- Fees on deposits above $100

- Not accepted in the USA

The bottom line

Tickmill Ltd is a forex and CFDs group of brokers offering the best services in these niches leveraging ECN technology. The liquidity provider reiterates to offer forex and CFDs trading services on a wide range of assets with ultra-fast executions and tight spreads starting from 0.0 pips. The broker is suited for all traders and claims to provide a $30 entry bonus to all new clients. Nonetheless, it operates under a reputable regulation led by agencies such as the FCA and CySEC.

However, it poses some drawbacks to clients as well as it charges fees on withdrawals and all deposits above $100. Moreover, traders may incur overnight fees, and slippages and the classic account traders pay a more significant fee on the market spread as their spread starts from 1.6 pips.