Introduction

Horn bottoms are down-trending spikes on trading charts. The pattern consists of two spikes that are visible on the weekly charts. The spikes are divided by a week and indicate a bullish reversal in the short term. Traders will notice that taller or longer horn bottoms have better prediction performance as compared to shorter ones. There is an outperformance when the right horn is found within the trading range of the left horn (or a little shorter than the left horn).

Identification guidelines

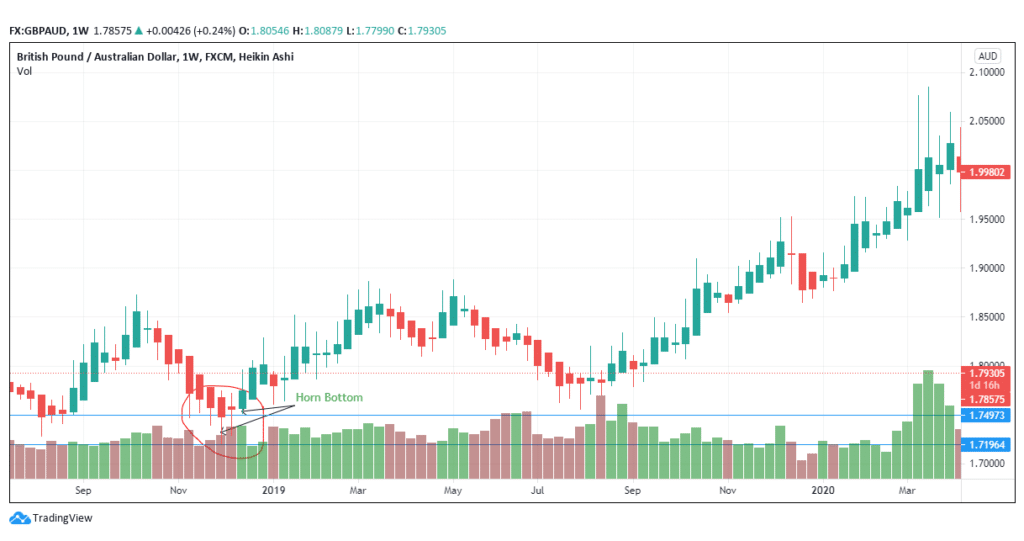

Figure 1: Horn bottom appearance on the GBP/AUD trading chart

The chart pattern in figure 1 shows how the down-trending left horn or spike is separated by a week from an up-trending right horn. The left horn reaches a low of 1.7196 while the right horn is at 1.7497. The failure rates associated with horns are low, meaning that traders will trade in a correct pattern after identifying them. Horn tops tend to signify a bearish turn, while horn bottoms indicate a bullish turn.

- Use a weekly chart

To spot a horn bottom, use a weekly trading chart. While they may also appear on daily charts, the weekly performance helps the trader to track movement and ease selections. The left spike begins on a downtrend. Note that the right horn is separated by a week.

