We Like:

- Different accounts to cover diverse clients’ needs

- Regulated by top-tier agencies, for example, the FCA

- A wide range of trading assets

- Instant execution of orders

- Top client funds security through segregation

- No hidden commissions

- Tight spreads

- Multiple trading tools

- Spreads 0.0 pips for the advantage account

- All accounts are swap-free

- Ability to copy strategies from over 5,000 expert traders

- Numerous payment channels

- Multilingual customer support team available 24/7

- Negative balance protection

We Don’t Like:

- High trading fees on Stock CFDs

- Trading commissions of $0.40-$2 at the advantage account

- Inactivity fee after six months of $5 every month

- Withdraw fees on several methods

- Fees on traders using the MetaTrader 5 platform

The Verdict:

The broker operates as an online brokerage platform offering clients access to the FX and CFDs markets. The broker launched in 2011 under the wings of the Exinity Group Ltd. and, over the last ten years, metamorphosed into one of the conglomerate’s successful brands.

It serves more than two million traders from 180 countries around the globe and prides itself with a 25+ award portfolio. Its clients trade a pool of instruments through an STP/ECN execution and tight spreads.

The instruments trade on the world’s braced trading platforms, the MT4, and the MT5. However, FXTM also offers its proprietary trading platform, dubbed the FXTM Trader. All platforms integrate with trading tools paving the way for a unique trading environment.

Company details

Exinity Group launched an online trading brand in 2011 dedicated to linking clients to the FX and CFDs liquidity markets. The brand, now known as the FXTM brand, deems itself a global leader in the trading industry as it serves two million+ traders from 180 countries worldwide.

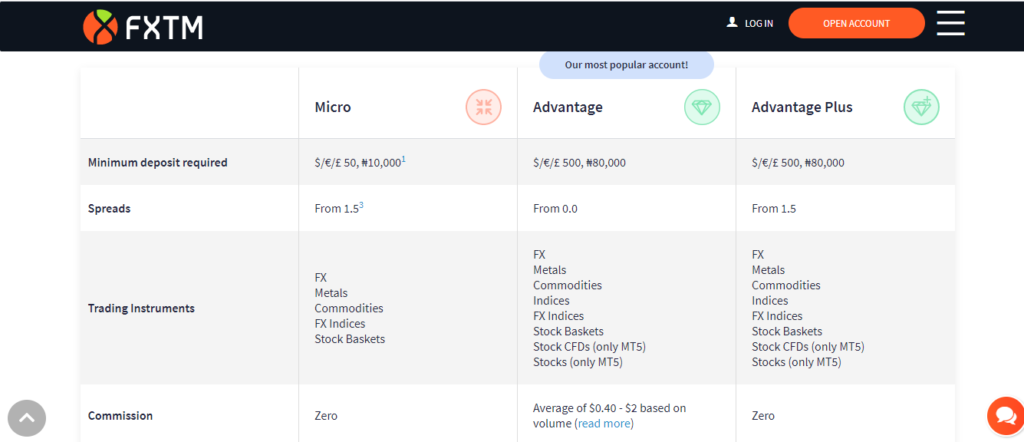

FXTM provides brokerage services to its many clients through an STP/ECN execution. The traders experience fast execution of orders and tight spreads starting from 0.0 pips. However, only the advantage account clients access such low spreads. The typical spread on the other accounts (micro and the advantage plus accounts) starts from 1.5 pips. The broker offers the following accounts:

- The micro account

- The advantage account (preferred by most clients)

- The advantage plus account

Trading with FXTM means you are dealing with an established broker. The company holds several trading licenses from top-tier and second-tier agencies and operates subsidiary offices in the UK, South Africa, and Nigeria. However, its main office operates in Limassol, Cyprus.

Briefly, FXTM holds trading licenses and authorities from the following regulatory agencies:

- The FCA

- The CySEC

- The FSCA

- The FSC of Mauritius

The solid regulation gives it traction to offer a pool of trading instruments through its platforms. Clients from different pockets of the world access the following instruments:

- Currency pairs

- Forex indices

- Commodities (precious metals & energies)

- Indices

- CFD stocks

Clients trade these instruments using the FXTM trading platform available as a mobile App and the MT4 and MT5 platforms. However, the broker offers MT4 and MT5 in several applications as they are the prime trading applications. Traders access these platforms via the web, as mobile apps on both IOS and Android, and as a desktop application on Windows and the Mac OS. In contrast, all its platforms integrate with plugins that aid in trading.

