We Like:

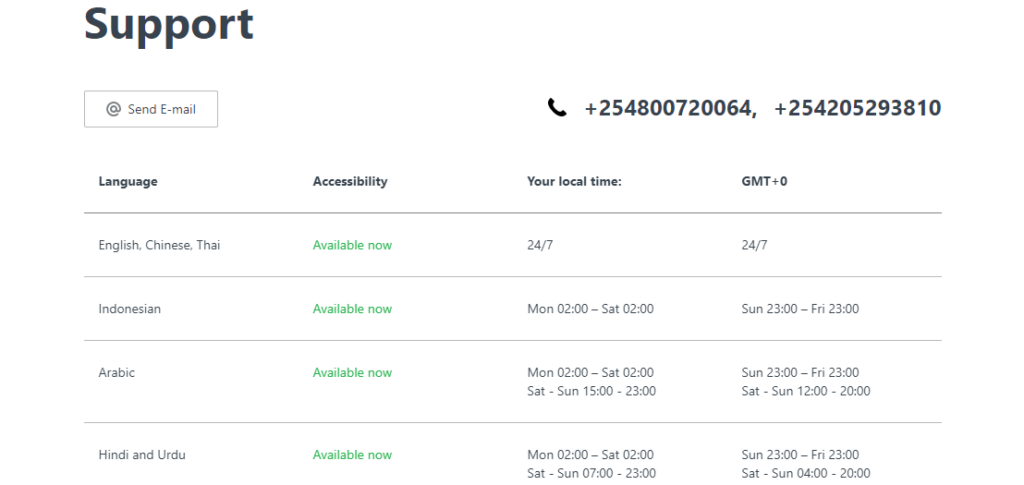

- 24/7 customer support

- Powerful trading tools

- Trade CFDs on forex and other products

- It is a top-tier regulated broker

- Suitable for both retail and institutional traders

- Holds clients’ funds in segregated bank accounts

- No deposit or withdrawal fees

- Offers a range of payment options

- Offers negative balance protection

- Waives deposit and withdrawal fees

We Don’t Like:

- Charges commissions on trades depending on the account type

- Some payment options may include a transaction fee

- Not available to US residents

The Verdict:

Exness is an online CFDs brokerage company that pioneered in the financial markets back in 2008. It runs an array of offices located in Cyprus, the UK, and Seychelles. The broker offers a spectrum of assets that clients speculate as CFDs with razor-sharp spreads starting from 0.3 pips and leverage of up to 1:2000. However, professional account clients trade with unlimited leverage.

As a result, the broker attracts multiple clients from around the globe and currently serves more than 145K active traders. The huge clientele also benefits from features such as negative balance protection, segregation of funds, zero deposit, and withdrawal fees, among others. Nonetheless, Exness holds licenses from reputable regulation bodies such as the FCA and CySEC.

Company details

The CFDs liquidity provider offers the world’s popular trading platforms — the MT4 and its predecessor MT5. Clients speculate on these assets’ tradable instruments backed by 24/7 multilingual customer support through Exness trading platforms. The powerful metaQuotes platforms integrate with cutting-edge trading tools to offer an effective trading environment.

Exness Markets’ assets include:

