We Like:

- Wide range of markets

- No commissions on stock CFDs

- An array of powerful trading tools

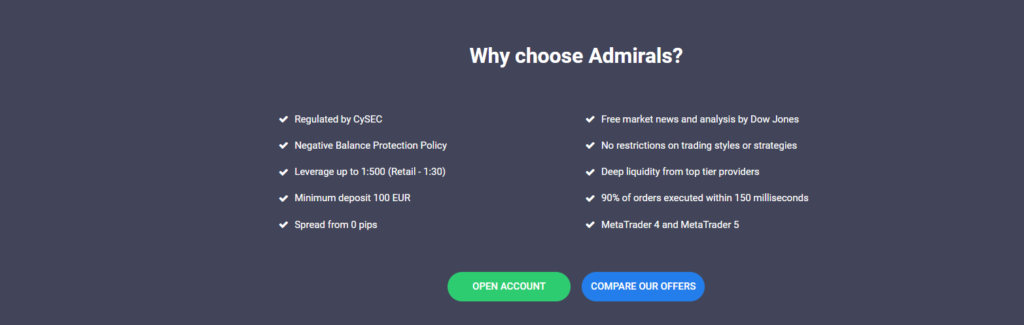

- It is a top-tier regulated broker

- Offers segregation of funds

- Provides negative balance protection to retail traders

- Offers a free demo account to novice traders

- Super-fast executions

We Don’t Like:

- Not accepted in the USA, Canada, Japan, and other regions with the same jurisdiction

- Dormant accounts face an inactivity fee capped at € 10 per month

- Charges currency conversion fees set at 0.3%

The Verdict:

Admiral Markets, founded in Tallinn, Estonia, has grown to several countries touching over 130 nations. It offers clients a wherewithal financial portfolio that allows them to trade and invest in more than 8,000 markets. The CFDs and investment financial body operate an array of offices located around the globe that collectively serve 20,000+ clients. It claims that the clients speculate its spectrum of assets with lightning-fast executions, meager spreads starting from 0.5 pips, and leverage of up to 1:500.

Each office falls under its jurisdiction, making Admiral Group limited a multi-regulated broker. It holds regulatory licenses from agencies such as the FCA, CySEC and abides by laws imposed by the MiFID II.

Company details

Founded around 20 years ago, Admiral Markets prides itself as the best CFDs brokerage company as it runs multiple offices around the globe and serves clients from 130 countries worldwide. Their clientele base is offered several investment fields, including forex, indices, stocks, bonds, ETFs, and commodities.

The initial startup was in Kesklinn, Estonia, where EFSA has regulated it. It has created a vast international reputation while also gaining recognition as the best forex company in Estonia. It has had a partnership with Trading Central, Acuity, and Dow Jones & Company recently.

Admiral Markets include:

- Stocks — 3000+ share CFDs as well as a variety of shares

- Commodities — metals, energies, and agricultural commodities

- ETFs, that is over 300 ETF CFDs

- Bonds, including US Treasuries and Germany Bund CFDs

- Forex — 47 CFDs on currency pairs

- Indices

Traders are advised to seek leverage which is 1:100. They can otherwise invest without leverage if they have access to around 100,000 deposit in their account.

Integrated trading tools at Admiral Markets include:

- Advanced financial chart comparison tools

- Different languages on the platform

- Research-backed analysis

- Premium analytics

With huge targets to grasp new customers, Admiral offers its new traders a free demo account to fully understand all about CFDs while also at the same time gaining more excellent knowledge and how to navigate this market that is new to them.

