The head and shoulders pattern is a very famous and profitable chart pattern. Head and shoulders pattern is a complex pattern as it contains three distinct characteristics in one pattern.

These characteristics are trend lines, support or resistance lines, and rounding.

Head and shoulders pattern can be divided into two types;

1. Head and Shoulders/Head and Shoulders Top and

2. Inverse Head and Shoulders/Head and Shoulders Bottom

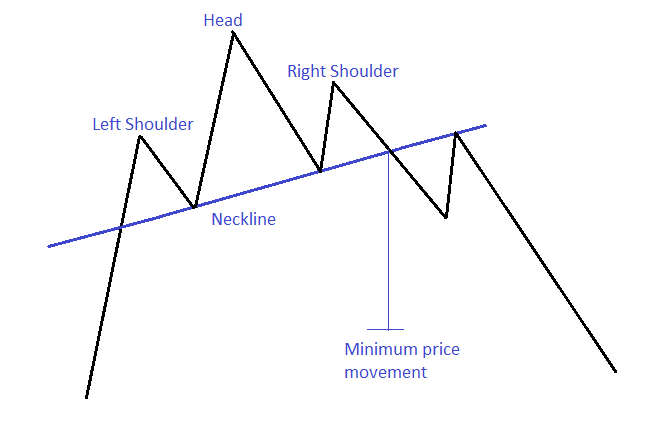

Head and shoulders/head and shoulders top is a reversal pattern found at the top of trend, and it detects trend reversals from uptrend to downtrend. It contains three peaks; left shoulder, head, and right shoulder. The head is the highest peak among them.

There is a neckline connecting the low points of the left and right shoulder. Minimum possible price movement equals to the distance from head to the neckline of the pattern. A classic head and shoulder pattern looks like as showed in the picture below.

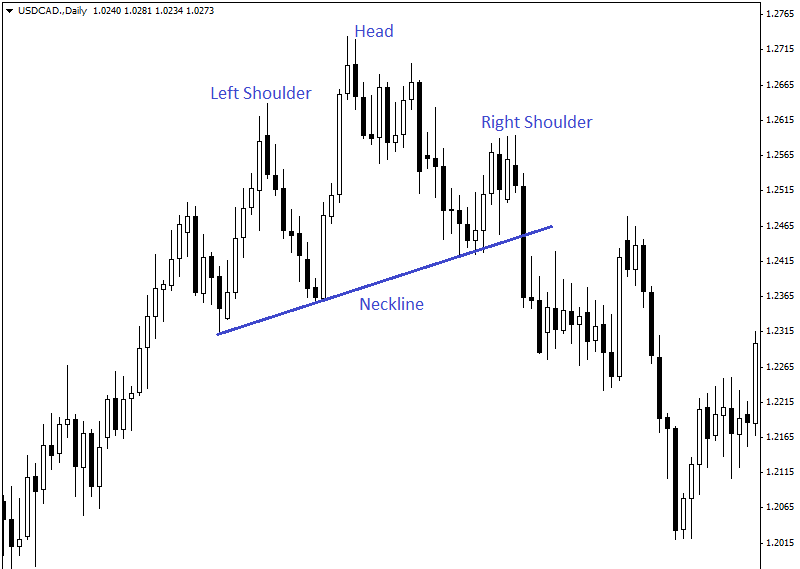

Here is another example of head and shoulders pattern in the daily chart of USD/CAD which has given below,

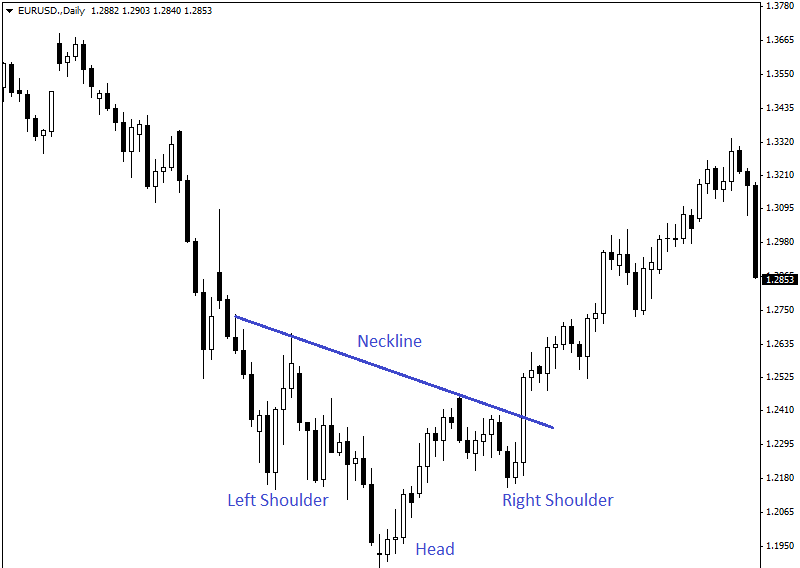

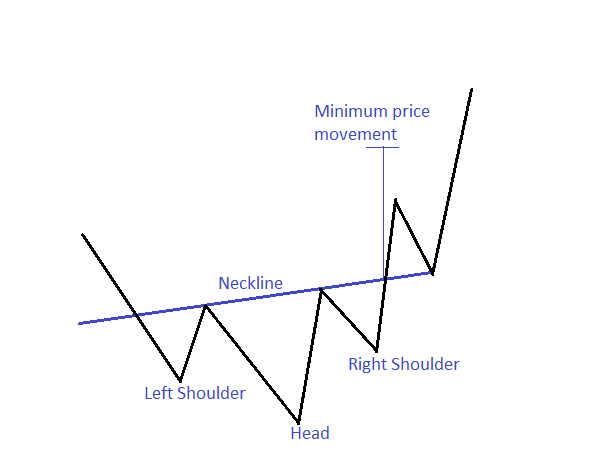

The inverse head and shoulders/head and shoulders bottom pattern are the exact opposite to the head and shoulders top pattern. This pattern consists of three low points; left shoulder, head, and right shoulder. The head is the lowest point among these three low points.

Minimum possible price movement equals to the distance between head and neckline. Here is an example of an ideal head and shoulders bottom.

Here is another example of head and shoulders bottom/inverse head and shoulders pattern in the daily chart of EUR/USD.