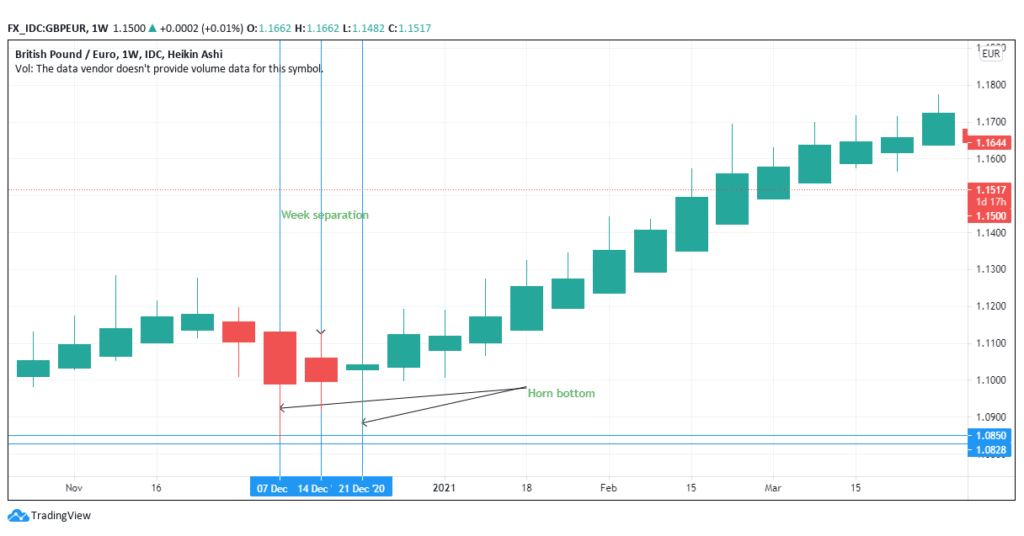

Figure 2: Horn bottom on GBP/EUR pair- weekly performance

In figure 2, the weekly chart is well elaborated- it has been enhanced to help spot the horn bottoms and the separation point. The left spike is formed from a short down-sloping trend. The price declines for a week before forming the horn bottom. The left spike starts on December 7, 2020, while the right spike is on December 21, 2020.

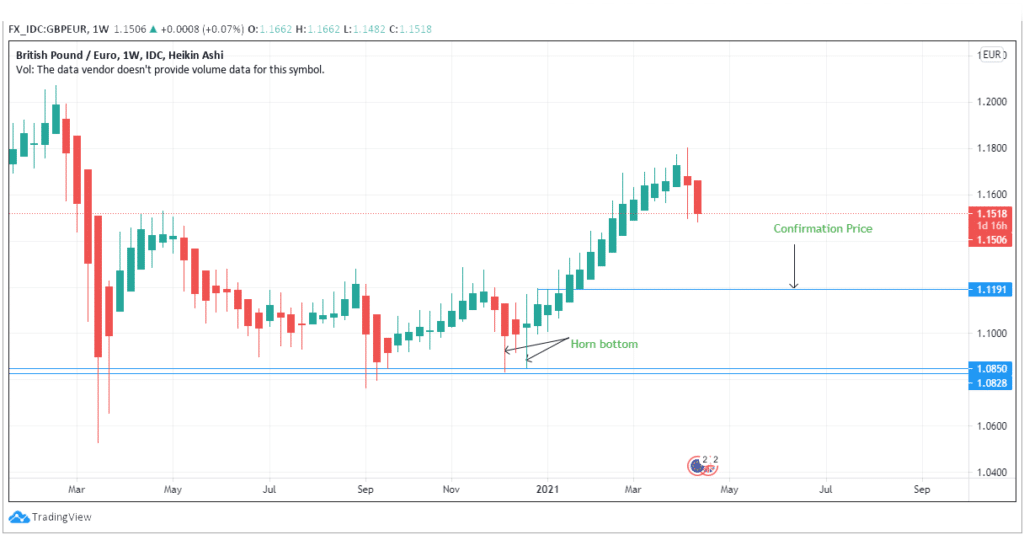

Figure 3: Uptrend before a short price down-trend leading to horn bottom

- Chart visibility

The weekly separation occurred on December 14, 2020. Notice that the closing price on the left spike is 1.0828 while the right spike is at 1.0850- slightly above but within the trading range.

The prior down-trend of price forming the left spike as noted can either be long or short. However, the determining factor is the length of the spike as opposed to the length of the prior price movement.

In figure 3, a clear depiction shows that there is a longer uptrend before the weekly down movement that gives way to the horn bottom. There is an uptrend from September 28, 2020, until November 23, 2020. This long uptrend is only separated from the horn bottom pattern by a week. Further, the bottom forms a significant bullish reversal pattern.

- Confirmation

The horn bottom is confirmed after the price closes above the highest point in the three-week pattern formation.