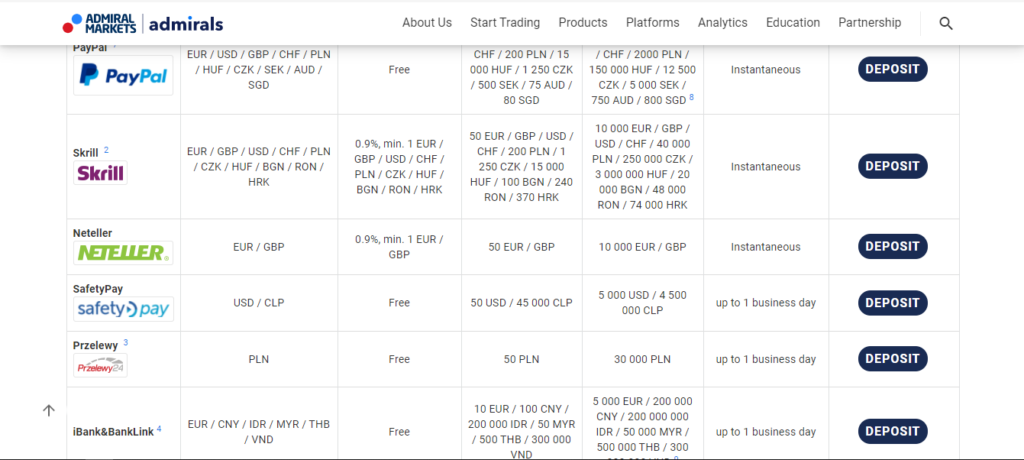

Available payment options

- Bank wire transfers

- E-wallets like NE teller and Skrill and PayPal

- Credit/Debit cards like Visa and MasterCard

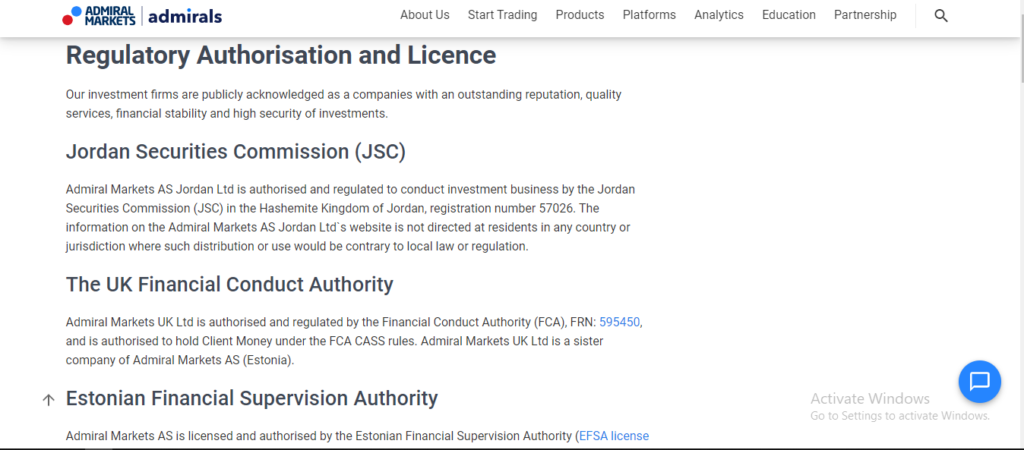

Regulations

The broker is regulated by the individual countries as well as the European Union in some cases:

- FCA in the UK

- EFSA in Estonia

- CySEC in Cyprus

- JSC in Jordan

- MiFID II in Europe

- AFSL in Australia

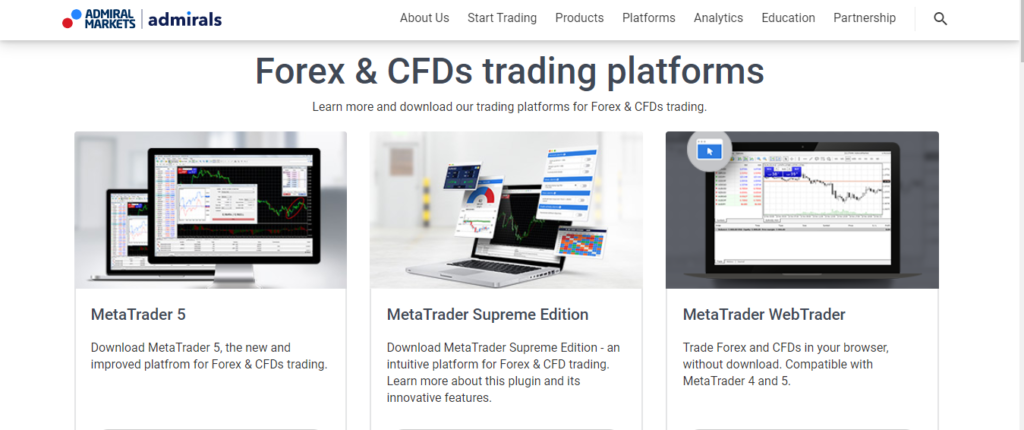

Trading platforms

Admiral Markets has a variety of choices in case the customer wants to have a self-suited platform. The platforms include MT4, MT5, MT Web Trader, and Trading App.

MetaTrader 4

- User friendly

- Flexible

- Secure

- Multi-language support

- Automated trading

- Customizable

- Advanced charting capabilities

MetaTrader 5

- Thousands of markets

- Easy to use

- Superior charting

- Free market data and news

- Trading robots

- Level II pricing

- VPS support

MetaTrader Web Trader

- No installation

- Use PC or Mac

- Trade-in browser

Trading app

- Allows trading of most popular instruments

- Convenient and live trading demo

- Monitoring account and market

- Managing and protecting your position

- User friendly

- Flexible secure

Range of markets

Admiral Markets have a variety of trading markets available for clients.

Forex

It allows you to trade a different array of currencies on the platform. Which mostly are known and include USD, GBP, JPY, etc.

Commodities

The commodities are available for trade through the CFDs where a given one such as silver or gold can be traded and oil and natural gas.