The integrated tools include:

- VPS trading for forex

- MT4 indicators

- Profit calculators

- Currency converter tool

- Trading signals

- Pivot points strategy tool

Due to its established trading imprint across the globe, FXTM offers diverse payment methods to meet the requirements of traders in different locations. The deposit/withdrawal methods extend from domestic local banks’ channels to modern online wire transfers like FASAPAY and E-wallets.

Briefly, they include:

- Domestic Bank wire transfers (depending on your region)

- Bank cards (Visa, MasterCard, Maestro)

- E-wallets like Skrill and Neteller

Note: FXTM accepts deposits in major currencies like USD, EUR, and GBP. It also waives all fees on deposits.

Regulations

ForexTimes anchors several reputable regulatory bodies already mentioned in this review. The regulatory agencies ensure the broker conducts transparent operations and the safety of clients’ assets. FTXM claims to offer solid security to clients’ funds through segregation (separating the traders’ money from the broker’s operating capital).

They include:

- The Financial Service Commission (FSC) of Mauritius — FXTM holds license № C113012295 from the agency.

- The Financial Conduct Authority (FCA) in the UK — the broker has the license № 777911.

- The Financial Sector Conduct Authority in South Africa — the body credited FXTM with the license № 46614.

- The Cyprus Securities and Exchange Commission — FXTM holds license № 185/12 from the second-tier regulatory body.

Trading platforms

As already reiterated in this review, FXTM offers three main trading platforms as different applications. Clients access markets using MetaTrader 4 and its predecessor MetaTrader 5 and the broker’s proprietary trading platform, the FXTM Trader.

As we noted, the MetaTrader platforms are in different applications to suit many clients while the FXTM Trader operates only as a mobile application. But all the platforms integrate seamlessly with EA tools and other trading tools. Let’s analyze each platform’s features ahead of selecting the platform to trade with at FXTM.

FXTM.com proprietary trading platform (The FXTM Trader)

Rolled out features:

- Live currency rates 24/5

- Keep track of your trades with the trading dashboard

- Manage your accounts from the same App

- Unlimited access to “MyFXTM” for fast deposits and instant withdrawals

General features:

- Ability to open, close, and modify positions in seconds

- Also available on multiple devices

- Fully integrated with chart tools and indicators

- No extra plugins to be added

- Easy to track the opened and closed positions

- One-click through trading for all instruments

MT4 trading platform

The MT4 trading platform is braced as a world-class financial trading platform. The platform rolls out unique trading features like MLQ4 that allows traders to develop strategies using their own EA advisors, indicators, and other tools. MT4 aids financial trading globally for many brokerage platforms.

At FXTM, it acts as the broker’s pillar trading platform serving all traders using FXTM’s accounts. It allows them to buy and sell assets in the FX and CFDs markets without any commissions. In brief, its features include:

- Provides access to a range of markets

- Interactive charts to monitor and analyze the markets

- Access to more than 30 technical indicators

- Powerful security system and multi-device functionality

- Instant real-time quotes

- All execution models available

- Trading history offered

- Available in more than 20 languages

MT5 trading platform

It was launched as a predecessor of the MT4 trading platform with more advanced trading features. The platform offers traders the latest technology that opens a doorway for newbies and veteran traders to the financial markets.

Clients rank the platform as the leading in trading and the future platform for trading FX and CFDs. At FXTM, traders access MT5 on multi-devices and in over 30+ languages. In detail, the features include:

- Access to all markets.

