- The UK increased its financial support for Q1 2021 by 35.67% to extend business support.

- The UK economy is expected to rebound 4% in 2021.

- Low retail sales have dampened Japan’s economic growth outlook.

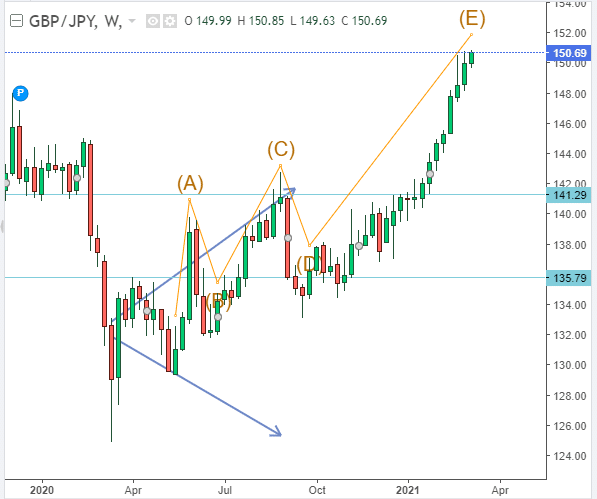

The GBP/JPY trading pair rose 21.39% in the 52-week range analysis from a low of 124.18 in March 2020 to a high of 150.74 on March 8, 2020. The pair is headed towards testing 2016 highs of 160.28 despite pessimism from the BoE that the UK economy will not return to its pre-pandemic levels. Although the economy contracted by 9.9% in 2020, the business-centered stimulus plan helped to cushion the UK against international currencies. Japan, on its part, is taking a cautious approach in regards to bond yields and quantitative or monetary easing. This approach has dipped the yen in favor of the pound based on investor preference.

Budget 2021 forecast

The UK economy forecast for 2021 projects a rebound in annual growth of 4%. In 2022, it is expected to rise to at least 7.3%. In the budget reading for 2021, the UK is preparing to focus its stimulus on improving businesses that had been run down by the pandemic. It is also meant to boost the rate of employment with incentives given to business owners. From the beginning of Q2 2021, companies will receive £3,000 for every apprentice hired.

The government set aside £300 billion ($415 billion) in 2020 to help businesses and the NHS to help fight the pandemic. In 2021, the fiscal support was increased to £407 billion ($562 billion), a rise of 35.67%. The way to recovery is pegged on jobs’ growth, sustainable investment of public finances, and managing the spread of COVID-19. Business support is expected to realize an additional £25 billion in income tax by 2025-2026. An additional 1.3 million Britons will be added to the income tax bracket to help the government sustain the recovery process in the next five years.

Negative market forces

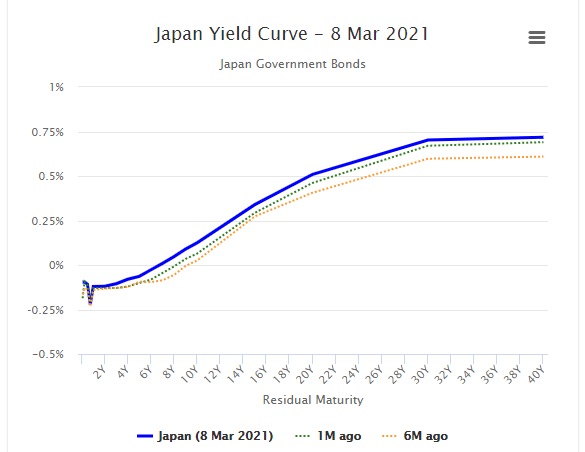

The BoJ announced that it did not intend to push the 10-year bond yield above its target of 0% despite having a ceiling of 0.2%. However, expected influence from US inflation pushed up the yields to 0.175% in Q1 2021. This yield lowered to 0.124% on March 8, 2021.

According to the Standard & Poor’s (S&P), Japan’s bonds have a credit rating of A+, meaning that they have a higher investment risk in the long-term.

Economic growth in Japan is expected to remain negative in Q1 2021, driven by a decline of 2.4% in retail sales in January 2021. There was a decline in consumer spending, especially in fabrics and general merchandise that serve an integral part of the services sector. Factory output rose 4.2% in January 2021 after facing low production in November and December 2020. The state of emergency is a key driver to stimulate stagnant growth as the country prepares to hold the Olympics.

The current delay in holding the summer event scheduled for 2020 has already cost the economy $2.8 billion. The economy is set to suffer a deficit of $22 billion if it prohibits spectators from attending the games and up to $13 billion for reducing the number by half.

Technical analysis

The GBP/JPY trading pair forms a broadening bottom pattern from April 2020. The Elliot triangle wave indicates a bullish pattern after the pair crossed the 135.79 resistance in Q1 2020. The pair intends to test new support at 160.00 before the end of 2021. Market fundamentals are in favor of the British pound. The 14-day RSI indicates a strong buy position at 62.577. The pair is trading close to its 50-day EMA at 150.15.