Triangles formed by drawing two converging trend lines. Each trend lines consist at least two or more price points; thus, upper trend line requires, at least, two or more high points in price and lower trend line require at least two or more points in price.

There are three different types of triangles differentiated by the slope of their trend lines. These are,

- Symmetrical Triangle

- Ascending Triangle and

- Descending Triangle

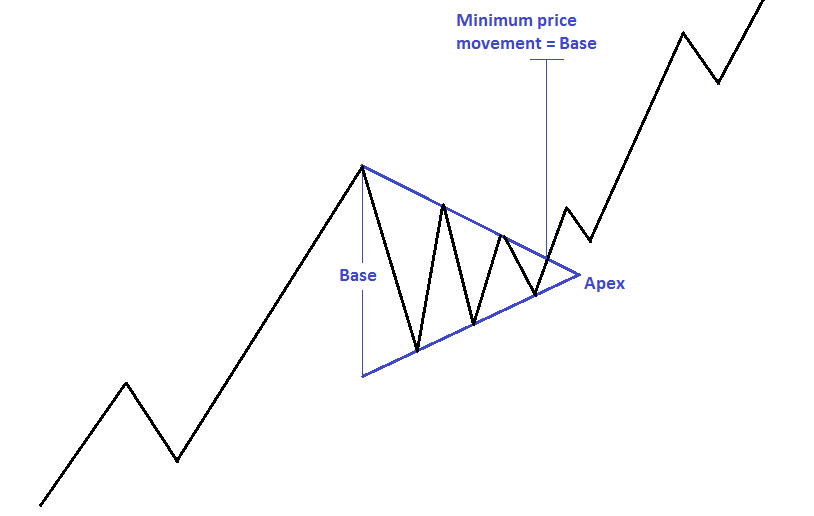

Symmetrical Triangle:

In a symmetrical triangle, the upper trend line is downward sloping, and the lower trend line is upward sloping at the same angle. The joining or meeting point of these two trend lines called “Apex” and “Base” is the distance from the first high point and first low point.

This pattern is bullish in an uptrend as it shows the high possibility of the continuation of the prevailing uptrend. Inversely, in a downtrend, this pattern indicates a high possibility of continuation of the downtrend. The possible price movement can be measured by the height of the base.

Minimum price movement from the point of breakout is equaled to the height of the base.

In many cases, after a breakout price tends to come near the broken trend line and then bounce back to the prevailing trend again. This scenario is a pullback. Pullbacks are highly profitable.

In the picture above, we can see the picture of a symmetrical triangle.

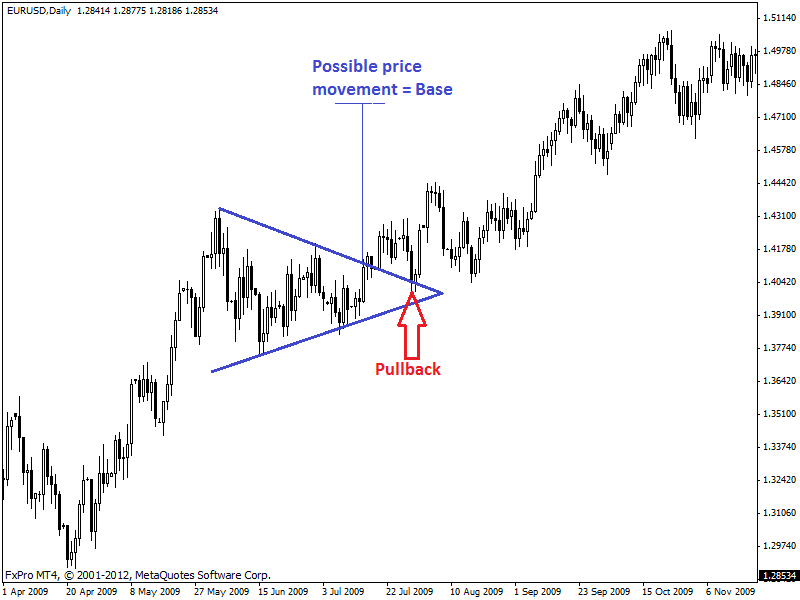

Now let’s take a look at the example in the technical chart of a currency pair.

