Using proper tools can significantly increase your profitability. The great thing about trading Forex and CFDs is that the majority of the resources to analyze the market are free.

First things first – measure the risk!

The first thing the professional trader needs to take care of before placing any trade is the risk. How much do you plan to risk on the trade? What is the appropriate size of your position according to your planned risk per trade? Position Size calculators can help you answer those questions quickly and easily.

Position Size Calculators are programs that help you in calculating the position size of your trades. Size calculators will help you to stay focused on making good trades without getting distracted by calculations.

Many brokers and other trading-focused websites offer position size calculators. You can also download the app on your phone. “Stinu” is one of the most user-friendly position size calculator apps available.

Price based tools

No, these aren’t common technical indicators. The following tools allow you to choose the right instrument and measure the risk better.

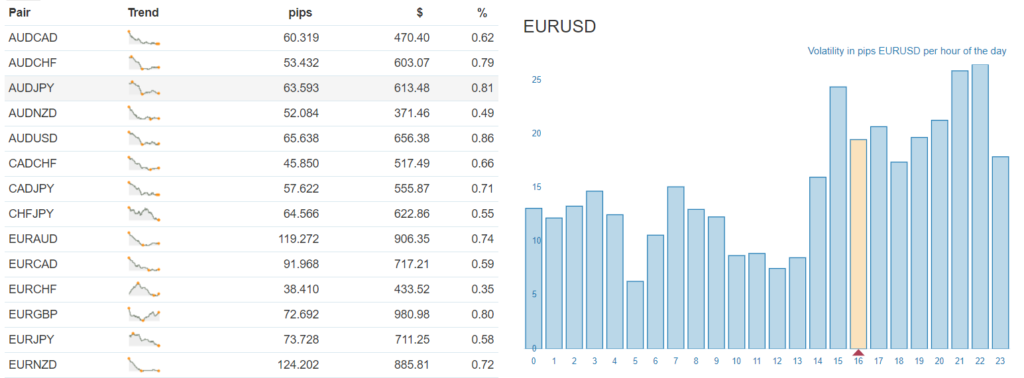

Volatility

Trading focused websites and brokers usually offer the tool to measure the average volatility of an instrument. You can see how volatile the instrument is during a particular period: time of the day, week, or a custom time, say ten weeks.

When you decide whether to make a trade or not, check the instrument’s volatility. The best time to trade is often during the peak volatility times.

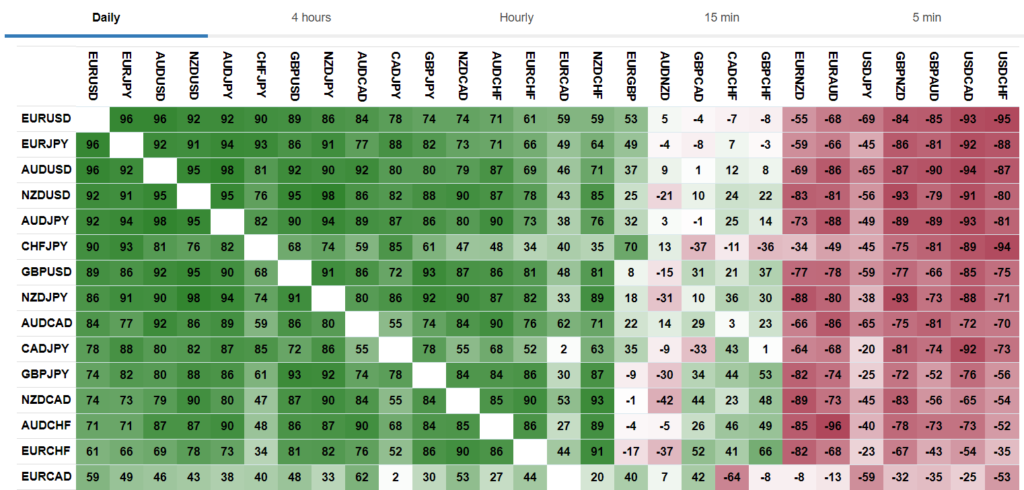

Correlation

Similar to the volatility tool, the same websites often offer the correlation tool. If you don’t limit yourself in the number of the instruments you trade and the positions you hold simultaneously, it’s easy to unintentionally get in correlated instruments.

If you hold correlated positions, the instruments move similarly, exposing you to the additional risk. To avoid that, before opening a trade, check the correlation of the instrument you intend to trade with the instrument you already have a position in.

