The chart pattern is the reflection of investors/traders psychology that appears in a bounded area. Charts patterns are identified by drawing trend lines and vertical support-resistance lines.

We can figure out the future possible price hikes by identifying chart patterns.

One of the basic assumptions of technical analysis is, “History tends to repeat itself”. This reflection of history in the present and the future does not occur in exact price or time, but it repeats in the form of chart patterns.

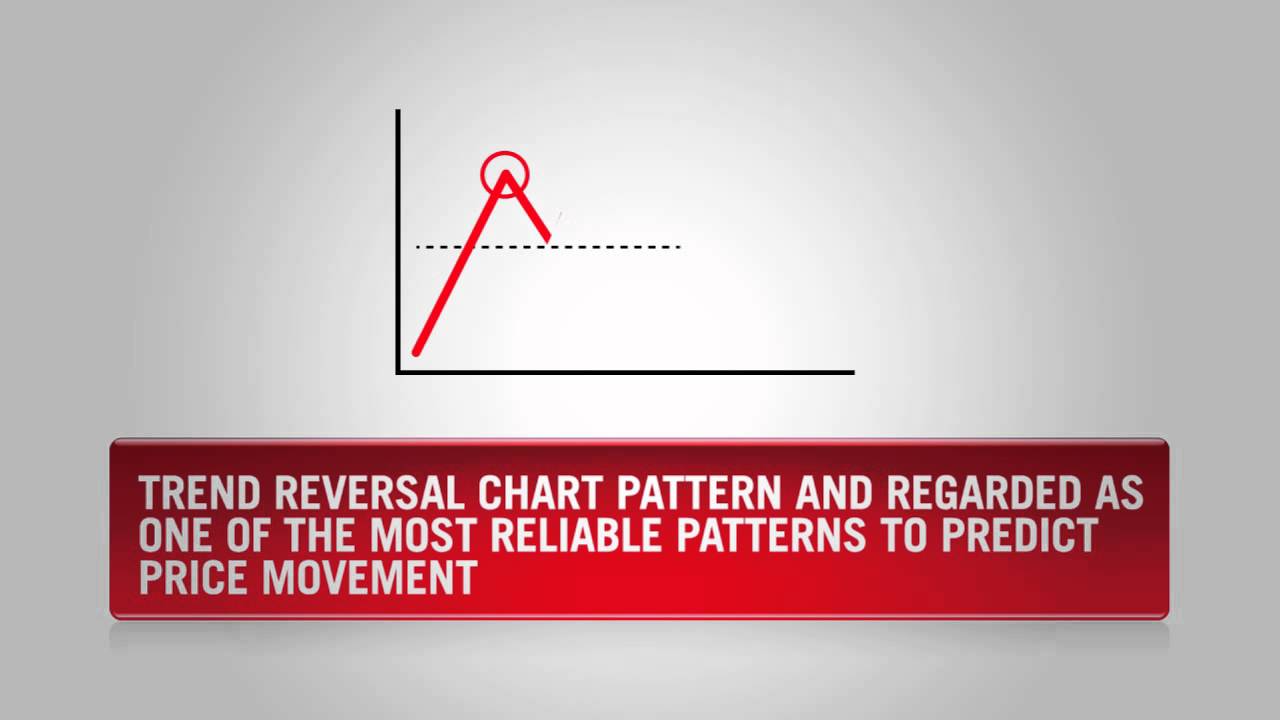

There are different types of chart patterns. Some are continuation patterns as these can detect the possibility the continuation of the trend. Some are reversal patterns as these patterns are capable of identifying profitable trend reversals.

Here is a list of most common, effective and widely used chart patterns,

Reversal Patterns :

- Double Top and Double Bottom

- Head & Shoulders Top and Bottom

Continuation Pattern :

- Triangles (Symmetrical, Ascending, and Descending)

- Rectangles (Bullish and Bearish)

- Flags and Pennants