- The UK government placed restrictions towards curbing the spread of the Delta Covid-19 variant by delaying reopening until July 2021.

- UK tourism and recreation sectors inched up to 62.4% in May 2021 (MoM) from 51.9%.

- Australia expects positive manufacturing & services PMI data for May 2021.

The GBP/USD pair gained 2.72% on June 21, 2021, from the previous day’s close. It opened at a low of 1.8367 and hit a high of 1.8496.

The British pound was accelerated by the reopening of tourism and the hospitality sectors as the UK moved away from the lockdown effect. May 2021 saw 11 out of the 14 economic segments in the UK report bigger output.

According to Recovery Tracker statistics by the UK’s Lloyds Bank, tourism and recreation sectors inched up 62.4% in May 2021 (MoM) from 51.9%. Transport also rose 63.2% (MoM) against 53.5%.

Readings above 50% show expansion among key UK sectors from April to May 2021. There was pent-up demand among hoteliers and travel agents with a resumption of strong consumption in domestic travel and logistical services. However, healthcare provision slowed 52.5% against 58.5% due to reduced client expenditures in the pharmaceutical industry.

Delta variant

The UK government placed restrictions towards curbing the spread of the delta Covid-19 variant by delaying reopening until July 2021.

As of June 21, 2021, groups of more than 30 were prohibited from meeting at social events. Restaurants were allowed to only offer table service with a limit of 50% placed for audiences of theatres. Some sporting events were allowed to have bigger crowds.

UK vaccination rate

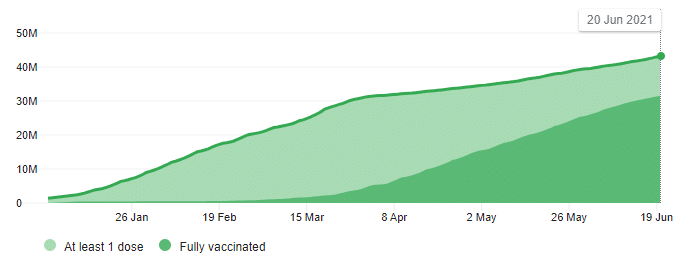

As of June 20, 2021, approximately 47.2% of the UK population had been fully vaccinated, with at least 64.7% having received one dose. Among the adult population, 81.9% received the first dose, while 59.7% had received the second dose.

Daily deaths have declined from highs of 1,631 recorded on January 26, 2021, to lows of 6 as of June 20, 2021, indicating effective vaccination. New cases have also declined 10.08% in the three days leading to June 20, 2021, from highs of 10,089 to 9,072.

The pound stood firm, despite a 0.8% rise in the property asking price (index). Housing prices climbed by £2,509, recording a historical high since 2015 in all British regions. The market was constrained as the buyer demand outstripped supply, especially among the wealthy class.

Industrial trend orders (statistics by the UK’s Confederation of British Industry, – CBI) are slated for release on June 22, 2021. The index stood at 17 in May 2021 (MoM) from a previous record of -8. A higher recording will work positively for the pound with the forecast already at 18.

PMI data release

Australia’s manufacturing PMI data for May 2021 (YoY), to be released on June 22, 2021, is expected to move from the previous record of 60.4. Services PMI data is also slated for release from a previous score of 58.0. According to a survey that indicated time-saving benefits, improved digital government services are expected to lift the Australian dollar.

No deaths have been reported from coronavirus in Australia since October 22, 2020, with up to 3.4% of its population fully vaccinated as of June 20, 2021. Australia closed its borders forcing citizens to spend the AU$65 billion that would otherwise be sent overseas. This move has helped to support the country’s stimulus plan.

Technical analysis

The GBP/AUD pair formed an upward curve on June 1, 2021.

The pair is moving above the 9-day EMA, likely headed towards the key trading level of 1.8566. Trading volume increased as the upward curve took shape. The 14-day RSI is in the overbought zone at 72.37, supporting the bullish turn of the GBP/AUD.