- The euro has gained close to 13% YoY in the past year.

- The ECB may raise interest rates in case inflation rises into 2021, against expectations.

- The US dollar is gaining strength despite rising COVID-19 cases.

Description

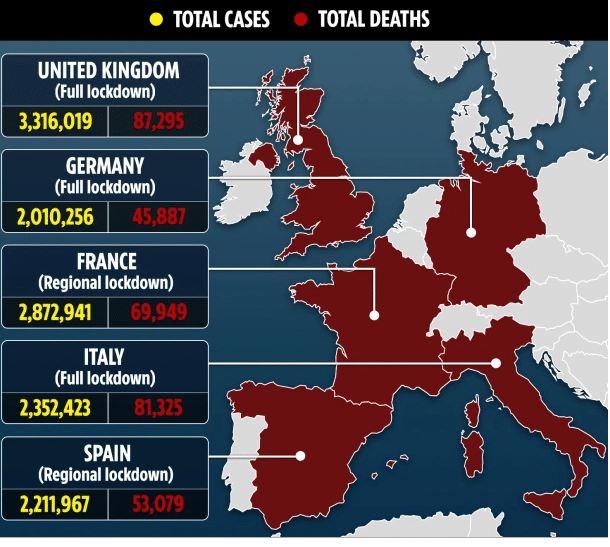

The euro has climbed 13% since March 19, 2020, to settle at $1.2080 as of January 15, 2021. The April 2020 stimulus helped to sustain an upper move in the EUR/USD pair to the tune of 15%. The pair reacted positively to a decrease in the interest rate in the US. Nevertheless, the euro has failed to consolidate the gains into 2021. The dollar has gained over the euro as investors are optimistic that Biden’s stimulus package will improve the American economy. However, the rising coronavirus cases in Europe have forced countries to stare at full lockdowns with the regional economy in limbo.

Up to 52 European nations have recorded 30 million cases, with the new coronavirus strain responsible for increasing infections. Insufficient vaccine supplies have put the whole operation in limbo. There is a possibility that the EUR/USD pair may trade negatively when the full effects of the pandemic hit the European banks in 2021.

Profitability in the financial sector is already weak. Banks’ issuance of dividends will be limited in 2021 as banks seek to protect their market capitalizations. The prolonging of the health crisis will decelerate economic recovery in banks and all sectors of the economy. We should consider how a re-imposition of lockdowns will destroy investor confidence and increase the private sector’s vulnerabilities.

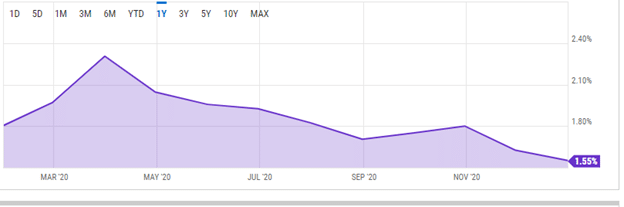

The dividend yield in the S&P 500 index decreased by 32.90% from March 2020 to December 2020. However, while the yield decreased, the payout increased by 0.7% YoY. The US economy is getting stronger, with investor confidence driving optimism in a definite direction.

The European Central Bank (ECB) is not expected to raise interest rates until 2022, where its deposit rates are at -0.5%. It is also set to end its relief bond-buying program worth €1.85 trillion ($2.25 trillion) to an end in March 2021 as planned with no other stimulus package in sight. With close to €800 billion used up as of December 2020, the Eurozone will be shielded off by the remaining trillion to cover off asset purchases and businesses’ funding.

Europe’s inflation rate is set to rise to 1.3% in 2021 from 0.7% in December 2020 and later rise to 1.5% in 2022. However, this forecast is untenable given the ECB has admitted that the high nominal-exchange rate is already weighing in on inflation. The rate will likely remain low as a result of the rise in COVID-19 cases.

The US stimulus package may raise inflation rates even as the Fed declared their unwillingness to increase interest rates. The dollar index has gained 0.08% since December 2020, with investors hoping for a peaceful transition in US politics.

Technical analysis

The 14-day relative strength index (RSI) shows an oversold position at 26.344, supported by the Stochastic RSI at 12.964. In tracking the pair’s currency price movement, the 14-day average true range (ATR) shows that it has high volatility. The ultimate oscillator also indicates a strong sell position of 0.0014. The 50-day simple moving average (SMA) gives the resistance ceiling at 1.2138 while the EMA is at 1.2132. The 100-day SMA also provides resistance at 1.2155 and an EMA of 1.2159. Investors are rushing to short the euro against the dollar as all signs show that the US economy will recover faster than the euro-zone.