If you’re interested in investing in Asian economies, Taiwan could be one of the best options. Favorable economic reforms and close trade relationships with China made Taiwan one of the most successful economies over the past decades. The country’s economic success speaks for itself – Taiwan is the 20th in the world in terms of purchasing power parity (PPP), making the country a magnet for international investors.

MSCI Taiwan Index can help you get exposure to Taiwan. You can invest in the Index either through ETF or CFD.

Taiwanese economy – pros and cons

Electronics is the competitive edge of Taiwan. The industry has been successfully developing since the 1960s, driving the newly industrialized economy, which consists of small and medium-sized businesses, promoting healthy economic competition.

The country’s economic stability also comes from low unemployment, maintaining inflation under control, significant trade surplus, and foreign reserves. Another strength of the Taiwanese economy is diversified trade exposure. The country moved from 49% of its exports to the US in 1984 to 20% in 2002, shifting more of its exports to China, Southeast Asia, and Europe.

The risks of investing in Taiwan include dependency on China’s economic growth and China-related geopolitical risks. However, the People’s Republic of China hasn’t pursued “taking back” Taiwan since 1992.

How may Taiwan benefit from the recent global chip boom?

The US imposed sanctions on China’s biggest semiconductor maker, SMIC that led to the decrease of chip supply for the biggest electronics producers. As China’s economy recovered faster than expected after the pandemic, the car sales took off, so the demand for automotive chips from automakers.

The semiconductor industry in Taiwan revolves around Taiwan Semiconductor Manufacturing Co. (TSMC), which produces chips for tech leaders like Apple, Google, and Qualcomm. Due to the overwhelming demand for chips, the car manufacturers even requested TSMC to increase the supply of car chips to the detriment of other kinds of chips, agreeing on higher prices.

TSMC constitutes 48.54% of the MSCI Taiwan Index market capitalization. If you invest in the broad market index, you’re essentially investing in TSMC while still staying diversified in other companies, although concentrated in the Information Technology sector (76.31%).

The technical picture of Taiwan’s instruments

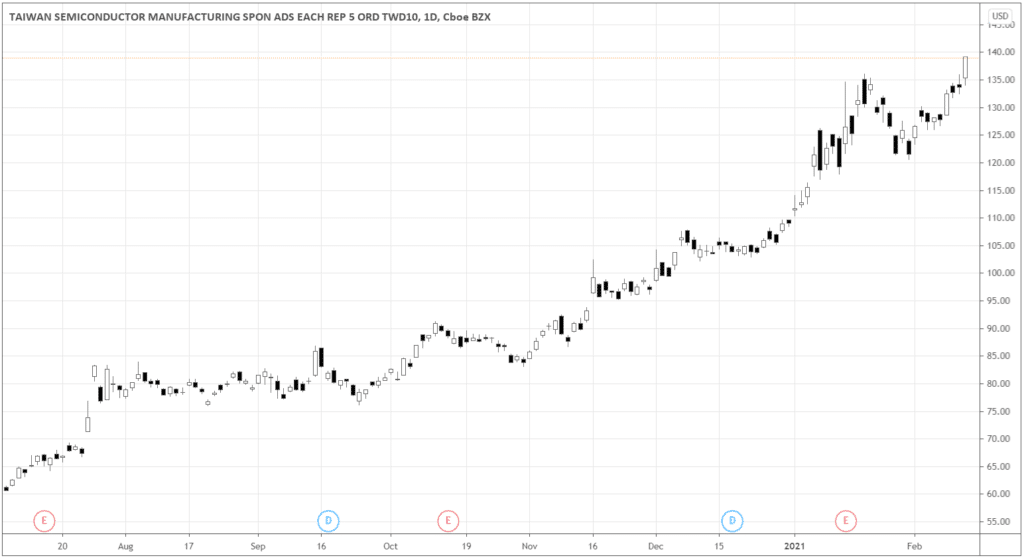

Now let’s look at what the actual prices are telling us. Below is the Daily chart of TSMC. It’s been in a powerful trend since 2020, which drives the stock market index higher.