Indices

Admiral Markets has various offers for new clientele regarding stocks and movements around the market. These stocks can be utilized to seek gains and a share of the market by the client. The available index CFDs on the platform include but are not limited to; DJI30, FTSE100 as well as DAX30.

Stocks

Customers can trade the world’s best-known blue chips via bond CFDs, long or short, with no additional costs incurred for short positions. Classic shares and stock CFDs are available. Retail clients can go for leverages of up to 1:5, professional clients of up to 1:20 maximum.

ETFs

Whereas ETFs can be traded without leverage and margin, ETF CFDs allow for a leverage of 1:5 (for retail clients) and 1:20 (professional clients). They are another tradable instrument that customers of Admiral Markets can trade with low commissions starting from as little as $0.01. As with stock trading, customers can also enjoy the dividends of stock companies here.

Bonds

The clients can trade bonds with leverage up to 1:10 (for professional accounts up to 1:200, both short and long). Trading is also possible from €100.

Cryptocurrencies

The broker offers the option of trading CFDs on cryptocurrencies such as Bitcoin, Litecoin, Ethereum, etc. Customers can thus bet on the falling or rising prices of the crypto CFDs without needing to hold any of the real cryptocurrencies themselves.

Main features

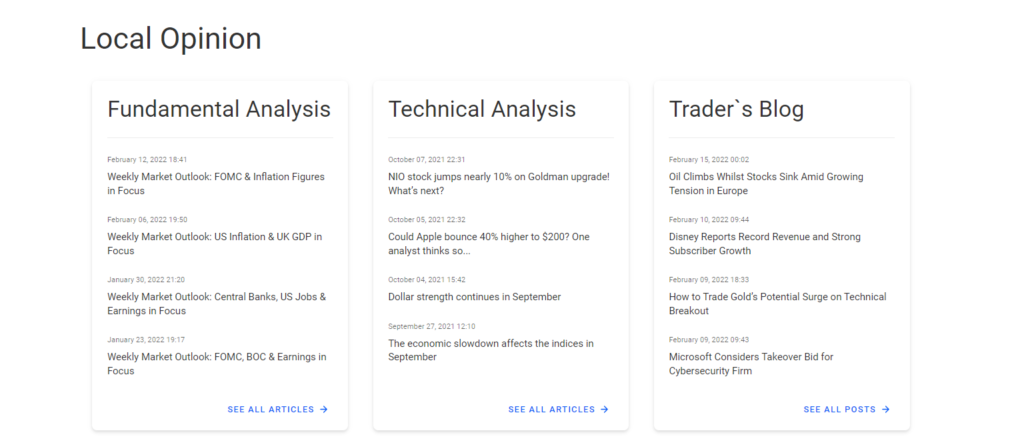

There are multiple webinars online covering CFDs and forex 101 lessons on the broker’s platform. Admiral Markets also releases educational books in multiple languages and demos analytical tools.

Additionally, traders get access to analytics, Dow Jones news, acuity trading. These tools are designed to educate market participants on investing strategies and judging market sentiment.

The broker has rolled out a modern copy trading service. The new tool offers a straightforward way to generate additional income for proven investors, with subscribers paying ongoing fees. The innovative solution lets clients copy the strategies and positions of established traders. A leaderboard and slick dashboard are available in the members’ area to manage activity.

Types of trading accounts

The broker offers several account types to fit the needs of both inexperienced retail traders and highly skilled professionals. The pricing is nearly the same across all accounts, with minimum spreads ranging from 0.0 to 0.5 pips.

Demo account

It gives a good head-start, helping market participants to find their way around and familiarize themselves with the software. A variety of instruments, including FX and CFDs on indices and shares, are available here.

Standard MT4 account

It ranks as the most popular option among clients of the brokerage firm. You can register with a minimum investment of $100 only, choosing from various base currencies, including EUR, USD, GBP, etc. Trading instruments include 37 currency pairs, five cryptocurrency CFDs, four CFDs for spot metals, three CFDs for spot energy markets, and 63 CFDs for stocks. Other instruments you can trade with include index futures, bonds, and cash indices.

Prime MT4 account

It offers the same base currencies as the standard account but comes with a greater variety of markets, with customers choosing from as many as 45 FX pairs. The account also supports CFD trading on spot energy, cash indices, and spot metals.

Admiral MT5 account

You can open it with a minimum deposit of $100 or the currency equivalent. The base balance currencies are the same as those offered for the two MT4 accounts. As for the trading instruments, there are more than 3,700 of those here, including 37 FX and tons of stock CFDs.

Invest account

It comes with an impressive portfolio of more than 4,350 stocks and up to 500 ETFs. One major difference here is that the account supports the exchange execution format for your trades.

Islamic account

Admiral Markets recently added a new offering to its portfolio geared to the needs of customers who uphold the Muslim faith.

