- Higher US yields have downplayed the threat of over-stimulation in the US economy.

- China’s GDP target of 6% in 2021, falls short of the decline in Q1 2021.

- China may not target to meet the trade deal with the US in 2021.

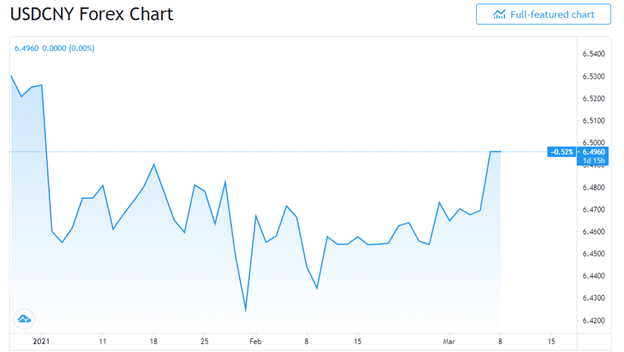

The USD/CNY trading fell 0.52% year-to-date as the US is set to maintain Trump’s trade tariffs for the better part of Biden’s term in office. China fell 42% short of meeting the $200 billion target set in the trade deal in 2020 but the condition has helped it in the global ranking. The US ranked sixth in its response to the global COVID-19 pandemic among soft powers while Germany held the top position. The US dollar has, however, managed to hold off strong volatility from the Chinese yuan after the Senate passed Biden’s $1.9 trillion stimulus package.

Stimulus effect

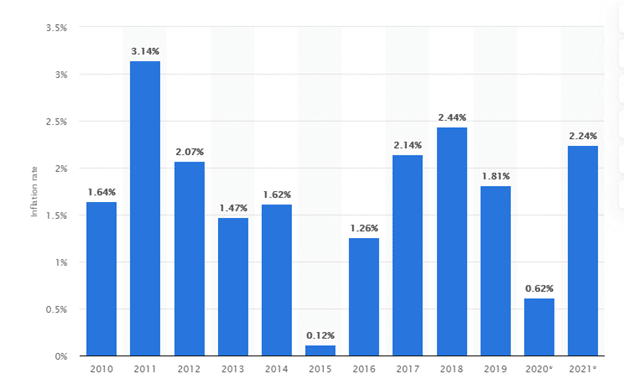

The US Senate passed the $1.9 trillion stimulus package awaiting final approval on March 9, 2021. The stimulus plan is expected to soar the inflation rate seeing the economy is moving into the post-pandemic era. In 2020, the inflation rate dropped to 0.62% from 1.81% in 2019. Economic projections show that the rate would jump to 2.24%, slightly above the Fed’s target of 2%.

The US has had close to 30 million coronavirus cases and up to 520,000 deaths since the start of the pandemic in 2020. The threat of higher inflation is imminent with calls from the US treasury to raise wages. In this case, we may see higher costs of living amid higher demand. The pressure will now be on the labor market in terms of wage sustainability to grow the real wage.

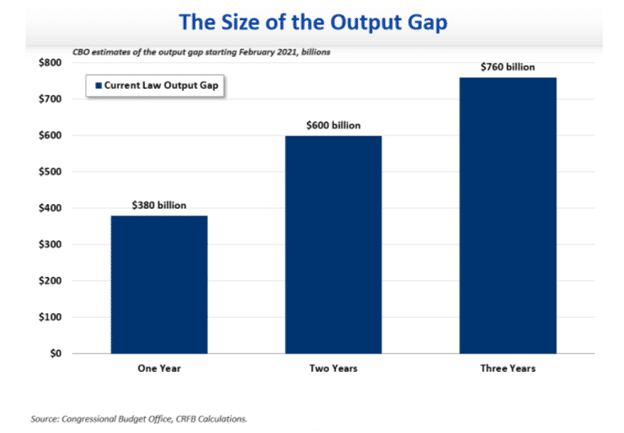

Additionally, the US may be trapped in an over-stimulus plan adding on to the output gap that stands at $380 billion. Projections are rife that the gap may rise to $760 billion by the end of 2023. In the first quarter of 2020, the output gap fell to 10% of the US GDP that translated to $550 billion.

The real threat, however, is if the inflation rate rises quicker than that of China – then the US commodities will become less competitive. This condition will lower demand for US goods and motivate a declining dollar. However, market response due to investor confidence may initiate higher interest rates that may lead to currency appreciation. The US 10-year Treasury yield rose 1.577% indicative of positive investor sentiment over the US economy.

China on its part is seeking to evade assets denominated by the US dollar to protect its currency. With up to $3.2 trillion in foreign reserves (denominated in the USD), China is in no hurry to add more until it tightens its monetary risks. The threat of imported inflation means that the world’s second-largest economy will consider external risks expected with the stimulus package.

GDP target

After achieving a GDP growth rate of 2.3% in 2020, China has set the 6% threshold as the 2021 target. However, this projection is still weak seeing the economy contracted 6.8% in Q1 2020. The Asian powerhouse is looking towards stronger reforms, innovations, and exclusive development.

China is also looking to improve urban employment by 5.5% by creating an excess of 11 million jobs. Urban employment was 9 million in 2020 and 11 million in 2019. While China is focused on improving its trade relations, it is more focused on working negotiations with Japan and South Korea as opposed to the US.

Technical analysis

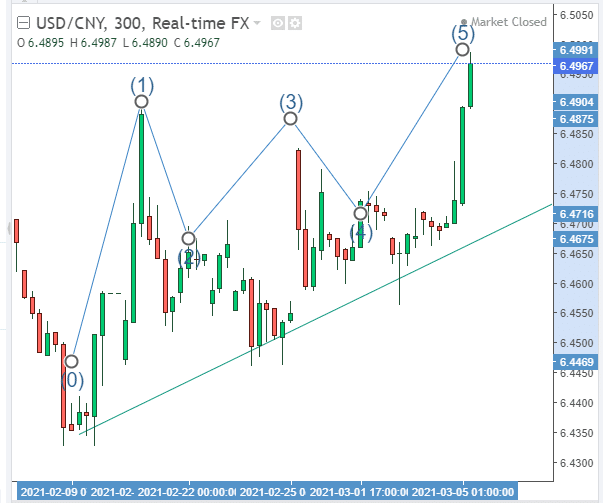

The 1-month (January 2021) Elliot impulse wave pattern shows that the USD/CNY trading pair is headed towards 6.5050. The pair may find new support at 6.4716 close to the 100-day EMA at 6.4702. This position is bullish for the dollar.