In the chart of daily EUR/USD given above, we can see an example of the symmetrical triangle and its pullback in an uptrend.

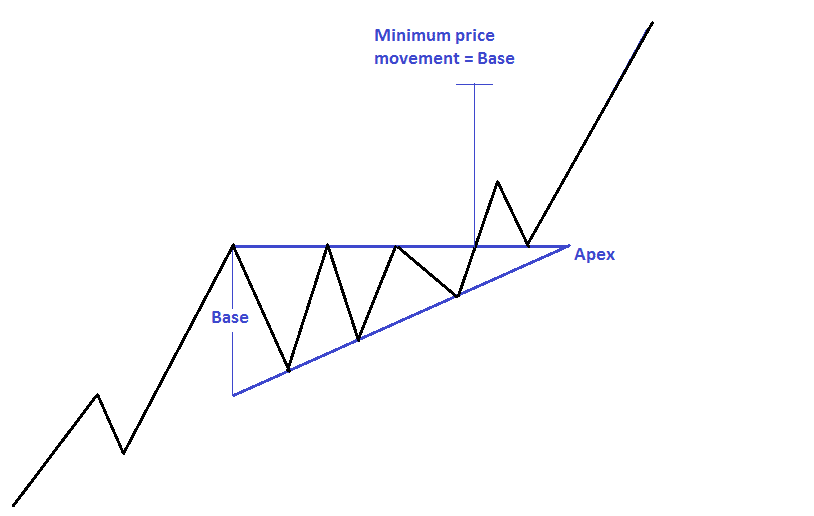

Ascending Triangle:

In ascending triangle, upper trend line should be horizontal (like horizontal resistance line), and lower trend line should be upward sloping. The horizontal upper trend line of this pattern indicates a resistance which is stopping the price from going further but the upward sloping lower trend line tells us about the presence of an uptrend.

Ascending triangle patterns are bullish patterns normally found in an uptrend. Like, symmetrical triangle, it has an apex point and a base and the minimum price movement equal to the height of base from the breakout point as shown in the picture below.

Breakouts and pullbacks of this pattern are particularly effective and profitable.

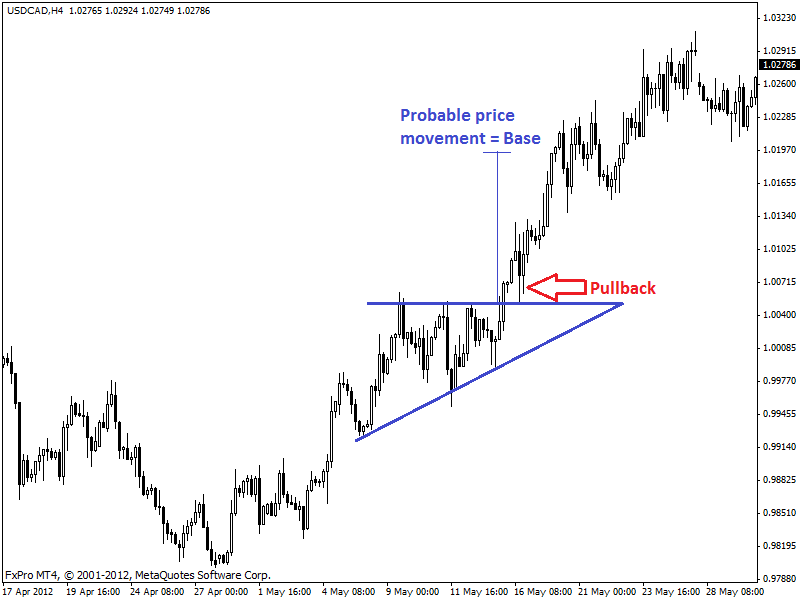

Now let’s see how this pattern looks like in a technical chart.