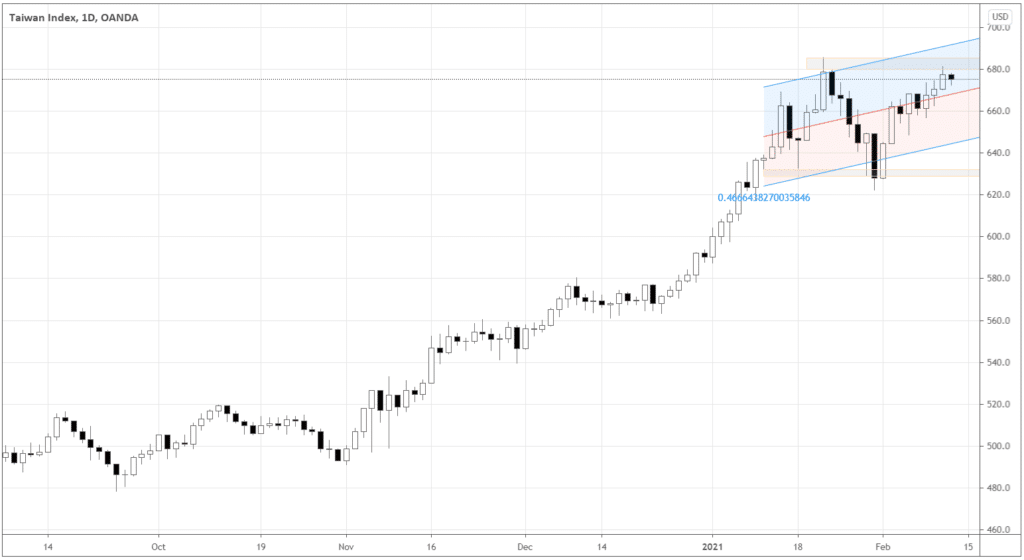

In the following chart, we have MSCI Taiwan Index. Notice that the TSMC stock price outstrips the Index making new all-time highs, while the Index is still approaching its ATH. Investing in the actual TSMC shares may bring more rapid price growth. However, Index has benefits of diversification, which means milder corrections.

The Index has formed the support area around 630 and the resistance near 680. I plotted the regression channel (blue and red areas) from the beginning of the correction.

Two standard deviations don’t extend until the support area. Therefore the likelihood of the market returning to the support is very low. If you still want to wait until the market pulls back, a reasonable price area to buy would be closer to the middle of the regression channel with the stop loss below 630. Otherwise, buying the breakout of 680 with the stop loss under the breakout day’s low could be a reasonable option.

The relative strength of the MSCI Taiwan Index

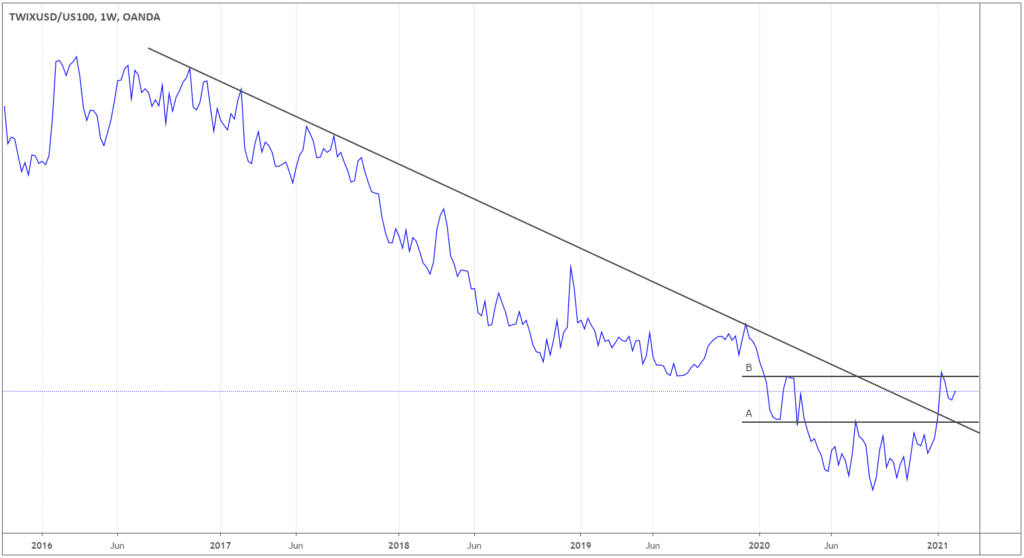

Let’s compare the strength of the MSCI Taiwan Index with the technology benchmark – NASDAQ-100. Below is the chart of the ratio of the Taiwan Index versus NASDAQ.

The ratio moved above the upper consolidation boundary “A” and pierced one of the trend’s significant lower highs, closing above the long-term trendline. The price action suggests the shift in the relative strength from NASDAQ to Taiwan’s Index.

Conclusion

The robust Taiwan economy and the current chip boom provide a unique investment opportunity. The price action confirms the fundamentals showing the distinct advantage of investing in Taiwan over the US tech companies.