- Consumer confidence in the country had decreased to 106.5 in the month, pulling down the krone.

- Unemployment grew 10.3% in June 2021 (MoM) from 9.8% in May.

- US natural gas inventory levels declined 26.53% from 49 billion barrels to 36 billion barrels, with investors upbeat on PCE data.

The USDSEK recouped losses at 2:31 am GMT on July 29, 2021, to gain 0.41% from the previous day’s close. Earlier in the day, at 3:34 pm GMT, the pair was trading at 8.5435, and hours later, it recovered and hit a high of 8.5736 (+0.46%). The increase in continuous jobless claims to 3,269K in the week ending July 17, 2021, had plummeted the dollar. However, it recovered with core PCE prices for Q2 2021 that rose 6.10% from a previous record of 2.70%.

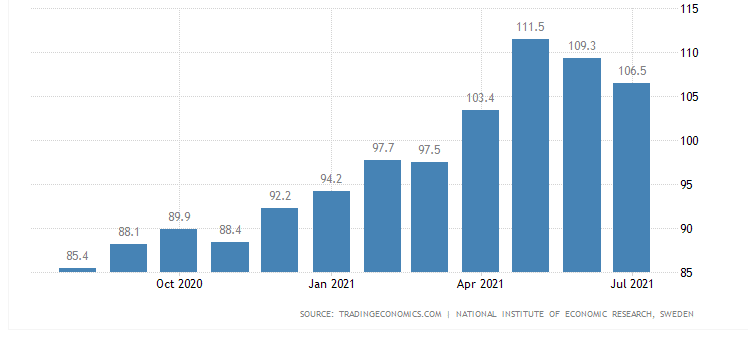

Confidence index levels

The Swedish krone appreciated after July 2021 saw a 3.28% increase in the manufacturing confidence levels. It rose from 125.2 in June 2021 to 129.2 in July 2021 (MoM). Consumer confidence in the country had decreased to 106.5 in the month, pulling down the krone.

This decrease was partly due to the shocking ruling by an environmental court in Sweden halting limestone mining by Cementa in the country. This rating was attributed to a 10.3% rise in unemployment levels in June 2021 (MoM) from 9.8% in May.

Labor survey

According to Statistics Sweden, 5,144,000 were employed in June 2021, with the unemployment rate at 10.3% (591,000). When seasonally adjusted, the employment number dropped 1.69% to 5,057,000. Permanent employee number increased to 3,855,000 while contract/temporary employees rose to 718,000.

GDP in Q2 2021 (QoQ) had risen 0.9% from a previous record of 0.8%, beating estimates at 0.7%. On annual analysis, the GDP in Q2 gained 10.0% after falling to 0.0% in 2020.

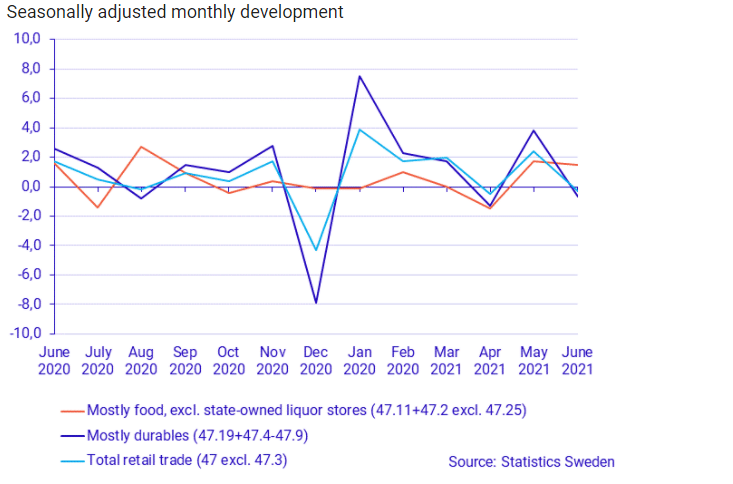

Swedish retail sales were down 0.3% in June 2021, with durables dropping 0.7% when compared to the previous month of May 2021. Sale of consumables (excluding liquor sold by the state) rose 1.5%.

In the 3-month ending in June 2021, the volume of retail sales (seasonally and working-day adjusted) rose 2.8%, similar to durables. Consumables were up 0.4%.

Low gas inventory

Investors are upbeat about the dollar’s recovery after natural gas inventory levels declined 26.53% from 49 billion barrels to 36 billion barrels. There is also optimism about the core PCE price index for June 2021 (YoY), slated for release later on July 30, 2021. Consensus estimates have raised the index forecast to 3.7% from a previous reading of 3.4%. On monthly terms, the core PCE is expected to rise by 0.6% in June 2021 from 0.5% recorded in May 2021.

On an annualized basis, US GDP growth stood at 6.5%, falling 2.0% short of analysts’ expectations at 8.5%. The minimal increase was due to the rising Covid-19 numbers from the novel Delta variant. Investors were worried about the economic prospects in the US, with total cases now at 35.584 million and deaths at 628.5K.

There was a 3.5% decrease in private investments in Q2 2021 due to a decline in residential/real estate expenditures.

Technical analysis

After forming the rounded bottom pattern, the price is seen moving towards the breakout point at 8.5055. It is still not near the resistance line at 8.7528, so we may expect the uptrend to continue.

There is a declining selling volume with the 14-day RSI at 44.95 near the neutral point. At 6:00 am GMT on July 30, 2021, the price was still below the 9-day EMA at 8.6143. Failure of the uptrend may pull the price below 8.4995 or trade higher towards 8.6000 when positive PCE data is confirmed.