Introduction

- Economic recovery is expected into 2021 to drain the oil oversupply experienced in the first quarter of 2020.

- Crude oil prices will test the $65 mark before the end of 2021. Slow recovery may push down the prices.

- The US is seeking to increase oil export in India, which is the third-largest oil consumer.

Oil prices are set to rally with growing economies increasing demand for the commodity and ease restrictions. The year 2020 has seen the price of US WTI crude turn negative. Contracts for oil futures fell below the zero marks. However, with the successful roll-out of vaccines, open economies, and the resurgent transport industry, we expect a spike in 2021.

Demand-supply factor

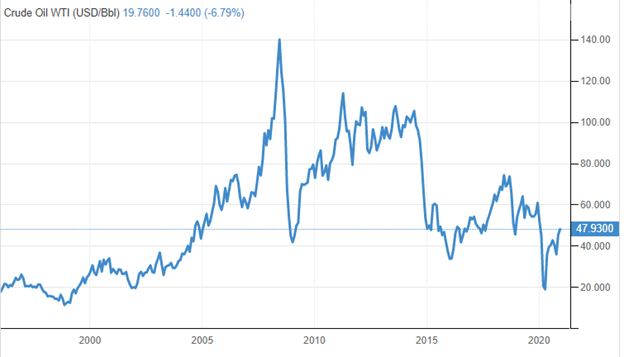

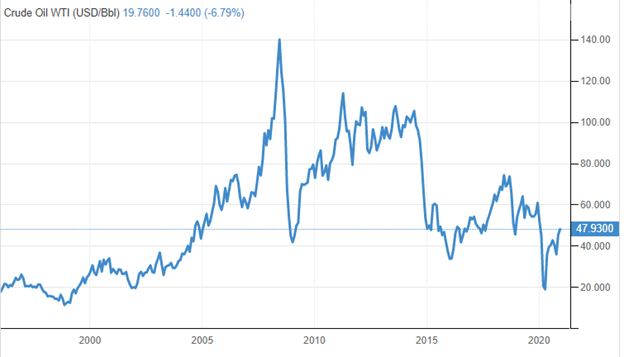

The December contract for Brent crude oil rose on 29th December 2020 to $51.18 a barrel, an increase of 0.59% in the run-up to 2021. WTI Crude rose by 0.67% to enter the trading day at $47.94. A 20-year analysis shows that Brent Crude Oil peaked in June 2008 at $166.46 a barrel, with WTI crude rising to $139.148 a barrel in the same period.

According to OPEC, the world’s “paper-market” oil consumption in June 2008 stood at 87 million, with its actual market demand at 1.36 billion BPD.

As of 2019, the US topped the world’s oil consumption at 19.4 million BPD, followed closely by China at 14 million BPD. WTI crude finished December 2019 at $61.85 a barrel at this consumption rate, while Brent Crude reached a high of $64,28. The price of crude oil may be headed to the pre-COVID era due to increased industrial activities in growing economies.

At the beginning of December 2020, OPEC and its partners agreed to increase oil production to 500,000 barrels per day. This process is set to start in January 2021, as the oil body expects heightened consumption at the time. Although the OPEC+ meeting plans to sustain the production cut to 7.7 million BPD through to March 2021, increased demand will force a slight increase.

In India, the third quarter’s industrial output grew by 3.6% after contracting 17.5% in the first quarter. The industrial mining index was healthy at 98, manufacturing at 130.7, and electricity at 162.2. The electricity index grew at a rate of 11.2% YoY. India took advantage of the low international crude oil prices by importing more than 270 million oil barrels in May 2020. With its primary oil source being the Middle East, India has a strategic partner in Iraq. The country’s crude oil import reached 4.4 million BPD in 2019, becoming the largest supplier at 22% of India’s oil import.

The US is also rushing to increase its stake in the Indian crude oil demand market. In FY 2019-20, American crude oil exports to India reached 5.4 million tons, up from 1.9 million tonnes in 2017. India’s fast-paced oil consumption is not slowing down. This demand will spill over to other countries, gradually increasing the price post-COVID.

Risk

Oil prices may contract owing to the new COVID-19 strain recently discovered in the UK. Further, slow economic recovery may trigger a pull in energy prices. The push for renewable energy in the US and Europe will also decrease demand pushing down prices. Stocked oil reserves in India may push consumption from 4.60 million barrels per day recorded in 2020.

Technical Analysis

The 200-day simple moving average indicates that light crude oil futures will find support at $53.14 a barrel and $38.71. The 50-day moving average reached a high of $63.56 a barrel, showing a strong uptrend into 2021. The chart shown above indicates that the Fibonacci retracement level connects near the $57 mark. The uptrend suggests that crude oil price moves to test the $60 and will find resistance at $65 into 2021.