- Fundamental technical analysis tools

- Built-in copy trading and automated trading

- Integrated economic calendar and email system

- 44 graphical objects

- Multi-threaded strategy tester

- Funds transfer between accounts

- MQL5 chat allows clients to interact

- Customized interface

- Access to global news

NB: clients using the MT5 platform incur trading commissions

Comparison between MT4 & MT5

| MetaTrader 4 | MetaTrader 5 |

| Number of supported types of order execution — three Partial order filling policies — no Additional order execution conditions — fill or kill Number of pending order types — four Netting allowed — no Hedging allowed — yes Market in-depth — no Number of technical indicators — 30 Number of graphical objects — 31 Time frames — nine Economic calendar — no Email system — yes (without attachments) Strategy tester — single thread MQL5 chat — no | Number of supported types of order execution — four Partial order filling policies — yes Additional order execution conditions — fill or Kill, immediate or cancel return Number of pending order types — six Netting allowed — yes Hedging allowed — yes Market in-depth — yes Number of technical indicators — 38 Number of graphical objects — 44 Time frames — 21 Economic calendar — yes Email system — yes (with attachments) Strategy tester — multi-threaded, multi-currency, real ticks MQL5 chat — yes |

Range of markets

Only two categories of markets trade in the world of finance. Traders can either trade the Forex market or the CFDs markets. Trading of CFDs includes assets such as indices, stocks, commodities among others. At FXTM, the traded markets exhibit both the FX in:

- Currency pairs

- Forex indices (not available to the Micro account traders)

and the CFDs markets in:

- Commodities such as metals and energies

- Stocks (stock CFDs and Stock Baskets)

- Indices

Forex & FX indices

The FXTM forex market runs 24/5 and includes all major currencies and pairs like the USD, EUR, JPY, among others. Traders trade Forex pairs such as the EUR/USD with spreads starting from 0.0 pips and leverage of up to 2000:1 on the broker’s popular account, the advantage account.

On the other hand, FXTM also allows clients to FX indices. FX indices are composed of five to six currency pairs that trade against one strong currency. If the price of that one currency rises against the five or six pairs, the value of the index increases.

FX indices are popular with clients who prefer to diversify their risk instead of investing in the price movement of one currency pair. At FXTM, only clients using the advantage account trade FX indices.

Examples include:

- GBP index

- USD index

- EUR Index

- JPY index

- AUD index

- NZD index

Stocks, stock CFDs, stock baskets

FXTM allows clients to trade major US and Hong Kong stocks with zero commissions. Trade can buy and sell stocks of companies like Facebook, Tesla, and Apple with real-time customer support access.

The minimum deposit to trade as little as one share or an entire portfolio is only $500. The assets trade on the largest exchanges in the world like:

- NYSE

- NASDAQ

- HKEX

Traders also buy and sell price movements of shares from notable brands like Apple and Alibaba. The stock CFDs apply to clients using the advantage account and, more so, the MT5 platform. Spreads for stock CFDs start from as low as 0.1 pips, but the clients incur a $4 fixed commission per lot.

FXTM’s stock basket consists of all the client’s companies customized by the broker’s experts into indices and trades with a single trade. Basically, they simplify the best companies that a client trades on stocks based on industries and global trends such that the client trades all at once.

Commodities

Commodities are physical goods trading on a brokerage platform. Most traded commodities consist of precious metals and energies and trade against major currencies like the US dollar. At FXTM, the energies that trade as commodities include:

- UK Brent oil

- US Crude oil

- US natural gas

While metals such as gold and silver trade on the advantage account with spreads starting from 0.0 pips. Traders buy and sell these metals using currencies like the USD and the EUR.

Indices

Indices trade on the FXTM as CFDs with flexibility and for long hours. They help investors diversify their portfolios. Such assets on this broker include:

- GDAX

- AUS200

- ND100m

- UK100

- SP500m

Main features

FXTM’s general features that make trading easy and open a gateway to profitability, include:

- Daily Market Analysis — a forex news portal that provides clients with market analysis and insights.

- FXTM trading signals — technical analysis tool that provides high-quality data of market fluctuations on several instruments.

- FXTM pivot point strategy — helps clients build on their strategy skills.

- Economic calendar — keeps clients up to date with economic indicators, news, and charts.

- Forex news timeline — provides investors direct access to the world’s live market news.

- Currency converter — helps traders calculate the foreign exchange rates of the major FX currency pairs.

- Margin calculator — helps calculate risks when trading.

- Pips calculator — accessed free and helps estimate potential profits or losses.

- Profit calculator — helps determine positions likely to yield profits.

Types of trading accounts

At this point, you might have caught the wind about the accounts offered at FXTM. But just to brainstorm, they include:

- Micro account

- Advantage account

- Advantage plus account

However, besides just listing, we will dive deeper and analyze each account’s details.

