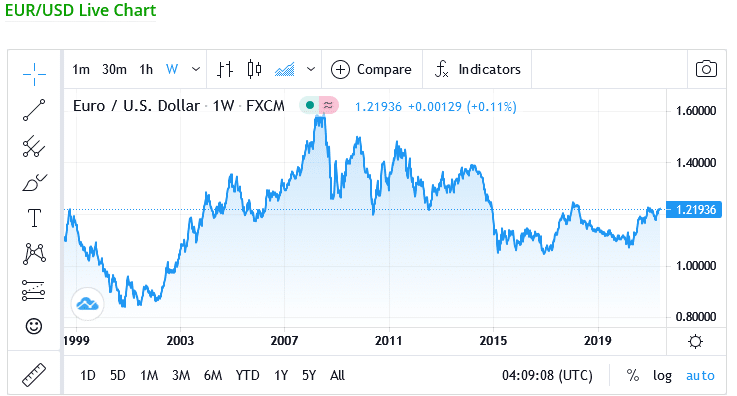

Euro continues to quench the dollar due to successful post-pandemic recovery. Coronavirus cases have dropped significantly, thanks to the widespread COVID-19 vaccination.

As per remarks of ECB board member Fabio Panetta, there is no chance of inflation showing an upward trend in the coming month.

However, as market sentiment goes, the pair might touch the level of 1.25 in the next few weeks. So, the guess is, should investors hold the euro for a little longer, or is it time to sell? Well, the forecast depends upon the US Core Consumer Price and PMI readings that will be released next week.

Strong numbers will certainly help the USD to disrupt the smooth rally of the Euro and give some relief to the greenback investors.

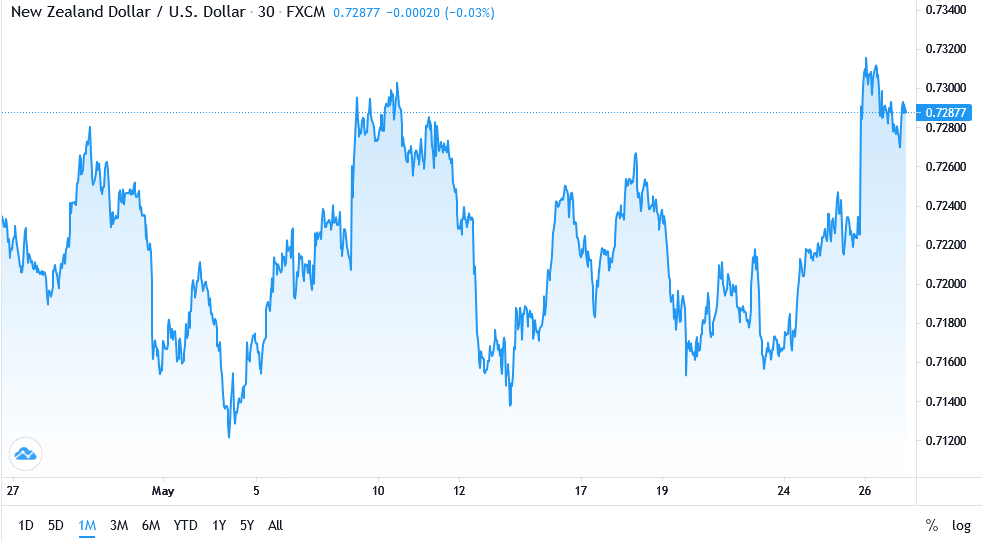

NZD/USD: Optimistic approach of RBNZ

Another currency going strong against the dollar: the New Zealand dollar. A strong economic outlook has been the reason for the upward trend of the currency, and investors are eyeing this opportunity, mainly in net short.

In its May meeting, the Reserve Bank of New Zealand kept most of the financial indicators unchanged, as predicted. The overnight Cash Rate was kept at 0.25% with the Large Scale Asset Purchase Program and (LASP) and Funding-For-Landing Program (FLP), important policy instruments were also unchanged. Both these programs were introduced to support the economy against the coronavirus crisis.

All these positives resulted in strengthening the Kiwi, and the market has seen a bullish trend in the whole week, against all odds!

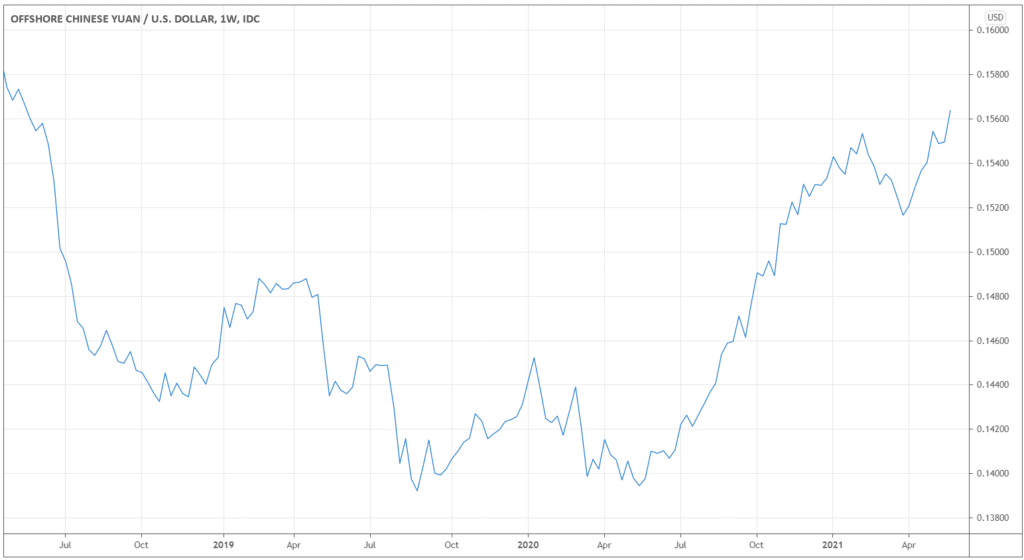

CNY/USD: How close is the yuan recovery?

At the start of the week, traders barely noticed the Chinese yuan, but currency began to show a strong recovery in the latter part of the week, resulting in the increased focus on the yuan.

The weak dollar let the yuan reach the highest level in the last three years. China’s economy is rapidly recovering after the pandemic, helped by foreign investment and an increase in exporters that hit a record high since last year.

Analysts are forecasting the positive momentum of the China economy in the future. Conversely, the rise in inflation and unemployment continues to fear the US economy. Therefore, if you are eyeing yuan, then it’s your best time to buy.

GBP/EUR: Is it time to buy GBP or sell it?

GBP and EUR are two of the most stable currencies globally and are considered less volatile. The economies of both economies are closely related and dependent on each other.

However, the question remains, is it time to invest in GBP against the Euro when investors are a little cautious due to the uncertainty around the UK. Despite stable retail sales reported in April, the numbers have slowed down in May.

Therefore, the Confederation Board of British Industry (CBI) is forecasting the slow growth of the UK economy in the coming months.

The pair is forming an ascending triangle, thus giving some hope to the GBP investors.

BTC/USD: Is Tesla the only hope for Bitcoin?

Problems continue to mount for pioneer cryptocurrency as the Chinese government issues a crackdown against the bitcoin mining industry due to climate concerns. This crackdown resulted in a steep drop in the value of the coin to 32,000, the lowest slump in the last seven days.

On the other hand, there is some boost for the coin due to the upcoming positive news. Elon Musk has tweeted about the recent development in Bitcoin renewable solutions. Another positive vibe for digital traders; American investor billionaire Carl Icahn has shown interest in investing up to $1B in crypto.