- The US import price index rose 0.3% for July 2021 (MoM), falling short of the 1.1% realized in the previous month.

- The first half of August 2021 saw consumer sentiment decline from 81.2 in July 2021 to 70.2 recorded in August 2021.

- Switzerland’s GDP growth was upgraded to 3.6% in 2021, with employees calling for a 1.75% salary increase in 2022.

The USDCHF lost 0.83% on August 13, 2021, from the previous day’s close. It traded to a low of 0.9155 after opening at 0.9229. The dollar was on a losing streak in the day, dropping 0.71% against the Japanese yen, 0.52% against the Australian dollar, and 0.60% against the kiwi (NZD).

Trade index

The US dollar declined after the import price index rose 0.3% for July 2021 (MoM), falling short of the 1.1% realized in the previous month. It also failed to beat analysts’ estimates at 0.6%. The import price index rose 10.2% against 11.3% recorded in 2020. The increase was driven by rising fuel and non-fuel prices from 2020 to 2021.

Non-fuel imports had their price index for July 2021 remain unchanged at 0.9% (same as June 2021). Foods and beverages advanced 0.3% in the month, while non-fuel industrial commodities declined 1.7%.

The export price index reacted positively, rising 1.3% in July 2021 (MoM) against 1.2% in June 2021. The index rose 17.2% against 16.9% recorded in 2020. Prices of agricultural exports dropped 1.7% in July 2021. The prices had risen 1.5% in June 2021 after advancing 6.1% in May. The July 2021 decrease was the first drop in agricultural prices since August 2020.

Consumer expectations

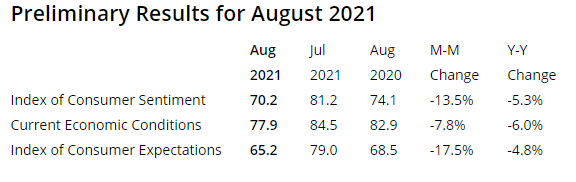

The consumer expectations survey conducted by the University of Michigan for August 2021 was bearish for the US dollar.

The first half of August 2021 saw consumer sentiment decline from 81.2 in July 2021 to 70.2 recorded in August 2021. It declined 5.3% year-over-year, losing 13.5% monthly.

Respondents in the survey were not as optimistic about the current economic conditions (in the US) in August 2021 as compared to July 2021. The index rose to 77.9, compared to 82.9 in August 2020, showing an annual fall of 6.0%.

Swiss economic recovery

Swiss workers called on the government to increase their wages by up to 1.75% by 2022. Switzerland’s GDP growth was upgraded to 3.6% in 2021, with all employees expecting to have a general adjustment to their cost of living.

Travail Suisse, the Union body representing Swiss workers, noted that an increase in salaries would help them adapt to Covid-19-related changes. Employees in the air, as well as public transport, called for a 1% salary increase. While low-wage divisions experienced low sales and declining orders, Swiss banks recorded significant profits.

The health sector is poised to receive up to 4% salary increments due to the ongoing fight against the pandemic. However, unemployment in Switzerland is still at a high of 35%, indicating the need to strengthen the labor market.

The Swiss franc rose 0.35% against the Australian dollar and 0.35% against the euro on August 13, 2021.

Technical analysis

The USDCHF hit resistance at 0.9474 and began a throwback after prices tested 0.9272 from below.

There is a slight decrease in the buying pressure with the 14-day RSI at 50.70. Volatility mildly increased at 0.00683, while the price continued to decline. The pair is expected to trade in the range of 0.9018 to 0.9272.