- Forex

- Stocks

- Indices

- Metals

- Energies

- Cryptocurrency

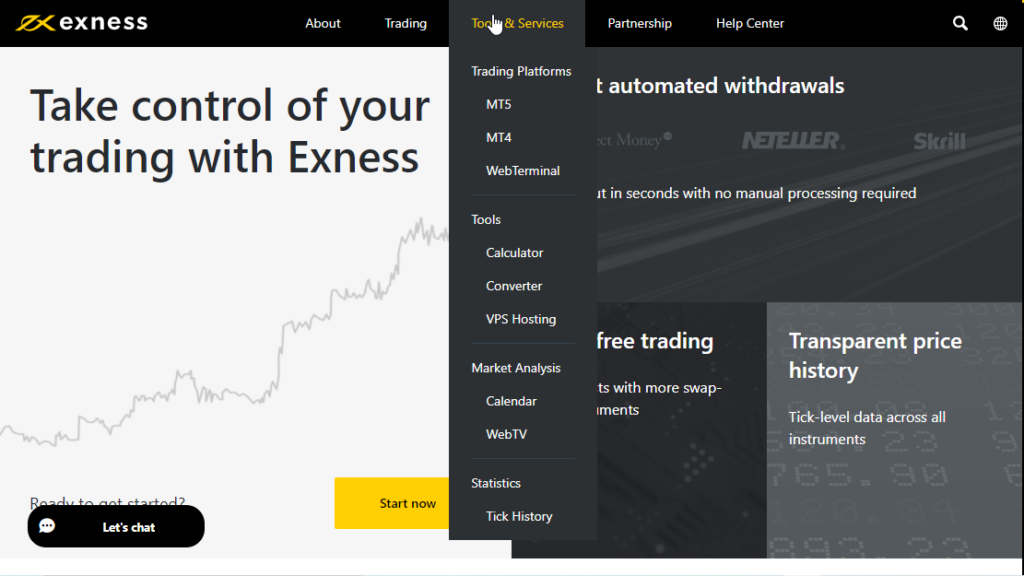

Clients speculate on these assets’ tradable instruments backed by 24/7 multilingual customer support through Exness trading platforms. The CFDs liquidity provider offers the world’s popular trading platforms — the MT4 and its predecessor MT5 to traders. The powerful metaQuotes platforms integrate with cutting-edge trading tools to offer an effective trading environment.

Integrated trading tools include:

- Currency converters

- FX calculators

- Economic calendar

- VPS Hosting

But before leveraging these tools in the Exness marketplace, traders have to fund their accounts with a set monetary size. The minimum amount required depends on the account type as they come with different trading conditions tailored to serve peculiar clients.

The minimum deposit is capped at $1 for the standard account traders but fluctuates depending on the account type. The broker also confirms that payment options influence the minimum deposit applicable to a client.

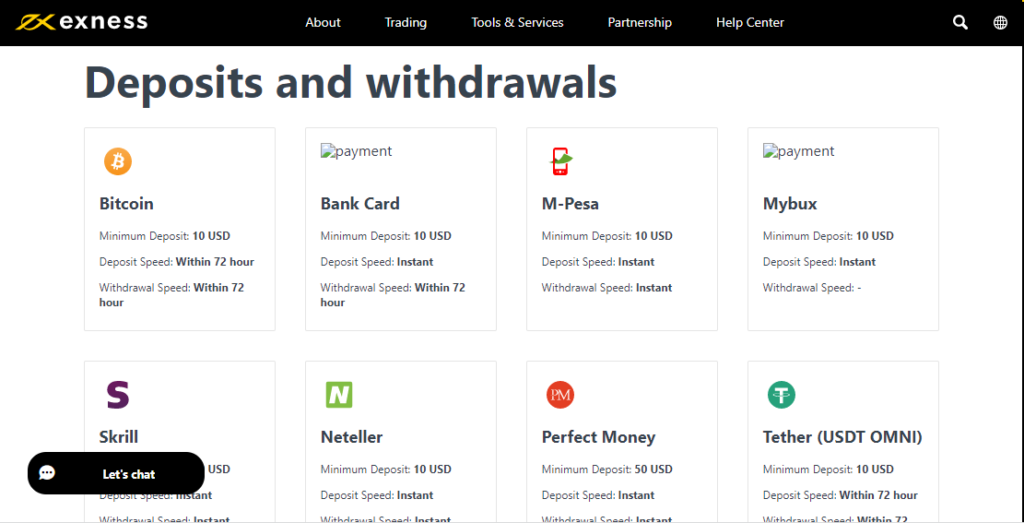

The payment options include:

- Bank wire transfer

- Bank Cards

- E-wallets like Skrill and Neteller

- Kenyan mobile money service — M-Pesa

- Cryptocurrency options such as BTC and USDT

Regulations

The broker is regulated by top-tier authorities, which are highly respected within the industry. The UK Exness is authorized and regulated by FCA, while the Cyprus office is regulated and authorized by CySEC. The broker’s array of licenses are as follows.

