We Like:

- Raw market spreads starting from 0.0 pips with deep liquidity.

- Real-time multilingual customer support.

- Powerful trading tools like VPS, calculators, among others.

- Trade CFDs on FX and other products.

- Offers social trading services through ZuluTrade, Duplitrade, and MyFxbook.

- Regulated by two-tier agencies making it relatively safe.

- Suitable for both retail and institutional traders.

- No inactivity fees.

- Holds clients’ funds in segregated bank accounts.

- No deposit or withdrawal fees.

- Traders cannot lose more than they invested as the broker provides negative balance protection.

- 50% welcome bonus.

We Don’t Like:

- High minimum deposit compared to other brokers

- Slippage and rollover — yes

- Not available in the USA and Canada

- Trading fees and commissions — yes

- Fees added on the market spread for the Standard account traders

The Verdict:

Vantage FX is a No Dealing Desk broker headquartered in Sydney, Australia. It leverages ECN technology to offer razor-sharp spreads starting from 0.0 pips and lightning-fast executions, as showcased through its ECN account types. However, traders have a chance of selecting the standard account type to mitigate most trading commissions as the account only adds fees on the spread.

The broker made its debut into the financial markets back in 2009 and now prides itself with over ten years of experience offering Forex and CFDs on 300+ tradable instruments. Its clientele comes from around the globe as the broker owns several subsidiaries across the world. As a result, the broker falls under several jurisdictions such as the ASIC and CIMA, making it averagely safe to trade with.

Company details

The Australian-based FX and CFDs provider Vantage Fx launched its trading services in 2009 to help financial speculators achieve direct access to the interbank market. It leveraged ECN technology to catch this goal, giving traders access to deep liquidity, low spreads, and latency. Currently, it offers RAW ECN spreads starting from 0.0 pips and ultra-fast executions, helping clients trade with low latency and razor-sharp spreads.

Its markets support more than 300 tradable instruments that clients speculate as forex and CFDs assisted by award-winning customer support. Moreover, despite providing meager spreads and speedy executions, the broker offers a leverage of up to 500:1 across its asset classes.

The broker’s asset classes include:

- Forex

- Indices

- Energies

- Soft commodities

- Precious metals

- The US, UK, EU & AU Share CFDs

It offers the world’s popular trading platforms, the MT4 and its predecessor, MT5, coupled with the broker’s proprietary trading platform, the Vantage Fx app. Traders access these asset classes’ instruments using Vantage Fx’s state-of-the-art trading platforms that come integrated with cutting-edge tools for effective trading. In addition, clients looking to tap into copy-trading have access to an array of social trading platforms such as MyFXbook, DupliTrade, and ZuluTrade.

Integrated trading tools include:

- Forex VPS

- Economic calendar

- FX calculators

- Sentiment indicators

- Pro trader tools

These tools give the limelight to profitable trading, but they must fund their trading account with a set monetary size for clients to leverage. For example, the minimum deposit for the standard account is capped at $200, and for the RAW ECN at $500.

However, the amount stretches to $20,000 for the Pro ECN account. This results because the accounts come with different trading conditions tailored to serve particular types of clients.

Vantage FX account funding methods include:

- Wire transfers

- BPAY (Australian clients only)

- VISA and MasterCard

- JCB

- E-wallets

The broker provides neutral client benefits across the accounts such as a 50% welcome bonus, zero deposit and withdrawal fees, segregation of funds, negative balance protection, no inactivity fees, among a spectrum of other services. Moreover, Vantage Fx notes to operate under a reputable regulation framework pillared by agencies such as the ASIC.

Regulations

Vantage Fx holds a couple of regulatory licenses from recognized agencies around the world. The regulatory framework supports agencies such as the ASIC. CIMA, among others, makes Vantage Fx an average safe broker to deal with.