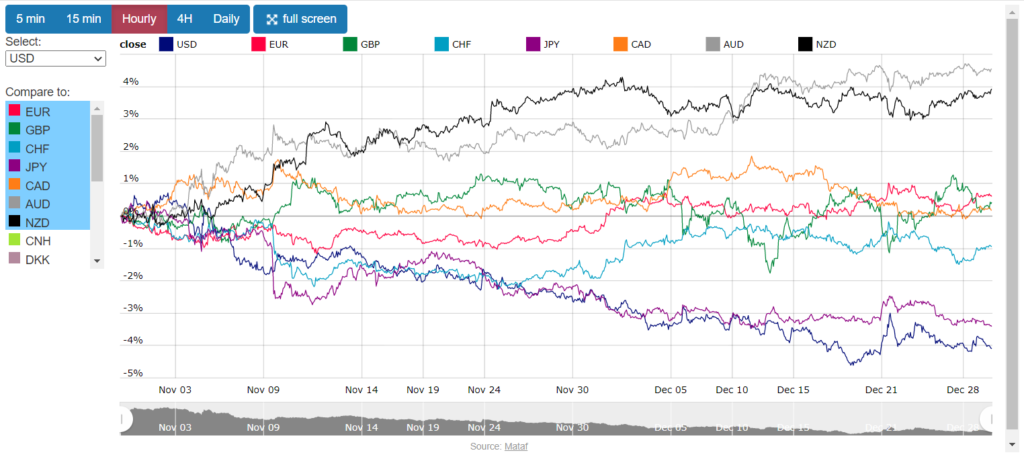

Currency strength index

Fewer websites offer this tool. However, there are also technical indicators to show similar data. The currency strength index enables you to choose the best pair to execute a trade idea. As the index measures the strength of currencies against each other on a relative basis, you can tailor the pair that has the biggest move potential.

For example, the best opportunities lie in the pair, where both currencies diverge in opposite directions. Therefore, you would buy the strongest at the moment and sell the weakest.

Events-based tools

The following tools can help you to cope with market uncertainty and protect your capital. In trading, it’s vital to know when to trade (or when not to) and understand the context of the market environment. The tools below can help you with that.

Economic Calendar

The tool helps you track the planned data releases and other important events that can move the markets. The events like Interest Rate Decision can cause extraordinary volatility, making it impossible to control the risk due to inconsistent liquidity. You don’t want to be caught up in the unexpected wild market fluctuations and damage your account.

I suggest you avoid trying to predict how the market reacts to the events from the calendar. Instead, have an attitude that “something may happen” during the time of the release. Therefore, you would need to be particularly alert and risk-averse regarding your existent positions.

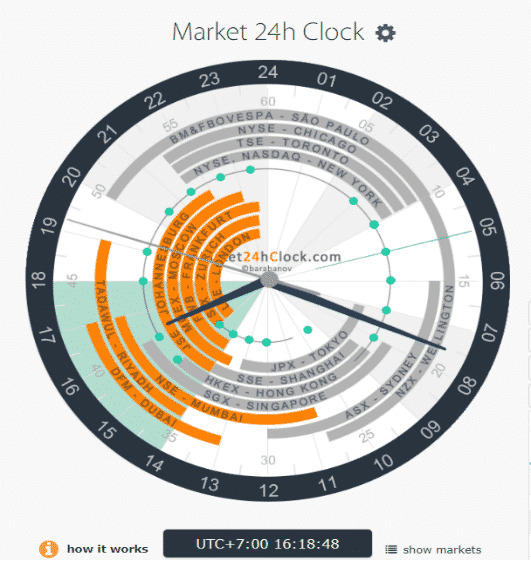

Market clock

The clock shows you what trading session the market is currently in and what the upcoming sessions are. Trading forex, you should be particularly aware of trading sessions. As trading is going on for 24 hours, different economies participate in the process, with their unique sentiments.

In general, every first and last hour of a trading session offers more liquidity and volatility, so it’s reasonable to plan your entries around those time windows.

Many trading websites offer some sort of market clock. If you pay a few dollars, you can also download the clock app on your phone and conveniently track the sessions. Many of such apps offer alerts to signal when the session opens and closes or a certain time beforehand.

News streaming source

Many brokers offer some sort of a live news streaming plugin, either on their website or on the trading platform. One of the most popular free news streaming resources available is forexfactory.com/news. The website gathers articles from different sources, including the most popular news agencies like Reuters, Bloomberg, BBC, etc.

If you want to customize to some extent the sources, and get the updates in the fastest manner, use social media to your advantage! Twitter remains one of the most popular platforms to provide the most up-to-date news. Specifically, I suggest using the TweetDeck, which is a dashboard where you see the tweets in an organized way from several accounts on a single screen.

A good way to use the news is to view them in relation to the current price action. If suddenly you notice the increased volatility, check the TweetDeck. Some of the accounts might tweet some sort of “Breaking news” with an explanation of what happened. Use this information to confirm the “in-play” mode of the market, and then act upon what you see the price action is doing.

Tools for professional growth in trading

The following tools are the classic means of self-improvement in trading and must be part of the arsenal of anybody who expects to be in this business for the long-run.

Trading journal

We talked about the trading journal a lot previously. In short, this classic tool helps a trader to track the progress and learn from his/her experience. The journal is particularly useful in overcoming losing streaks.

