Forex hedging is a common trading strategy that traders, as well as forex expert advisors, use to offset the risk of price fluctuations in the forex market. Unlike other trading strategies such as scalping, trend trading, or positional trading, hedging seeks to reduce unwanted exposure to currencies from other positions.

Understanding Forex Hedging

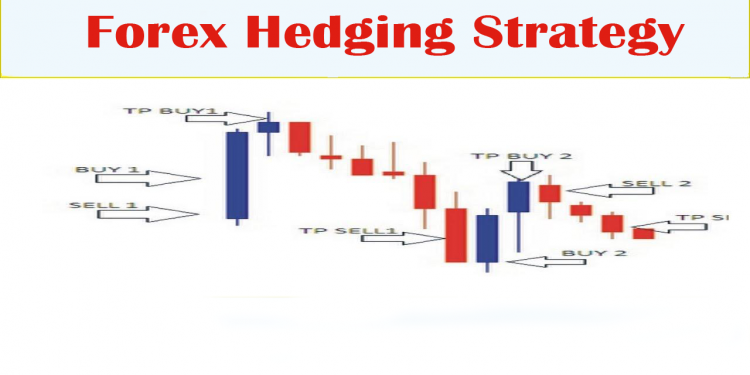

In its purest form, hedging is simply the opening of new positions, either manually or with the help of forex robots in automated trading to protect existing positions from adverse events. Likewise, it involves holding two or more positions at any given time to offset losses from the first position with profits from the new position opened.

Hedging is not a precept of the financial market. It occurs in our day to day lives, as well. For instance, people take insurance covers on properties and assets as a way of protecting underlying them from adverse events. While hedging cannot prevent an adverse event from occurring, it does go a long way in minimizing the losses that might occur.

In the financial markets, traders, as well as automated FX trading systems, deploy three types of hedging strategies to mitigate losses on underlying portfolios. Direct hedging is popular and the most deployed hedging strategy. The strategy involves opening a second position on the same asset but this time in the opposite direction.

Trading Safe-havens is another popular trading strategy deployed in times of crisis in the financial markets. Safe havens are simply forex trading instruments that tend to increase in value in times of economic downturn or geopolitical tension. Gold is one of the best safe havens that investors go to in times of financial crisis. Gold is often used to hedge against inflation, which comes into being’ in times of economic or financial crisis.

Two Currency Pair Hedging Strategy

Two pair currency hedging remains the most popular and common hedging strategy deployed in the forex market by traders as well as the Algorithmic FX trading system. Unlike the other two strategies, two currency pair strategy involves focusing on two correlated currency pairs when hedging.

EUR/USD and GBP/USD are the two most popular currencies in the forex market when it comes to hedging. Conversely, consider that EUR/USD is moving up as the EURO continues to strengthen against the dollar. However, after some time, it might become clear that the dollar might strengthen in response to new economic releases in the U.S, such as the retail sales data or the Non-farm payroll.

In this case, if a trader is long the EUR/USD, pair he or she might look to hedge the position against short-time price fluctuations triggered by an upcoming event in the U.S. The hedge, in this case, could come in the form of entering a short position on the GBP/USD pair.

By opening a short position on GBP/USD, a trader or FX Expert Advisor would essentially be betting on the U.S dollar strengthening against the British pound as well as the EUR in the previous long position on the EUR/USD.

Conversely, any gains accrued on the GBP/USD short position would go a long way in offsetting losses accrued on the long positions on the EUR/USD currency pair.

The two-pair hedging strategy also finds excellent use in the stock market. In this case, traders look for stocks of companies trading within the same industry for hedging purposes. Consider Twitter, and Snap ink all operating in the social networking space. If one is long Twitter stock, he or she could open a short position on Snap stock as a way of mitigating any losses on an upcoming event likely to take a toll on stocks trading within the social networking space.

Two pair hedging risk

It is important to note that a two pair hedging strategy does not generate the desired outcome all the time. As one of the most important forex trading risks, traders, as well as Automated FX trading systems, should always be aware of all the risks that the strategy can give rise to.

For starters, hedging more than one currency pair or stock increases the risk exposure in an investment portfolio. For instance, opening a short position on GBP/USD to militate against losses on EUR/USD would amount to increasing short exposure to the pound and long exposure to the euro.

Likewise, there is always a possibility of one position in the two pair hedge process generating more profits or losses than the other position. Therefore it is important to ensure there is a balance between the two positions.

Conclusion

Two-pair currency hedge is a simple hedging strategy that can be used by novice traders as well as forex robots to militate against losses on one position. The strategy only requires one to understand how pairs are correlated and how they are likely to react to various adverse events in the market. Conversely, the most important step in hedging is choosing the right forex pair to trade and hedge.