Typically, a forex trader has two aims: First, to minimize losses; second to maximize profits. It is the reason why many traders are opting for forex expert advisors because they are better at achieving the objectives. Notably, expert advisors are not susceptible to emotions and, hence, the probability of making a mistake is low.

Expert advisors and human traders alike rely on specific strategies to beat the market. Usually, trading strategies entail detailed technical analysis and in-depth market research. Traders prefer FOREX expert advisors on most occasions because they are better at thorough and comprehensive market research. Mainly, expert advisors rely on special algorithms to dredge information concerning the specific currencies or commodities that you want to trade. This way, you get to trade with your eyes open.

What is a breakout trading strategy?

A breakout trading strategy is one that leverages the sudden spike in the price of a currency pair. Interestingly, one needs to understand breakouts so that they can learn to leverage them. , a breakout is the situation where the price of a currency pair breaks past the resistance level or the support level.

However, the breakout depends on the level of support or resistance that you choose to use. If a breakout occurs when the price breaches the resistance level, it means the market is entering a bull phase and that traders should go long. The opposite is true when the breakout happens on the downside. Usually, many traders who opt for automated trading set up their systems to recognize breakouts. It is what forms the core of breakout trading strategies.

Nonetheless, traders face the challenge of fake breakouts when using this strategy. The risk of fake breakouts is higher when the trader is using a forex EA because the system may fail to recognize it. Therefore, you need a highly responsive system if you are going to trust it with your money. Even for human traders, it is not easy to recognize fake breakouts, making it difficult to avoid them. However, a good forex breakout trading strategy should prevent false breakouts.

How to avoid false breakout

Before we go over the types of forex breakout trading strategies, you must learn how to avoid false breakouts. This way, you can also train your algorithmic FX trading system to avoid such situations. In the end, you will be able to maximize profits and minimize losses. Here is what you need to do.

- Continuously adjust the resistance and support levels

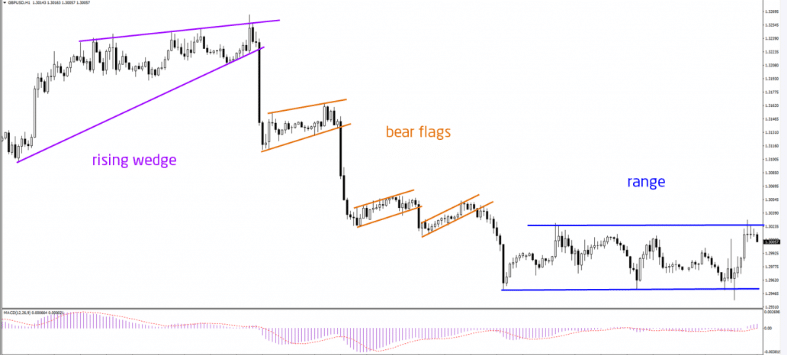

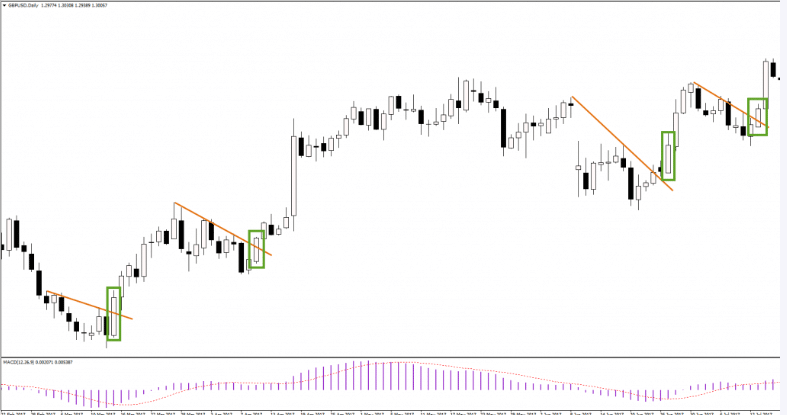

Successful traders listen to the market and do as it commands. Even if you are using an automated forex trading system, you need to configure it in a way that it can recognize changes in the roadmap of the price and adjust accordingly. Particularly, a trader should always realize that the price does not follow a fixed path, even when your technical analysis says so. Also, you must be able to recognize chart patterns. This way, it will be easy to know when a breakout trade setup is appearing.

