- The Turkish lira has gained more than 12% from December 2020 to February 2021.

- Export sales in Turkey rose by 2.5% in January 2021, shrinking the trade deficit from 2020.

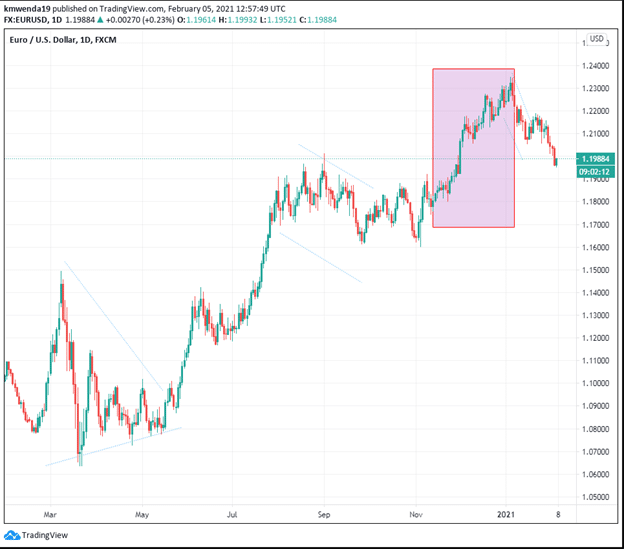

- The rise of the EUR/USD trading pair in November 2020 facilitated the increase in the value of Turkish exports.

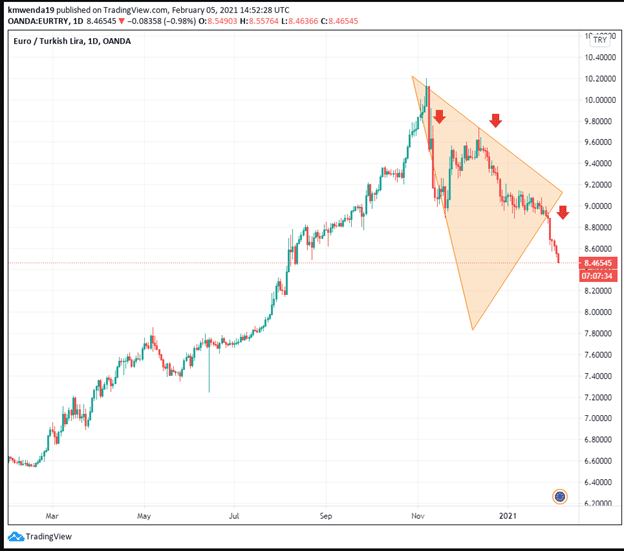

The euro has been on a losing streak against the Turkish lira since December 10, 2021, with the pair dropping almost 12% to stand at 8.4741 on February 5, 2021. The inflation rate of the euro area hit the negative zone in December 2020 (for the 5th month in a row). The harmonized index of consumer price (HICP) was -0.3% (YoY). The unemployment rate also increased from 7.4% to 8.3% into 2021, with countries such as Spain most affected. Turkey, on its part, has been improving its relationship with the EU, especially on retail trade.

Soaring exports

Turkish export sales in January 2021 grew by 2.5% YoY to settle at $15 billion (TL 107 billion). Imports fell 5.6% to $18.1 billion aiding to shrink the foreign trade deficit by 32%. The increase in exports against imports suggests the stability of the macroeconomic environment and an indication that the country has left behind the pandemic year. December export sales had soared by 16%, amounting to $17.84 billion, indicating that the Turkish lira has had a rising demand into 2021.

Germany was the major partner of Turkey, importing goods worth $1.5 billion. The rest are as follows:

| Country | Value imported from Turkey in January 2021 |

| United States | $933 million |

| Italy | $864 million |

| UK | $814 million |

| France | $737 million |

The EU formed Turkey’s largest market with exports of up to $6.5 billion (equal to 42.9% of the overall monthly sales in the country). The rise of the EUR/USD trading pair into 2021 facilitated the increase in the value of the exports at the time.

Improved trade balance with Russia, Turkey, and South Korea had made the trade surplus of the eurozone surge in November 2020. The EUR/TRY trading pair hit a 52-week high of 10.2015 in November 2020. The trade surplus surged 27.72% to €25.8 billion from a low of €20.2 billion in 2019. The EU jumped from a trade deficit of €2.4 billion in 2019 to a trade surplus of $6.2 billion in 2020 (first 11 months).

Switch auctions held on January 26, 2021, revealed that Turkey had sold fixed-bond coupon bonds worth $190 million (€1150 million or TL 1.4 billion). The bonds were set to mature on November 13, 2020. This sale drove the EUR/TRY currency to a lower exchange rate at 8.9649. However, the increase in interest rates to 17% excited investors as they opted to trade Turkish assets into 2021.

No rate cuts soon

In an open letter to the government, the Turkish Central Bank (CBRT) stated that the annual inflation rate surpassed the 5% target by more than 9% to settle at 14.6% in December 2020. High prices of commodities such as energy, agricultural products, and metals mean the bank is not cutting rates soon.

Technical analysis

Three arrow markdowns in the last quarter of 2020 and in 2021 indicate that the EUR/TRY trading pair may move lower in the year. The 14-day RSI shows an oversold position at 27.799. The stochastic RSI also indicates that the trading pair is oversold at 9.149. High volatility is expected with the 14-day average true range (ATR) at 0.0228. The Bull/Bear technical indicators have tilted towards the bear position of the currency at -0.0478.

The 50-day SMA gives support at 8.5572 and the EMA at 8.5494. Both technical and moving averages show that the EUR/TRY is in a strong sell position.