The Micro account

- Minimum deposit required — $50

- Starting spread — 1.5 pips

- Trading Instruments — FX, commodities like metals, stock baskets

- Commission — zero

- Platforms — MT4

- Accepted Deposit Currency — USD, EUR, GBP, NGN

- Leverage — (fixed) up to 1000:1 {for forex} and up to 500:1 [for commodities]

- Order execution — Instant Execution

- Margin call — 60%

- Stop out — 40%

- Swap-Free — yes

- Limit & stop Levels — one spread

- Minimum volume in lots per trade — 0.01

- Maximum number of orders — 30

- Maximum number of pending orders — 100

The Advantage account (FXTM popular account)

- Minimum deposit required — $500

- Starting spread — 0.0 pips

- Trading Instruments— FX, commodities like metals, Indices, FX indices, stock baskets, stocks, and stock CFDs (only on the MT5)

- Commission — between $0.40-$2 (based on the volume)

- Platforms — MT4 & MT5

- Accepted deposit currency — USD, EUR, GBP, NGN

- Leverage — (floating) up to 2000:1

- Order execution — market execution

- Margin call — 80%

- Stop out — 50%

- Swap-free — yes

- Limit & stop levels — no

- Minimum volume in lots per trade — 0.01

- Maximum number of orders — unlimited

- Maximum number of pending orders — 300

The Advantage Plus account

- Minimum deposit required — $500

- Starting spread — 1.5 pips

- Trading Instruments — FX, commodities like metals, indices, FX indices, stock baskets, stocks, and stock CFDs (only on the MT5)

- Commission — zero

- Platforms — MT4 & MT5

- Accepted deposit currency — USD, EUR, GBP, NGN

- Leverage — (floating) up to 2000:1

- Order execution — market execution

- Margin call — 80%

- Stop out — 50%

- Swap-free — yes

- Limit & stop levels — no

- Minimum volume in lots per trade — 0.01

- Maximum number of orders — unlimited

- Maximum number of pending orders — 300

Opening an account at FXTM

The broker allows clients to open both a real account and a demo account of the selected account type.

However, the steps involved when opening a real account include:

Step 1: Log into their website and click the open account button.

Step 2: Fill the registration form they provide.

Step 3: Verify your account through a pin code they sent.

Step 4: Log into your trading account using the provided credentials.

Step 5: Select the account type.

Step 6: Make the required deposit.

Step 7: Download the instructed trading platform.

Step 8: Start trading.

Commissions and spreads

Just as indicated on the accounts analysis, the micro account and advantage plus account have zero commissions. However, a $0.40-$2 commission is incurred on the advantage account depending on the volume of trade. Although advantage account clients trade spreads as low as 0.0 pips while the micro account traders and the advantage account investors incur a fee on the markup spread as the spreads start from 1.5 pips.

But all clients have something to smile about as FXTM waives down all the fees on deposits regardless of the method. As mentioned, the broker offers multiple payments methods as it serves clients from 180 countries. However, some methods hike fees on withdrawals. Trading using the MT5 has some charges imposed too.

Customer service

FXTM offers clients real-time customer service made up of a FAQ section, live chat, an email button, and a callus button. The FAQ section aims to provide all the information that clients search for via queries. If the client fails to find the content inquiring about on the FAQ section, he can contact the customer support through:

- The live chat

- The email

- Or call them via the provided numbers

FXTM Review

What we liked

- Top-class customer service

- No deposit fees

- A pool of payment methods

- Good trading platforms integrated with plugins

- Unique trading features

- Easy to open an account

- Well regulated broker

- Copy-trading available

What we disliked

- High trading fees on stocks

- Fees on withdrawals

- Unfair account trading conditions (MT5 not offered to micro account traders)

- Commission on the advantage account

- Fewer instruments for the micro account

The bottom line

The broker offers multiple trading instruments in the FX and CFDs markets to clients through its real accounts. The accounts provide a good trading platform for both beginners and experienced traders. Newbies also benefit from its 5000+ expert traders by replicating their strategies using the MT5 platform.

Starting your trading journey with FXTM guarantees you the safety of your assets as the broker holds trading licenses from legitimate regulatory agencies worldwide and offers segregation of funds and negative account protection.