● Registered in Seychelles with the No. 8423606-1 and regulated by the Financial Services Authority(FSA) of Seychelles with license No. SD025.

● Exness B.V security intermediary is registered in Curacao with the Reg. No. 148698(0) and holds license No. 0003LSI from the CBC of Curacao.

● Exness Markets VC Ltd is registered in Vincom capital and regulated by the FSC, license No. 2032226.

● In Africa, the broker is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with registration number 2020/234138/07 and FSP number 51024.

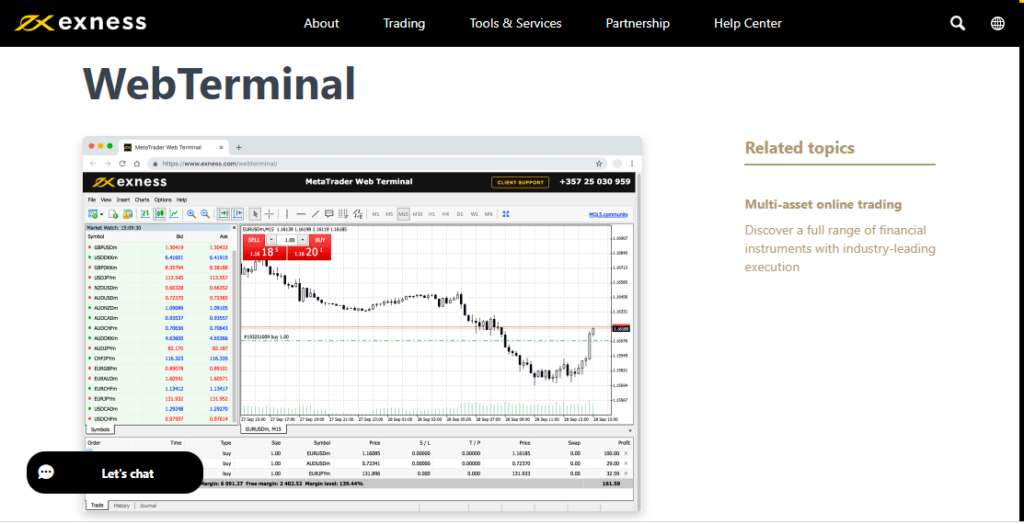

Trading platforms

As briefly introduced, the broker provides the MetaTrader 4 and the MetaTrader 5 platforms to traders integrated with state-of-the-art trading tools. They operate in multiple terminals like on desktop, android, and IOS giving clients the ability to trade from any interface. Besides, the broker couples these platforms with a web-based version (Exness web terminal) that allows clients to access the markets via the web.