- Observe the strength of candlestick close

Candlesticks close at different strengths. Usually, a candlestick that closes closer to high or low levels indicates strength. Therefore, the situation is a strong bullish breakout if the candlestick closes nearer the high level than the low. The opposite suggests a robust bearish breakout.

Types of forex breakout trading strategies

Breakout strategies depend on the momentum of the price action in the market. It means the most effective breakout trading strategies rely on momentum indicators. Specifically, these indicators help the trader or the FX EA to anticipate the direction of the price action and strength of the breakout. It is important because breakouts are sudden spikes that die out very fast. Therefore, you may miss out if you are not quick enough to spot the breakouts and to utilize them. Here are some helpful strategies.

ATR momentum

To be sure, momentum is the best moneymaker for forex traders, but it could also go wrong. The biggest challenge when using momentum candles to earn from the market is that candles can reverse suddenly. For example, you might be chasing a bullish candle only for the trend to turn sharply into a bearish direction in the next candle. However, you are most likely to find yourself in this situation if you rely more on guesswork.

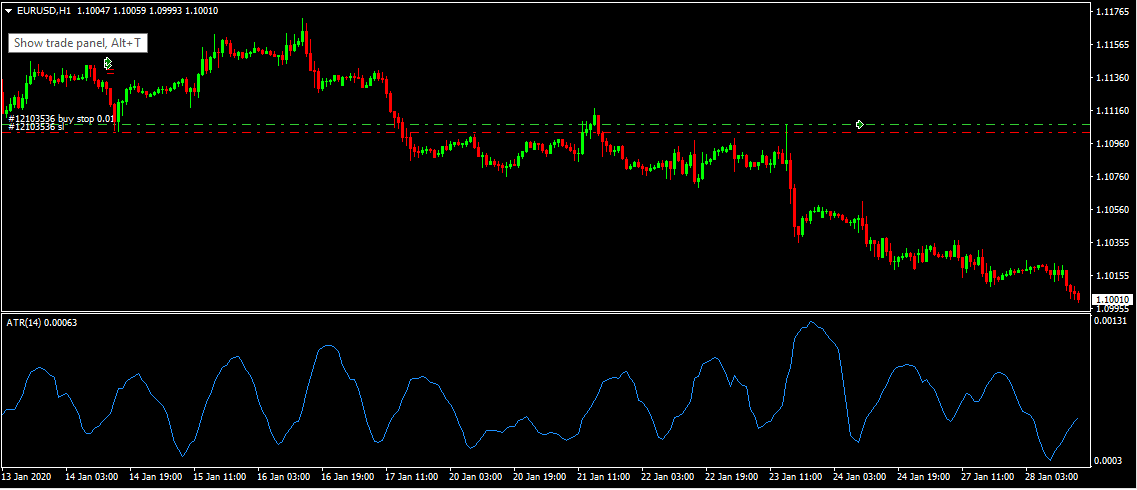

Fortuitously, the ATR momentum strategy for breakout trading helps to get the guesswork out of trading. This strategy is even more effective when you are using a forex robot. The strategy has a set of rules that enable traders and automated FX trading systems to avoid momentum candles with a low probability of breakout.

In the image above, the ATR indicator helps the trader to filter out weak momentum candles. This indicator is also helpful to expert advisors when trading breakout strategies.

Fisher Gator Reversal strategy

Breakouts are excellent indicators of the direction of the price action in the market. However, they can also tell you if a reversal is in the offing. For example, breakouts can help a trader to notice when the price action in the market is losing momentum or an increasing momentum. Usually, this happens when candles begin to close at lower highs or higher highs. Therefore, modeling a breakout trading strategy around this phenomenon helps you to take advantage of trend reversals.

This trading strategy uses a total of three indicators i.e., the R Gator, the MA Ribbon Filled indicator and the FBS Fisher indicator. Used alongside each other, the indicators help the trader to confirm whether a trend reversal is happening or not.