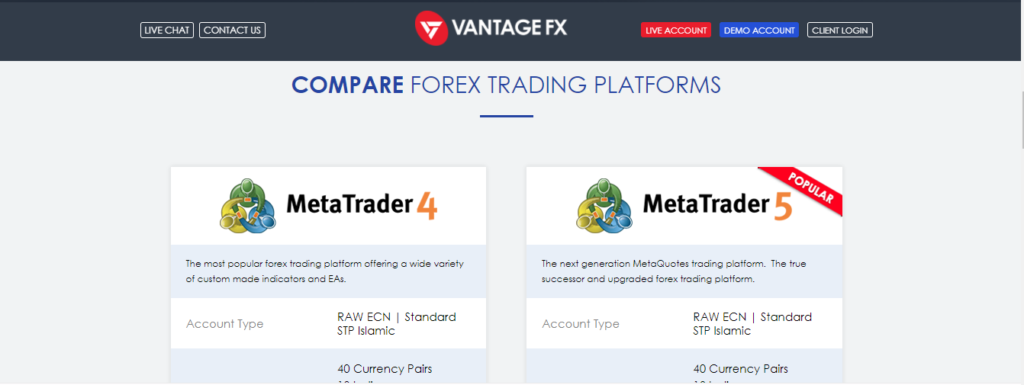

Trading platforms

Before beginning their trading journey, clients have a wide range of trading platforms to choose from at Vantage Fx. The forex and CFDs liquidity provider offers state-of-the-art trading platforms integrated with ECN technology for low latency and cutting-edge tools for effective trading. The platforms include:

- The MT4

- The MT5

- Vantage Fx App

- Social trading platforms such as MyFxbook, ZuluTrade, etc.

MetaTrader 4

- Account types — RAW ECN and Standard STP in Islamic

- Markets traded — All

- The platforms are accessed via — Mobile, Web, and Desktop

- Leverage up to — 500:1

- The min trade size is — 0.01 lot

- Account base currencies — AUD, USD, GBP, EUR, SGD, CAD

- Hedging — Allowed

- Scalping — Allowed

- Number of time frames — 9

- Forex robots — MQL4-based

MetaTrader 5

- Account type — RAW ECN and Standard STP in Islamic

- Markets traded — All

- Operates on which platforms — desktop, web, mobile

- Leverage up to — 500:1

- The min trade size is — 0.01 lot

- Account base currencies — AUD, USD, GBP, EUR, SGD, CAD

- Hedging — Allowed

- Scalping — Allowed

- Number of time frames — 21

- Forex robots — MQL5-based

Range of markets

The broker provides a wide range of markets that collectively support 300+ tradable instruments. The products include 44 FX pairs, 16 indices, 10+ commodities, and several share CFDs.

Forex

It opens the FX 24/5, enabling traders to buy and sell a total of 44 currency pairs. These pairs include majors, minors, exotics, and trades with razor-sharp spreads starting from 0.0 pips and ultra-fast executions fueled by ECN technology. Collectively, they yield from nine base currencies and trade with a leverage of up to 500:1.

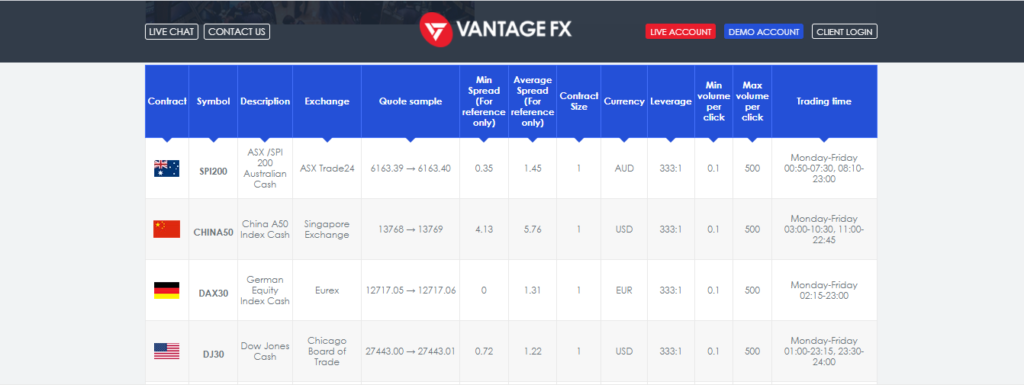

Indices

An array of liquid stock exchange indices from across the globe trade on Vantage Fx allowing customers to speculate on their instruments as CFDs with leverage of up to 333:1. The indices market generally supports 15 major stock markets, such as S&P 500, DAX FTSE, DJ30, and more.