In the 4 hour chart of USD/CAD above, we can see an ascending triangle pattern, and it is a pullback.

Descending Triangle:

The descending triangle is opposite to the ascending triangle. In descending triangle, lower trend line should be horizontal (like horizontal resistance line) and upper trend line should be downward sloping. The horizontal lower trend line of this pattern indicates a support line.

This support line is stopping the price from going further down, but the upward sloping lower trend line tells us about the presence of a downtrend.

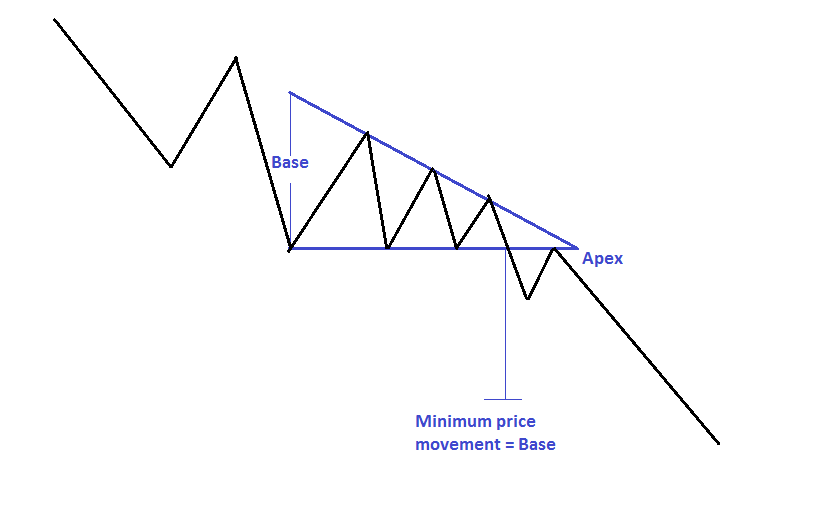

Descending triangle patterns are bearish patterns normally found in a downtrend. Like, symmetrical triangle, it has an apex point and a base and the minimum price movement equal to the height of base from the breakout point as shown in the picture below.

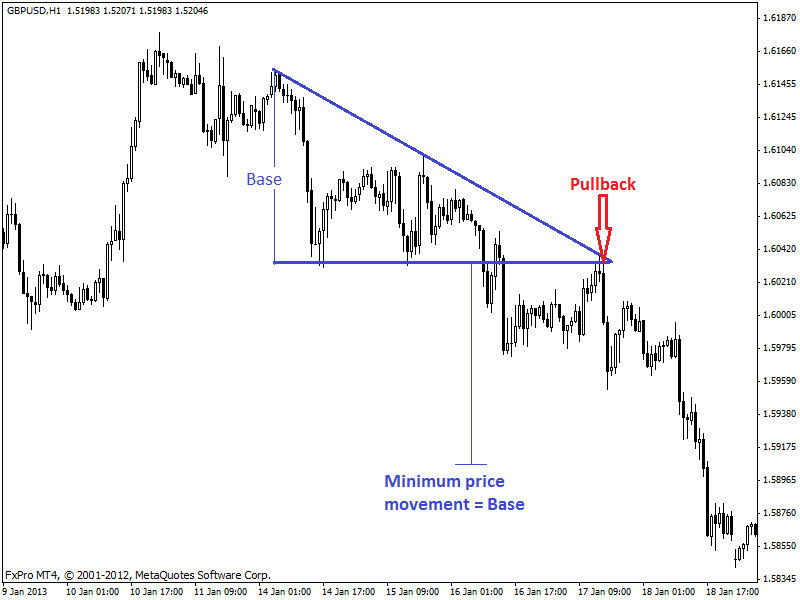

Now let’s see how this pattern looks like in a technical chart.

In 1 hour chart of USD/CAD above, we can see a descending triangle pattern and its pullback which pushed the price downward.