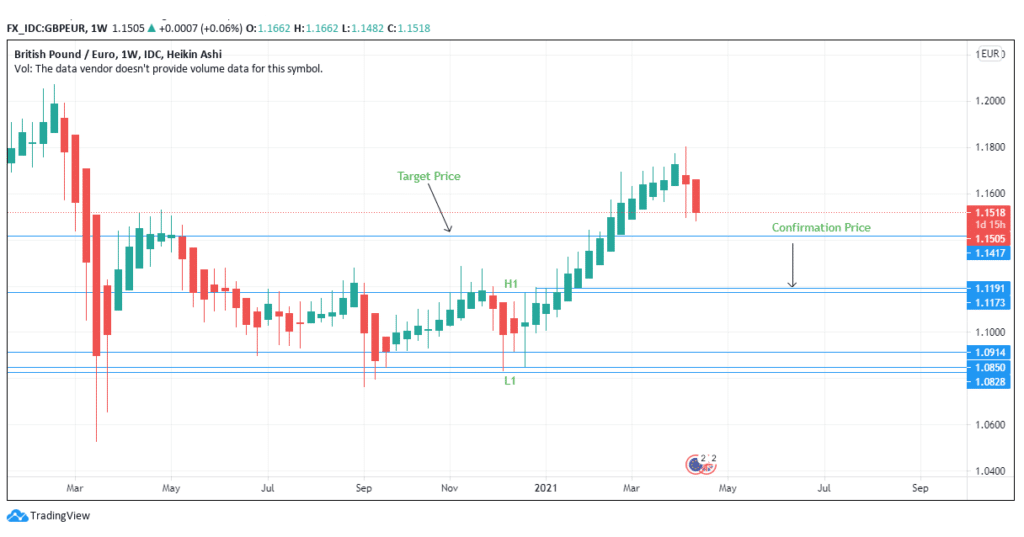

Figure 4: Confirmation price of the horn bottom

The price closes above the highest (high) position in the spike pattern. Figure 4 indicates that the confirmation price is at 1.1191. This confirmation validates the horn bottom pattern. The confirmation also helps the trader to go long. It signals a short-term bullish reversal trend.

Trading strategy

- Computation of the price target

The target price in an upward breakout is calculated by first subtracting the highest price of the three bars forming the horn bottom (H1) with the lowest point of the pattern (L1). The resulting figure should then be multiplied by 70%.

[(H1-L1) * 70%]

Figure 5: Target Price Computation in GBP/EUR

In figure 4, the highest price (H1) in the horn bottom forms at 1.1173, slightly below the confirmation line. This price is subtracted to the lowest price (L1) of the horn bottom at 1.0850. The difference is 0.0323. Take this price and multiply it to 70% or 0.7. Add the result to the confirmation price. The price target becomes 1.1417. A look at figure 4 shows that the price continues to move above the target, further confirming the valid nature of the horn bottom.

- Watch for the volume change

The volume recedes as the chart forms the horn bottom. The decrease in volume in the pattern should prepare the trader to execute a long trade or prepare a buy move. The volume is higher before the pattern as the bottom movement takes shape.

You will notice that the volume continues to rise after shifting in a bullish trend. The breakout volume is also high as the chart lengthens the price difference in the trading chart. In the case where the pattern forms in a prior bullish market the difference in performance will be minimal.

Further, the trader will need to establish if the right spike is within the trading range of the left spike. In this case, the right spike has to have a lower high as compared to a higher low (see figure 4).

The price should climb immediately after the twin spikes appear. The trader can wait for two weeks if the price does not climb as quickly after the formation of the horn bottom. In most cases, the bottom appears in the yearly low points. However, the trader should not wait for the yearly low to identify the trend shift. Action should be taken as soon as prices change from a bullish to a bearish trend or a retracement in the chart pattern.

- Use a stop Loss

Place the stop-loss option at most $1 below the lowest price point in the horn pattern when trading stocks. On average, place the stop-loss at most 20 pips when trading forex due to the minimum expected price move. The price may decide to retest the low position before the formation of the pattern rather than proceeding with the uptrend. The stop loss will protect you from the unexpected retest.

Conclusion

The horn bottom pattern represents a bullish reversal pattern. The confirmation line above the highest high in the pattern validates the pattern. The trader can decide to compute the price target before initiating the buy option. Place the stop-loss below the lowest low of the pattern to avoid the consequences of a retest.