- US services PMI data for June 2021 declined to 64.8 from a previous reading of 70.4.

- Stockpiles of crude oil declined by 7.614 million barrels from a previous reading of -7.355 million.

- Australia’s retail turnover for May 2021 rose 0.1% (MoM).

The AUD/USD pair gained 0.46% on June 23, 2021, from the previous day. It moved from a low of 0.7538 to a high of 0.7599. The US dollar lost against the Aussie after services PMI data for June 2021 declined to 64.8 from a previous reading of 70.4. It failed to beat consensus estimates at 70.0. Manufacturing PMI data surged 62.6 from a previous record of 62.1, but it failed to uplift the dollar against the Aussie. The index for composite output also fell to a 2-month low at 63.9 in June 2021 (MoM) from a high of 68.7.

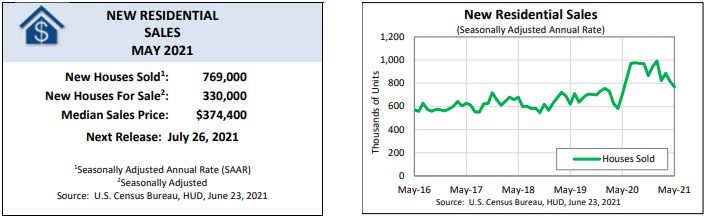

Low home sales

There was a decline in the number of new houses sold in the US at 769,000 (seasonally-adjusted annual rate) from a previous record of 817,000. The number failed to beat consensus estimates at 870,000. The median selling price of the single-family units was $374,400, with the average price at $330,000.

US home sales

Monthly estimates show that the house sale declined 5.9% for May 2021 from a previous reading of -7.8% in April 2021.

Oil inventories

Stockpiles of crude oil declined by 7.614 million barrels from a previous reading of -7.355 million barrels. The decrease exceeded consensus estimates at -3.942 million barrels signifying a positive change for the dollar due to increased transport and manufacturing activity. However, imports of crude oil rose to 0.430 million barrels against a previous decline of 0.845 million barrels.

Crude Oil Prices

WTI crude gained 0.49% at $73.21 per barrel, while Brent crude stood at $75.34 per barrel. Gasoline also surged 1.71% to sell at $2.262 per barrel. An increase in crude oil imports into the US will work against the dollar, especially when prices are high. Inventories of heating oil also increased to 0.199 million barrels from a decline of 0.518 million barrels. The amount of gasoline produced also reduced to 0.401 million barrels from a previous supply of 0.495 million barrels.

Australia’s retail turnover

Australia’s retail turnover for May 2021 rose 0.1% (MoM) after the previous month recorded an increase of 1.1%.

Australia’s retail turnover (May 2019-May 2021)

On a seasonal-adjusted basis, the turnover stood at A$31,069.3 from April’s A$31,028.2. Food retailing increased the retail turnover at 1.5% but was offset by a decline in household goods at -1.0%, while clothing and personal accessories stood at -1.5%.

Employment numbers have risen in Australia with the advanced deployment of digital technology. May 2021 saw an additional 115,200 personnel added to the payroll bringing the entire workforce to 13.12 million. The data beat forecasts that had predicted a 30,000 increase across different states.

In the State of Victoria, Covid-19 restrictions lowered retail turnovers by 1.5%, but food retailing withstood the pressure to inch up 4.0% due to high supermarket sales. Out of the 910 deaths recorded in Australia, about 810 emanate from Victoria, with 54 from New South Wales (NSW). As of June 23, 2021, the total coronavirus cases stood at 30,378, with new cases at 12. Approximately 1.09 million people have been fully vaccinated in Australia out of the 6.72 million doses issued (representing 4.3% of the population).

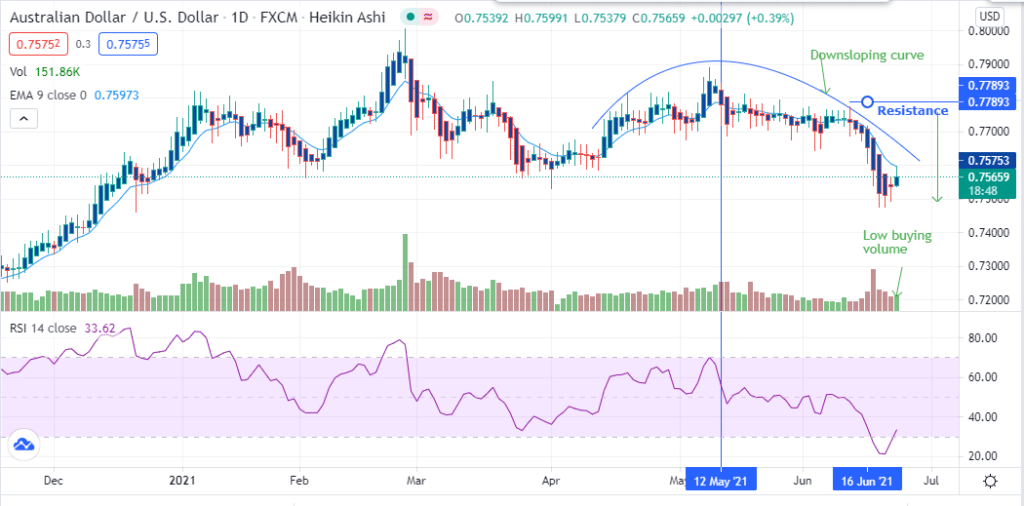

Technical analysis

The AUD/USD pair formed a sloping curve with the steady downtrend visible from May 12, 2021. The pair met resistance at 0.7789.

There is low buying volume, and the 14-day RSI is close to the oversold region at 33.62. We may see the price holding on at the 0.7575 level or continue to drop further as selling action takes shape.