Commodities

The commodities marketplace at Vantage Fx supports a wide range of commodity products such as energies, precious metals, and soft commodities like cocoa and coffee.

Energies

Energies available include crude oil, natural gas, gasoline, and many more. These assets trade 24/5 as CFDs allowing traders to go long and short with ultra-fast executions and real-time expert support. But, Crude oil trades with a leverage of up to 100:1 and 0.01 lots. The leverage is up to 20:1 for natural gas, gasoline, and low sulfur gas.

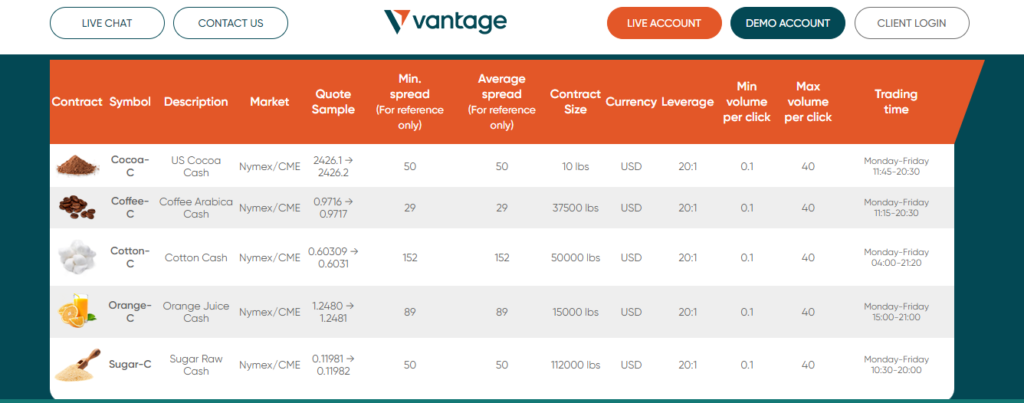

Soft commodities

A spectrum of grown and processed commodities such as cocoa, coffee, orange juice, and sugar trade on the broker’s platform as CFDs 24/5 with speedy executions, leverage of up to 20:1, 0.01 lots.

Precious metals

The precious metals market supports assets such as gold, silver, platinum, and an array of other mined products. It opens 24/5, and traders can speculate on the asset’s price as CFDs. Gold trades with a leverage of up to 500:1 and 0.01 lot while silver’s leverage extends up to 100:1 with 0.01 lot. Copper tags along with a leverage of up to 50:1 and 0.01 lot.

Share CFDs

Vantage Fx share market supports shares of major global companies from regions such as the US, UK, AU, and EU. These regions’ companies collectively yield about 226 shares on global exchanges like Nasdaq, NYSE, and others. Traders then speculate these assets as CFDs 24/5 with leverage of up to 20:1.

Main features

Several features give the broker the force needed to acquire more clients and diversify its products and services. So far, we have unpacked some of the broker’s features.

- Award-winning customer support — the broker promises to provide a qualified client support team in multiple languages. As a result, the broker easily attends to clients from all over the world.

- Leverages ECN technology for fast executions — traders experience low latency and fast executions of orders when trading with the Sydney-based broker.

- Wide range of markets — the broker also offers customers access to multiple asset classes supporting about 300 tradable instruments such as forex and CFDs.

- Cutting-edge platforms — traders access the markets from anywhere as Vantage Fx offers a spectrum of trading platforms available on the Web, desktop, and App.

- Powerful trading tools — trading is also aided by special trading tools like forex calculators to mitigate losses.

