- Australia’s Federal Treasurer insisted that the country needs to stick to the reopening guidelines to avert a further economic meltdown.

- The US trade deficit for July 2021 decreased by $86.38 billion from an earlier record of 92.05 billion in June 2021.

- The US dollar was negatively impacted by the 0.3% increase in personal consumption expenditures (PCE) at $42.2 billion that was lower than the one in June 2021.

- The AUDUSD pair added 1.08% as of August 27, 2021, closing at 0.7312. It opened at 0.7234 and hit a high of 0.7317, representing a 1.15% increase throughout the trading day. Over the week, the pair has added 2.50% showing a strengthening aussie despite the lockdown.

Reopening promise

Australia’s Federal Treasurer, Josh Frydenberg, has insisted that the country needs to stick to the reopening guidelines after completing weeks of lockdowns. Territorial and state governments in the country ratified a roadmap in July 2021 that agreed to reopen the country after vaccinating 70% of the population against Covid-19.

Australia’s vaccination rate as of August 27, 2021, reached 26.6%, with 6.76 million people fully vaccinated out of a total dosage of 18.4 million. The low vaccination rate saw up to 1,120 new cases by August 28, 2021, with a 7-day average of 974.

Nine hundred ninety-three deaths were recorded in Australia, the cities of Victoria and New South Wales (NSW) lead with 820 and 143 respectively.

The economy seems to have recovered from a 2.7% retail sales decline in July 2021 (MoM). Analysts had predicted a decline of 2.3% into the month after the sales had decreased 1.8% in June 2021.

US income and trade outlays

The US trade deficit for July 2021 decreased by $86.38 billion from an earlier record of 92.05 billion in June 2021.

The US recorded a 1.1% increase in personal income in July 2021 (MoM), representing $225.9 billion from 0.2% in June 2021. Records released by the Bureau of Economic Analysis (BEA) showed that disposable personal income (DPI) soared 1.1% ($198 billion).

However, the US dollar was negatively impacted by the 0.3% increase in personal consumption expenditures (PCE) at $42.2 billion. It was lower than the 1.1% surge recorded in June 2021 but still met analysts’ estimates at 0.3%.

The core PCE price index for July 2021 (MoM) also increased 0.3%, showing a slight decrease from the earlier record of 0.5% in June 2021.

Real personal consumption (RPC) for July 2021 (MoM) also declined 0.1% after it had inched up 0.5% in the previous month.

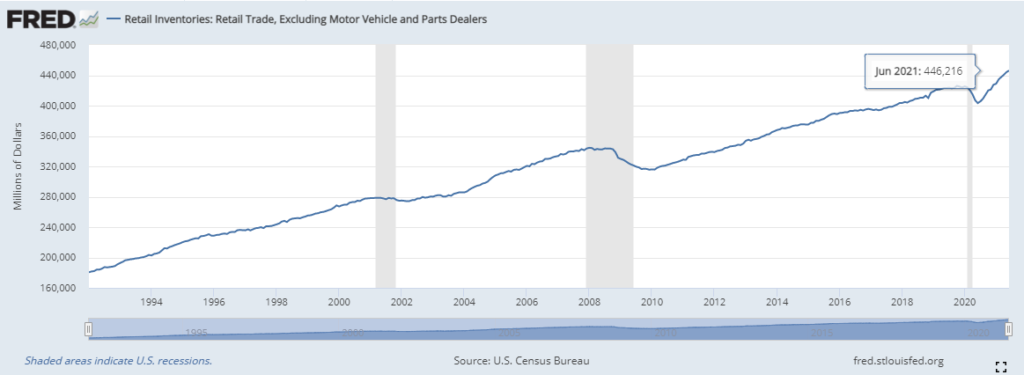

The lower record of retail inventories (in exclusion of motor vehicles) also hurt the dollar after recording a 0.5% increase in July 2021 from a gain of 0.8% in June 2021.

Retail inventories soared 0.8% in June 2021, representing an increase of $446.216 billion.

Wholesale inventories for July 2021 also surged 0.6% (MoM) but were lower than the 1.1% increase recorded in June 2021.

Investors were pessimistic after Fed Chair Powell reiterated that tapering of the $120 monthly purchases did not translate to an increase in interest rates. Powell was, however, upbeat that significant progress had been made towards achieving maximum employment in the US.

Technical analysis

The AUDUSD rebounded after falling to 0.71041 as Australia’s Federal Treasurer reiterated the need to reopen the economy according to schedule. The pair is staying above the 9-day EMA at 0.72534, indicating the possible bullish continuation. It may hit a high of 0.74078 if the aussie maintains the upside.

There is a slight increase in buying momentum with the 14-day RSI reaching 43.35. Volatility has also increased to 0.00780, showing the pair is ready for a significant move.

A move below the support level may push prices lower towards 0.69814.