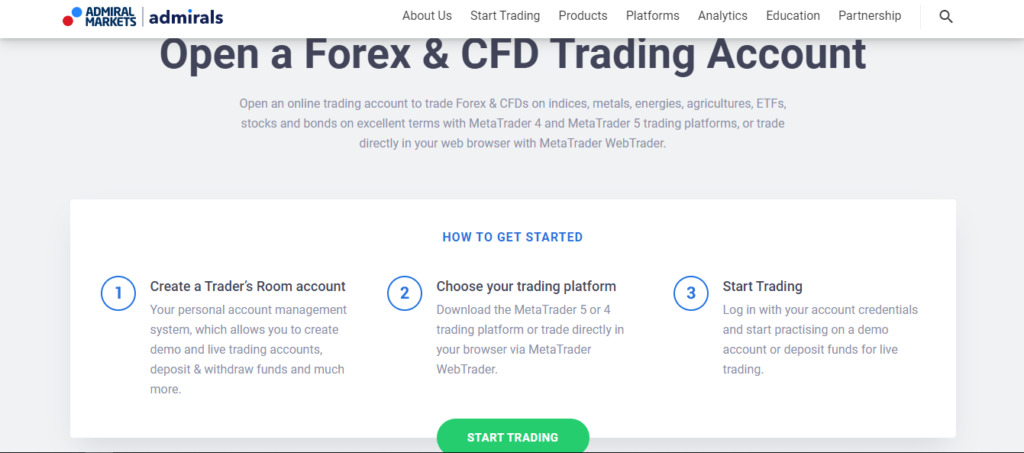

Opening an account at Admiral Markets

Step 1. Get into the website link https://admiralmarkets.com

Step 2. Select Start trading on the site

Step 3. Create a trader’s room account

Step 4. Choose the trading platform

Step 5. Start trading

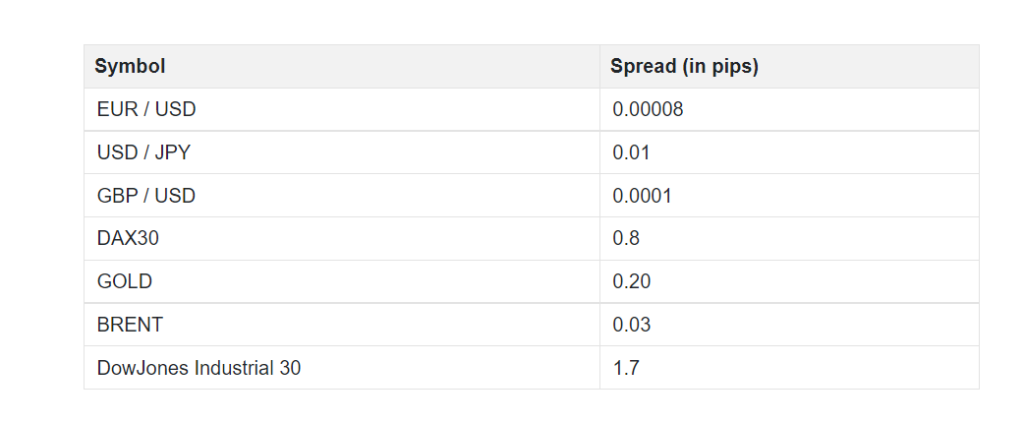

Commissions and spreads

Commissions

Forex & metals: from USD 1.80 to 3.00 per lot

Cash indexes: from USD 0.05 to 3.00 per lot

Spot energies: USD 1 per lot

Spreads

From 0 pips

Customer service

The broker services clients from a huge number of countries. The broker supports a versatile range of languages to better cater to their needs.

Assistance and information are available via a convenient live chat, serviced by a team of professionals who are always quick to get back to customers. You can also use the feedback form to ask questions, report issues, or suggest how Admiral Markets can improve its services and website.

- Email: [email protected]

- Support number: +442035041364

- Live chat: logo found at the bottom of the broker’s website

Admiral Markets Review

What we liked

- Minimum deposit of €1.

- Regulated and under check by individual countries based in.

- Powerful trading capabilities with a free range of tools.

What we disliked

- There have been cases of multiple brokerage accounts under its name, and they have constantly denied it.

- Commissions on CFDs.

- Lack of social trading.

- Rollover deposit and currency conversion fees.

The bottom line

Admiral Markets is regulated by individual countries that are the financial regulators. It has looked to grow globally and has gained ground in over 130 countries. It has gained multiple customers in the same sense as well it has increased their financial base from their investment. There is greater leverage offered of 1:100 where clients can make their investment. The market spread offered by the broker is 0.5 pips to the clients.

The downside of it is the constant cases and controversies against them. For instance, the Estonian regulator EFSA fined them for not working within its agreed standards as required.