- Provides social trading platforms — it also allows traders to tap into copy-trading as signal providers or followers using ZuluTrade, MyFxbook, and DupliTrade.

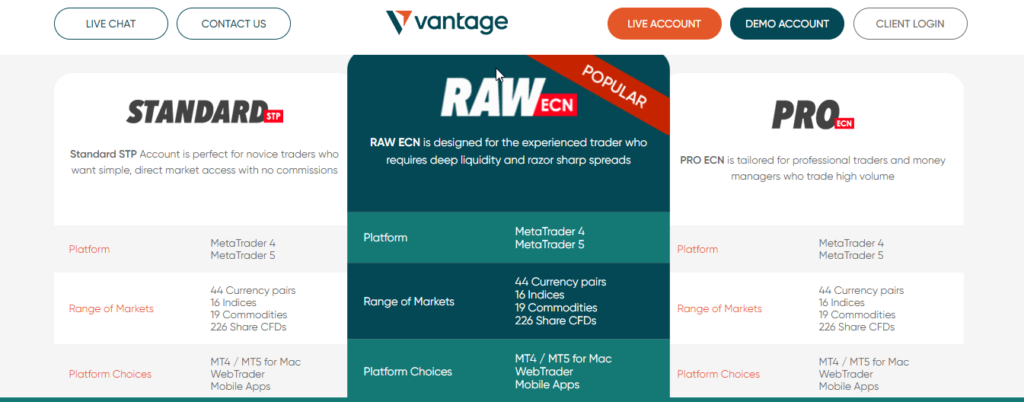

Types of trading accounts

Clients have several account types to choose from at Vantage Fx, depending on their trading objectives. Some traders prefer to incur fees on the market spread only and mitigate commissions, while others decide to trade with spreads capped at 0.0 pips. As a result, the broker offers three account types.

Standard STP account

- Platforms offered — MT4 and MT5

- Markets traded — All

- Trading platforms choices — MT4 or MT5 for Mac, WebTrader, Mobile Apps

- The min deposit is capped at — $200

- The min trade size is — 0.01 lot

- 500:1 max leverage

- Min spread starts from — 1.0 pip

- Commission — $0

- Account base currencies — 9

RAW ECN account

- Markets traded — All

- Trading platforms choices — MT4 or MT5 for Mac, WebTrader, mobile apps

- The min deposit is capped at — $500

- The min trade size is — 0.01 lot

- 500:1 max leverage

- Min spread starts from — 0.0 pips

- Commission — from $3 per lot per side

- Account base currencies — 9

PRO ECN Account

- Platforms offered — MT4 and MT5

- Markets traded — All

- Trading platform choices — MT4 or MT5 for Mac, WebTrader, mobile apps

- The min deposit is capped at — $20,000

- The min trade size is — 0.01 lot

- 500:1 max leverage

- Min spreads starts from — 0.0 pips

- Commission — from $2 per lot per side

- Account base currencies — 9

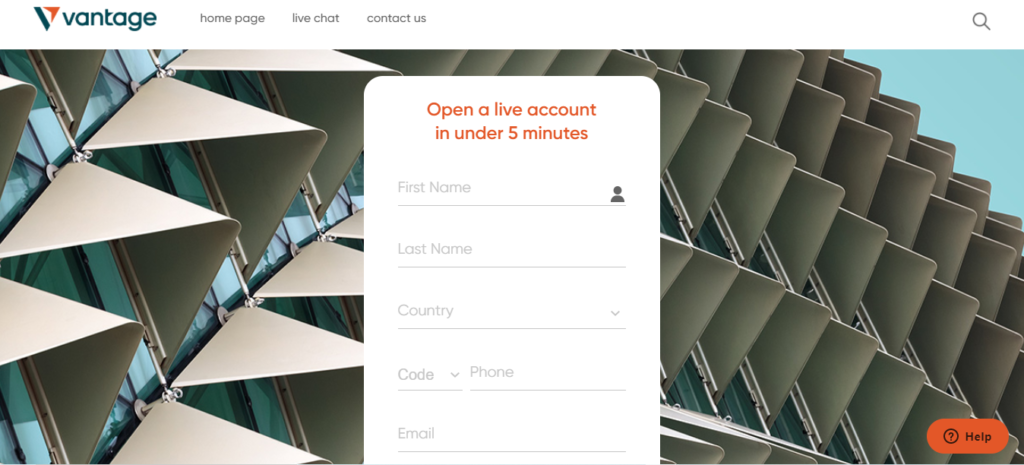

Opening an account at Vantage Fx

The account opening process is relatively fast and involves the following steps.