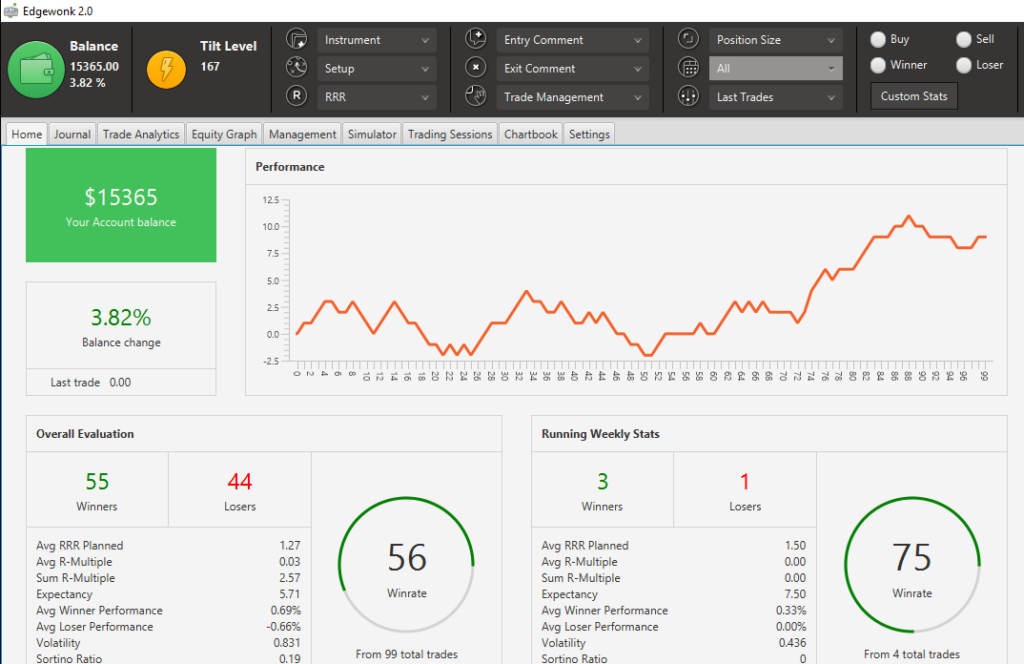

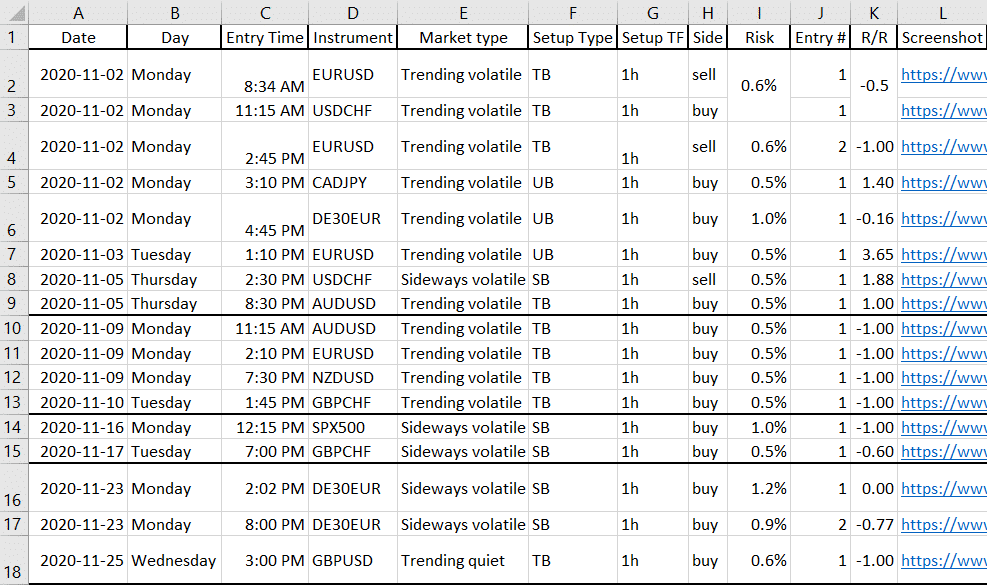

Statistical data

This is your trading statistics database showing you the key metrics of your performance, such as R/R ratio, Win rate, Expectancy, etc. These are the fundamental data points to run your trading business efficiently. Based on the metrics, you can adjust your trading approach to improve profitability.

The dataset is often part of the trading journal. Many online trading journal services provide you with everything you need to successfully document your trades, automatically calculate various trading metrics, etc.

The advantage of the online services is that you don’t need to manually enter the data of every trade. Instead, you can just upload your statement to the website, and they will calculate everything for you! You can save a lot of time and eliminate any mechanical mistakes. Online trading journals are usually subscription-based, ranging from around $100 to $180 yearly.

You can also create your statistical database in Excel, adjusting it to your personal needs, and saving on any sorts of fees.

Final words

Depending on your trading style, you will use different tools described above. Don’t overwhelm yourself by employing everything at once. However, you should start using the most critical tools like position size calculator, Economic Calendar, and trading journal as soon as possible. Keep an eye on the rest of the tools; as you gain more experience, you will notice which one of them is worth adding to your regular arsenal.