Analysis of the platforms

MT4

- Implement a variety of strategies — yes

- Multiple types of trading orders — yes

- Order executions — Instant and Market

- Perform technical analysis — yes

- Analytical objects — 23

- Built-in technical indicators — 30

- Integrated market watch tools and news plugins — yes

- Autotrading — yes through EAs

- Client data encryption — yes

MT5

- Open multiple positions for a trading instrument

- Create up to 21 charts in one minute

- Access a built-in economic calendar

- 35 inbuilt indicators

- 22 analytical tools

- 46 graphical objects

- Available to all Exness account types

- Access all Exness financial markets

- Order execution — Instant or Market

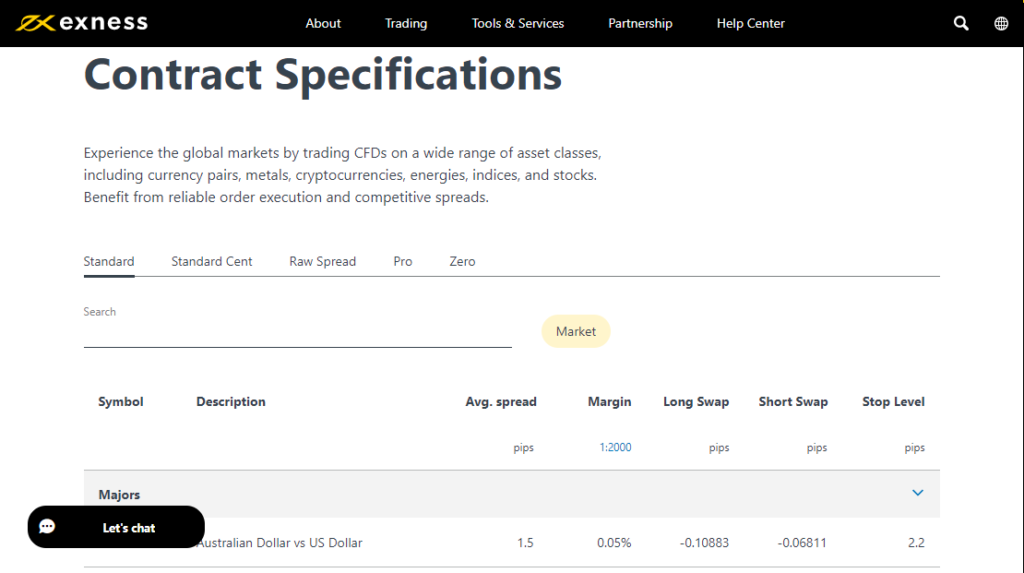

Range of markets

The broker provides clients with a wide range of tradable assets to speculate with fast executions and tight spreads. The market bracket encloses 107 currency pairs,81 stock and indices,13 cryptocurrencies, and 12 commodities.

Forex

The Exness forex market holds 107 currency pairs encompassing major FX crosses and digital currencies pairs. Traders speculate on these products as CFDs 24/5 with tight spreads and ultra-fast executions bolstered with leverage of up to 1:2000.

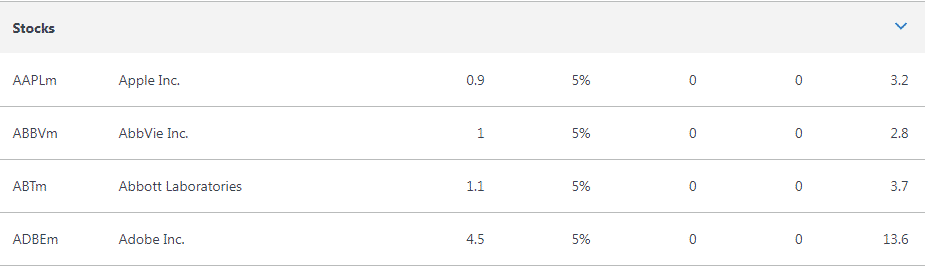

Stocks

About 81 stock instruments trade on Exness with a margin of 5%. The market opens five days a week, and clients speculate these assets as CFDs.The market supports stocks of global companies such as Apple, Amazon, Alibaba, among others.

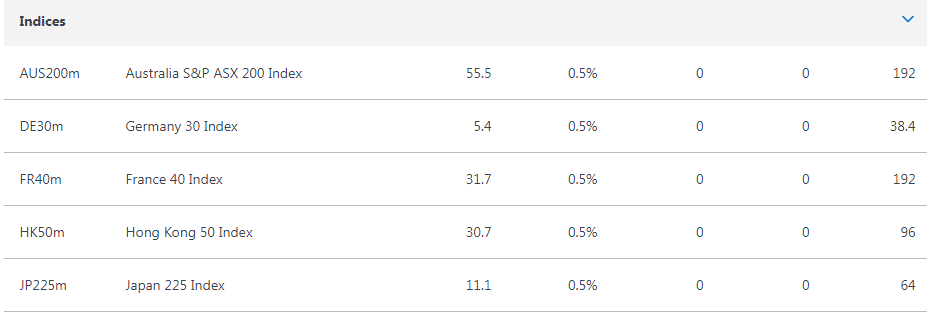

Indices

The broker provides traders access to the most liquid stock indices from across the globe, including AUS200, UK100, US500, etc., trading with a margin of 0.5%. The market opens 24/5, and clients speculate the instruments as CFDs, allowing them to go long and short hence benefiting even when the market falls.

