- The UK is seeking to reinforce its post-Brexit deal with Canada.

- Canada’s savings have increased to an all-time high.

- Canada may raise interest rates in 2021.

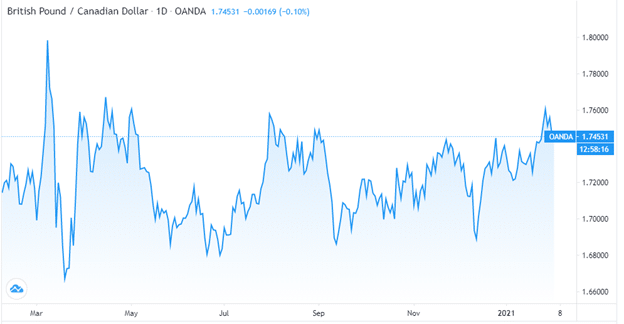

The British pound rose by 3.4% from December 11, 2020, to settle at 1.7460 on February 3, 2021. The pound overcame sharp volatility amid news that the UK was negotiating entry into the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP). The UK had earlier signed another trade deal with Canada worth £20 billion ($35 billion) in 2020. The post-Brexit trade deal is meant to reinforce business relationships between the two countries.

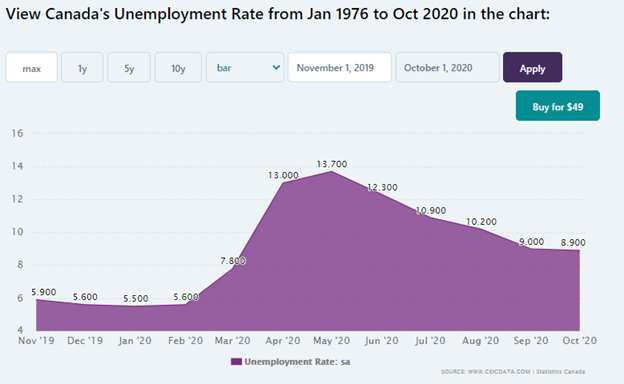

Job creation in Canada during the pandemic declined from 7.1 million in March 2020 to 6.5 million in April 2020. The City of Ontario lost up to 220,000 jobs in 2021. The country’s unemployment rate dropped to 8.90% in October 2020 from 9.0% in September 2020 (when monthly earnings stood at $3,358.10).

May 2019 saw Canada’s unemployment rate reach an all-time low of 5.40% before it reached a record high a year later at 13.7%. From a population of 38.01 million, the participation rate of the labor force is 64.90%. This number shows that Canada has a lot to gain from the UK trade deal. Goods exported from the UK to Canada include electric cars and sparkling wine.

The TPP trade deal would give the UK access to exotic markets such as Mexico, New Zealand, Malaysia, Canada, and Vietnam. The partnership is worth £9 trillion, with the UK industries assured of cut tariffs, especially for food, drinks, and vehicle businesses. Additional opportunities are expected in the technological services. The deal also gives autonomy to the UK regarding maintaining its laws, financial instruments, and boundaries.

The UK’s trade with the CPTPP countries in 2019 was worth £111 million, representing an 8% growth since 2016. This deal’s significant gains include decreased tariffs on whisky exports to Malaysia from 165% to 0%. While the UK-Canada trade deal is supposed to rake in benefits in 2024, the UK’s car exports to Canada under the CPTPP would be reduced to 0% by 2022.

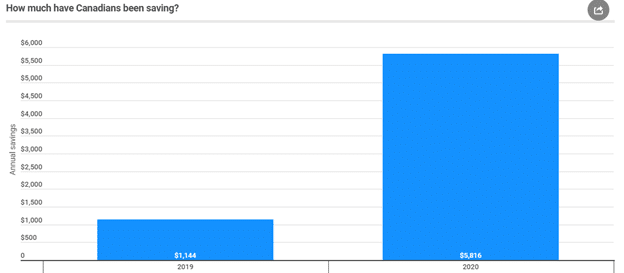

Canada’s stimulus program has led to a large supply of money in the country that is likely to increase the inflation target above 2% into 2022. In 2020, the money supply grew by 19%, with Canadians saving an average of $5,816 in 2020 (about 14.75% of disposable income). This amount has increased by more than 400%, from $1,144 saved in 2019.

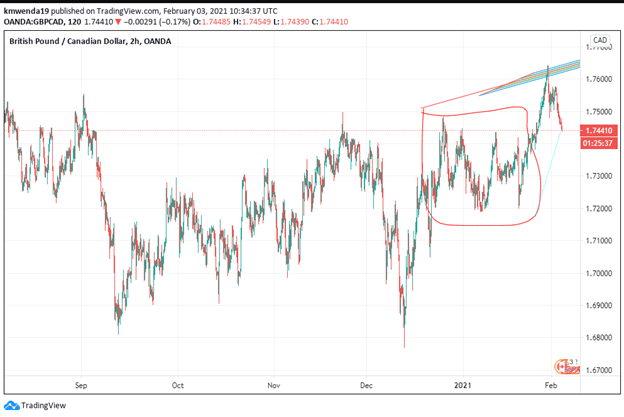

Apart from high savings, household debts have also risen in Canada to 110.97% of Q3 2020. The deficit in the second quarter of 2020 stood at 106.16% of the GDP. Additionally, the economy grew at 8% into 2021 (3.5% more than the 4.5% projected by the Bank of Canada). The Bank’s interest rate of 0.25% is likely to be increased in 2021 as the government seeks to anchor the country’s economic situation. If Canada raises interest rates ahead of the UK, we will have a slight tilt of the GBP/CAD trading pair in favor of the Canadian dollar into 2022.

Technical analysis

The Canadian dollar is looking to overpower the British pound with the 14-day RSI at an oversell position at 32.159. The holding pattern just before the British pound breaks out indicates that the trading pair may experience less volatility in 2021. The 14-day ATR supports this view with a record of 0.0018. The 200-day SMA gives new support at 1.7489 while the EMA is at 1.7484.

Positive trade news in the UK may drive the trading pair to the 1.8100 range, while Canada’s rising interest rates may lower the base to the 1.7100 trendlines.