- The IMF forecasts Australia to grow GDP by 4.5% in 2021.

- The UK intends to join the CPTPP and increase exports to Australia.

- Manufacturing and real estate attracted the largest change in Australian FDI between 2017 and 2019.

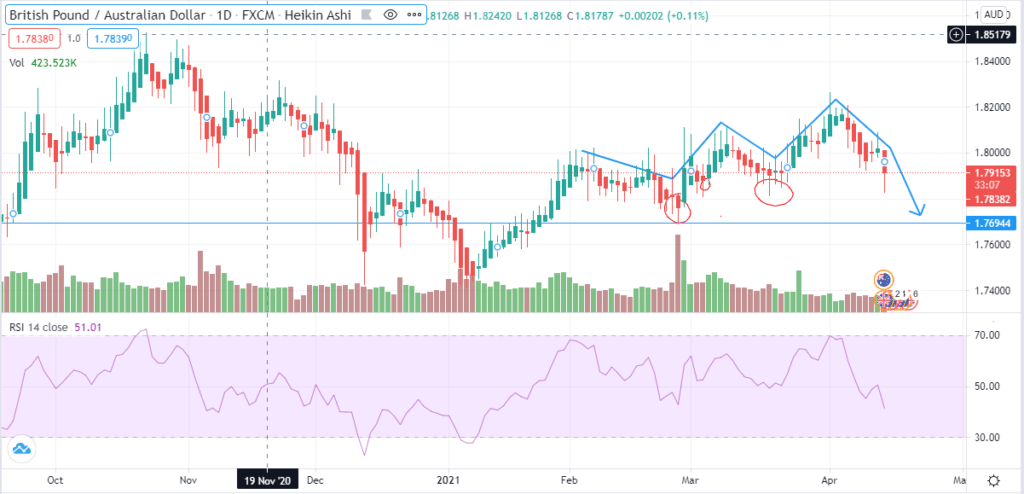

The GBP/AUD pair closed at a -0.84% price change on April 14, 2021, from the bidding price at 1.7840. The British pound took a hit after the UK’s labor productivity in Q4 2020 declined 0.7% YoY. The Coronavirus Job Retention Scheme (CJRS) reduced the rate of working hours by 5.9%. Q4 2020 also saw the multi-factor productivity (MFP) that considers the labor market’s input from workers and ICT specifics fall 0.2%.

The UK GDP may contract mildly in Q1 2021 due to the restrictions lifted on April 12, 2021. The UK plans to reopen the entire economy by the end of June 2021, with only the non-essential shops and outdoor hospitality ventures in operation.

The Australian economy has struggled to survive not just from the effects of the pandemic but from the trade war with China. Sanctions imposed by Beijing have made Australian commodities export decline by 78%. However, Australia diversified coal exports to other countries surging revenues by $9.5 billion.

Positive forecast

The IMF’s forecast for Australia in 2021 grew by 4.5% post-pandemic from a 2.4% decline in 2020. The unemployment rate is expected to reach 6.6% in 2021 before falling to 5.5% in 2022 as the JobKeeper program comes to an end.

Eleven months into Q2 2021 saw an increase in advertised roles in Australia. The Commonwealth Bank of Australia (CBA) made a positive indication that the unemployment rate would fall by at least 5% in 2021 and a further 4.7% by the end of 2022. Under the JobKeeper initiative, up to 1.1 million employees as of Q1 2021 were receiving their subsidies.

Australia’s CPI may grow towards 1.7% as inflation is contained in 2021. The Reserve Bank of Australia (RBA) kept the official cash rate (OCR) at 0.1%. Inflation is projected to reach the highs of 2.4% in 2026.

UK-Australia trade agreement

The two countries began free trade negotiations on June 17, 2020, with the GBP/AUD trading pair at 1.8231. In the financial year 2018-2019, bilateral trade between the two countries was worth $30.3 billion. In 2018 the UK came third among Australia’s largest services trading partners.

Total services trade offered by the UK to Australia accounted for 7.7% (A$15.2 billion). Common services traded include professional financial trade and telecommunication. UK’s stock investment in Australia was A$686 billion, with foreign investment at A$127 billion. The FTA will help Australia improve the investment rules, especially with the expected increase in UK imports.

Australia’s FDI as of 2019

Manufacturing attracted the highest FDIs from 101.8 in 2017 to 131.4 in 2019 (+29.08%). Real estate followed manufacturing in attracting FDIs by growing from 91.4% in 2017 to 110.9% in 2019 (+21.33%). The UK intends to increase FDIs from other countries as a post-Brexit agenda to help overcome the EU’s pressure.

The UK is on the verge of joining ranks with the 11 member block, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Stalled negotiations between the UK and Australia mean a slow-down for the UK’s accession post-Brexit. The CPTPP is touted to overtake the EU in terms of GDP growth among the member states.

Technical analysis

Daily Chart Analysis of the GBP/AUD trading pair

The GBP/AUD trading pair could not complete the three rising valley pattern. The downtrend is likely to continue. We find that the pair may find support at 1.7694 but first linger around 1.7839. The 14-day RSI stood at 51.01, indicating heightened buying activity. Investors have a positive sentiment towards the GBP as compared to the Australian dollar.