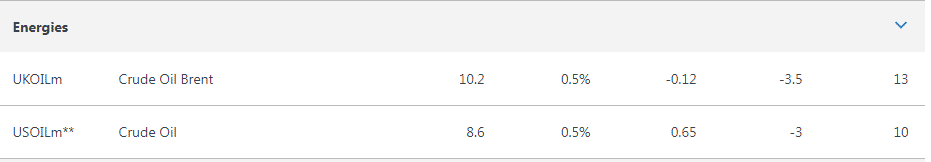

Energies

Energies are a spectrum of hard commodities traded as CFDs on most brokerage platforms. The broker provides traders with two energy products traded as CFDs from Monday to Friday. The assets include UK-OIL and USOIL and trade with a margin of 0.5%.

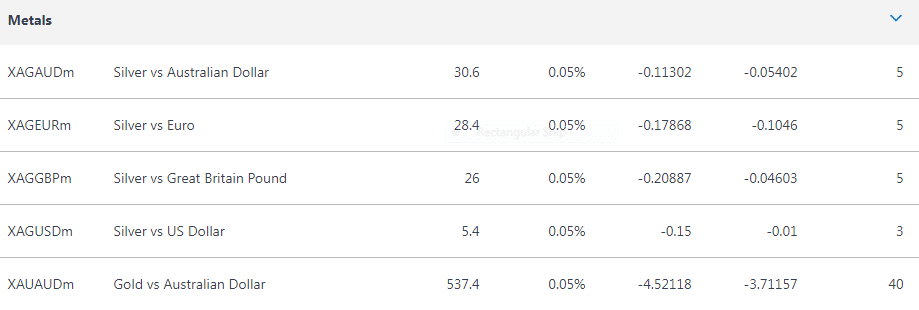

Metals

Just like Energies, metals are precious commodities that allow traders to diversify their portfolios by speculating on them as CFDs. This allows the client to trade the asset without owning the underlying instrument. The broker offers an array of precious metals that trade with a margin starting from 0.05% up to 1%. The available products include Gold, Silver, Platinum, and Palladium.

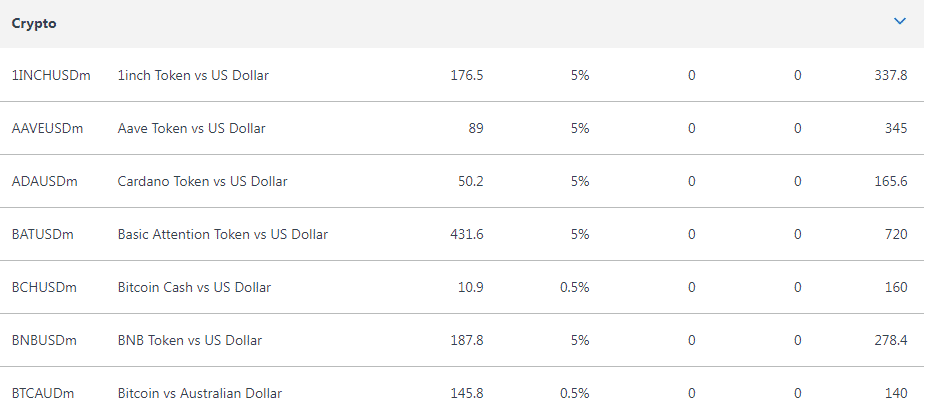

Cryptocurrencies

The digital market at Exness holds a wide range of crypto-assets encompassing Defi tokens and significant currencies such as BTC, XRP, LTC, and many more. They trade against fiat currencies like the US dollar, Japanese Yen, among others, with a margin of 0.5% or 5% depending on the pair.

