- Business confidence in New Zealand is at a near-annual high.

- The euro increased in February 2021 with high export and manufacturing data.

- New Zealand will tighten monetary policy to curb rising real estate pricing.

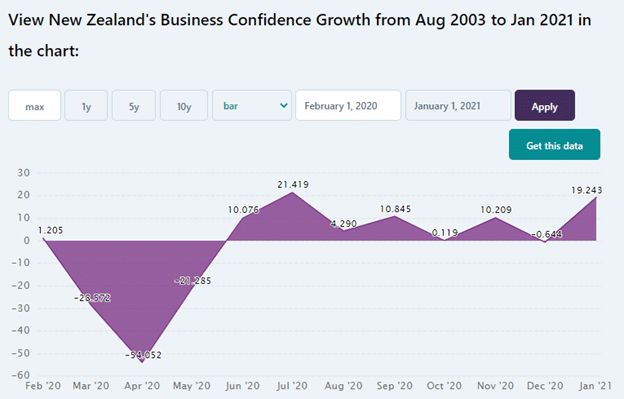

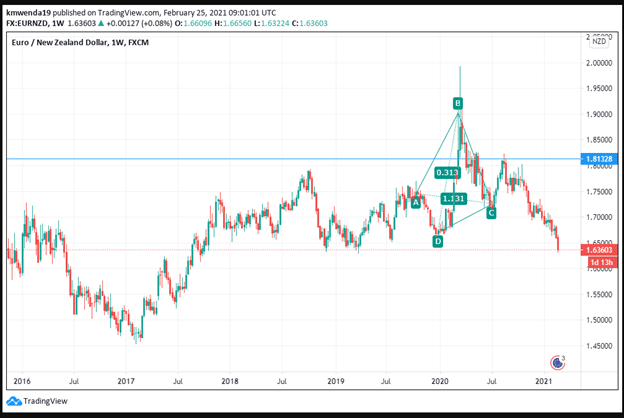

The EUR/NZD broke off retracement levels in December 2020, where it scored a 3-month high of 1.7308 to hit a sharp reversal from January 2021. The pair hit resistance at 1.7199 on December 28, 2020, and has since fallen to a low of 1.6385. The business confidence rate has grown in New Zealand from -54.052 in April 2020 to +19.43% in January 2021. The euro dominated in February 2021, as the trading pair rose 1% from a low of 1.6679 to 1.6846.

Business confidence

New Zealand’s business confidence reached a near-annual high of 19.2% in January 2021 after rising from a decline of -0.644% in December 2020. Individual sentiments’ analysis shows that a net 22.3% of business owners are optimistic of growth in 2021 compared to 21.7% surveyed previously in December 2020. The positive February outlook follows New Zealand’s successful management of COVID-19 and robust economic recovery. The country’s 10-year bond yield reached an annual high of 1.90 on February 25, 2021.

However, the euro held off gains in February 2021 as the Austrian Manufacturing PMI jumped to a 3-year high. The PMI jumped 7.56% from 54.2 in January 2021 to 58.3 in February 2021. With the index above the 50-mark threshold, Austrian manufacturing had expanded considerably, the best score since 2018. The increase was motivated by increased new orders, faster output growth, and many new businesses that created employment. There was a rise in international demand from Asia, United States, and Germany.

In January 2021, India increased its import of steel relative to export, becoming a commodity’s net importer. Total steel exports from Germany, Austria, France, and Taiwan to India increased year on year (Y/Y) compared to January 2020. More exports by European countries into 2021 are expected to boost the euro against a basket of other currencies.

The euro was also lifted by Germany’s GDP data for December 2020 that showed it rose 0.3% in Q4 2020 compared to Q3 2020. However, Germany’s economy declined 4.9% in 2020. Spending in private households declined 3.3% in the quarter due to the new COVID-19 variant. Exports increased 4.5% as the global manufacturing economy recovered as well as the Chinese orders. We expect the ongoing vaccination program and new test methods to improve the European power-bloc normalization efforts and improve domestic demand into 2021.

New Zealand’s housing prices

Housing prices in New Zealand have risen 19% since 2020 despite analysts’ forecast of a resounding fall. NZ’s GDP grew 14% in Q4 2020 as the country’s success in managing the spread of COVID-19 returned the economy to normal. Median home prices in January 2021 reached NZ$730,000. Auckland’s median price was NZ$1 million, higher than any of the other developed nations. The government has asked the Central bank to put a lid on property prices by tightening fiscal policy in New Zealand. High housing prices are curtailing first-home buyers from homeownership.

Technical analysis

The diamond top pattern formed at the beginning of 2020 as the euro took extraordinary measures to fight COVID-19. However, New Zealand, as shown in the ABCD trendline, has forced a reversal of the uptrend. Strong resistance was hit at 1.81328, and since then, prices have declined into 2021. We are likely to see further a decrease of the EUR/NZD trading pair as New Zealand tightens monetary policy to curb rising property prices.