- The Bank of Canada has maintained a constant policy rate at 0.25% into 2021.

- Home sales are expected to increase in the US in 2021 due to Biden’s stimulus package.

- The revamped USMCA trade deal is expected to favor the US in terms of employment and export.

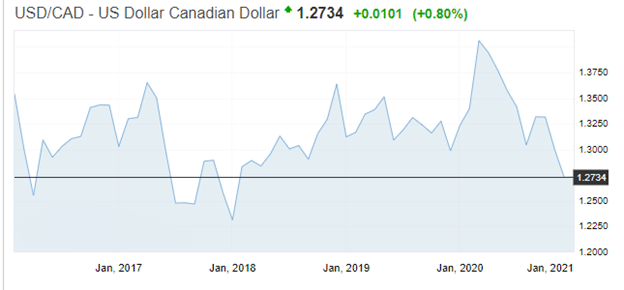

The Canadian dollar has strengthened by 12.25% against the US dollar since March 19, 2020. Pre-pandemic gains of the US dollar reached a high of 1.4512. Factors attributed to this improvement include a high employment rate, job creation, and the USMCA trade deal. There has also been an increase in housing demand as the work-from-home strategy has turned homes into offices among Americans and Canadians. The Bank of Canada into 2021 remained unchanged at 0.25% and the bank rate at 0.5%. Despite the second Covid-19 wave, the bank is hopeful that the economy will grow by 4% in 2021.

Mortgage rates into 2020 were reduced to 1% by the Canadian banks making it easy to secure homes. There was also limited supply that made the sale of dwellings (nationwide) spike by 7.2% in December 2020 (MoM). Additionally, the 10-year government bond shot by 0.84% (3 basis points). The BoC’s promise to keep low borrowing costs until 2023 can only hold if inflation stays at the current lows.

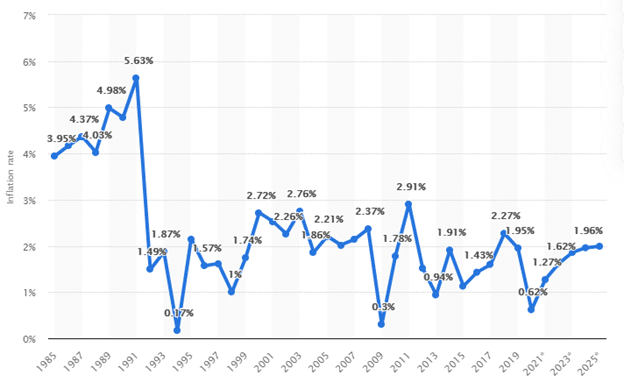

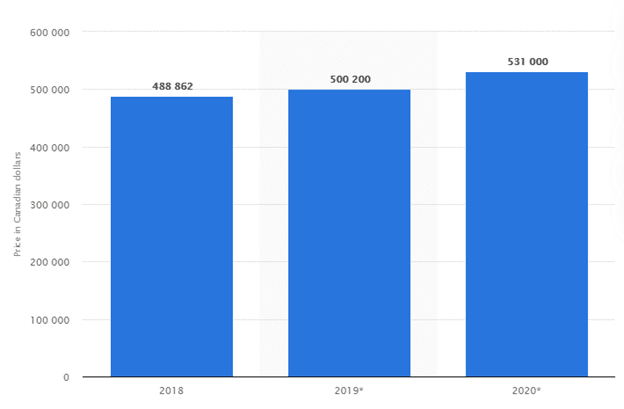

The Bank of Canada will not raise interest rates until inflation attains the 2% threshold. The quality is expected to remain at 0.62% in 2021, with fears of additional lockdowns due to the second Covid-19 wave. However, the rate of inflation may reach the intended threshold before the end of 2021. A consideration of the real estate boom shows that Canadian homes’ benchmark prices went up 1.5% into 2021, 13.1% year on year (YoY). The average prices of homes were C$607,280, up from C$531,000.

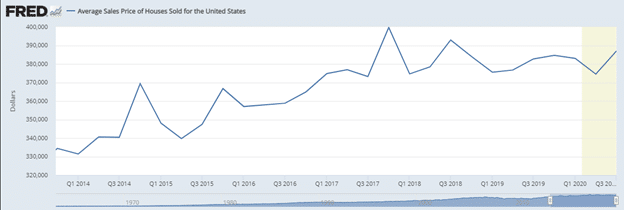

In the US, the average prices of homes have increased by 15.72%, from $334,400 (Q4 2013) to $387,000 (Q3 2020).

Factors driving the US housing boom include high demand and low-interest rates. However, the stimulus effect may increase mortgage rates as inflation is expected to rise in America in 2021. We feel that houses will be more affordable in Canada than in the US. In December 2020, the number of building permits in Canada surged by 12.9% from a forecast of 3.0%.

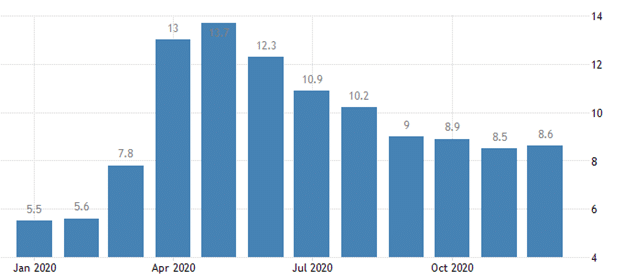

The US maintained its unemployment rate at 6.7% into 2021, while Canada increased by 0.1% (8.5%-8.6% MoM). While part-time employment reduced by 99,000 in December 2020, the Canadian economy added 36,500 in full-time jobs (MoM). An improvement in the employment trend may also increase the rate of inflation overall.

US-Canada-Mexico (USMCA) trade deal

The USD/CAD trading pair shot 8.26% from December 2019 to March 2020 in favor of the US dollar. This increase occurred when the US ratified the trade deal with Canada and Mexico in December 2019 to revamp the North American Free Trade Agreement (NAFTA). This deal was seen as one-sided as it took away employment opportunities from the US to Mexico. The latter’s low wage requirements mean that companies found it easy to relocate away from America, especially with tariffs.

The improved trade deal added $1.2 trillion in annual trade across the three countries. This agreement supported a total of 12 million jobs. The USMCA deal would also keep a third of American agricultural export. The trade agreement came into force in July 2020, and we expect to see how it will reinforce job-creation and merchandise trade between the two countries. These factors support a buy position in favor of the US dollar.