- The Canadian dollar reacted positively to the ECB’s decision to delay bank bond purchases.

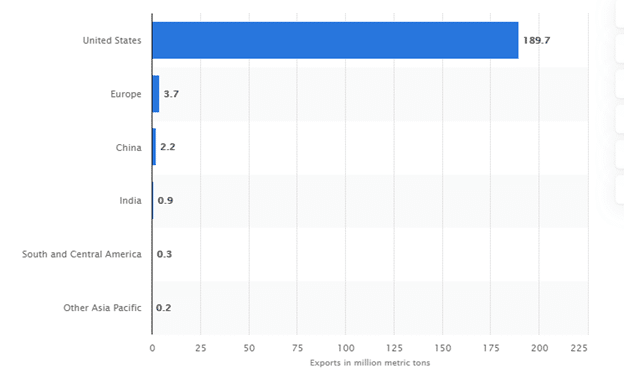

- Oil prices will continue to rise as economies recover and inventories decrease.

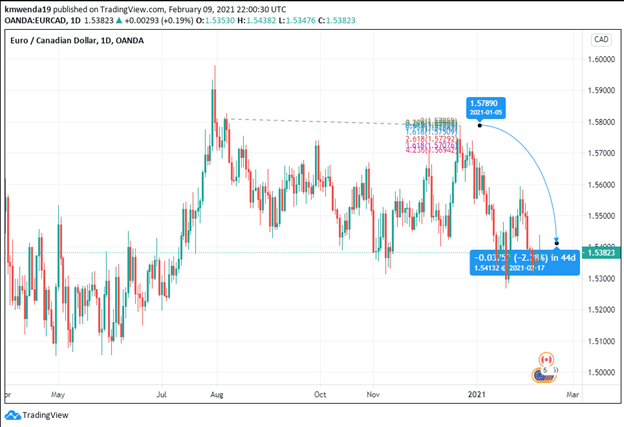

- The EUR/CAD may move below the 1.53 support area in 2021.

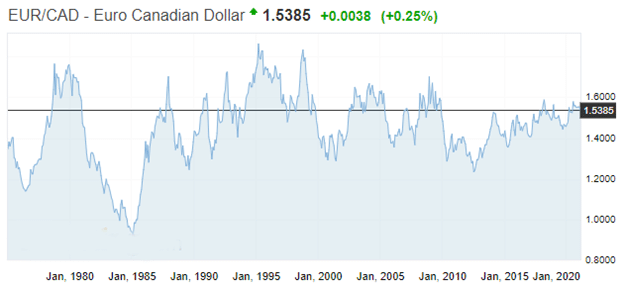

The euro rose 5.87% year on year against the Canadian dollar to settle at 1.5383 on February 9, 2021, from lows of 1.4530 in 2020. Rising oil prices have continued to boost the Canadian dollar that is related to commodity prices. Additionally, the ECB’s decision to downplay the option of purchasing stocks and bank bonds has put a limit to the gains made by the euro year-to-date (YTD).

ECB’s chief economist, Philip Lane, on January 31, 2021, indicated that the ECB’s monetary actions in 2021 excluded purchasing bank bonds/stocks. The continental bank offers short-term rates, the purchase of assets, and targeted lending services to fight the pandemic. The decision to keep away from buying stocks boosted the CAD 1.21% against the euro.

Germany’s lockdown has weighed in on the GDP leading to a 1.4% decrease in the forecast for 2021. The government projected back in November 2020 that the GDP in 2021 would grow by 4.4%. The second coronavirus wave with new variants, slow rollout of vaccines in the EU has led to German output contraction in the first quarter of 2021.

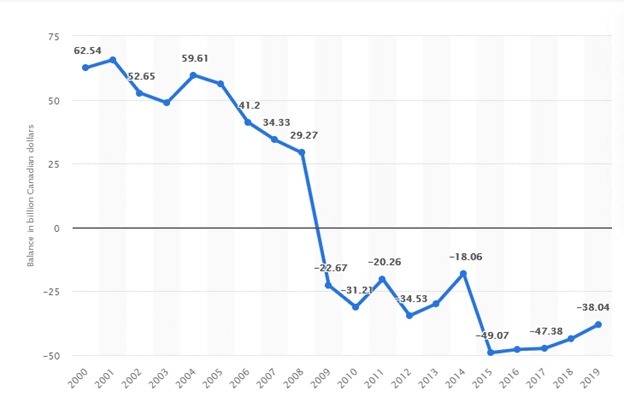

In Canada, a decline in the importation of consumer products coupled with increased exports of energy products led to a decrease in its trade deficit. The deficit in December 2020 was CAD$ 1.67 billion ($1.3 billion) compared to market expectations of C$ 3.1 billion. The debt has improved by 46.12% as compared to estimates. However, the total trade deficit for the year 2020 was C$ 36.2 billion (more than double that of 2019).

Canada’s trade balance since 2000-2019

Canada has had a negative trade balance since 2009 when the euro hit highs of 1.7025 against the Canadian dollar.

A decrease in the trade deficit will help the Canadian dollar to recover against the euro in 2021.

Additionally, Canada is also pegging its recovery on accelerated trade relations and the quick rollout of the Covid-19 vaccine. North America remains integral in the growth process projected at 4% until 2022. The third quarter of 2020 had seen the real GDP decrease by 5.2% YoY, causing the EUR/CAD trading pair to hit a 52-week high of 1.5997 in August 2020. However, the economy began to peak in October 2020 when job losses reduced to 600,000 from a record high of 2.9 million recorded in April 2020.

The year 2020 also saw a decline in Germany’s exports at 9.3% and imports at 7.1% (2019). The trade balance stood at €179.1 million (€1.2047 billion – exports and €1.0256 – imports) in 2020. The trade surplus (though significant) was Germany’s fourth slump in four consecutive years. The Canadian dollar gained 3.81% against the euro in 2020 as Germany’s trade surplus could not break out from the declining zone.

A continual increase in the price of commodities such as oil will positively impact the Canadian dollar. In 2019, Canada exported 3.7 million metric tons of crude oil to Europe.

Technical analysis

The EUR/CAD currency pair is expected to meet resistance at the 1.57890 level. Investors are in a wait-and-see mode, with the 14-day RSI showing a neutral position at 49.399. The stochastic RSI shows traders have oversold the currency pair at 2.505. The 200-day SMA gives new support at 1.5417 while the EMA is at 1.5396.

Decreased oil inventories and improved crude oil prices will drive the Canadian dollar higher against the euro.