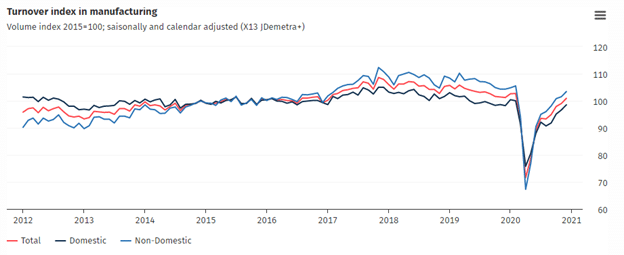

- Germany’s manufacturing index fell by 10% in 2020 as compared to 2019. New order levels are yet to return in Q1 2021.

- Fewer jobless claims in the US may lead to positive investor sentiment about the dollar.

- Brent crude reaches the $60 a barrel threshold despite the executive order.

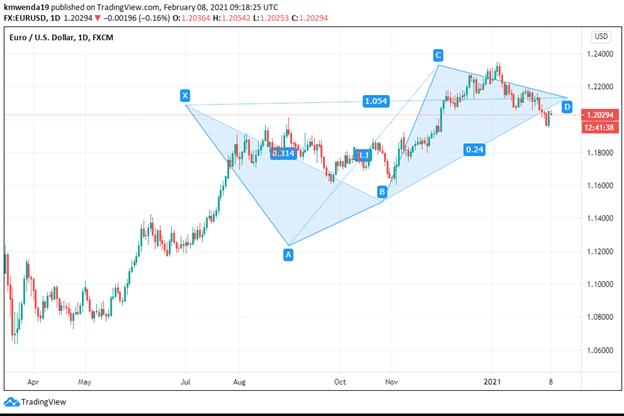

The EUR/USD trading pair fell by 2.32% in the two days leading to February 8, 2021, after hitting the annual high of 1.2325. This decrease was attributed to a sharp 1.9% decline in German factory orders in December 2020. The reduction was the first in 7 months after a continual increase in industrial orders since May 2020. The dollar’s positive reaction was after the US unemployment rate fell to 6.3% (+0.4%) in January 2021.

The US Congress is expected to pass (Biden’s) stimulus budget bill by the end of February 2021 (despite the lack of GOP voters). With the unemployment rate falling close to 7%, fewer jobless claims may increase the dollar’s exposure by investors. The US dollar may regain its global status as a haven with the strengthening of the economy.

The year 2020 saw the manufacturing sector’s turnover in German fall by 10.1% compared to 2019.

December 2020 saw domestic orders in Germany reduce by 0.9%, while foreign orders also decreased by 2.6%. New orders scheduled from the eurozone also declined 7.5%, while those from countries outside the euro area increased by 0.5% month on month (MoM). The decline in domestic orders may indicate that Germany’s factory level is yet to rise above the contraction zone into 2021.

To help boost the trans-Atlantic alliance with other countries, Germany increased its NATO budget to €53 billion ($63.8 billion) in 2021. The 3.2% increase in defense spending from the €51.4 billion capped in 2020 may improve foreign orders and not just halt the redeployment of US troops from Germany. The budget was increased to 1.57% of the country’s GDP that stood at $3.8 trillion as of 2019. The GDP may decline in 2020-2021 due to virus restrictions that have hampered the manufacturing sector’s growth.

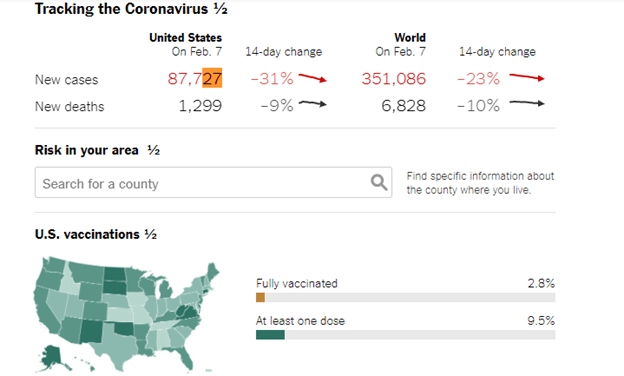

As of February 6, 2021, less than 4% of EU adults had been inoculated against Covid-19 compared to more than 20% in the UK. The coronavirus vaccine’s first dose has been administered to more than 27 million Americans, with up to 6 million getting the full amount. Almost 10% of the US population has been vaccinated.

In the past 14 days (since mid-January 2021), new coronavirus cases in America have declined by 31%, while recent deaths have decreased by 9%. The US is quickly catching up with the global figures, with new deaths behind by 1% point from the worldwide decline of 10%. Additional vaccination will help to speed up economic recovery in the second quarter of 2021.

Brent crude hit the $60 a barrel threshold to trade at $60.21 on February 8, 2021 (+1.47%), while WTI crude hit $57.65 (+1.41%). The rising oil prices show that big oil investors are not worried about President Biden’s executive order to reduce fracking. The US has seen a steady rise in oil and gas rigs in the first quarter of 2021 by 8%. The US dollar is headed for a breakout against the euro.

Technical analysis

The XABCD pattern indicates that the EUR/USD trading pair may find short-term resistance in the 1.21 region. The 14-day RSI shows a neutral position of the currency at 51.871. The 20-day SMA is at 1.2039, while the EMA is 1.2029. The 200-day SMA also supports the EUR/USD currency pair’s sell position at the 1.2062 region.