Double top and double bottom are simple, profitable and classic chart patterns. They are reversal patterns.

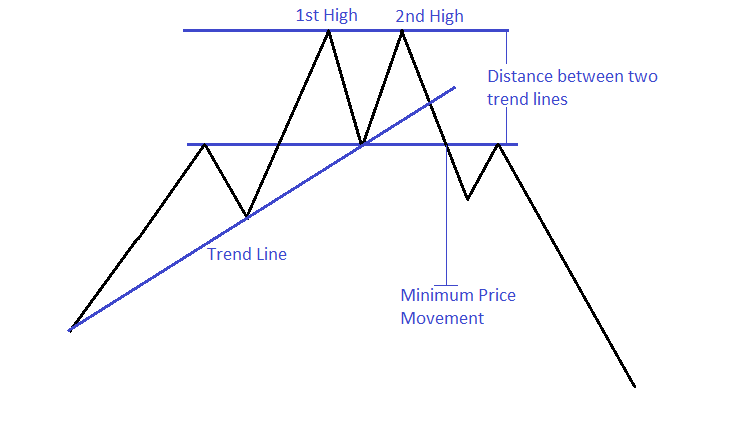

Double Top Chart Pattern :

In a double top pattern; the upper trend line consists two similar or nearly similar high points and the lower trend line consist a low point. This low point of lower trend line lies between two high points that joined to draw the upper trend line.

This pattern often called “M-pattern” as it looks like English letter “M”.

Trend line breakouts, uptrend line breakout and pullbacks of this pattern are very effective sell signal which is an entry signal to take a short position. Minimum possible price movement after breakout equals to the distance between two horizontal trend lines. Here is an example.

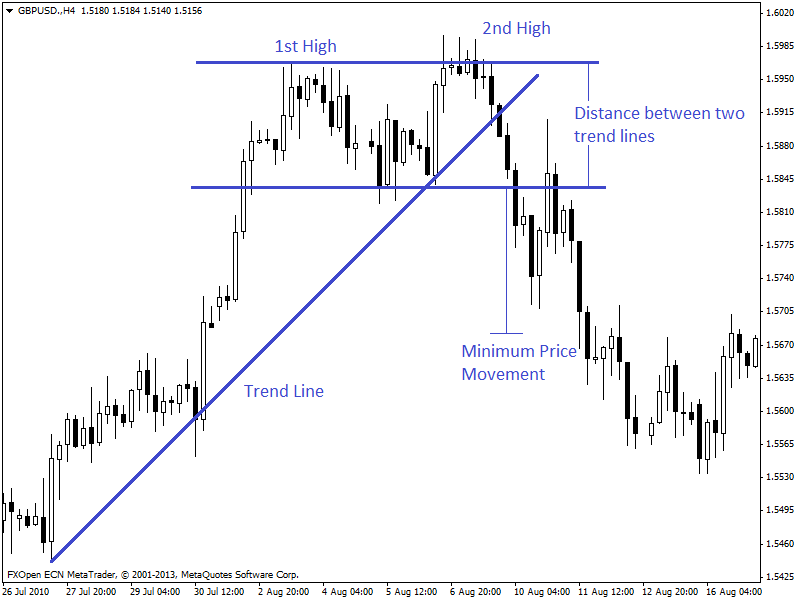

In the 4 hour chart of GBP/USD (given below), we can see a double top pattern has formed. As a double top pattern formed, it has broken the upward trend line first which is a sell signal. Then it is another sell signal as it moves below the trend line.

After this breakout price came back near the broken horizontal trend line (support line also). And then bounced back downtrend again which is a pullback and another profitable sell signal.

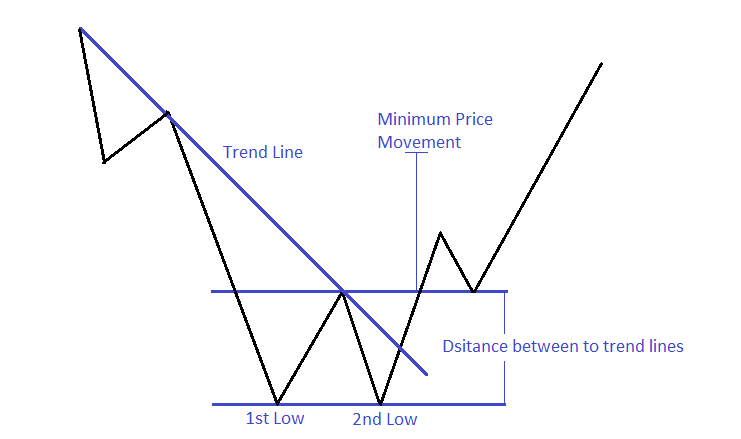

Double Bottom Chart Pattern :

In double bottom chart pattern; the lower trend line consists two similar or nearly similar low points, and the upper trend line consists a high point. This high point of upper trend line lies between two low points. These two points joined together to draw a trend line. This pattern often called “W-pattern” as it looks like English letter “W”.

Trend line breakouts, uptrend line breakout, and pullbacks are very effective entry signal for a short position. Minimum possible price movement after breakout equals to the distance between two horizontal trend lines. Here is an example.

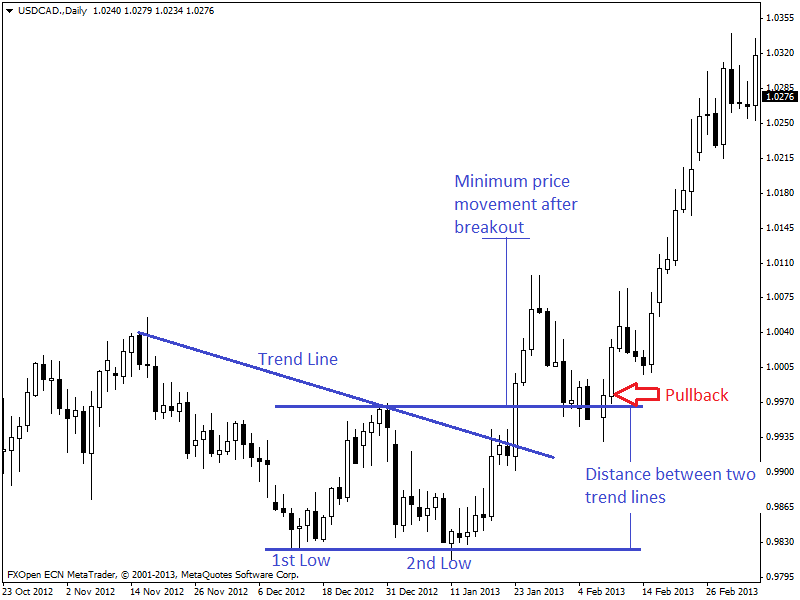

In the chart of daily USD/CAD (given below), we can see a double bottom pattern has formed. It has broken the downward trend line first which is a buy signal. Then it has broken the upper horizontal trend line (resistance line) which is a delayed but another buy signal.

Then price came back near the broken horizontal trend line (resistance line) and then bounced back to uptrend again; which is a pullback and another profitable buy signal.