- The UK remains in lockdown even as it continues to carry out mass vaccination campaigns. The UK situation mirrors what has been going on elsewhere in the world, but the pace of vaccination looks sufficient to calm the market’s nerves.

- Despite Covid-19 accounting for much of the market’s issues, it looks like risk-on conditions are making a comeback in the broader financial markets. Last week, a group of retail stock traders rallied together to squeeze shorts out of GameStop’s stock. As a result, there has been increased activity relating to the USD, which is gaining broadly.

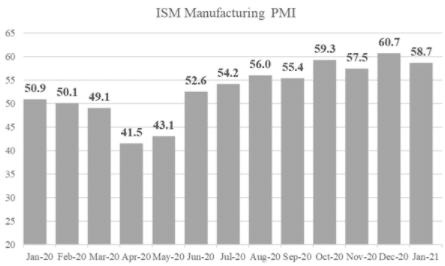

Broad Manufacturing PMI is heartening

This week is a busy one for the markets from a fundamental perspective. PMI data in Japan, Australia, and much of Europe came positive, but the fundamentals did not benefit all of the respective currencies. The Australian dollar (AUD) was down 0.03% to 0.7623, and both the JPY and the EUR were up by 0.03% to 104.91 and 0.02% to 1.2026 respectively time of writing.

IHS Markit had initially estimated the eurozone’s preliminary manufacturing PMI for January as 54.7 but later revised the value up by one basis point. January was a dull month for the eurozone in the manufacturing sector, considering that December’s manufacturing PMI was 55.2. From a national perspective, the Netherlands tops the manufacturing PMI chart with 58.8. Germany’s manufacturing PMI contracted by remains superior to the region’s average.

ISM January PMI data for the US economy was disappointing, but it did not stop the USD from gaining against much of the market. Nevertheless, the PMI – which came in at 58.7 – almost solidifies the strength of the US economy.

Is the ongoing short squeeze in equity markets underpinning the greenback?

One finds it interesting that the USD is strengthening across the board while there aren’t special reports that could catalyze the frenzy. Or is it? The USD could perhaps benefit from the ongoing push-and-pull between Reddit users and hedge funds, some of whom had shorted the stock more than 140% for Melvin Capital.

The group of Redditors has also gone after silver, a metal that hedge funds had also shorted mercilessly. At the time of writing, one ounce of silver was trending at $29.55, meaning the stock was on its way to a cleanser.

A short squeeze often obligates some hedge funds to sell their holdings in other assets, and the resulting money is used to cover their positions. If the short-squeeze mania holds on stronger for some more time, some hedge funds risk declaring bankruptcy.

The USD could rise higher in the coming days

Right now, the USD appears as a party crasher, considering that its coronavirus battling situation is behind the eurozone. But perhaps the anticipation of the passing of a new stimulus package deal is fueling the demand for greenbacks. Reports indicate that President Biden is ready to go around any resistance launched by the GOP against the passing of the $1.9 trillion programs.

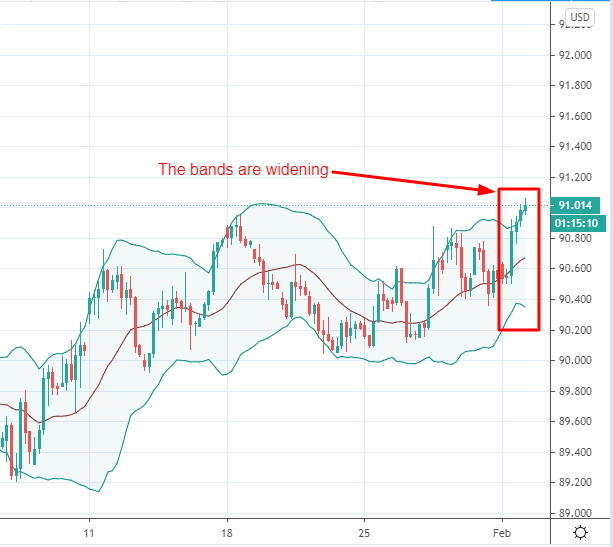

Interestingly, the US dollar index (DXY) over the past few hours indicates that market action has substantial weight. As the figure below shows, the DXY seems to be consolidating last-few-days’ gains into a substantial bull run.

Also, the general posture of the Bollinger Bands in the figure shows the index trending upwards. The US remains the most aggressive in terms of monetary policy to stabilize the economy. During its last meeting, the Fed’s FOMC held rates constant, perhaps as a signal that more radical steps could be taken to prevent a full-blown recession in the country.