Main features

- Offers competitive spreads — the broker provides meager spreads starting from 0.3 pips across its range of assets.

- Powerful trading tools integrated with its trading platforms — traders have access to cutting-edge trading tools such as forex calculators that help mitigate volatility risks.

- 24/7 customer service — the broker also claims to offer a qualified multilingual customer support team to answer to its clients.

- Holds a top-tier regulation license — the broker is regulated and authorized by the Financial Conduct Authority (FCA), making it a safe broker to trade with.

- Multiple payment options — customers have a wide range of payment options to choose from when funding or withdrawing money from their accounts. Exness also notes that it has waived all fees for these transactions, but some channels may add a transaction fee.

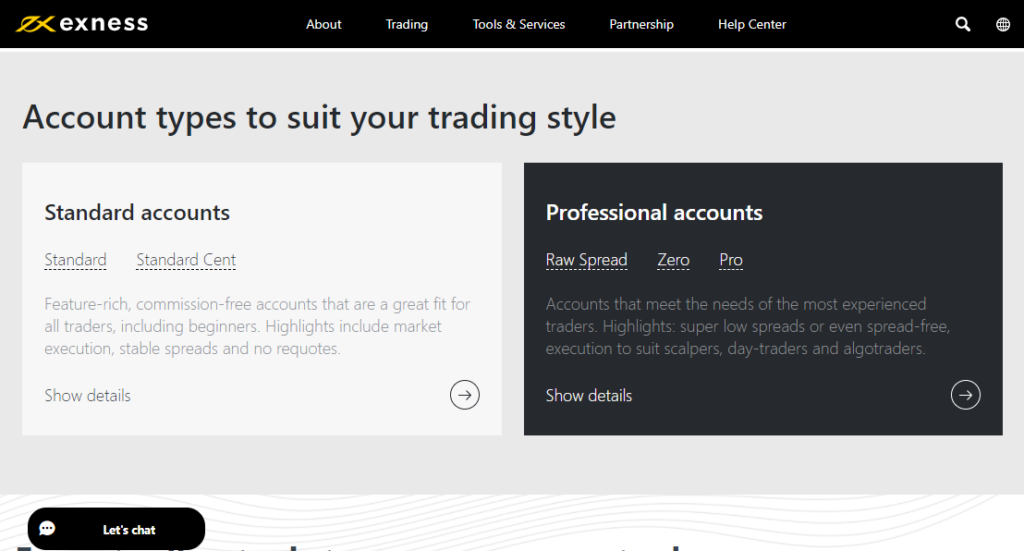

Types of trading accounts

Clients can opt for the standard accounts or the professional account types, depending on their trading objectives. Some individuals prefer to exploit the markets with commission-free accounts and stable spreads, while others prefer to trade the instruments with very low spreads or even spreads capped at 0.0 pips.

To meet these clients’ goals, the broker offers two standard accounts and three professional account types. Also, the trading platform a client selects determines the account conditions applicable.