Step 1. Log in to their official website and click the live account button.

Step 2. Fill in your personal details and confirm whether it’s a corporate or an individual account.

Step 3. Verify the account and choose the trading account type.

Step 4. Fund the account with the required amount.

Step 5. Start trading.

Commissions and spreads

Vantage Fx operates as a No Dealing Broker, leveraging ECN technology to offer deep liquidity, low spreads, and latency. Its ECN business model is implemented on the RAW and PRO ECN accounts, where clients experience ultra-fast executions with spreads starting from 0.0 pips but face commissions up to $3 per lot per side.

However, the broker also acts as a market maker as replicated on the Standard STP account — where clients trade with spreads starting from 1 pip. Meaning, the broker adds fees on the spread for these clients.

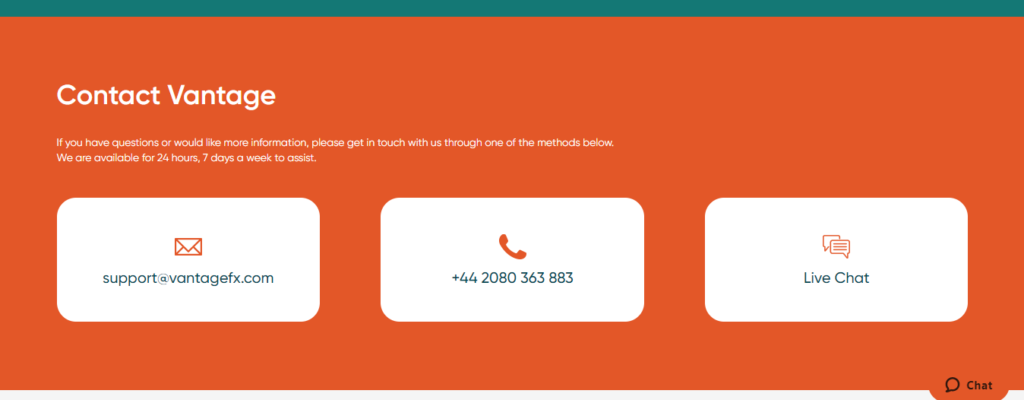

Customer service

Vantage FX claims to provide award-winning customer support in multiple languages, making it easy to serve clients worldwide. Clients can contact the support team to resolve issues through a wide range of channels like live chatting, phone calls, and emails.

Nonetheless, they also have access to a FAQ section holding resources on most relevant client issues, such as depositing funds and opening an account. Besides, the broker provides plenty of educational tools that come in handy to clients when boosting their trading skills.

Vantage Fx Review

What we liked

- Tight spreads starting from 0.0 pips

- Superior trading technology

- Deep liquidity

- Low latency with no requotes

- Segregation of funds in top-tier banks

- Easy account opening

- 24/7 multilingual expert support

- Lightening-fast executions

What we disliked

- Commissions on trading, especially for the ECN account traders

- Not regulated by top-tier agencies such as the FCA

- Fees added on the spread for the Standard STP account traders

The bottom line

Vantage Fx is a forex and CFDs brokerage company offering services to retail and institutional traders with lightning-fast executions fueled by ECN technology, meager spreads starting from 0.0 pips, and leverage of up to 500:1. Its range of markets supports about 300 tradable instruments speculated by clients backed by real-time multilingual expert support. However, the broker charges commissions on trades, and its minimum deposit is a bit high compared to other brokers.