- Income levels among the poorer US households have grown during the pandemic.

- Total assets in the US commercial banks increased by 11.7% in December 2020.

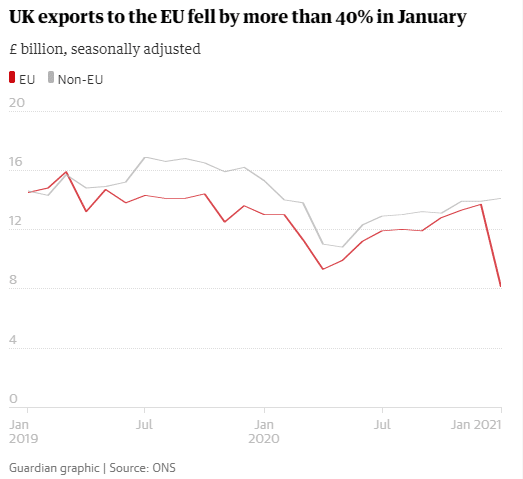

- The UK economy is reeling from a decrease in the EU exports post-Brexit.

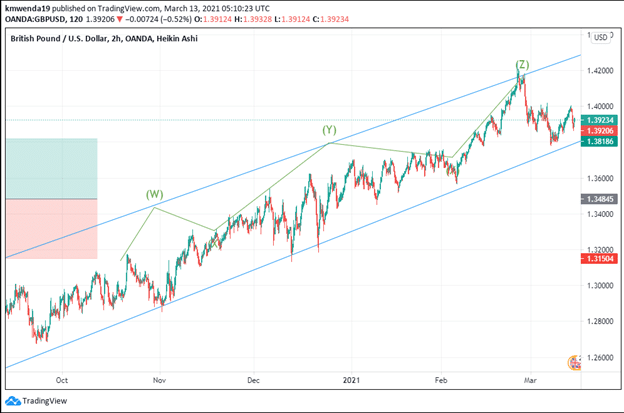

The British pound has fallen 1.89% against the US dollar after the GBP/USD forex pair plummeted from a high of 1.4191 on February 24, 2021, to a low of 1.3923 on March 12, 2021. News of the passage and ratification of the $1.9 trillion by President Biden helped to fuel the dollar’s recovery with investors upbeat about an increase in risk appetite. Other than the direct deposit of $1,400 stimulus checks, the fiscal plan is expected to support the household economy. The relatively poor US households are expected to improve in 2021, as wealth grew by $12.6 trillion in 2020.

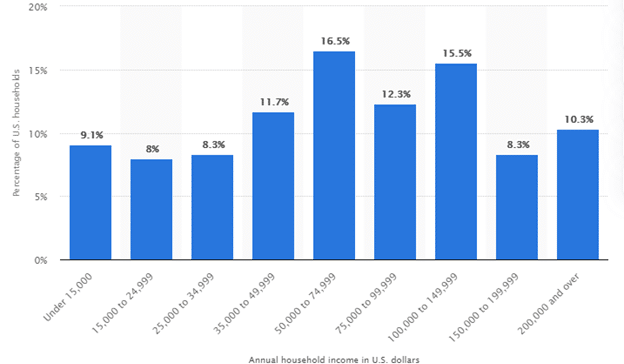

Income distribution

As of 2019, only 10.3% of the US households had an income level above $200,000.

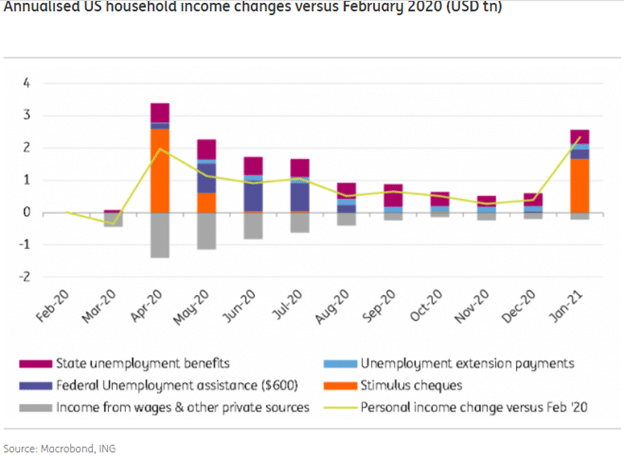

The highest income level in the US (on annual basis) at the time earned up to $75,000 distributed at 16.5%. In 2020, the US government decided to evade direct interference with the labor market and instead opted to initiate $600 weekly Federal employment benefits. Increased after-tax compensation to boost income has made annualized household income rise close to $2.5 trillion as of January 2021.

Poorer households have benefited from this government policy even as the third round of the stimulus checks is expected to hit bank accounts as early as March 13, 2021. Household assets were up 9.36% in 2020 to reach $147.2 trillion against $134.6 trillion in 2019. This situation is likely to increase job opportunities especially in small businesses that may jump to all-time highs into 2021.

The involvement of banks in the stimulus programs has helped to boost performance in the FY 2020/2021.

Total assets in US commercial banks increased by 11.7% in December 2020 (in seasonally adjusted annual rate) from 5.0% at the beginning of Q4 2020.

Total liabilities decreased by 33.5% in December 2020 from a year high of 47.9% (in Q2 2020) to 14.4%.

Shrinking the UK economy

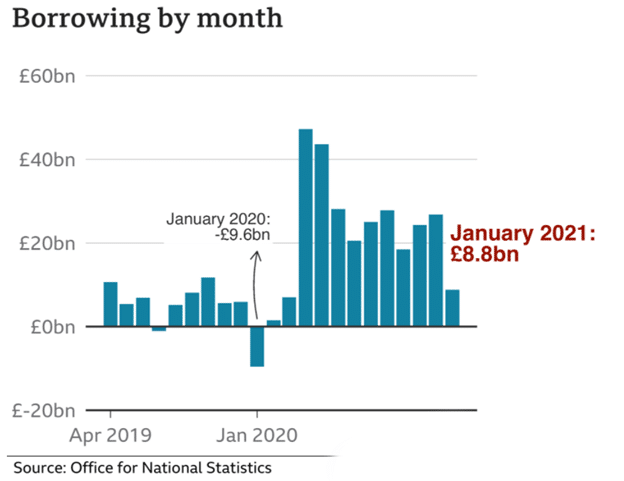

The British government increased its borrowing for pandemic support to £270.6 billion with £46 billion being spent on covering furloughed workers’ salaries. The amount borrowed had increased by more than 450% from that of 2019 that stood at £48.6 billion.

British lawmakers have also caused the government to desist from raising taxes although the increase is somewhat inevitable.

January 2021, saw the UK economy shrink by 2.9% due to the coronavirus lockdown that is scheduled to be lifted before Q2 2021. This position is, however, an improvement since predictions had estimated a 4.9% contraction.

The UK is feeling the post-Brexit effect as goods export into the EU narrowed 40.7% in January 2021 or £5.6 billion. Imports also declined by £6.6 billion (28.8%). The export commodities that were mostly affected included seafood and fish (-63.6% in January 2021). Food and live animals account for 7% of the total the UK export market leading to a limited effect on the GDP.

More concentration was, however, given to the non-EU countries with exports rising to almost 40%.

Technical analysis

The GBP/USD trading pair seems to have hit resistance at 1.42000. The 14-day RSI shows a neutral position of 45.926 among traders. The 20-day SMA supports a sell position at 1.3911 while the EMA is at 1.3921. Positive data in regards to the disbursement of the $1,400 stimulus checks may favor the dollar against the pound.