A few things about forex trading are as scary as Fibonacci. Even the sound of the name itself gives you chills, but it should not be that way. The concept of Fibonacci is identifiable everywhere, from nature to architecture and art. Drawn from the divine ratio, otherwise called Phi, Fibonacci is simply a mathematical derivation of the ratio.

In forex trading, traders and forex expert advisors alike rely on technical analysis to find the most opportune moments to enter or to exit a trade position. Technical analysis entails studying past price movements to determine possible future movements. Further, technical analysis is a technique that traders use to test trading strategies. Mainly, technical analysis provides critical insights about what one can expect if one followed a specific price pattern.

Understanding the Fibonacci indicator

Fibonacci is one of the best forex indicators for automated trading, as well as manual trading. The usage of the indicator is based on the mathematical theory behind the Fibonacci levels. The mathematical theory is the brainchild of Leonardo Fibonacci, an Italian mathematician, and an enthusiast of the Golden Ratio. This ratio is 1.618 or 0.618, depending on the direction you look at it, where 0.618 is the inverse of 1.618. The ratio is divine or golden because it is identifiable in nature, art, architecture, and many other places. Greeks call the ratio Phi.

Interestingly, Fibonacci manifested the divine ratio using a series of numbers, where a number is the sum of two preceding numbers. This series can go on to infinity. For example; 0,1,1,2,3,5,8,13,21,34,55,… Curiously, 3 is the sum of 2 and 1, 5 is the sum of 2 and 3, and so on. Further, dividing 5 by 3 gives 1.6667, dividing 8 by 5 gives 1.6 and so on. It goes on until the ratio comes closer to 1.618.

The Fibonacci lines (tools for Fibonacci trading strategy)

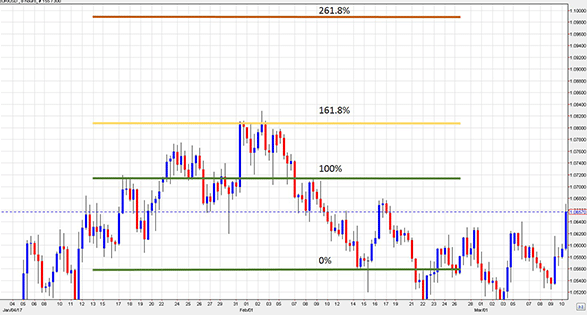

Traders and FX expert advisors use the ratio to derive what they call the Fibonacci lines. Usually, these lines represent certain percentages that traders use to identify entry and exit points during trading. The lines form a grid that starts from level 0 to level 100. However, the levels could be extended past the 100 level.

Mainly, traders focus on the price levels that lie within the Fibonacci lines. This way, the traders can identify possible signs of a trend reversal when they study the candles within the 0 to 100 grid. For candles beyond the 100 level, it indicates that the trend will continue.

The Fibonacci lines are crucial in what traders call Fibonacci retracement. Fibonacci retracement is one of the best forex charting tools relied upon by traders to set up trading strategies. This technique helps massively during technical analysis. Usually, the level 0 of the Fibonacci grid lies on the extreme downside of a price chart while the level 100 rests on the extreme upside of the price chart. Then, special lines, each representing a certain ratio derived from the Fibonacci series, divide the space between 0 and 100. Each ratio is expressed as a percentage.

These lines are crucial towards the identification of possible resistance and support levels on the price chart. However, sometimes the market might swing past the 100% line. Here,you need to extend the Fibonacci lines past the 100 level.

Fibonacci trading strategy

Having understood the Fibonacci concept, it is time to put the tools to work. The most simplified Fibonacci trading strategy is one where you focus on trends and retracement levels. Usually, the retracement lines establish essential support and resistance levels. These levels are critical towards helping you to know when the best time to enter a trading position is. In automated trading, you can configure the system to watch out for retracements that signal a momentary pullback. Once the price pulls back and encounters resistance or support, you can now enter the trade.

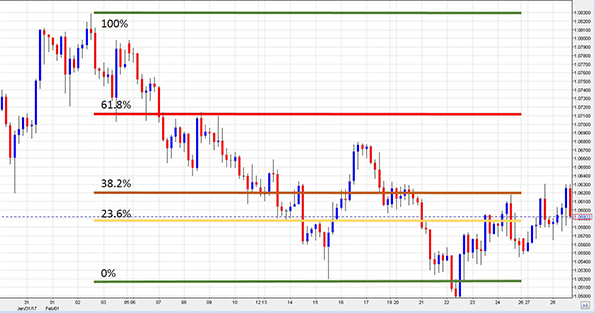

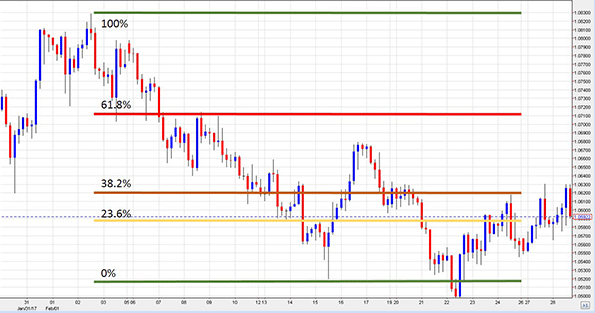

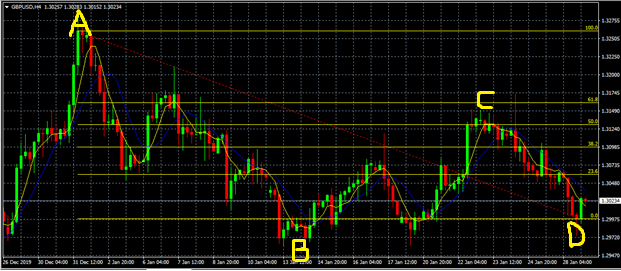

In the image above, we have drawn the Fibonacci retracement lines over a GBPUSD price chart ranging from 26 December 2019 to 29 January 2020.

The GBPUSD four hour chart above shows that a downtrend started on 31 December 2019 at point A. This downtrend continued until the price bottomed out at point B on 13 January 2020. Then, the price attempted a retracement only fall back to a Fibonacci retracement level 0. However, the price picked up some positive momentum and climbed a little past 50.0% Fibonacci retracement level at Point C on 22 January. After that, the price tumbled steadily to point D on 28 January 2020.

From the Fibonacci trading strategy presented in the price chart above, you had the opportunity to short the GBPUSD at point C because of the resistance level at 61.8% Fibonacci retracement level. However, Fibonacci retracement alone is not enough to enable you to identify the right trading opportunity. That is why in the chart above, we have added a 5-period simple moving average (yellow line) and a 10-period simple moving average (blue line). Whenever these two cross, they signify a possible trend reversal. As you can see at Point C, the two lines crossed.