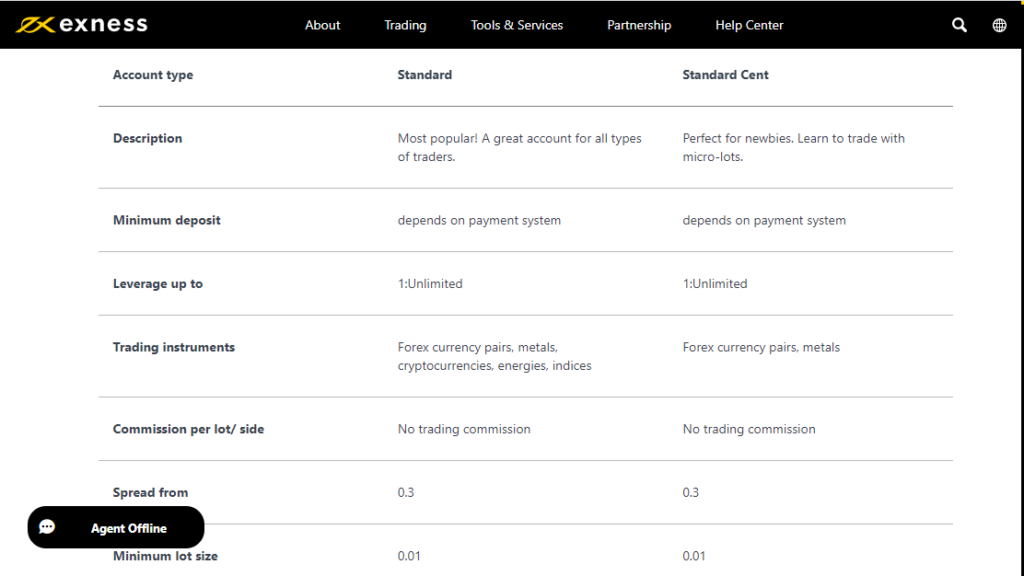

Standard accounts

- Platforms — MT4, MT5

- Min. lot size — 0.01

- Spreads from — 0.3 pips

- Starting deposit — $1

- Leverage — 1: unlimited

- Tradable instruments — all for the Standard account and only currency pairs and metals for the Standard cent account

- Stop out level — 0%

- Order execution — market

- Margin call — 60%

- Swap-free — available

- Hedged margin — 0%

- Number of positions — unlimited for the Standard and 1000 for the cent account

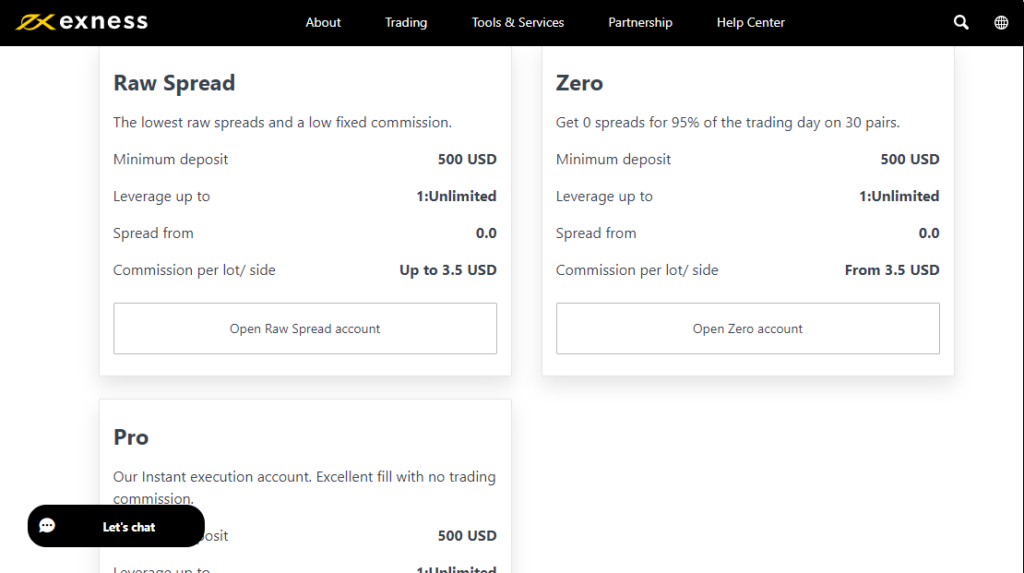

Professional accounts

- Platforms — MT4, MT5

- Min. lot size — 0.01

- The commission per lot — $3.5 but no commissions for the Pro account

- Spreads from — 0.0 pips but 0.1 pips for the Pro account

- Starting deposit — $500

- Leverage — 1: unlimited

- tradable instruments — all

- Stop out level — 0%

- Minimum number of positions — unlimited

- Hedged margin — 0%

- Margin call — 30%

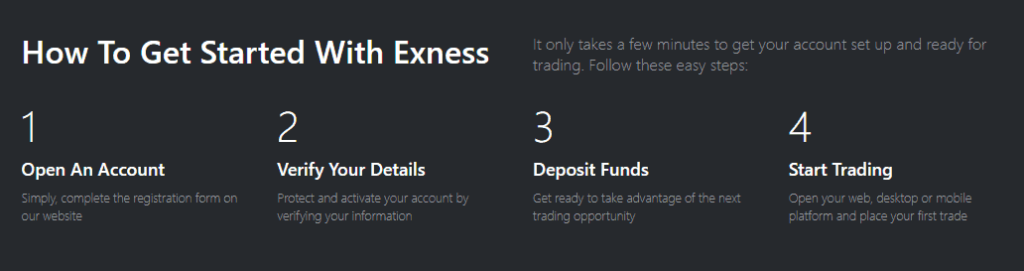

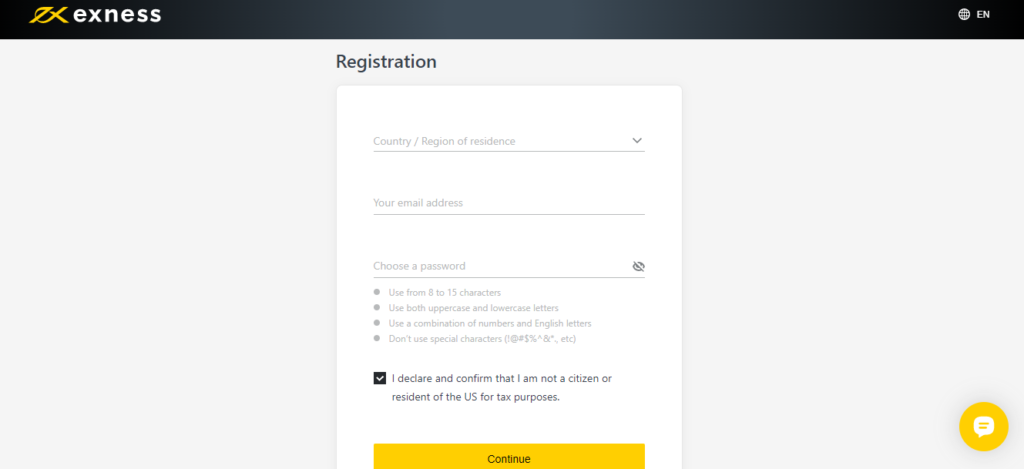

Opening an account at Exness

The account opening process is relatively fast and involves the following steps.

Step 1: Log into their website and click the start trading button.

Step 2: Fill in your personal details on the form that pops-up.

Step 3: Verify account details.

Step 4: Agree on terms and conditions.

Step 5: Fund the account.

Step 6: Start trading.

Commissions and spreads

Standard account traders face floating spreads starting from 0.3 pips meaning the broker adds commission on the market spread and some spreads may be a bit higher on a spectrum of assets. However, these clients also trade with zero commissions as compared to Professional account traders that incur $3.5 commissions per lot.

Customer service

Exness boasts of providing 24/7 multilingual customer support to clients that they can contact through the live chat button, email, and phone call. In addition, the Exness community has access to a help center platform that aids in searching materials and answering their queries.

Exness Review

What we liked

- Competitive spreads starting from 0.3 pips

- Reliable customer support

- Easy account opening

- Negative balance protection

- Unlimited leverage and strategies

What we disliked

- Not accepted in the USA

- Few education resources

- Commissions on trades

- Some payment options charge transaction fees

The bottom line

It is a top-tier regulated broker with an array of offices around the globe. The top-tier regulation imprint makes it a safe broker to trade with for novice, intermediate, and veteran traders. As a result, the CFDs liquidity provider confirms attaining a milestone of 145K+ active traders. It offers tight spreads floating from 0.3 pips and leverage of up to 1:2000 across multiple asset classes.

However, the drawback is that it fails to provide rich educational resources that come in handy boosting newbie traders’ skills. Hence, it might be challenging for beginners to understand the art of trading through Exness. In addition, some payment options charge a transaction fee.